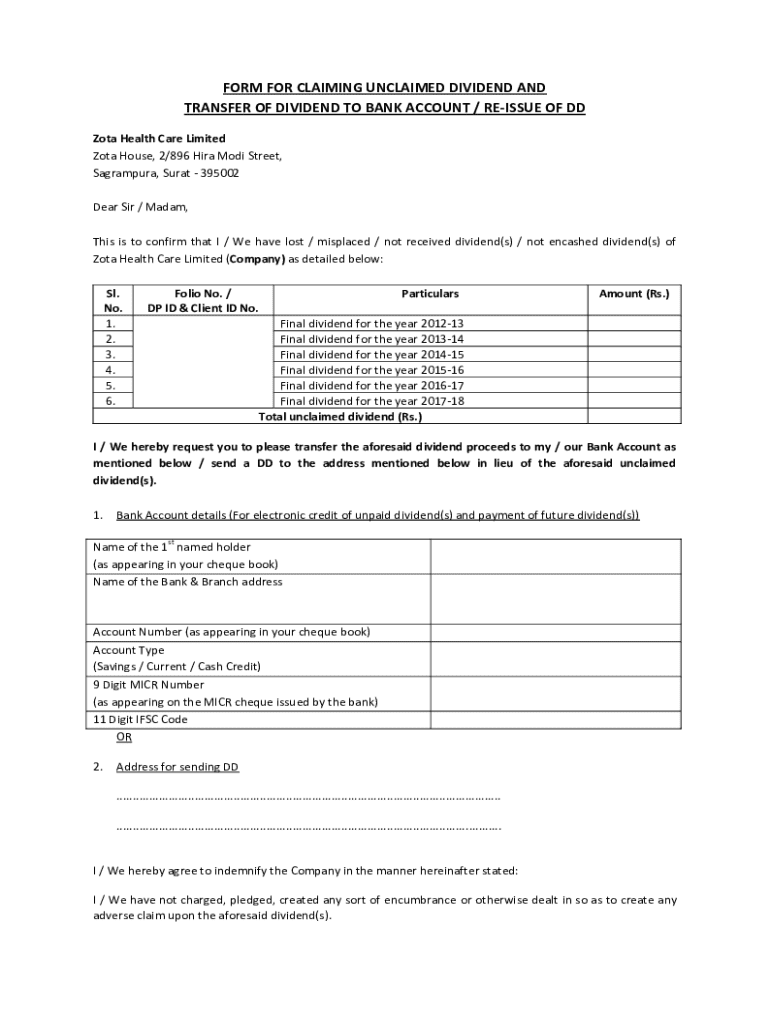

Get the free Claim Form for Unclaimed Dividend

Get, Create, Make and Sign claim form for unclaimed

Editing claim form for unclaimed online

Uncompromising security for your PDF editing and eSignature needs

How to fill out claim form for unclaimed

How to fill out claim form for unclaimed

Who needs claim form for unclaimed?

