Get the free Beneficiary Designation

Get, Create, Make and Sign beneficiary designation

How to edit beneficiary designation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation

How to fill out beneficiary designation

Who needs beneficiary designation?

Beneficiary designation form - How-to guide

Understanding beneficiary designation forms

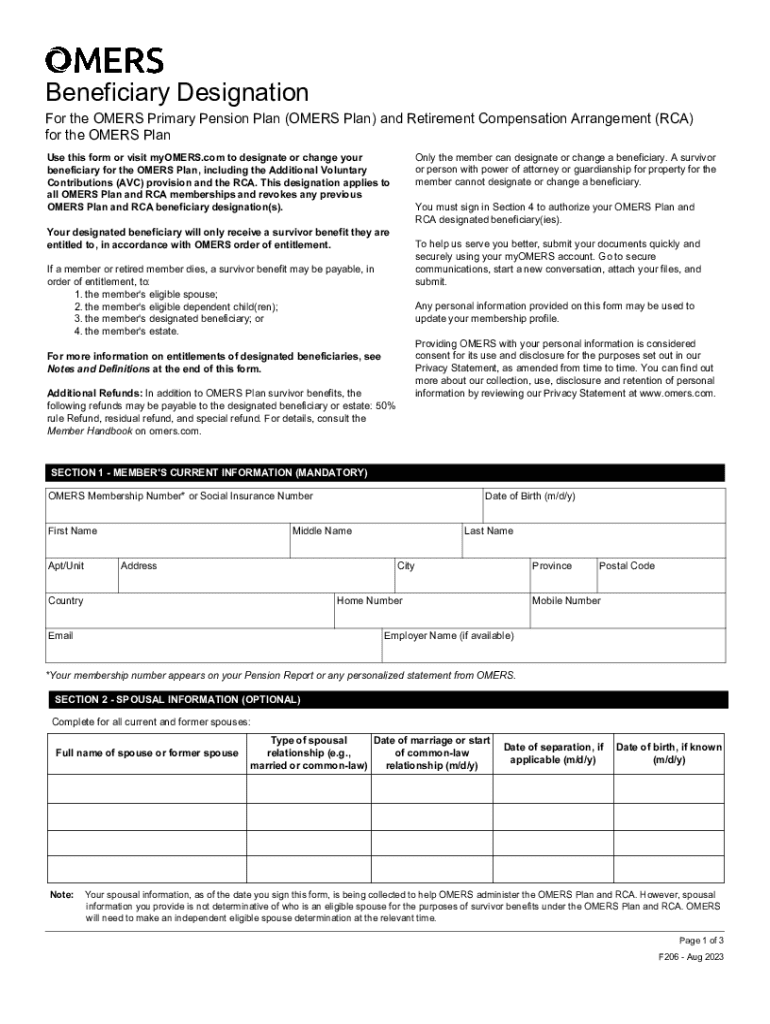

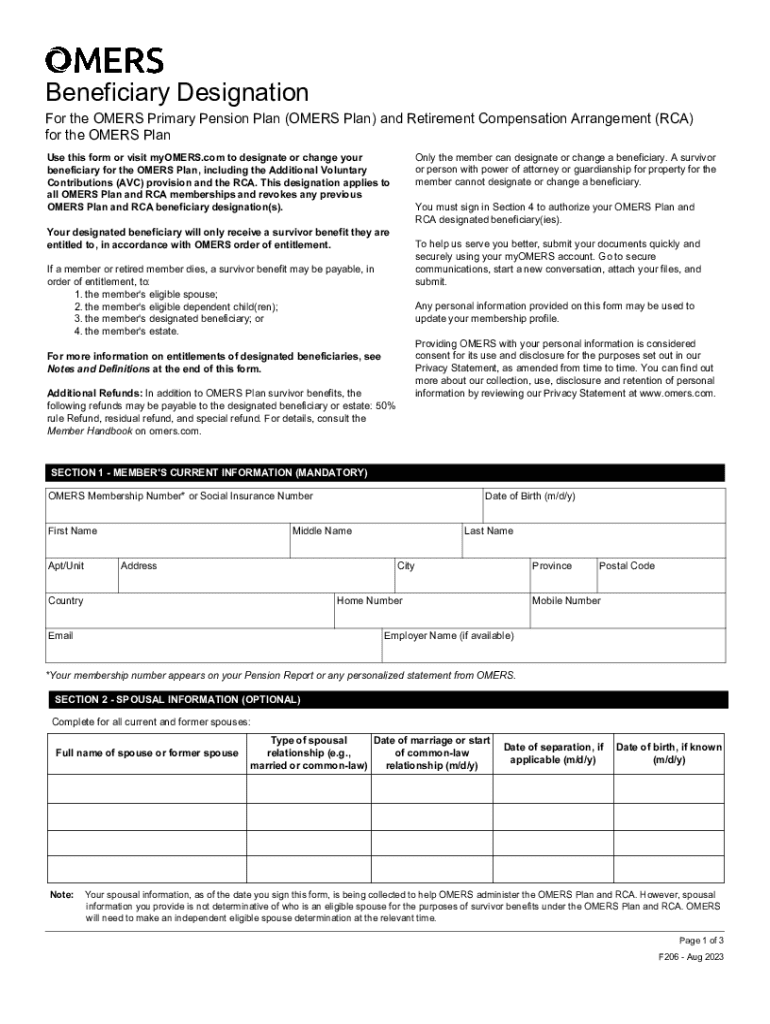

A beneficiary designation form is a critical document used to specify who will receive certain assets or benefits upon your death. These forms play a vital role in the distribution of your estate, making it essential to fill them out accurately and thoughtfully. By designating beneficiaries, you can ensure that your wishes are respected and that your loved ones are provided for without unnecessary delays or complications.

Accurate beneficiary designation is not just a matter of preference; it holds legal weight. An incorrect or outdated designation can result in assets being distributed against your wishes. Therefore, understanding when and why these forms are necessary is crucial. Common situations include life insurance policies, retirement accounts, and certain financial accounts where beneficiaries are specified.

Key elements of a beneficiary designation form

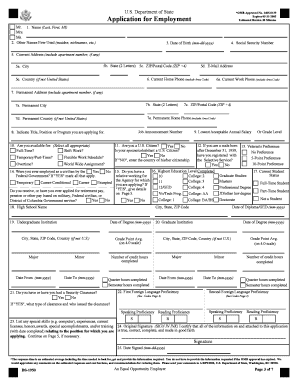

Filling out a beneficiary designation form requires specific personal information to ensure proper identification of both the account holder and the beneficiaries. This often includes your full name, date of birth, and contact information. Such details are critical in avoiding any confusion regarding your identity or your designated beneficiaries.

Alongside your information, the form needs details about the beneficiaries. Primary beneficiaries are those who are first in line to receive your designated assets, while contingent beneficiaries receive assets if the primary beneficiaries are unavailable, such as in the event of their passing. The form typically requires signatures and dates to ensure its legitimacy.

