Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

How to Fill Out Form 990: A Comprehensive Guide

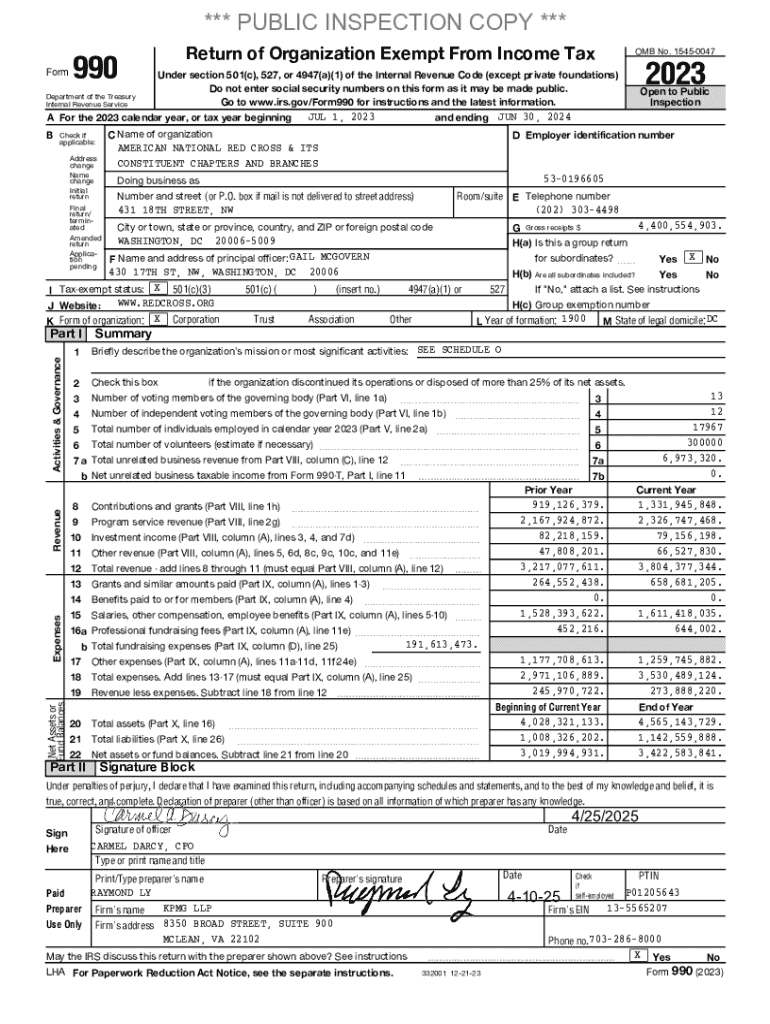

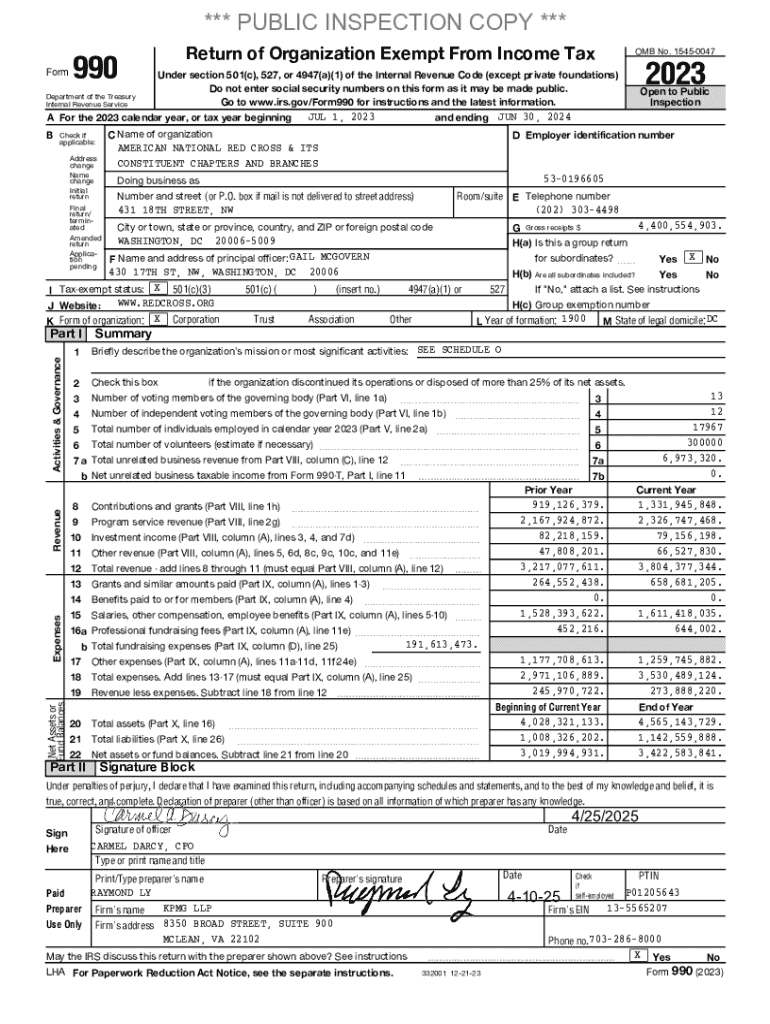

Understanding Form 990

Form 990 is a crucial document for nonprofit organizations in the United States. It serves as an annual information return that provides the IRS and the public with a comprehensive overview of the nonprofit's operations, finances, and activities. Understanding Form 990 is essential for compliance, transparency, and maintaining the trust of donors and the community.

