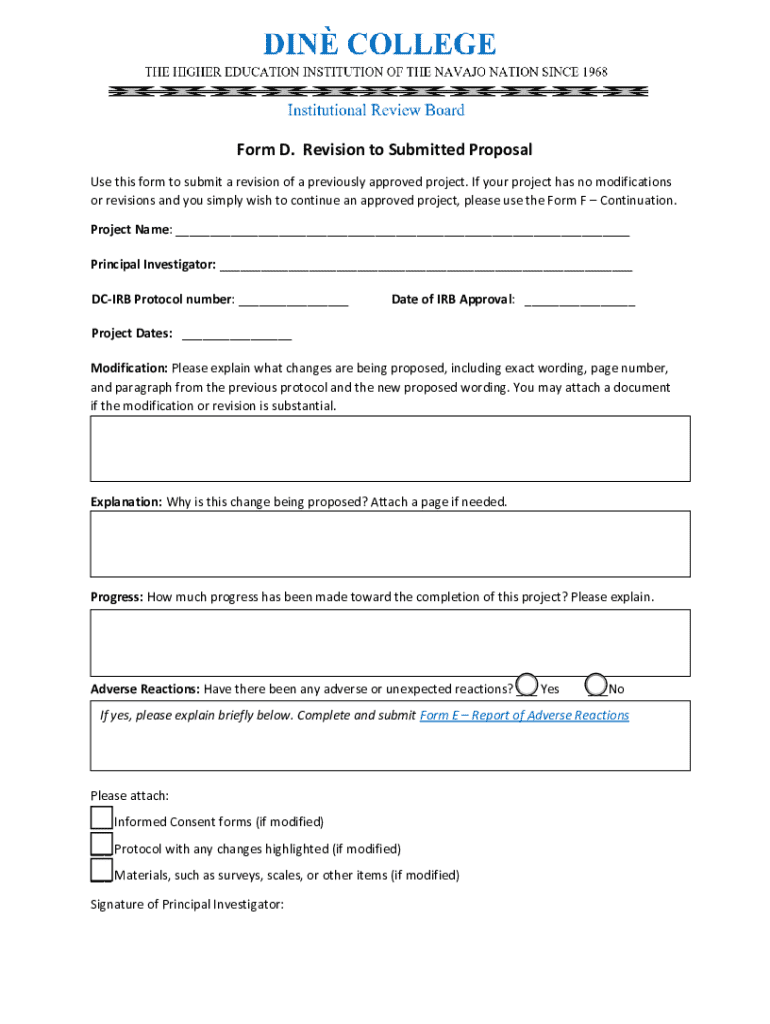

Get the free Form D

Get, Create, Make and Sign form d

How to edit form d online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form d

How to fill out form d

Who needs form d?

How to Fill Out Form

Understanding Form

SEC Form D serves as a notification of exempt offerings of securities primarily under Regulation D. This form allows companies to provide the necessary information to the SEC related to their offerings without registering with the SEC, thus streamlining the process of raising capital.

The importance of Form D cannot be overstated. It signifies that a company is looking to raise funds in a way that conforms to specific exemptions under federal securities laws. This enables private placements, giving companies access to much-needed capital while complying with legal requirements.

The role of Form in the SEC filing process

The SEC filing process for exempt offerings involves several key components, among which Form D acts as a pivotal document. Under Regulation D, there are exemptions like Rule 504, 505, and 506 that allow companies to raise capital from accredited investors without full registration.

Form D serves as a vehicle for ensuring compliance with these exemptions, allowing issuers to inform the SEC and investors alike about the details surrounding their offerings. This not only provides transparency but also protects investors through disclosure.

Step-by-step guide to filling out Form

Filling out Form D may seem daunting, but breaking it down into sections simplifies the process. The first section, Basic Information about the issuer, requires the name, address, and contact details of the company filing the form.

Section 2 pertains to the offering itself, where details about the type and amount of securities being offered are provided. Finally, Section 3 focuses on the use of proceeds, detailing how the funds raised will be utilized by the issuer.

Common questions arise at each stage, from how to provide accurate data to particular details required in these sections. Best practices involve double-checking each entry for accuracy and completeness to avoid delays or complications.

eSigning and document management of Form

Utilizing pdfFiller can enhance the filing process for Form D, as its interactive tools facilitate filling out the form efficiently. Users can easily edit text fields, add necessary attachments, and ensure that all required information is included.

Once the form is completed, pdfFiller provides options for eSigning the document, making the submission process smoother. Document management features allow users to save, categorize, and retrieve their filings, ensuring easy access to this essential information in the future.

Common mistakes to avoid when filing Form

Filing Form D comes with its own set of challenges. Common errors often involve missing critical information such as issuers' details or specifics regarding the offering. Incomplete documentation can lead to penalties or rejection of the filing.

Additionally, misunderstanding regulatory requirements can complicate the process further. It's crucial for issuers to stay informed about current regulations to ensure that their submissions meet the SEC's standards.

Conducting routine checks and reviews before submission can significantly reduce the likelihood of errors. Cross-referencing the form with SEC guidelines is a best practice that should not be overlooked.

Navigating exempt offerings and private placements

Understanding the exemption process is essential for companies looking to raise capital without undergoing a full SEC registration. Regulation D outlines various exemptions that allow companies to offer securities while providing a framework for compliance.

For successful private offerings, maintaining transparency with potential investors is vital. This includes providing investors with detailed disclosures and updates about the use of proceeds, financial conditions, and any associated risks.

Investment opportunities and capital-raising strategies

Leveraging Form D effectively can help attract investors to your offering. Providing clear, concise, and compelling information within the form can enhance the appeal of your securities to potential investors.

Building trust through transparency is also paramount. Regular updates, accessible documentation, and adherence to compliance can foster a positive relationship with investors, encouraging their support and involvement.

Differences between Form and other SEC filings

Understanding the distinctions between SEC Form D and other SEC filings can offer clarity on when to use each. For example, Form D is tailored specifically for private placements, unlike Form S-1 that is for registration statements for public offerings.

Similarly, Form 8-K serves as a current report for significant events affecting a public company, while Form D caters to specific exemptions in securities offerings. Knowing these differences can help a filer choose the right form according to their needs.

Long-term compliance and reporting obligations

After filing Form D, issuers have ongoing reporting responsibilities. This includes staying updated on plans for securities offerings and disclosing material changes to investors as required by securities regulations.

It's essential to keep abreast of regulatory changes as failure to comply with new directives can lead to penalties. Regular monitoring of SEC updates ensures that issuers maintain compliance and uphold good standing.

Frequently asked questions about Form

Individuals filing Form D often have questions regarding the timeframes, associated costs, and available resources to aid in the process. Understanding the general timeline involved in submissions can help manage expectations throughout the filing experience.

For first-time filers, expert guidance emphasizes the importance of meticulous preparation and thorough research. Leveraging tools such as pdfFiller can be instrumental in streamlining the process and enhancing overall compliance.

Conclusion

Filing Form D is a crucial step for companies seeking to raise capital through exempt offerings. By understanding the nuances of this form and leveraging tools like pdfFiller, issuers can navigate the regulatory landscape with confidence.

The integration of seamless editing, eSigning, and document management within pdfFiller empowers organizations to streamline their Form D filing process and maintain stringent compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form d without leaving Google Drive?

How can I send form d for eSignature?

How do I fill out form d using my mobile device?

What is form d?

Who is required to file form d?

How to fill out form d?

What is the purpose of form d?

What information must be reported on form d?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.