Types of beneficiary designation forms

Several types of accounts and policies require beneficiary designation forms. Primarily, life insurance policies utilize these forms to specify who benefits from a policy upon the insured individual's death. Similarly, retirement accounts like IRAs and 401(k)s require designations to ensure that funds are distributed efficiently.

Wills and trusts also interact with such forms, often directing how assets should be managed and dispersed, especially in cases where a trust is involved. Financial accounts, including bank accounts and investment accounts, often necessitate beneficiary designations to avoid probate processes, which can delay access to assets.

Steps to fill out a beneficiary designation form

Filling out a beneficiary designation form isn't overly complex, but it requires attention to detail. The first step is to gather all necessary information about yourself and your prospective beneficiaries. This can include full names, dates of birth, and contact information. Having this handy will streamline the process.

Next, choose your beneficiaries. Consider factors such as financial need, relationships, and any specific wishes you have. Once you've determined who will receive your assets, complete the form accurately, making sure to avoid common mistakes that can lead to issues later. Double-check all entries for accuracy and clarity. Finally, sign and date the form to validate it.

Best practices for managing your beneficiary designation

Managing your beneficiary designations requires ongoing attention. It’s important to regularly review your designations, ideally at least once a year, or whenever major life events occur, such as marriage, divorce, or the birth of a child. These changes can impact who you want to receive your assets.

