Get the free Proof of Debt – General Form

Get, Create, Make and Sign proof of debt general

Editing proof of debt general online

Uncompromising security for your PDF editing and eSignature needs

How to fill out proof of debt general

How to fill out proof of debt general

Who needs proof of debt general?

Understanding the Proof of Debt General Form: A Comprehensive Guide

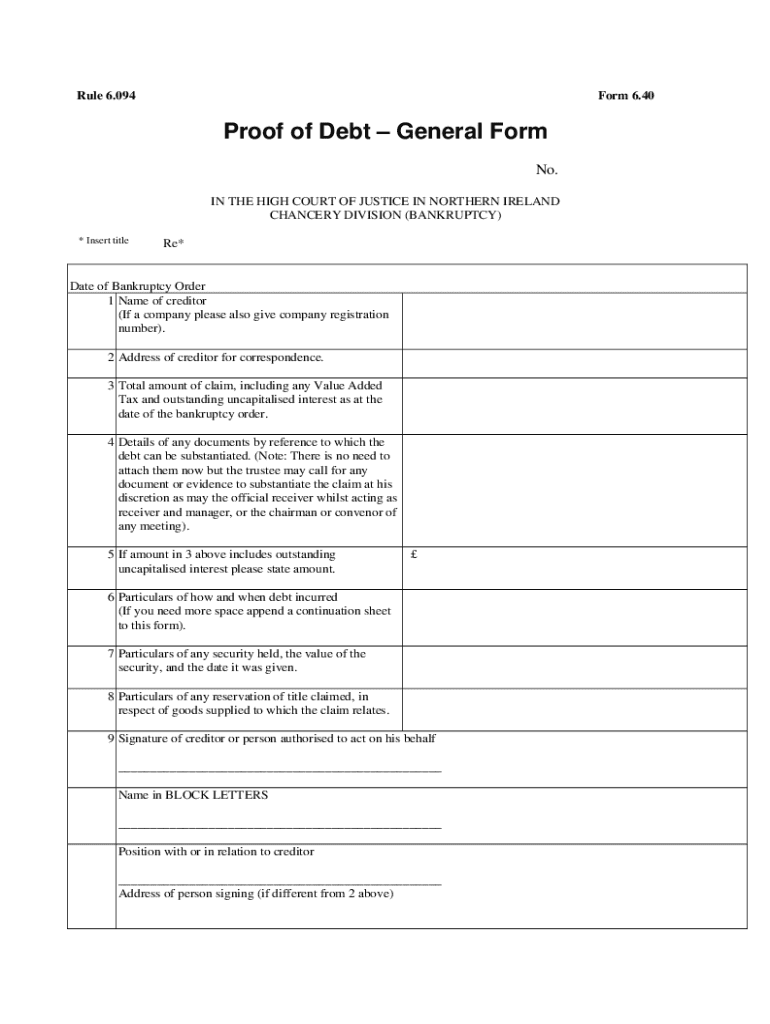

Understanding the proof of debt general form

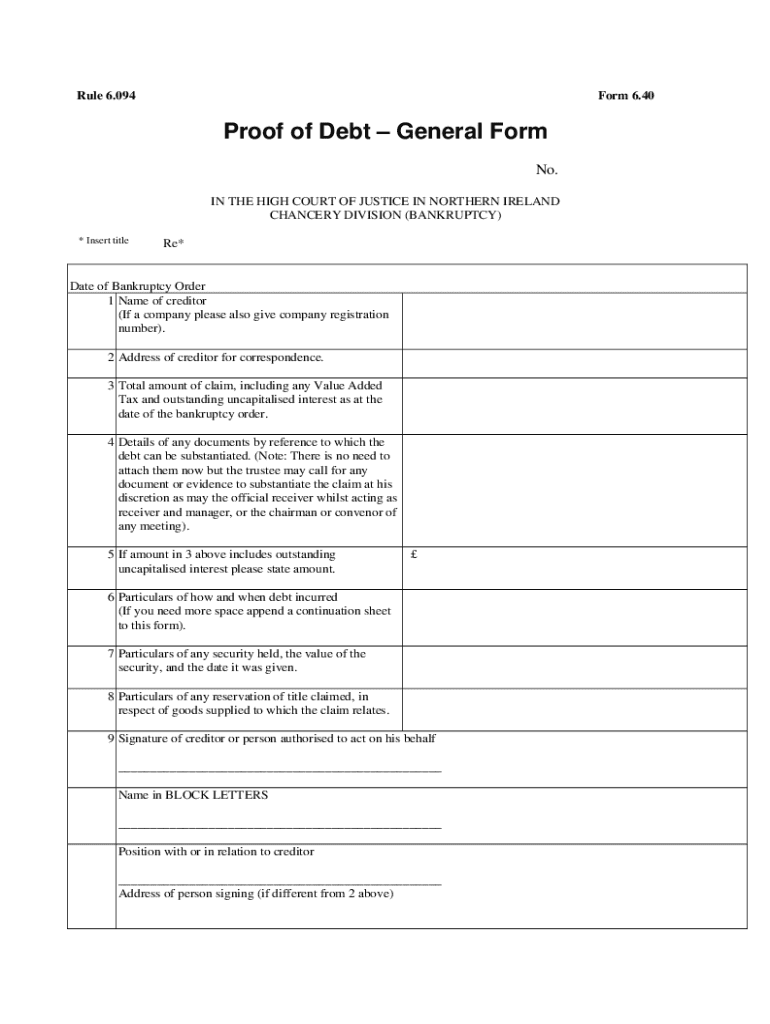

The proof of debt general form serves a critical role in financial disputes, particularly in bankruptcy proceedings. Defined as a formal document submitted by a creditor to claim amounts owed by a debtor, this form is vital for validating financial claims and ensuring that the rights of creditors are upheld. Without accurate completion and timely submission, creditors can lose their right to collect debts.

Who needs a proof of debt? Primarily, creditors, including individuals, legal entities, and businesses, must submit this document when a debtor enters bankruptcy. Even individuals facing financial distress may need such a form to establish their claims against entities that owe them money. Thus, it becomes paramount for all parties involved in financial transactions to understand the importance of submitting a proof of debt accurately.

Filing a proof of debt is essential for multiple reasons. Firstly, it validates claims in bankruptcy cases and demonstrates legitimacy in the creditor’s demand for payment. Secondly, it ensures creditor rights are upheld in court. Most importantly, it impacts the debt recovery process—creditors who fail to submit this form may inadvertently relinquish their rights to receive any payment.

Overview of the proof of debt general form

The proof of debt general form contains several critical components that must be completed correctly to have validity. It begins with identifying information, which includes the creditor's name, address, and contact details. Additional sections require a breakdown of the amount owed, within which the creditor calculates and reports assessable amounts. Unless fully documented, these claims can be contested or rejected.

