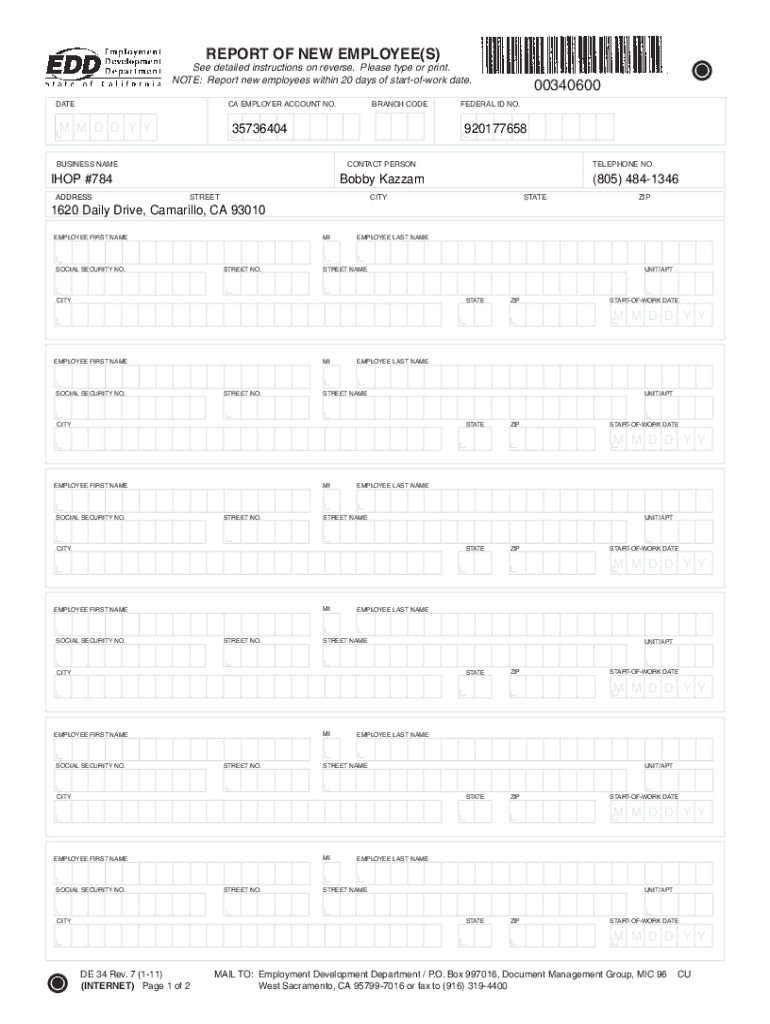

Get the free Report of New Employee(s)

Get, Create, Make and Sign report of new employees

Editing report of new employees online

Uncompromising security for your PDF editing and eSignature needs

How to fill out report of new employees

How to fill out report of new employees

Who needs report of new employees?

Comprehensive Guide to the Report of New Employees Form

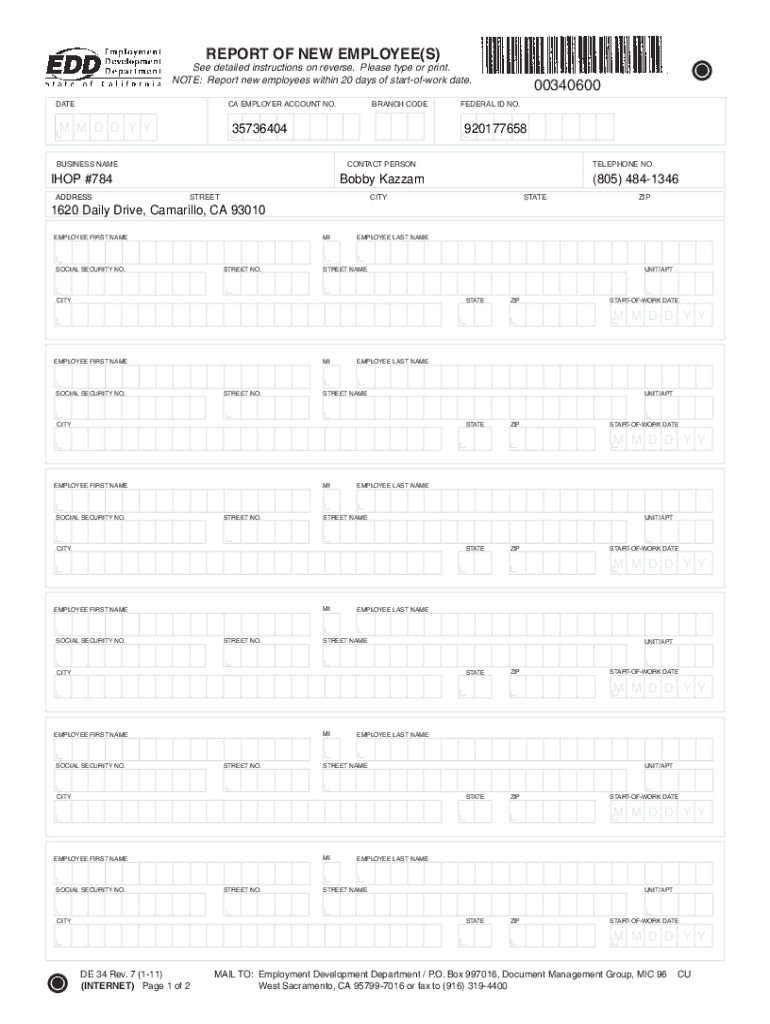

Understanding the new employee reporting form

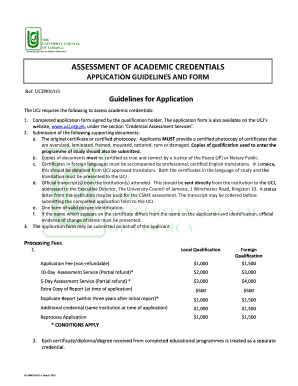

The report of new employees form is a crucial document that employers must complete to inform state authorities about new hires. Its primary purpose is to ensure compliance with state and federal laws aimed at tracking employment for child support enforcement and tax purposes. Accurate and timely reporting enhances workforce management and aids in the proper execution of government programs.