Claim Form for Unclaimed Form: A Comprehensive Guide

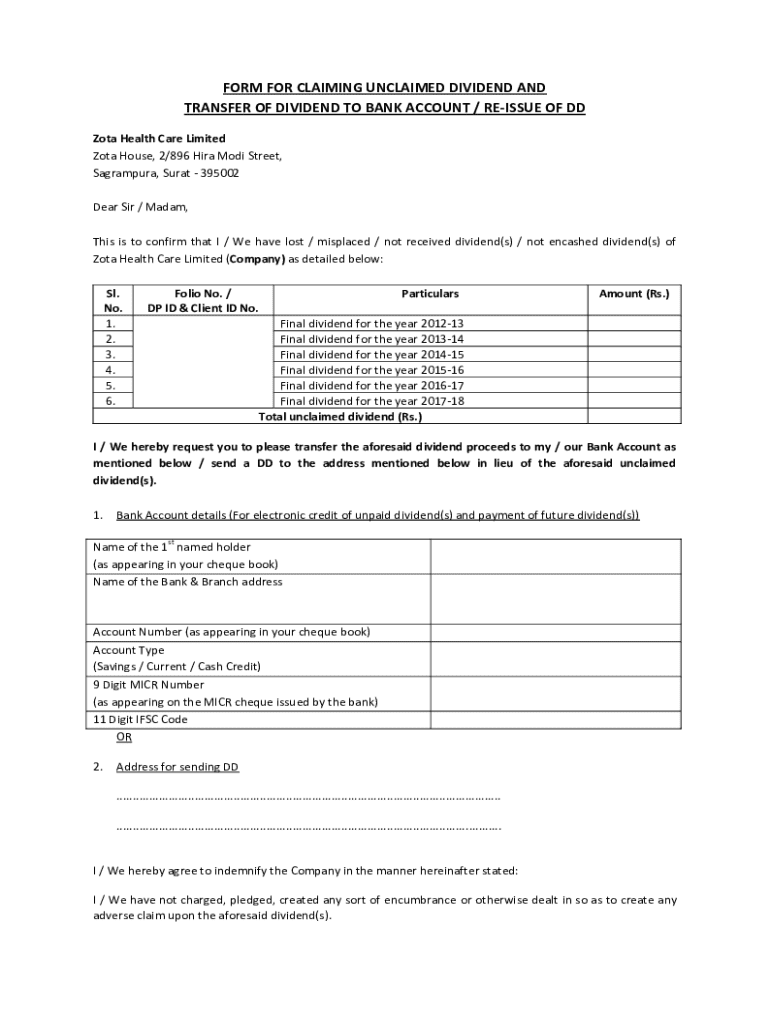

Understanding unclaimed forms

Unclaimed forms refer to documents associated with funds, assets, or benefits that are not actively claimed or retrieved by their rightful owners. These can range from forgotten bank accounts, uncashed checks, or even life insurance payouts that have gone unnoticed. Understanding why forms become unclaimed is essential for effective recovery.

Common reasons for a status of unclaimed include administrative errors in submission, insufficient follow-up by the claimant, or miscommunication with governing agencies. It is important to note that unclaimed forms are often retrievable even after significant time lapses, provided the proper claim process is followed.

When to use a claim form for unclaimed funds

The need to use a claim form for unclaimed funds arises in various scenarios. For instance, many individuals may forget about old bank accounts, retirement funds, or utility deposits that were never collected. Additionally, individuals who inherit assets might face similar dilemmas if the deceased left unclaimed funds behind.

Filing a claim form promptly is vital. Many jurisdictions impose deadlines on claiming funds, and waiting too long could result in losing the right to the funds. Therefore, maintaining timely action can greatly benefit claimants seeking to recover what is rightfully theirs.

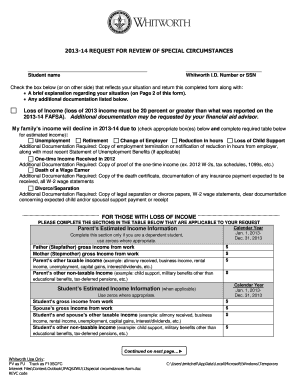

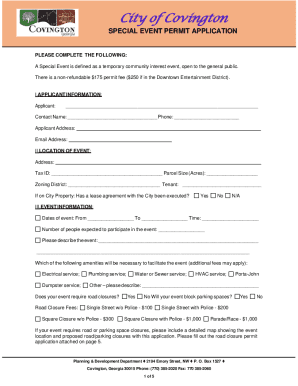

Types of claim forms available

Various claim forms are available depending on the type of unclaimed funds involved. Financial institutions often have their specific forms designed for different account types or circumstances. Similarly, government agencies may provide unique claim forms tailored for programs such as tax refunds or state-administered benefit programs.

