Get the free Form 8868 and Form 990

Get, Create, Make and Sign form 8868 and form

Editing form 8868 and form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8868 and form

How to fill out form 8868 and form

Who needs form 8868 and form?

Form 8868: Your Comprehensive Guide to Filing Extensions

Understanding Form 8868

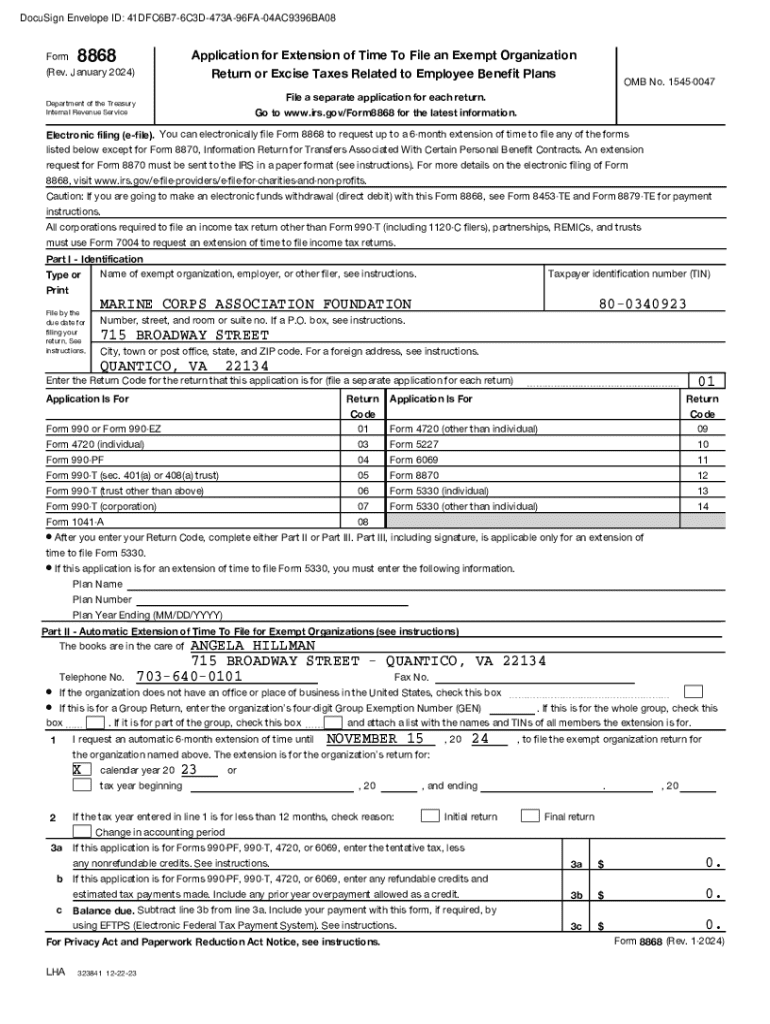

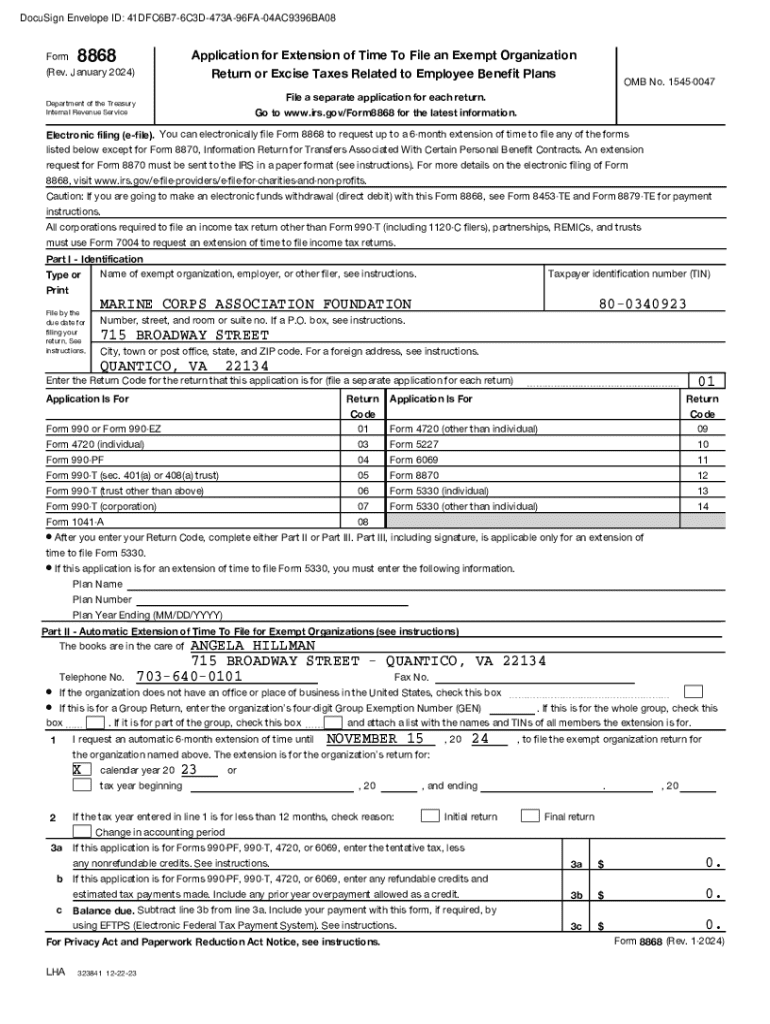

Form 8868 is a critical document for organizations that are classified as exempt under IRS regulations. This form serves a specific purpose: it allows eligible tax-exempt organizations—including charities, nonprofits, and employee benefit plans—to apply for an automatic extension of time to file their annual returns. Understanding its purpose is essential for maintaining compliance with IRS regulations and avoiding penalties.

These organizations typically have specific deadlines for filing their tax returns, such as Form 990, Form 990-EZ, or Form 990-PF. Form 8868 extends these deadlines, giving organizations an additional six months to prepare and submit their returns, which can be invaluable in ensuring accuracy and completeness.

Key changes in Form 8868 for the current tax year

For the 2024 tax year, Form 8868 has integrated several important updates that organizations should be aware of. These changes enhance the filing process, providing clearer guidelines and deadlines for eligible entities, thereby reducing confusion.

One notable update is the streamlining of filing requirements. The IRS has improved the clarity of the instructions, which helps organizations better understand how to correctly complete the form. Additionally, any changes in tax law or IRS processing timelines can affect how exemptions are handled and the overall compliance landscape.

Who can file Form 8868?

Eligibility for filing Form 8868 is straightforward but must adhere to specific criteria. Exempt organizations recognized under Section 501(c) of the Internal Revenue Code can file the form. This includes a wide variety of nonprofit entities, such as charitable organizations, educational institutions, and social clubs.

Moreover, certain employee benefit plans are also eligible to extend their filing deadlines through Form 8868. Importantly, governmental entities face different regulations and may not qualify under the same exemptions, necessitating a careful review of eligibility requirements.

