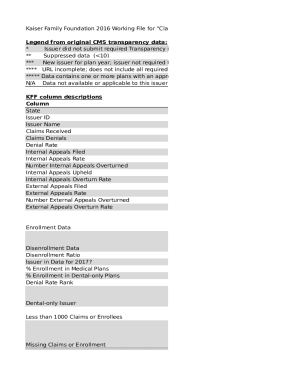

Get the free wilmette transfer tax

Get, Create, Make and Sign wilmette transfer tax form

How to edit wilmette transfer tax form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out wilmette transfer tax form

How to fill out real estate transfer tax

Who needs real estate transfer tax?

Your Complete Guide to the Real Estate Transfer Tax Form

Understanding the real estate transfer tax form

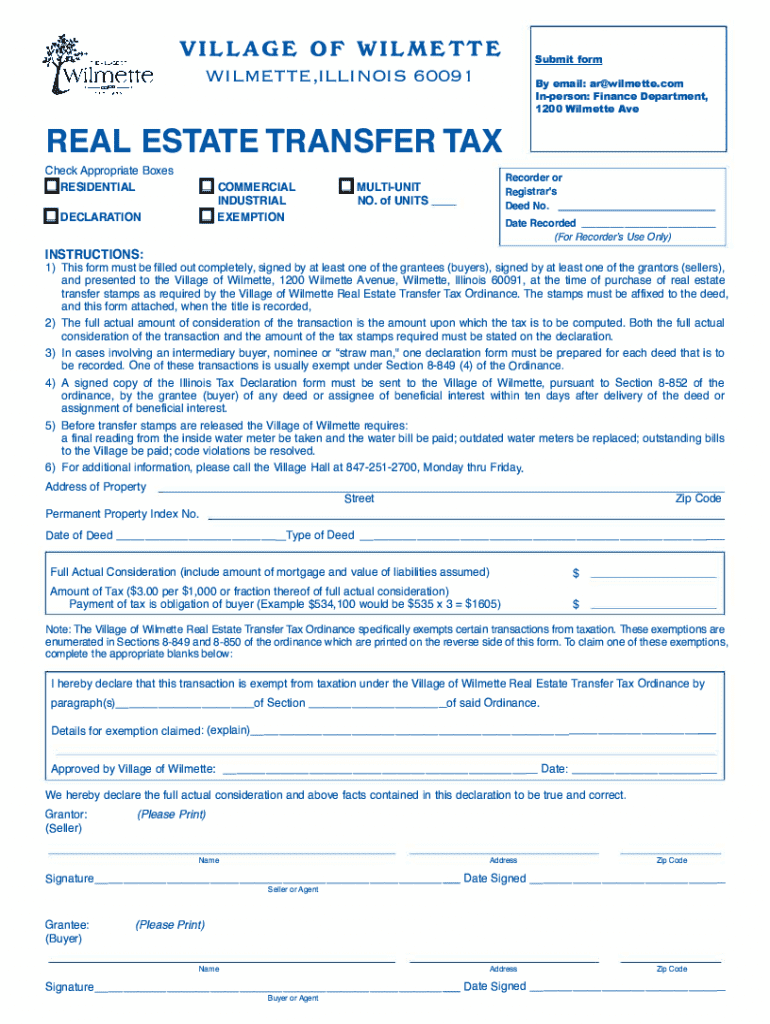

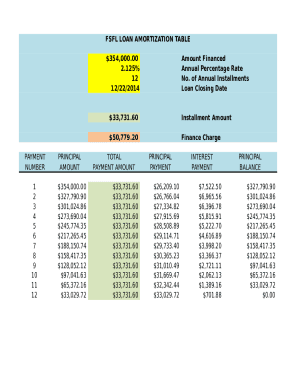

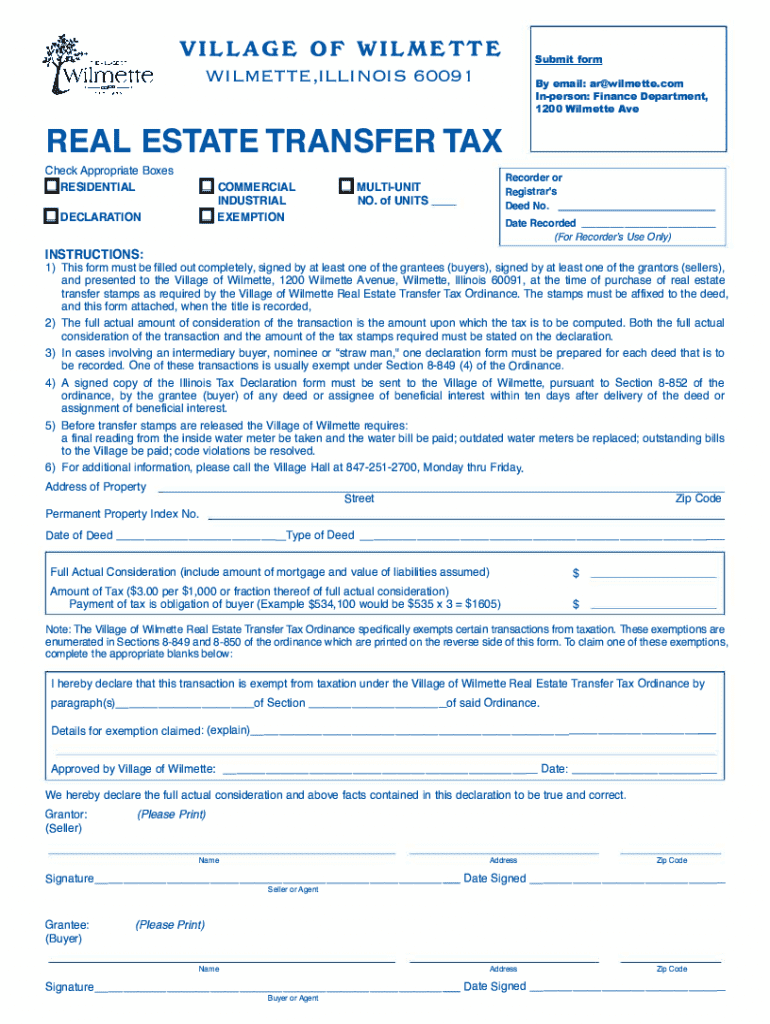

The real estate transfer tax form is a critical document that details the tax incurred during the transfer of property ownership. This tax, imposed by state or local governments, is calculated based on the property's sale price and can vary significantly by location. Accurately completing the transfer tax form is essential because any errors could lead to delays, penalties, or incorrect tax assessments.

Real estate transfer tax serves multiple purposes: it generates substantial revenue for local municipalities and provides a historical record of property ownership changes. Understanding its nuances can save significant money and avoid legal complications down the line.

Who needs to file the real estate transfer tax form?

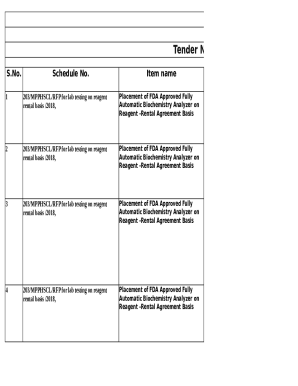

Both individuals and entities are required to file the real estate transfer tax form. It's predominantly necessary for homebuyers and sellers involved in property transactions, but it also includes real estate agents and brokers facilitating these deals. Additionally, business entities that purchase commercial properties must fulfill this obligation.

Different filing scenarios exist for residential and commercial properties. Homeowners transferring residential properties will typically need to file this form after sales, while commercial transactions often have additional requirements due to varying tax regulations.

Key components of the real estate transfer tax form

The real estate transfer tax form includes several key components that must be thoughtfully completed. The first major section collects taxpayer information, which includes the name, address, and other identifying details necessary for proper record-keeping and tax assessment.

Next is the property details section, requiring a thorough description of the property being transferred. This includes the property's location, size, and specific transaction details. Finally, the tax calculation section determines the total tax owed by applying the relevant rates to the transaction's purchase price. Properly understanding the relevant terminology such as 'consideration,' which refers to the purchase price or value of the property, as well as 'exemptions' and 'filing fees,' is vital for accurate filing.

