Get the free Annual Notice of Assessment

Get, Create, Make and Sign annual notice of assessment

How to edit annual notice of assessment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual notice of assessment

How to fill out annual notice of assessment

Who needs annual notice of assessment?

Annual Notice of Assessment Form: A Comprehensive How-to Guide

Understanding the annual notice of assessment form

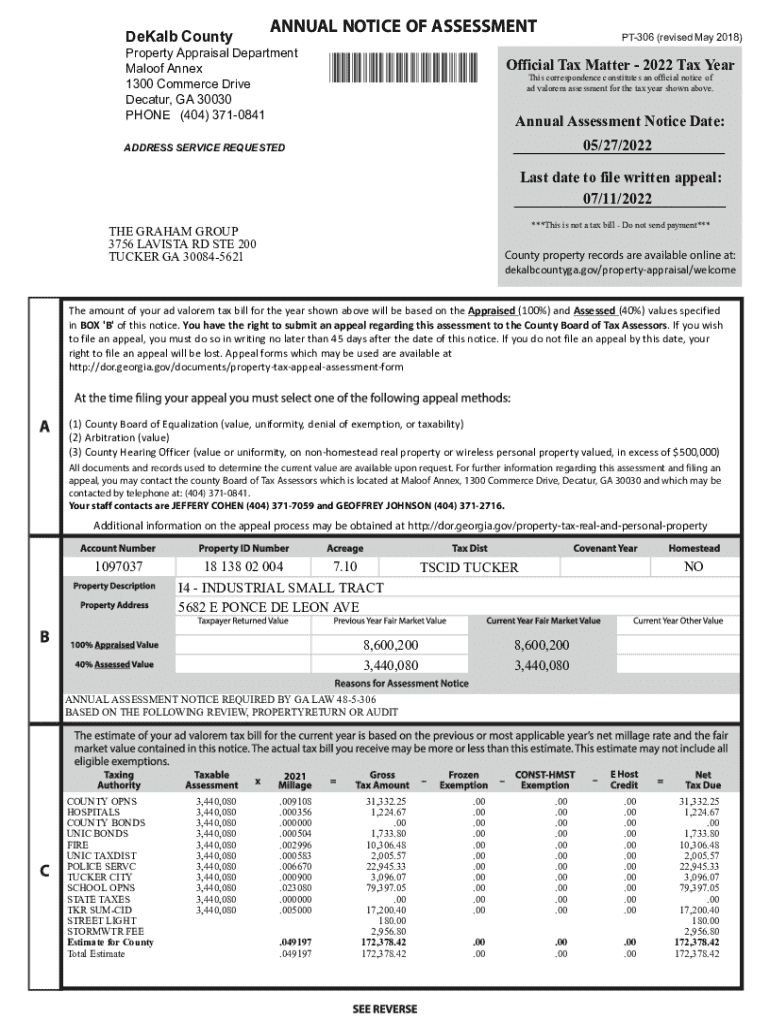

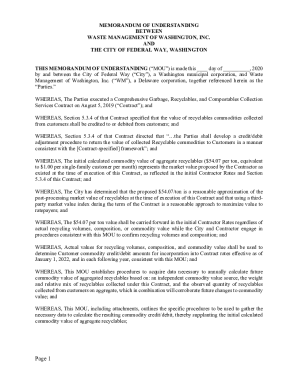

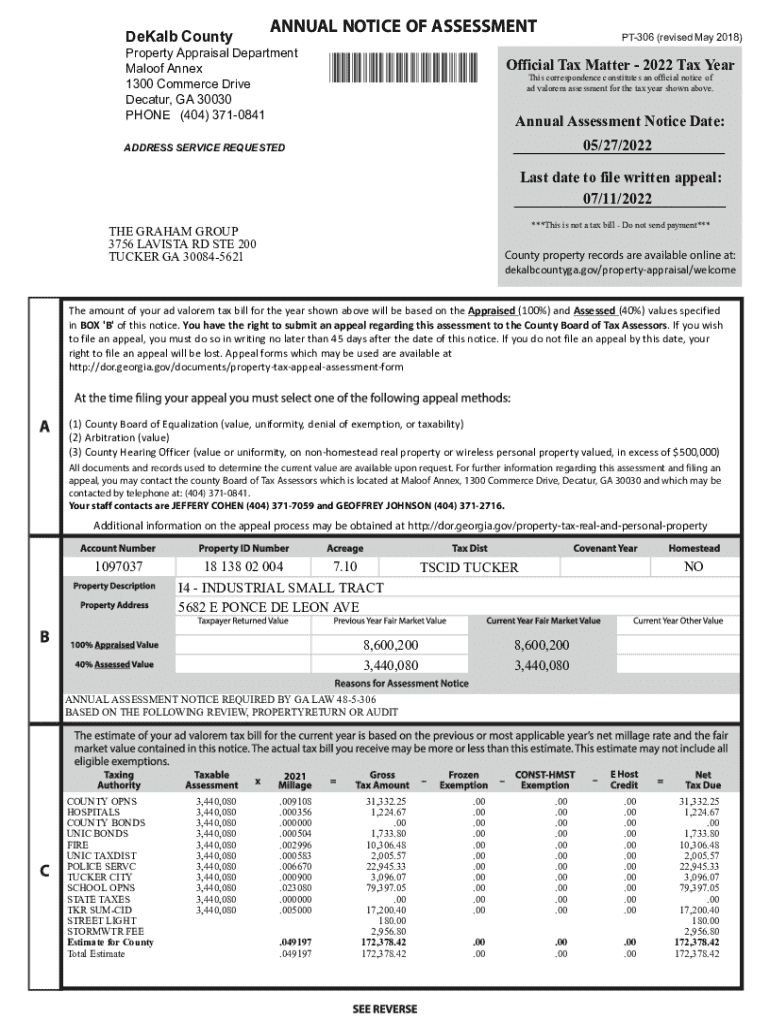

The annual notice of assessment is a crucial document sent by local governments to property owners, summarizing the assessed value of their property for tax purposes. This form plays a pivotal role in how property taxes are calculated and informs owners of any changes or updates in their property valuation. Recognizing the importance of this document helps property owners understand their tax liabilities and the implications of assessments on their overall financial obligations.