Forms eligible for extension

Form 8868 provides an opportunity to extend the filing period for several specific forms related to tax-exempt organizations. The primary forms eligible for extension include Form 990, Form 990-EZ, and Form 990-PF. These forms are crucial for reporting the operational aspects and financial activities of exempt organizations.

Additionally, Form 8868 can also extend the deadline for Form 5330, which is essential for reporting any excise taxes related to employee benefit plans. Understanding which forms can be extended can significantly aid organizations in managing their filing responsibilities and improving compliance.

Filing deadlines

The deadlines for filing Form 8868 are integral to the compliance process for tax-exempt organizations. Generally, Form 8868 should be filed by the original due date of the return to receive an automatic six-month extension. For example, if an organization’s tax return is due on May 15, the Form 8868 must be submitted by that date to secure an extension until November 15.

Important dates to keep in mind include the fiscal year-end for the organization, which can affect when Form 8868 is due. In addition, organizations should be aware that if the original return due date is missed, then payment of any taxes owed with the return is required to avoid penalties, even if an extension is granted.

Detailed filing instructions for Form 8868

Filing Form 8868 can appear daunting without a clear understanding of the steps involved. To start, organizations need to gather necessary information such as their Employer Identification Number (EIN), the tax year for which the extension is requested, and specific forms related to the organization.

The completion of Form 8868 is structured into three main parts:

Each part must be completed with accuracy to avoid complications in the extension process.

Where and how to file Form 8868

Submitting Form 8868 can be done through either online or mail options. For those who choose to e-file, numerous authorized e-file providers can facilitate the process, ensuring it is both faster and reduces the chance of errors. It’s essential, however, to confirm that the provider is authorized by the IRS.

