Get the free Form 708-a

Get, Create, Make and Sign form 708-a

How to edit form 708-a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 708-a

How to fill out form 708-a

Who needs form 708-a?

Understanding Form 708-A: A Comprehensive Guide

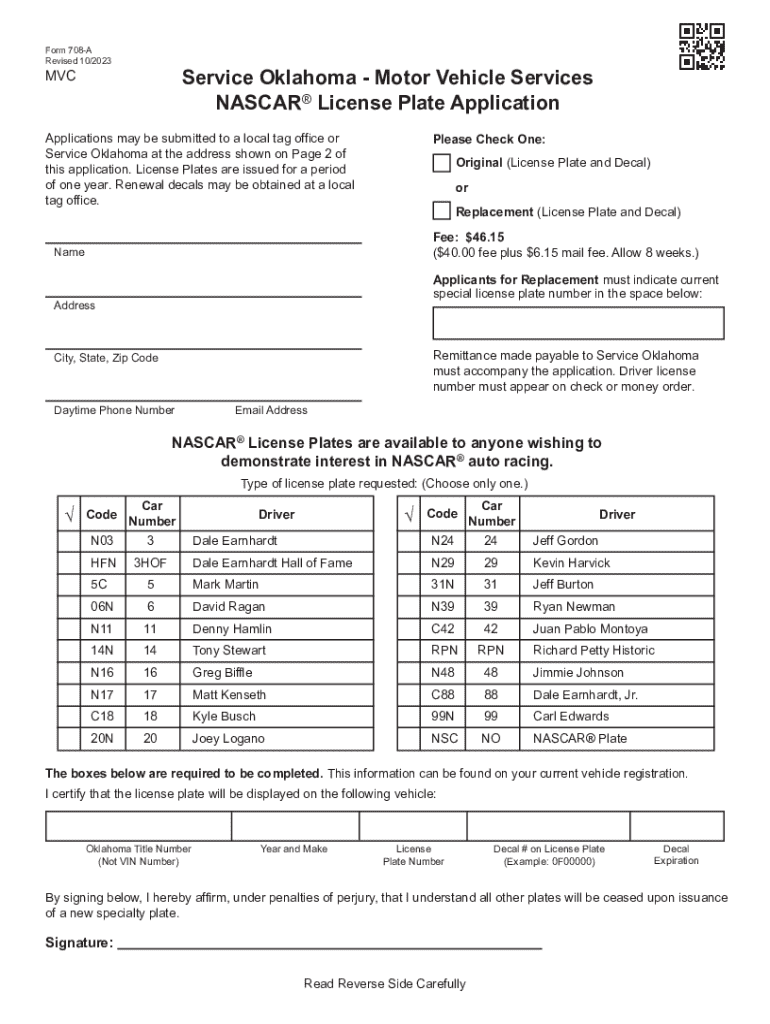

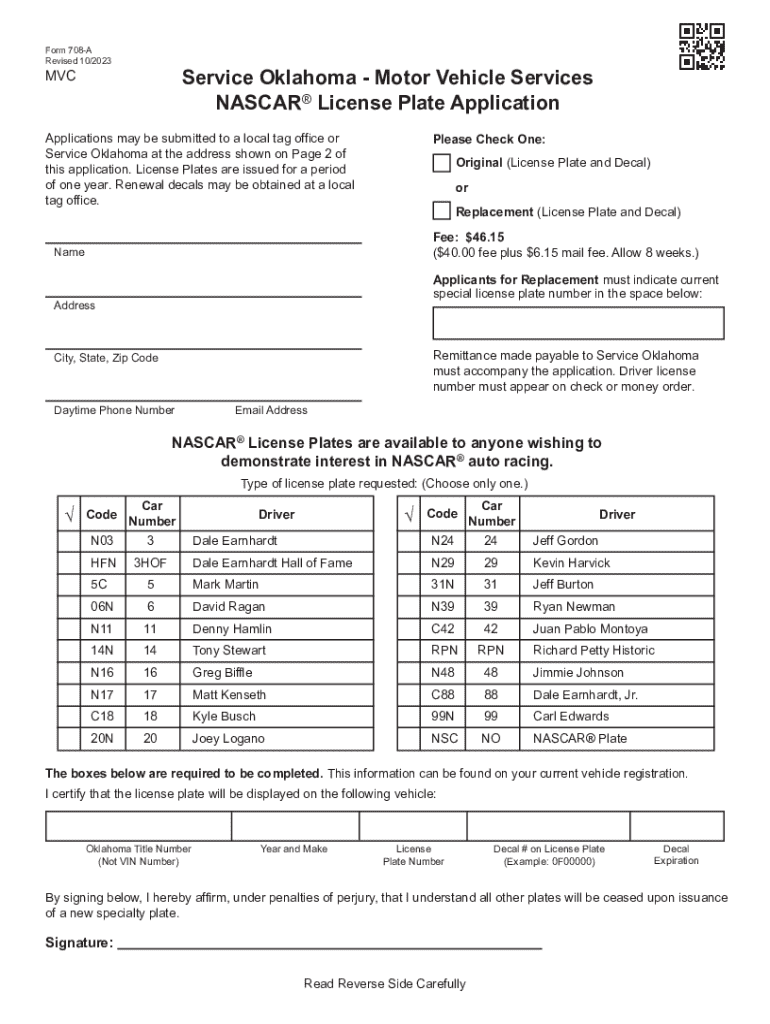

Overview of Form 708-A

Form 708-A is a specific tax form utilized to report the receipt of covered gifts or bequests by individuals and organizations. This form is vital for ensuring compliance with tax regulations governing the reporting of significant financial gifts received from benefactors. Properly completing Form 708-A helps in the accurate tracking of taxable gifts, ensuring both the recipient and donor fulfill their tax duties.

The importance of accurately reporting these gifts cannot be overstated, as failure to do so can lead to penalties, audits, or misinformation regarding tax obligations. Individuals and entities that meet specific thresholds need to fill out Form 708-A, and this guide will help navigate the process effortlessly.

Understanding the requirements for Form 708-A

To be eligible to submit Form 708-A, individuals must receive gifts that meet or exceed the statutory limit established by the IRS for the reporting year. This limit varies, making it crucial for potential filers to remain aware of current threshold amounts and any governing tax laws. Before filling out the form, certain key information is necessary to ensure a smooth filing process.

Identification details are paramount, including your Social Security Number or Tax Identification Number. Additionally, a thorough description of the gift or bequest, which includes its fair market value and the relationship to the donor, must be provided. Being aware of relevant tax rules surrounding gifts can help in determining any tax implications resulting from the transaction.

Step-by-step instructions for completing Form 708-A

Completing Form 708-A can seem daunting at first. However, breaking it down into systematic steps can simplify the process significantly. First, you must gather any necessary documents such as prior tax returns, any previous gift declarations, and documentation from the donor regarding the gift.

After assembling the necessary documentation, start filling out the personal information section of the form. This section will typically ask for your full name, address, and identification numbers. An example of this can include entering your full name as it appears on your official papers and ensuring your SSN is accurately reflected.

The next critical step involves reporting the actual details of the gift or bequest. Make sure to describe the gift clearly, stating its fair market value and the date of receipt. It’s also important to understand the financial reporting requirements, as the implications may affect your taxes or any obligations to the IRS.

Finally, upon completion, ensure that you submit Form 708-A through the appropriate channel. You can choose to file electronically or by mail, depending on your convenience. Always remember to keep an eye on the deadlines to avoid any potential complications with late submissions.

Tips for editing and managing Form 708-A

Utilizing tools such as pdfFiller can greatly enhance your experience in managing and editing Form 708-A. This platform allows you to seamlessly edit your PDF documents, ensuring all information is accurate and up-to-date before submitting. There’s no need to stress over formatting or design; pdfFiller provides user-friendly templates and options to ensure your document looks professional.