Step-by-step guide to filling out the real estate transfer tax form

Preparation for filing the real estate transfer tax form begins long before the actual completion. First, gather all necessary documents relevant to the property transaction, including previous ownership records, sale agreements, and tax identification information. Understanding your tax obligations is crucial to avoid miscalculations during the form-filling process.

When filling out the form, carefully navigate each section, ensuring details are accurate to avoid common mistakes such as misspellings or incorrect number entries. After completing the form, review it meticulously; inaccuracies might lead to substantial penalties or delays in processing. Forms may be submitted either digitally through platforms such as pdfFiller or physically at local offices, depending on your jurisdiction.

Interactive tools for enhancing your filing experience

Using pdfFiller's advanced features can significantly simplify the process of filling out the real estate transfer tax form. With editing capabilities, users can easily modify their forms to meet changing requirements or to correct errors without starting over. eSigning allows users to effortlessly add digital signatures, ensuring that submission is not only quick but also secure.

Additionally, pdfFiller's collaboration tools enable users to work with partners or attorneys simultaneously, streamlining the review and approval process. This multifaceted platform is designed for individuals and teams who require flexible, access-from-anywhere document creation solutions.

Understanding tax implications and exemptions

Various exemptions can apply to the real estate transfer tax, which can significantly influence the tax amount owed. Common exemptions may include transactions involving transfers to family members, transfers due to divorce settlements, or any sales priced at a minimal consideration. Understanding these exemptions is critical to ensure you do not miss opportunities to reduce your tax burden.

It's also essential to understand the consequences of incorrect filing; potential penalties can include fines or complexities that delay the property transfer process. By accurately filling out the form and utilizing available resources, you can avoid many common pitfalls.

Getting help with the real estate transfer tax form

If navigating the complexities of the real estate transfer tax form becomes overwhelming, help is always available. Local tax offices can provide assistance tailored to your jurisdiction, directing you to necessary resources and answering specific questions regarding forms or filing requirements. Start by checking with your state or county tax department for contact information.

Additionally, online resources, including FAQs and instructional guides, are often available through platforms like pdfFiller, offering guidance for common issues and concerns. Utilizing these resources can save time and prevent costly errors.

Frequently asked questions (FAQs)

Many questions arise about the real estate transfer tax form, especially regarding timelines and penalties. For instance, individuals often inquire about how long it takes to process this form after submission; this can depend significantly on local regulations and the completeness of the submission. Missing filing deadlines is another common concern, where implications might involve penalties or additional interest charges.

Another frequently asked question is whether refunds are available for overpayments. Typically, yes; but the request process must be handled according to specific local guidelines. Addressing these common queries can demystify the process and reduce anxiety for first-time filers.

Case studies and examples

Real-life scenarios can illustrate the successful completion of the real estate transfer tax form. For instance, Jane, a first-time homebuyer, used pdfFiller to ensure her form was filled accurately. By taking advantage of editing and collaboration tools, she was able to consult with her attorney before finalizing the document, ensuring it met all necessary criteria.

Another example includes a small business purchasing a commercial property. By properly accounting for exemptions available in their jurisdiction, they were able to save significantly on their transfer tax. Testimonials from users highlight the effectiveness of pdfFiller in making the filing process smoother, with many expressing how the platform's features built their confidence in managing necessary documents.

Maintaining records after submission

After submitting the real estate transfer tax form, the journey isn't over. Properly storing and managing documents relating to your property transactions is crucial. Keeping copies of submitted forms allows for easy reference in future dealings or potential audits. Best practices suggest digital storage as the optimal solution, making use of cloud-based services such as pdfFiller for easy accessibility and organizational clarity.

The platform not only helps with filing but also allows ongoing document management, enabling users to track changes and retrieve necessary information quickly. This comprehensive approach ensures that all elements of your real estate transactions remain organized and accessible long after submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete wilmette transfer tax form online?

How do I fill out wilmette transfer tax form using my mobile device?

How do I edit wilmette transfer tax form on an iOS device?

What is real estate transfer tax?

Who is required to file real estate transfer tax?

How to fill out real estate transfer tax?

What is the purpose of real estate transfer tax?

What information must be reported on real estate transfer tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.