Moreover, the proof of debt general form requires supporting documentation. This documentation can range from invoices, contracts, and communication records that confirm the debt. It is also essential to note that variations of the form may exist based on jurisdiction, as rules governing the bankruptcy process differ by region. Individual forms may also be distinct from those prepared for businesses, reflecting different data needs.

Preparing to fill out the proof of debt general form

Before filling out the proof of debt general form, gather all necessary information and supporting documentation. Financial records, such as previous invoices and any contracts clarifying the debtor's obligations, provide the foundation for your claim. Also, reference prior communication with debtors to validate your claim fully. Ensuring that all relevant evidence is on hand can streamline the process and minimize the likelihood of errors.

It's equally important to understand the signature and authentication requirements that accompany this form. Typically, a signature from the creditor or their representative is needed to affirm the claim's accuracy. Additionally, evaluating your debts—whether they are legal or non-legal—prior to filing can help ensure proper classification and reporting, thus avoiding complications.

Step-by-step instructions for completing the form

Completing the proof of debt general form involves several key steps. Start with the header section, filling out the creditor information completely. This includes name, contact details, and any relevant account numbers. Step two requires detailing the debt amount owed—be accurate and include a breakdown if there are multiple components to the debt.

In step three, you must provide justification for the claim by attaching all supporting documentation. Ensure that invoices, contracts, and correspondence demonstrating the debt’s validity are included. Finally, step four involves your signature on the form, certifying that the details provided are truthful and accurate. This commitment is legally binding and crucial for maintaining the integrity of your claim.

Common mistakes in filling out the proof of debt general form

Filling out the proof of debt general form can be straightforward, but common mistakes often hinder effective claims. First, ensure that all personal or business information is accurate. Mistakes in this section can lead to delays or claims being deemed invalid. Secondly, double-check your calculations regarding the amount owed—accurate debt amount calculations are crucial for a successful claim.