For those opting to mail in Form 8868, the specific mailing address varies based on whether the organization is expecting a refund or has a balance due. Generally, forms should be sent to the address indicated in the instructions from the IRS. For example, one address is designated for organizations that are not required to make a payment, while others apply to those with tax obligations.

Filing information and compliance

Compliance with IRS regulations regarding Form 8868 is crucial for organizations seeking to maintain their tax-exempt status. Key compliance points include ensuring timely submission of both Form 8868 and the respective annual returns. Timeliness can avoid unnecessary penalties and interest that arise from late filings.

For organizations that fail to submit Form 8868 on time, penalties can be significant. The IRS may impose a flat fee based on how late the return is filed. Similarly, failing to file necessary tax returns after taking an extension can result in additional penalties that impede an organization’s financial standing.

Frequently asked questions about Form 8868

Organizations often have various queries regarding Form 8868, particularly when it comes to the application process. Common questions include whether Form 8868 needs to be filed annually or if once is sufficient, and the answer is that it typically must be submitted each year an extension is sought.

Clarifications on misunderstandings about the filing requirements can also sometimes arise. For instance, some entities incorrectly believe that the automatic extension applies to all forms outright and may not take specific instructions into account. Organizations should also understand that penalties for failing to file on time are in place regardless of whether an extension was previously granted or not.

Helpful resources for completing Form 8868

Completing Form 8868 can be simplified by accessing various IRS publications and materials that outline the filing process in detail. The IRS provides resources such as Publication 557, which covers the requirements for tax-exempt organizations and offers guidance on completing related forms.

Additional resources include checklists and guides available on pdfFiller that ensure organizations do not overlook vital components during their filing. Furthermore, interactive tools can assist users in editing and managing necessary documents seamlessly, which aids in a smooth filing experience.

Insights for specific audiences

Different audiences, including nonprofits, tax professionals, and business owners, might have unique considerations when it comes to completing Form 8868. For nonprofits and charitable organizations, understanding the nuances of compliant reporting is crucial, as it impacts their operational funding and community initiatives.

Tax professionals and reporting agents must be equipped with the latest updates regarding IRS regulations and compliance measures specifically related to Form 8868. Business owners and aggregate filers need to consider how various exemptions and operational aspects of their organizations affect their filing approach—especially when managing employees under benefit plans.

Interactive tools for form management

Utilizing interactive tools can significantly ease the management of Form 8868 as well as related documents. With pdfFiller's platform, users can edit, sign, and collaborate on forms directly, facilitating a smoother workflow. The platform allows organizations to upload and access forms from anywhere, making it more manageable to stay on top of filings.

Cloud-based storage options also enable teams to manage their documentation comprehensively. Features such as sharing, commenting, and real-time collaboration further streamline how organizations can prepare their forms efficiently.

Understanding the impact of delays

Failing to file Form 8868 on time can have significant consequences for an organization, including late penalties and interest charges on owed taxes. Timely filing not only demonstrates compliance with IRS regulations but also enhances the overall credibility of an organization in the eyes of its stakeholders.

Moreover, being organized and proactive by filing early can prevent last-minute issues, such as lost documentation or miscommunication with stakeholders. Establishing reminders well ahead of deadlines can streamline the procedural aspects of filing extensions.

Key takeaways on managing Form 8868

Ultimately, managing Form 8868 efficiently involves awareness of important filing dates and requirements. Organizations need to prioritize compliance to avoid penalties and ensure a smooth filing process. Staying informed about significant changes in tax legislation regarding tax-exempt entities is equally important.

Utilizing resources like pdfFiller can enhance productivity and accuracy in the document management process. Moreover, remaining engaged with IRS updates ensures that organizations adapt to changes effectively, which is crucial for their overall operational stability.

Future developments and stay updated

Keeping abreast of future developments regarding Form 8868 and associated compliance requirements is vital for all tax-exempt organizations. Leveraging resources, such as the IRS website and subscribing to newsletters focused on tax regulations, enables organizations to stay informed about changes that might affect their filing obligations.

Engaging with tax professionals and industry networks can provide insights into adapting to new guidelines efficiently, which can be the difference between compliant and non-compliant status.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in form 8868 and form without leaving Chrome?

How can I fill out form 8868 and form on an iOS device?

Can I edit form 8868 and form on an Android device?

What is form 8868 and form?

Who is required to file form 8868 and form?

How to fill out form 8868 and form?

What is the purpose of form 8868 and form?

What information must be reported on form 8868 and form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.