Accurate reporting not only helps maintain compliance but also benefits employers through smoother tax processes and minimal legal repercussions. Varying reporting requirements exist across states, necessitating attention to specific local regulations to avoid potential fines or confusion.

Who is required to report new hires

Employers with employees in any US state are generally required to report new hires. This includes businesses of all sizes, from small startups to large corporations. However, there are some exceptions. For instance, organizations such as religious institutions may have different reporting obligations depending on local laws.

Both Human Resources and Payroll departments play vital roles in this reporting process. HR is responsible for collecting new employee data while Payroll manages the actual submission of the report, ensuring that all pertinent information is filed accurately and timely.

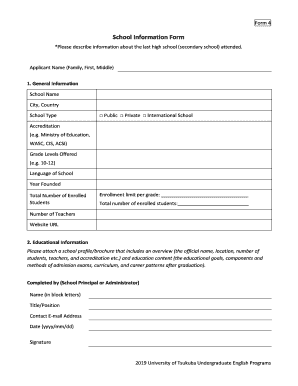

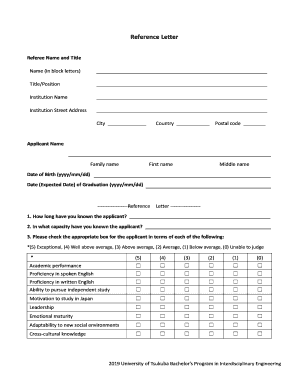

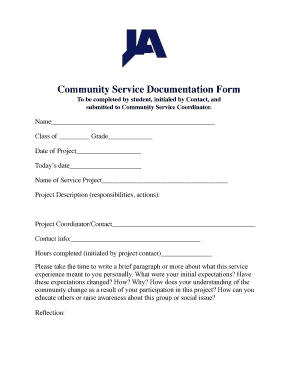

Key information to include in the report

When completing the report of new employees form, several key pieces of information must be included. It's essential to gather complete and accurate data to avoid issues with compliance or delays in employee processing.

The core components involve not only employee details but also employer details for cross-reference by authorities.

Reporting deadlines and timelines

Understanding the reporting deadlines is vital for avoiding legal pitfalls. Generally, employers must submit the report of new employees form within a specific time frame, which can vary by state. For instance, some states require reports within 20 days of the new hire's start date.

The implications of late reporting can be serious, including financial penalties and stricter scrutiny from state agencies. Certain circumstances, such as hiring temporary employees or contractors, may also have different reporting timelines, necessitating careful adherence to regulations.

Methods of reporting new hires

Employers can report new hires using various methods, making the process flexible and accessible. The choice of method may depend on the technology available and the preferences of the employer.

Online reporting is becoming the most common method, with state-specific portals designed for efficiency. Instructions vary by state, but these platforms are generally user-friendly.

Best practices for completing the new employee report

Ensuring accuracy in your report of new employees form is paramount. Common mistakes include misspelled names, incorrect Social Security Numbers, and omitted fields. Making a checklist can help employers avoid these pitfalls.

Additionally, employers should regularly check their compliance against state laws, as regulations may change. An internal review process can aid in capturing discrepancies before submission.

Frequently asked questions (FAQs)

Addressing common queries can clarify understanding regarding the reporting of new employees. Employers often ask what happens if they forget to report a new hire. In many cases, employers will face penalties or fines depending on state laws.

Another common concern is whether new employee reports can be amended. Yes, amendments can usually be made, but specific procedures must be followed based on state requirements.

Need assistance?

Employers who find themselves confused by the reporting process should know where to turn for assistance. Each state has designated agencies responsible for handling new hire reporting, and their contact details are often available online. Engaging with these resources ensures critical compliance.

In addition, utilizing tools like pdfFiller can streamline the process. This platform offers features tailored for new hire reporting, allowing users to edit documents, securely eSign, collaborate, and manage all reporting needs efficiently.

Resources for multi-state employers

Multi-state employers face unique challenges in reporting due to varying regulations across states. It becomes essential to maintain a comprehensive understanding of each state's specific requirements. Online resources, state-specific guidelines, and compliance checklists can aid in this endeavor.

Using tools like pdfFiller not only simplifies the documentation process but also allows teams to collaborate effectively, ensuring that everyone involved is knowledgeable about the specific requirements for each jurisdiction.

Final thoughts on employee reporting compliance

Compliance with the report of new employees form is not just about avoiding fines; it's about upholding the responsibilities that come with being an employer. By accurately reporting new hires, businesses contribute to essential state programs that provide financial assistance for families in need. Employers must stay informed and proactive in their reporting duties to foster a responsible workforce.

pdfFiller enhances this experience by streamlining the reporting process. With its document management capabilities, employers can ensure compliance while saving time and reducing errors. By employing such tools, businesses are better prepared to navigate the complexities of employment regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete report of new employees online?

How do I edit report of new employees online?

Can I sign the report of new employees electronically in Chrome?

What is report of new employees?

Who is required to file report of new employees?

How to fill out report of new employees?

What is the purpose of report of new employees?

What information must be reported on report of new employees?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.