Another frequent mistake involves insufficient supporting documentation. Failing to attach the necessary financial evidence might result in rejection of your claim, as creditors need to prove their positions meticulously. Lastly, do not overlook the importance of signing and dating the form; neglecting this critical step ensures that your claim will not be processed—leading to wasted time and resources.

Tips for submitting the proof of debt general form

When you're ready to submit your proof of debt general form, consider the various methods available. Online submission offers quick and sometimes streamlined processing, especially through platforms like pdfFiller, while traditional mail remains an option for those who prefer physical documentation. Each method carries its own benefits, and it’s crucial to consider your circumstances and the jurisdiction’s requirements for submission.

Be mindful of deadlines associated with filing. Timeliness is crucial—failure to submit within specified timelines can prohibit your claim from being processed. After submission, establish follow-up procedures to monitor the status of your claim to prevent discrepancies. Keeping track of correspondence and confirmations can save a lot of headache later in the process.

Managing and storing your proof of debt documentation

Once submitted, managing and storing your proof of debt documentation becomes essential for reference and legal purposes. Consider the method of storage—digital solutions offer flexibility and security. Using software like pdfFiller aids in storing documents securely, easily retrieving them when needed, and managing versions effectively.

Digitization aids accessibility; you can edit, sign, or share documents via cloud storage when using a secure platform. It also ensures that approval chains are clear and collaborative. By using tools designed for document management, you enhance your team's capabilities and streamline any potential claims process.

Frequently asked questions (FAQs)

What happens after submitting the proof of debt? Upon submission, the court processes the form and lists the claim for review in bankruptcy hearings, where it may be accepted or challenged by the debtor. It’s a vital step in ascertaining the payment priorities during bankruptcy proceedings.

Can you amend an already submitted proof of debt form? In most cases, amendments to the proof of debt can be made. You may need to file a supplemental form, clarifying the changes and providing additional documentation. It’s crucial to follow the specific rules outlined by the court governing your case.

What if the debtor disputes the proof of debt claim? If a debtor disputes the claim, the case may be reviewed in a court hearing. Both parties will be given an opportunity to present their evidence. Having organized, clear documentation will be invaluable in addressing any disputes, reinforcing the initial claim's legitimacy.

Real-life examples of proof of debt submissions

Successful claims through proof of debt submissions often come from well-prepared creditors possessing comprehensive documentation. For instance, a contractor submitting claims against a business that failed to pay for services rendered showcased invoices, emails detailing agreement terms, and payment requests, ultimately resulting in a successful validation of their debt in court.

Conversely, a common pitfall in claim denials arises when insufficient documentation was presented. A creditor who simply submitted a contract without correspondence proving the debt was actively sought faced rejection due to a lack of necessary context. This example underscores the importance of thorough documentation in increasing the likelihood of successful claims.

Legal resources and support for proof of debt issues

Navigating the complexities of debt claims often requires legal expertise. Seeking legal assistance when considering filing a proof of debt can help clarify your rights and obligations. Various legal resources exist, from free consultations with bankruptcy attorneys to specific organizations that offer guidance on creditor rights.

Moreover, understanding bankruptcy laws is crucial. Many counties provide resources on their court websites detailing procedures regarding proofs of debt, deadlines, and forms required. Familiarizing yourself with these local resources can greatly enhance your ability to navigate the legal landscape effectively.

Interactive tools for better document management

Utilizing tools like pdfFiller can significantly enhance your experience in managing proof of debt documentation. This platform provides features for document editing, electronic signing, and collaborative capabilities, perfect for teams needing to track multiple submissions. Templates for various forms are readily available, simplifying the process of preparing essential documents.

Additionally, smart tips to enhance your document creation experience involve leveraging img options to grab relevant assets and integrating sections for better presentations. This facilitates the creation of polished documents, ensuring that every submission appears professional and well-structured.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the proof of debt general electronically in Chrome?

How do I fill out the proof of debt general form on my smartphone?

Can I edit proof of debt general on an iOS device?

What is proof of debt general?

Who is required to file proof of debt general?

How to fill out proof of debt general?

What is the purpose of proof of debt general?

What information must be reported on proof of debt general?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.