Get the free Form 265-act-rev 1966

Get, Create, Make and Sign form 265-act-rev 1966

Editing form 265-act-rev 1966 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 265-act-rev 1966

How to fill out form 265-act-rev 1966

Who needs form 265-act-rev 1966?

Comprehensive Guide to Form 265-Act-Revenue 1966 Form

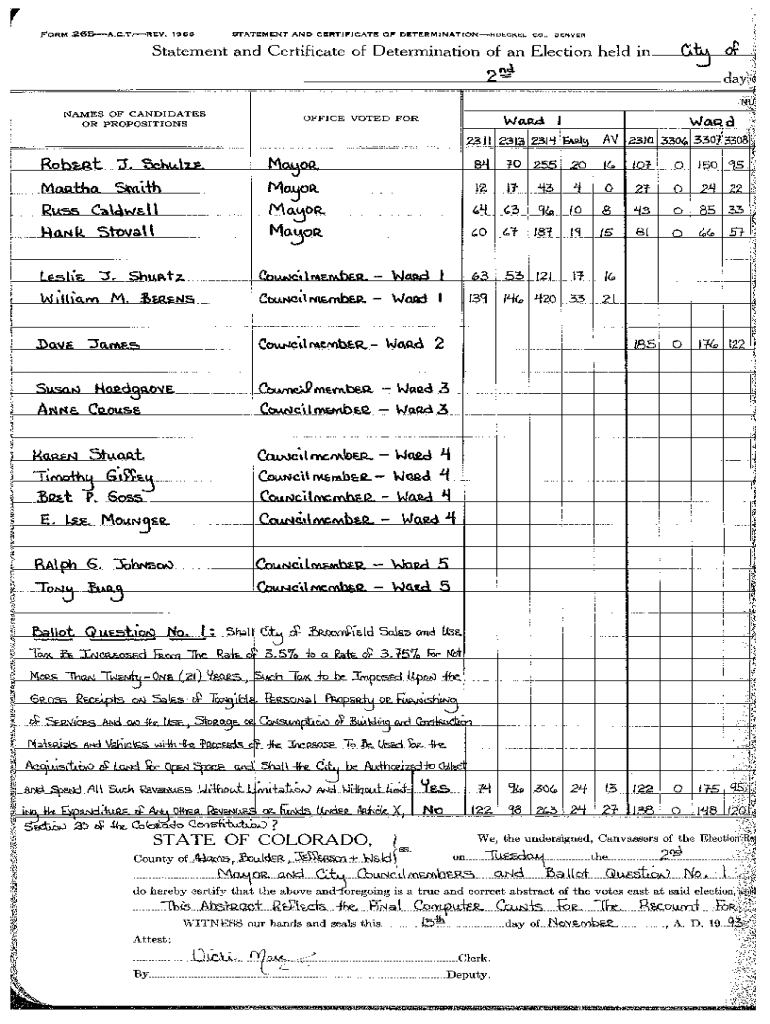

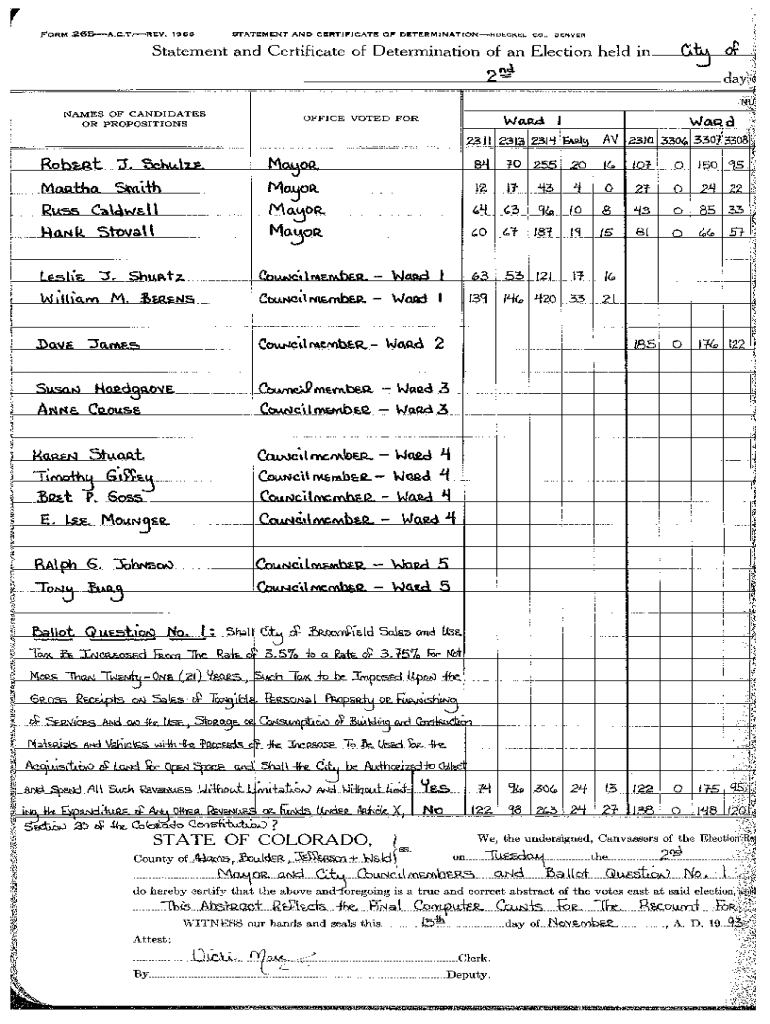

Overview of Form 265-Act-Revenue 1966

Form 265-Act-Revenue 1966 serves as a critical tool in the administration and compliance of various regulatory requirements. Specifically designed for reporting and managing revenue, this form plays a significant role in ensuring that individuals and businesses adhere to the applicable laws and regulations. Its importance cannot be overstated, as it aids in the collection of vital data that informs fiscal policy and compliance on both state and federal levels.

The historical context of Form 265 traces back to initiatives aimed at enhancing revenue generation and management. Established during a pivotal time in tax legislation, the Act sought to refine and streamline processes behind revenue reporting. Understanding the origins of Form 265 helps users appreciate the structure and necessity of the information required today.

Key features of Form 265

Form 265 encompasses a variety of components that users must comprehend fully to ensure accurate and effective submission. One of the primary features is the types of information required, which can range from personal identification details to comprehensive financial insights. The structured format is designed to facilitate usability while ensuring that all relevant data is captured.

These sections collectively ensure that all required data is presented in an organized manner, allowing for efficient processing and review.

Step-by-step instructions for filling out Form 265

Filling out Form 265 can seem complex, but with the right preparation and approach, it can be straightforward. Before you begin, gather all necessary documents and information that will be vital during the filling process. Having documents readily available minimizes errors and delays.

Editing and customizing Form 265 using pdfFiller

The pdfFiller platform significantly enhances the user experience by providing interactive tools for editing Form 265. Users can easily manipulate document fields to ensure accuracy and completeness. With a few clicks, you can customize data entries and adapt the form to reflect your unique circumstances.

eSigning Form 265: A seamless process