The importance of Form 990 lies in its role in nonprofit accountability. By requiring nonprofits to disclose their financial information and operational practices, the form helps ensure that these organizations are using donations effectively and in line with their stated missions.

Form 990 consists of several key components, including:

Organizations required to file Form 990 include most tax-exempt organizations, charities, and private foundations. However, some small organizations with gross receipts under a specified threshold may be exempt from filing. Understanding these criteria is critical for nonprofit leaders to ensure compliance.

Preparing to fill out Form 990

Preparation is key when filling out Form 990. Begin by gathering essential documents, including financial statements for the fiscal year, organizational bylaws, and any previous Form 990 filings. These documents will provide necessary insights and data to ensure accurate reporting.

It's important to familiarize yourself with key terminology related to nonprofit structures and financial metrics. Understanding terms such as 'net assets' and 'unrestricted funds' will enhance your ability to accurately report financial information.

Specific financial documents you should collect include:

Step-by-step instructions for completing Form 990

Filling out Form 990 can be streamlined by breaking it down into sections. Start with Part I, where you summarize your mission, activities, and financial data for the organization’s operations. Ensure you provide a clear and concise overview, focusing on core activities and outcomes.

Next, complete Part II, the signature block. This section requires the signature of an authorized individual who can attest to the accuracy of the submitted information. Both digital and handwritten signatures are acceptable, but ensure that you comply with IRS guidelines regarding authorization.

When filling in the financial data in Parts III-V, attention to detail is paramount. Report revenue and support while categorizing various types of income, such as contributions, grants, and investment income. Include detailed expenditure reports that accurately reflect operating costs and how funds were utilized.

Focusing on these schedules is equally important. Each requires specific data to ensure compliance and transparency. Here’s how to proceed with each relevant schedule:

Common mistakes to avoid

Filing Form 990 can be a complex task, and several common mistakes can lead to penalties or compliance issues. One frequent error is submitting incomplete forms. Ensure all sections are fully completed, and every question is answered appropriately to avoid delays or rejections.

Incorrect financial reporting can also cause significant problems. Double-check all numbers and financial entries. It’s vital to align figures with your financial statements to prevent discrepancies that could raise red flags with the IRS.

Other common pitfalls include:

Filing and submission of Form 990

Once Form 990 is completed, the next step is submission. Depending on your organization's size and structure, you may choose electronic filing options or mail-in submissions. The IRS encourages electronic filing due to the speed and ease of confirmation.

For electronic submissions, ensure that you use IRS-approved platforms. If mailing, double-check that you’re sending to the correct IRS address as specified for Form 990, considering any specific instructions based on your state or organization type.

After submission, confirmation is essential. Verify receipt of your document through the IRS’s online services or by waiting for a confirmation point via email. Keeping a copy of your filed Form 990 is crucial for your records and future reference.

Managing Form 990 post-filing

After filing Form 990, organizations must maintain records for compliance. This includes retaining financial statements, relevant correspondence, and proof of submission for a minimum of three years, as mandated by the IRS. Keeping meticulous records is vital for any potential audits or inquiries.

Non-compliance with filing requirements can lead to penalties that are both financial and legal. Organizations face significant fines for late filings or discrepancies in reporting. Additionally, there may be restrictions on future tax-exempt status if compliance is not consistently maintained.

Resources for further assistance

Filling out Form 990 is a vital task for nonprofit organizations, and several resources are available to assist. Online tools and platforms can streamline your process, ensuring compliance and accuracy. Many communities provide workshops or webinars focused on nonprofit management, which can offer valuable insights.

For those who prefer personal assistance, seeking professional help from accountants or legal experts familiar with nonprofit laws is advisable. They can provide tailored advice based on your organization’s unique needs and requirements.

Utilizing pdfFiller’s solutions for form management can significantly enhance your experience. The platform allows users to fill, edit, and manage your Form 990 seamlessly. It includes features that enable collaboration, document sharing, and secure storage, making it easier to maintain compliance and transparency.

FAQs about Form 990

Nonprofit organizations often have questions regarding Form 990. For instance, what happens if you miss a filing deadline? Organizations should file an extension if necessary. However, penalties can still apply for late submissions.

Amendments to submitted Form 990 can be made by filing Form 990-X. This allows nonprofits to correct any errors found post-filing. Additionally, first-time filers might find the process overwhelming, so it's often recommended to start early and seek assistance as needed.

Regarding trends, recent Form 990 filings show an increase in transparency and digital reporting practices among nonprofits. Many organizations are adopting modern technology to enhance compliance and reporting accuracy, reflecting a growing emphasis on accountability within the sector.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form 990 in Chrome?

How do I fill out form 990 using my mobile device?

Can I edit form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.