Get the free Return of Organization Exempt From Income Tax

Get, Create, Make and Sign return of organization exempt

How to edit return of organization exempt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return of organization exempt

How to fill out return of organization exempt

Who needs return of organization exempt?

Return of Organization Exempt Form: A Comprehensive Guide

Understanding the Return of Organization Exempt Form (Form 990)

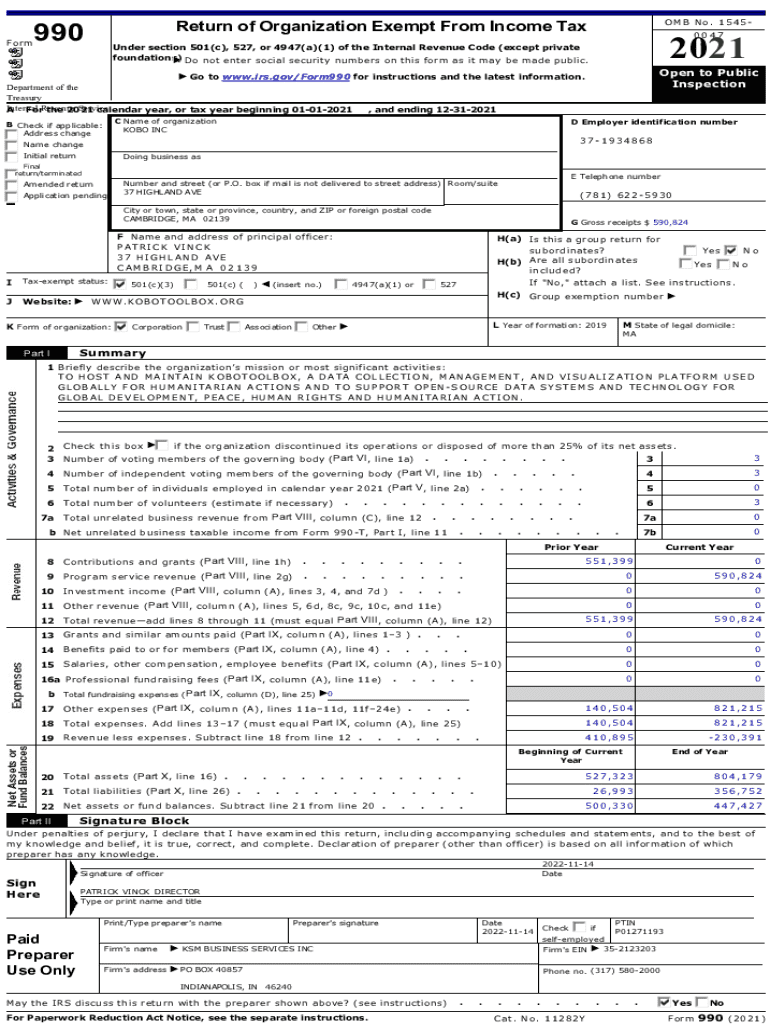

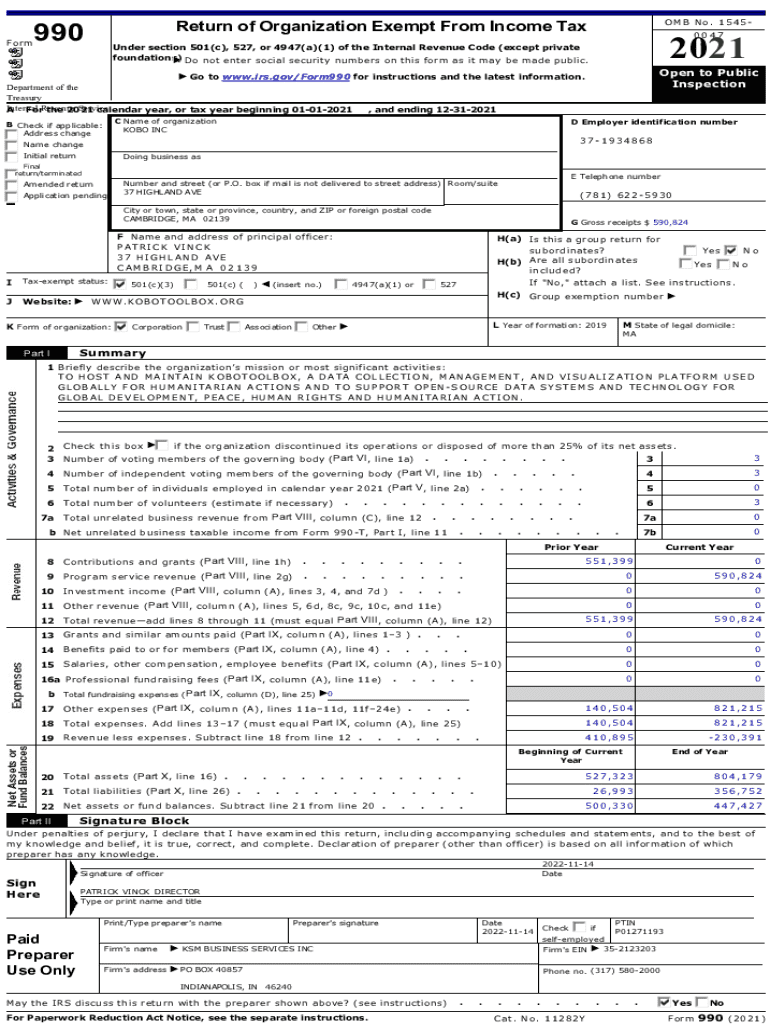

The Return of Organization Exempt Form, widely known as Form 990, is a crucial instrument for non-profit organizations in the United States. Designed by the Internal Revenue Service (IRS), this form ensures that tax-exempt organizations can provide transparent and detailed financial information. Its primary purpose is to allow the IRS and the public to assess the compliance and operational integrity of these non-profits.