The convenience of electronic signatures revolutionizes the signing process for Form 265. Electronic signatures not only save time but also enhance security and compliance. With pdfFiller, eSigning is straightforward and integrates seamlessly into the overall document management process.

This streamlined approach ensures that all necessary steps are taken without unnecessary delays.

Collaborating on Form 265

Collaboration is a critical component when managing Form 265, especially for teams that require input from multiple stakeholders. pdfFiller offers robust sharing options that facilitate team collaboration on this essential document.

These tools foster a more collaborative environment, enhancing the quality and accuracy of the information submitted.

Managing Form 265 after submission

Post-submission, managing Form 265 is crucial for compliance and record-keeping. Users can confidently utilize pdfFiller’s storage and retrieval options to ensure they maintain a comprehensive repository of all submitted documents.

Efficient management ensures that users remain prepared for audits or inquiries regarding their submitted forms.

Frequently asked questions about Form 265

Users often have queries regarding the completion and submission of Form 265. It’s essential to address common concerns to streamline the filling process.

Being informed about these issues can significantly ease the overall experience in dealing with Form 265.

Additional tips for effective form management

Managing Form 265 effectively goes beyond just filling it out correctly. For individuals and teams, implementing best practices for document security is essential.

By adopting these practices, users can not only complete Form 265 but also ensure their data remains secure and compliant.

User testimonials: Success stories with pdfFiller and Form 265

Real-life experiences from users highlight the impact of efficient document management on dealing with Form 265. Testimonials illustrate how pdfFiller has revolutionized their approach to form completion and submission.

These success stories serve as a testament to the efficiency and ease that pdfFiller brings to managing Form 265.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 265-act-rev 1966 to be eSigned by others?

How do I edit form 265-act-rev 1966 in Chrome?

Can I edit form 265-act-rev 1966 on an Android device?

What is form 265-act-rev 1966?

Who is required to file form 265-act-rev 1966?

How to fill out form 265-act-rev 1966?

What is the purpose of form 265-act-rev 1966?

What information must be reported on form 265-act-rev 1966?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.