Collaboration features in pdfFiller are particularly advantageous for teams or family members involved in filling out Form 708-A. You can conveniently share documents and work together on necessary edits or discussions regarding the information presented. Additionally, eSign options are available, allowing for an efficient signing process that can help expedite the form submission as needed.

Risk management and recordkeeping for Form 708-A

Effective recordkeeping is crucial once Form 708-A has been submitted. Understand the requirements for maintaining records related to gifts and bequests, as proper documentation can safeguard you against potential audits or discrepancies. The IRS recommends retaining records for a minimum of three years from the date of filing your return or the due date of the return, whichever is later.

Consider methods to secure confidential information, such as encryption or secure storage facilities for any physical records. This practice ensures sensitive details are protected, particularly when dealing with significant financial transactions that come with inheritances or substantial gifts.

Common mistakes to avoid when filing Form 708-A

Filing Form 708-A can involve a series of common mistakes that may lead to complications. One frequent error is entering incorrect identification numbers, which can delay processing or create mismatches with IRS records. Another common issue includes failing to provide an adequate description of the gift, leading to questions from tax authorities regarding its legitimacy or valuation.

Ensuring accuracy in reporting the fair market value is crucial, as improperly valuing the gift could result in underreporting taxes owed, leading to significant penalties. Double-checking your details and even having a second person review your submitted documents can mitigate the risks associated with mistakes on Form 708-A.

Related documents and resources

Understanding Form 708-A is crucial, but it's also important to be aware of other related documents that can aid in the process. Forms such as the Form 709 (United States Gift (and Generation-Skipping Transfer) Tax Return) may be necessary for reporting gifts exceeding exempt amounts, providing further documentation for tax purposes.

Additionally, familiarize yourself with IRS guidelines and pertinent tax rules through official resources. Links to IRS publications and state-specific regulations can greatly enhance your knowledge and readiness for filing, providing clarity on any existing legal requirements that pertain to your specific situation.

Frequently asked questions (FAQs)

Individuals may have queries regarding Form 708-A, such as who is required to submit it, what specific gifts need reporting, and how to correctly identify values and descriptions. One common question revolves around whether all gifts must be reported, and it's critical to clarify that only those meeting the threshold need to be documented.

Understanding how pdfFiller aids in the completion and management of Form 708-A is another frequent inquiry. pdfFiller streamlines the process, ensuring those filing have a user-friendly experience and easy access to templates and PDF editing features, helping users to navigate the sometimes complex requirements of the form effortlessly.

Contact information for further assistance

For further assistance with Form 708-A, reaching out to customer support can offer clarity to specific concerns. Many software platforms, including pdfFiller, provide dedicated customer service lines to help navigate any issues faced while filling out the form or managing documents.

Additionally, consulting tax advisors or legal experts can provide valuable insights into the nuances of Form 708-A and the implications surrounding your gifts or bequests. It’s wise to maintain an open line of communication with professionals who can address any uncertainties as you proceed with your filing.

Updates and changes to Form 708-A regulations

Regulations surrounding Form 708-A are subject to change, adjusting to new tax laws and adjustments in reporting thresholds. Staying informed on recent changes is essential for accurate compliance. For instance, new legislative changes may impact not just the reporting criteria, but also how gifts are valued for tax purposes.

Moreover, it’s advisable to regularly review IRS publications or reliable tax resources to keep abreast of any announcements regarding the form that could influence filing. Awareness of current legislation ensures that you are taking the correct measures and remaining up-to-date on your tax responsibilities related to gifts and bequests.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the form 708-a in Gmail?

How can I edit form 708-a on a smartphone?

How do I edit form 708-a on an iOS device?

What is form 708-a?

Who is required to file form 708-a?

How to fill out form 708-a?

What is the purpose of form 708-a?

What information must be reported on form 708-a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.