It's crucial to understand that claim forms can vary significantly by state or agency; each may have specific requirements that must be adhered to. Therefore, researching the forms pertinent to your situation can save time and reduce potential errors.

Step-by-step instructions for filling out the claim form

When preparing to fill out the claim form for unclaimed funds, initial preparation can set the stage for a successful claim. Gather all necessary personal and financial information, such as Social Security numbers, previous addresses, and identification documents. This preparation also includes obtaining any supporting documents that may be required, like proof of identification or prior account statements.

Completing the claim form involves paying attention to detail across several critical sections. The applicant information section should be filled out thoroughly, ensuring all personal details are accurate. The claim details will require an explanation of the nature of the claim and the amount being claimed, while the supporting documentation section will validate the claim, often necessitating copies of identification or related materials.

Common mistakes can hinder the claims process. One frequent error is submitting incomplete information, which may lead to claim denial. Similarly, missing signatures or crucial documentation can stall the process or result in an outright rejection, making it imperative to review all forms before submission.

Tips for submitting your claim form

When the claim form is ready, choosing the proper submission method is vital. Many organizations now provide an online platform that allows for quick electronic submissions, often leading to faster processing times. However, some may still prefer or be required to submit paper forms through the mail. Consider the agency's preferred methods to ensure your form reaches the appropriate department.

Tracking your submission allows you to confirm its receipt and follow up as necessary. After submitting, keep a copy of all documents and note the date of submission. Many agencies provide a tracking number or acknowledgment, which can facilitate faster follow-ups. Knowing when and how to follow up can keep your claim on track and highlight any potential issues early.

Interactive tools for claim management

pdfFiller offers a suite of interactive tools that simplify the document management and claim submission process. With features like PDF editing, eSigning, and team collaboration capabilities, pdfFiller stands out as a comprehensive solution for managing claim forms and other essential documents, providing a seamless user experience.

Using pdfFiller for submitting your claim form can streamline the process. The platform allows users to fill out claim forms digitally, ensuring accuracy while also enabling easy uploads of necessary supporting documents. A detailed walkthrough of pdfFiller’s actionable features can facilitate successful claims, with many users sharing success stories of recovering unclaimed funds through efficient document management.

Frequently asked questions about claim forms

After submitting your claim form, understanding what happens next can help ease concerns. Generally, agencies will process claims within a specific timeframe, which can vary widely based on volume and complexity. Once reviewed, claimants should receive notification of the outcome, whether approved or denied.

If a claim is denied, there are often processes in place to appeal the decision. Knowing how to navigate these appeals and what additional information may be required can significantly impact your chances of success. Obtaining clarification about denials can also help in ensuring that any mistakes are rectified in future submissions.

Resources for further assistance

For ongoing support with unclaimed funds, various resources can provide assistance. Relevant agencies often have dedicated customer service lines and online resources to guide claimants through the process. Furthermore, community forums or support groups can share insights from individuals who have successfully navigated similar experiences.

Websites of state treasury departments, banking authorities, or federal agencies are often rich with information, including downloadable claim forms and FAQs. You may also find useful contact information directly on these sites to facilitate direct inquiries primarily centered around claims and unclaimed funds.

Final tips for successful claims

To enhance your chances of successful claims, maintaining organized documentation is vital. By retaining copies of all correspondence and proof of submission, you can follow up efficiently and assertively. Regularly check the status of your claim, as agencies may not always proactively inform you during the process.

Utilizing platforms like pdfFiller for ongoing document organization can streamline this process. The ability to track and manage critical documents in one place eases the burden of maintaining full oversight of your claims and future forms that need attention.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my claim form for unclaimed in Gmail?

How do I edit claim form for unclaimed straight from my smartphone?

How do I fill out claim form for unclaimed using my mobile device?

What is claim form for unclaimed?

Who is required to file claim form for unclaimed?

How to fill out claim form for unclaimed?

What is the purpose of claim form for unclaimed?

What information must be reported on claim form for unclaimed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.