The document typically includes important information regarding the property, such as its assessed value, tax rates, and any exemptions that may apply. A clear understanding of these details allows homeowners to make informed decisions regarding their property and finances. Moreover, understanding how the annual notice of assessment can affect future property transactions is vital for owners planning to sell or refinance.

Who needs the annual notice of assessment form?

The primary recipients of the annual notice of assessment form are individuals and homeowners. Property owners must take this document seriously, as it directly impacts their property tax bill. A sudden increase in assessed value can lead to higher taxes; thus, understanding the assessment process becomes crucial for effective financial planning.

In addition to homeowners, real estate agents and financial advisors can benefit from this form. It aids them in guiding clients through property transactions by providing insight into expected tax obligations and valuations. Additionally, property management companies often handle multiple properties, making it essential for them to track assessments for all managed properties to ensure accurate financial reporting and budgeting.

How to obtain your annual notice of assessment

Obtaining your annual notice of assessment form can usually be done through a few straightforward channels. The most common sources are local government offices, where property tax assessments are managed. Many municipalities provide digital access to these forms, making it convenient for residents to retrieve their documents.

In addition to visiting local offices, online platforms, including pdfFiller, allow users to access and download their forms directly. Users should familiarize themselves with the relevant local government website or online portals that can facilitate this process. Below is a simple step-by-step guide for online access:

Step-by-step instructions for filling out the annual notice of assessment form

Before filling out the annual notice of assessment form, gather all necessary documents, including prior tax records, property deeds, and any previous assessments. This preparation ensures that you have all the details required to accurately complete your form.

Each section of the form contains specific instructions to guide you through the input. Generally, the form includes fields for the property owner's name, property description, assessed value, and applicable tax rates. It’s important to differentiate between residential and commercial assessments, as commercial properties often have different valuation methods. Additionally, be cautious of common mistakes, such as incorrect property descriptions or outdated contact information that may lead to complications with your assessment.

Editing the annual notice of assessment form

After completing your form, there may be instances where you need to modify the content. Using pdfFiller, users can easily access tools designed for modifying their documents. These features allow users to add annotations, make notes, or correct errors directly on the form.

Common changes made to the annual notice of assessment form include adjusting property information, such as square footage or zoning classifications, and updating contact details for tax notifications. Utilizing these editing tools effectively ensures that your assessments remain accurate and enhance communication with local tax authorities.

Signing the annual notice of assessment form

Electronic signatures have gained legitimacy in many states, allowing property owners to sign their annual notice of assessment forms without the need for a physical presence. The validity of eSignatures rests in compliance with state laws; thus, checking with local regulations is crucial.

Integrating pdfFiller's eSigning tools simplifies the signing process. Follow these steps to add your eSignature to the annual notice of assessment form efficiently:

Managing your annual notice of assessment documents

Effective document management is essential for keeping track of your annual notice of assessment forms. One of the best practices is to create a structured digital storage system. Utilize folders on your computer or cloud storage platforms to categorize files by year and property type.

Creating backups using pdfFiller ensures that even in emergencies, your assessment documents are secure. Regularly tracking important dates, such as re-assessment deadlines or tax payment due dates, enhances your financial readiness, preventing any unexpected surprises. Utilizing reminders or calendar alerts can streamline this process.

Frequently asked questions about the annual notice of assessment form

Many property owners may wonder what steps to take if they did not receive their annual notice of assessment. It is advisable to contact the local tax assessor’s office immediately to verify your property's status and ensure your contact details are accurate in their records.

Additionally, those who believe their assessment is incorrect often inquire about the process to contest their assessment. Typically, this involves submitting a formal appeal along with necessary documentation, such as comparable property assessments or proof of any errors in the stated valuation. Keep in mind that important deadlines vary by location, so checking local rules is critical to ensuring your appeal is submitted on time.

Additional tools and resources

Several online resources can assist property owners in managing their assessments effectively. Local government websites often provide online calculators to estimate property taxes based on assessed values and current tax rates. Additionally, pdfFiller offers options for creating, managing, and collaborating on all related property tax documents.

Exploring pdfFiller's additional features—such as templates for other tax-related documents—can streamline your document management process. Whether you collaborate with a tax professional or property manager, pdfFiller enhances teamwork by allowing multiple users to access and edit documents in real-time.

Contact information for assistance

Should you require assistance with your annual notice of assessment or any related documents, contacting the appropriate local government office is the first step. They can provide guidance on your specific tax district's processes and address any concerns regarding your assessment.

Users of pdfFiller can also access customer support for any issues related to document management. With pdfFiller’s capabilities, users can take full advantage of features like document signing, editing, and cloud storage, allowing them to streamline their document workflow efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit annual notice of assessment from Google Drive?

How do I edit annual notice of assessment on an Android device?

How do I fill out annual notice of assessment on an Android device?

What is annual notice of assessment?

Who is required to file annual notice of assessment?

How to fill out annual notice of assessment?

What is the purpose of annual notice of assessment?

What information must be reported on annual notice of assessment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.