For exempt organizations, Form 990 serves multiple purposes: it is a reporting tool for income and expenditures, a mechanism for public accountability, and a way to establish legitimacy. It plays a significant role in managing public trust, as stakeholders expect transparency regarding how funds are utilized.

Types of organizations required to file

Various types of organizations are mandated to file Form 990. The most common among these are charities registered under section 501(c)(3) of the Internal Revenue Code, which includes public charities and private foundations. However, other forms of exempt organizations, such as social clubs and mutual benefit organizations under sections like 501(c)(4) and 501(c)(7), also fall under this requirement.

Understanding the classification of your organization is essential. For instance, 501(c)(3) organizations enjoy a more rigorous set of regulations and public scrutiny compared to other types. In certain instances, organizations with gross receipts that remain below specified thresholds may qualify to file simpler variations of the form, reducing their burden.

Variants of Form 990

Form 990 has several variants designed to accommodate organizations of different sizes and complexities. While larger organizations typically file the full Form 990, smaller entities have alternatives that streamline the process. These variants ensure that all organizations can meet their filing requirements without undue burden.

The three main versions are:

Choosing the appropriate variant depends on your organization’s size, complexity, and financial activity. It’s crucial to understand when and which form to use for compliance.

Filing requirements and deadlines

Timely filing of Form 990 is critical for non-profit organizations to maintain their tax-exempt status. The standard due date for filing is the 15th day of the 5th month following the end of the organization’s fiscal year. For many organizations with a December 31 year-end, this falls on May 15.

Extensions are available, commonly allowing an additional six months of time to file. However, organizations must officially request this extension using Form 8868.

Detailed breakdown of Form 990 sections

Form 990 is structured into several key sections, each requiring specific information that highlights different aspects of the organization’s operations and fundraising activities. Understanding this structure is vital for accurate reporting.

The major parts of Form 990 include:

Additionally, understanding essential schedules like Schedules A through R is important as they provide deeper insights into an organization’s financial practices, governance, and program services.

Penalties for non-compliance

Non-compliance with Form 990 filing requirements can lead to significant penalties that adversely affect an organization’s reputation and financial health. The IRS imposes fines on organizations that fail to file, with penalties escalating for continued non-compliance.

In cases of willful neglect, organizations might face fines that could reach thousands of dollars. Furthermore, non-compliance can jeopardize their tax-exempt status, leading to increased scrutiny from the IRS and damaging public trust.

Public inspection regulations

One of the essential aspects of Form 990 is its public accessibility. Non-profit organizations are legally obligated to make their Form 990 available for public inspection, enhancing transparency and accountability. This allows the public, stakeholders, and potential donors to review the financial health and operational integrity of these organizations.

Typically, organizations must provide a copy of Form 990 upon request, and they can also publish it on their websites. This not only safeguards their public reputation but also assists in building trust among donors and beneficiaries.

The role of Form 990 in charity evaluation

Form 990 serves as a valuable resource for individuals and entities evaluating charities. By analyzing the data contained within these forms, researchers, donors, and advocacy groups can assess an organization’s financial health, effectiveness, and adherence to ethical standards.

Donors particularly benefit from reviewing Form 990 to make informed decisions about where to allocate their funds. Key metrics such as revenue, expenses, and program outcomes can indicate how well an organization is meeting its mission.

Challenges and common errors in filing

Organizations face various challenges when completing Form 990, including complex regulations and frequent changes in tax laws. Common mistakes can lead to compliance issues, increased scrutiny, and ultimately financial penalties.

Some prevalent errors include incorrect financial reporting, omission of required schedules, and failure to adhere to deadlines. Taking proactive measures such as conducting a thorough review and consulting with legal advisors can significantly reduce these risks.

Tips for seamlessly preparing your Return of Organization Exempt Form

When it comes to preparing Form 990, leveraging tools that streamline the process can make a significant difference. pdfFiller is an excellent platform for ensuring that your Form 990 is completed accurately and efficiently. With features specifically designed for collaboration and document management, completing the form becomes a more manageable task.

Utilizing pdfFiller’s capabilities enhances the document management process, allowing organizations to edit, eSign, and manage all their documents from a single cloud-based platform. Best practices include keeping meticulous records and ensuring that all internal processes align with the information provided on Form 990.

Future trends in non-profit reporting

The landscape of non-profit reporting is evolving, with regulations becoming more stringent and complex. Future filings of Form 990 may require additional data and transparency standards as the spotlight on accountability grows brighter. Organizations will need to remain agile, adapting to new requirements to maintain compliance.

Additionally, the rise of digital solutions signifies an important trend, allowing organizations to harness technology for improved record-keeping and reporting accuracy. As new tools emerge, non-profit managers will benefit from integrating these digital solutions into their operational frameworks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit return of organization exempt straight from my smartphone?

How do I fill out return of organization exempt using my mobile device?

Can I edit return of organization exempt on an iOS device?

What is return of organization exempt?

Who is required to file return of organization exempt?

How to fill out return of organization exempt?

What is the purpose of return of organization exempt?

What information must be reported on return of organization exempt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.