Common mistakes when completing a beneficiary designation form

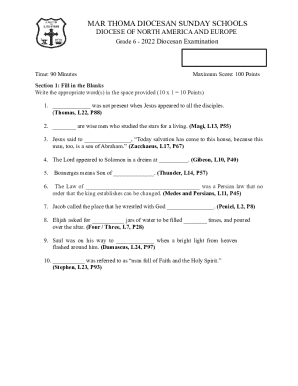

Errors in completing a beneficiary designation form can lead to significant issues for your estate. One of the most common mistakes is leaving sections blank, which can render the form invalid or create ambiguity. It's crucial to fill out every applicable section completely.

Additionally, ensure that information provided on your beneficiary designation form is consistent with other documents, such as your will and trusts. Discrepancies can cause legal complications and disputes among beneficiaries. Lastly, always keep a copy of the submitted form for your records; this provides a reference point for you and your loved ones.

Resources for assistance

There are numerous resources available to aid you in completing your beneficiary designation form. Printable beneficiary designation form templates can often be found on financial institution websites or legal service platforms. These templates provide a structured way to fill out the necessary information.

Additionally, online tools can assist in completing forms accurately, reducing the chance of mistakes. Many financial advisors and lawyers specialize in estate planning and can provide professional assistance with the process, ensuring your designations align with your overall financial strategy.

Legal considerations related to beneficiary designation forms

Understanding the legal implications of beneficiary designation forms is imperative. Different states have varying laws governing transfer on death and beneficiary designations. It is crucial to familiarize yourself with your state’s specific regulations to ensure compliance.

Failing to designate a beneficiary can result in your assets entering probate, a time-consuming process that can create unnecessary financial burdens for your heirs. Designated beneficiaries usually have ownership rights and can receive assets quicker, which enhances the peace of mind that comes from properly managing your estate.

Interactive tools offered by pdfFiller

pdfFiller provides a range of interactive tools specifically designed to assist users in managing their beneficiary designation forms. With document editing capabilities, you can modify and fill forms easily without the need for physical paper. Its eSignature feature allows for seamless signing, making the process efficient and legally binding.

Additionally, pdfFiller offers cloud-based management, which ensures that your documents are securely stored and easily accessible wherever you are. Whether you’re working individually or as part of a team, collaboration options facilitate coordinated efforts on completing and managing your beneficiary designations.

Frequently asked questions (FAQs)

Understanding common inquiries regarding beneficiary designations can clarify the process further. For instance, what happens if a beneficiary is no longer living? Most often, the assets would then pass to contingent beneficiaries, or according to your estate plan if none are designated. Similarly, many wonder about changing their beneficiary designations, which can usually be done at any time as long as the current holder's account allows it.

It’s also vital to know what happens when no beneficiary is designated. In such cases, assets will typically go through probate, taking longer to distribute and potentially creating additional costs in legal fees. Understanding these facets of beneficiary designation can assist individuals in making informed decisions.

Testimonials from users

Many users have shared their successful experiences using pdfFiller to complete their beneficiary designation forms. From intuitive editing features to easy e-signature collection, individuals have found that these tools significantly reduce stress and confusion over the handling of important documents. Users frequently remark on the enhanced peace of mind that comes from having their designations accurately filled out and easily accessible.

Testimonials highlight the importance of getting beneficiary designations right — both for themselves and their loved ones. They emphasize that a well-organized beneficiary designation form can resolve potential issues and foster clarity during challenging times.

Next steps after completing your beneficiary designation form

Once your beneficiary designation form is completed, the next steps involve secure submission and storage. Ensure that the form is sent to the appropriate institution—be it your insurance company, retirement plan administrator, or banking institution. It’s advisable to confirm receipt with them to avoid any hiccups.

Additionally, store your completed form in a safe place, both digitally and physically, making it easily accessible if needed. Regularly revisiting your designation setup is vital to ensure it reflects your current intentions, embracing any life changes that might require updates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute beneficiary designation online?

How do I edit beneficiary designation straight from my smartphone?

How do I fill out beneficiary designation using my mobile device?

What is beneficiary designation?

Who is required to file beneficiary designation?

How to fill out beneficiary designation?

What is the purpose of beneficiary designation?

What information must be reported on beneficiary designation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.