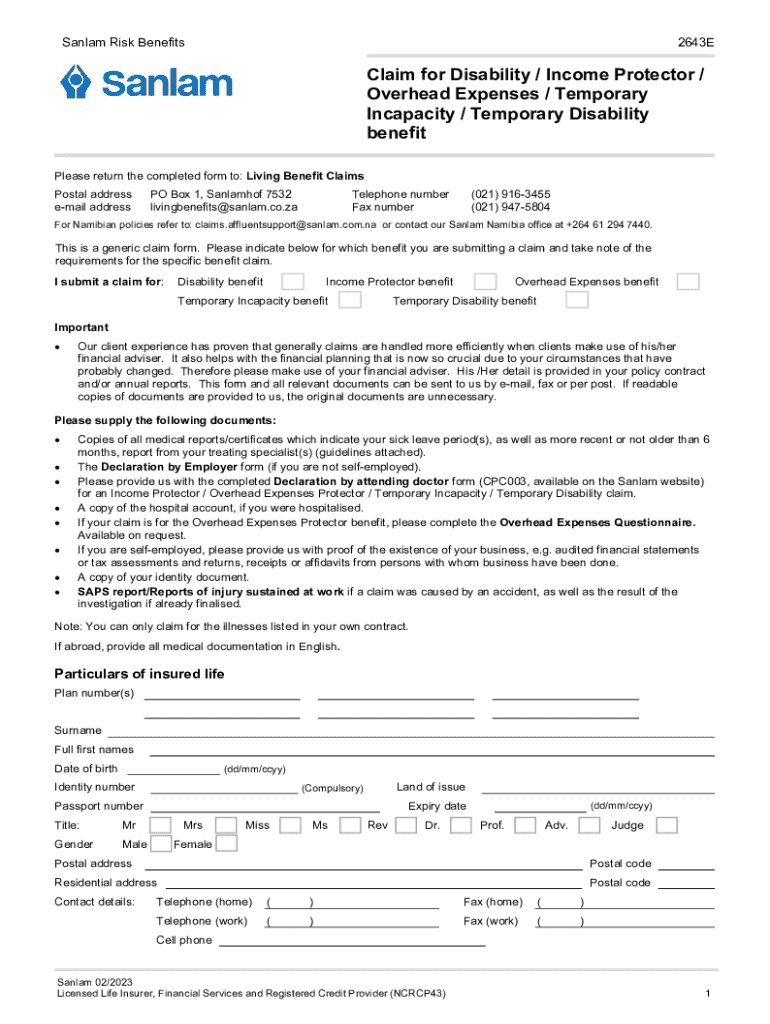

Get the free Sanlam Risk Benefits

Get, Create, Make and Sign sanlam risk benefits

Editing sanlam risk benefits online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sanlam risk benefits

How to fill out sanlam risk benefits

Who needs sanlam risk benefits?

Understanding the Sanlam Risk Benefits Form: A Comprehensive Guide

Understanding Sanlam risk benefits

Sanlam risk benefits comprise a set of insurance products designed to protect individuals and families against financial hardships due to unforeseen circumstances such as death, disability, or critical illness. These benefits are integral for financial planning, offering peace of mind that loved ones will be supported in times of crisis.

Key features of Sanlam risk benefits include comprehensive coverage options and additional services that enhance the overall value of the insurance. Coverage typically includes life insurance, disability income, and critical illness cover, allowing policyholders to tailor their protection based on individual needs.

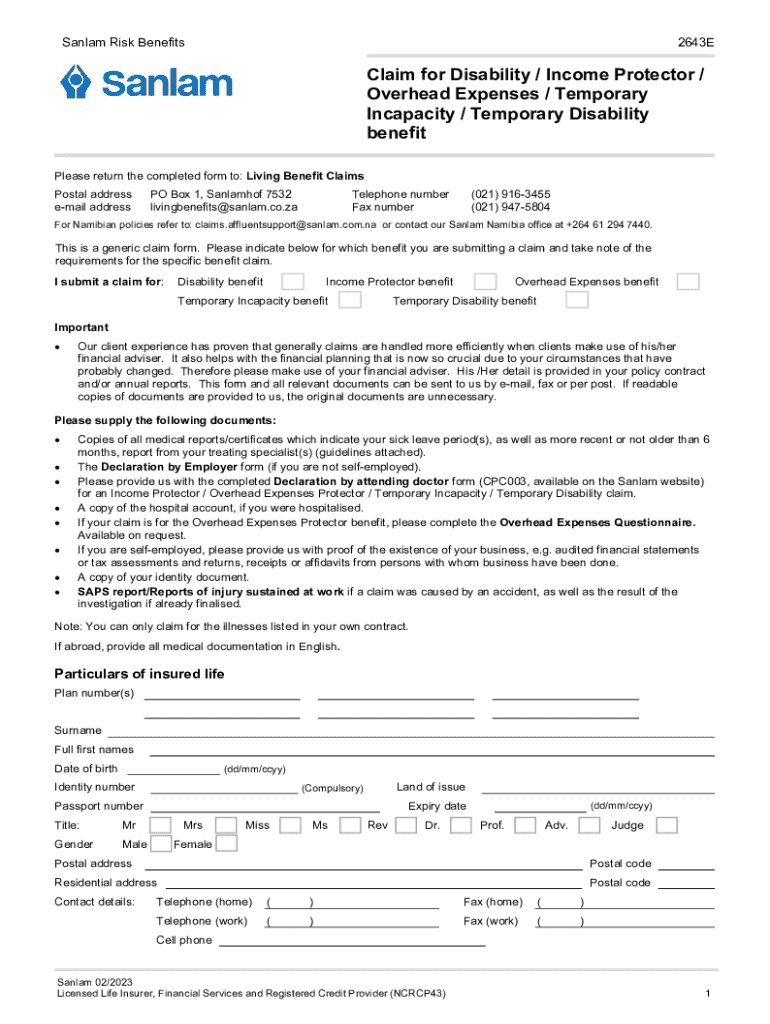

Overview of the Sanlam risk benefits form

The Sanlam risk benefits form is a critical document for individuals seeking to apply for or modify their risk benefits. This form serves multiple purposes, including initiating coverage, updating existing policies, or claiming benefits. It is essential for anyone looking to secure their financial future through Sanlam's offerings.

Individuals who should fill out the form include new policyholders, beneficiaries, or existing clients adjusting their coverage. Typically, the form is utilized during the initial application process, during yearly reviews, or when life changes necessitate updates to the current policy.

Step-by-step guide to completing the Sanlam risk benefits form

To appropriately fill out the Sanlam risk benefits form, it's crucial to gather all necessary information beforehand. This includes personal identifiers such as your name, date of birth, and contact details, alongside important financial data like employment information and income levels. Prior knowledge of existing coverage, if any, is also crucial as it may impact your new application.

When you begin filling out the form, break it down into structured sections. Start with the personal details, ensuring accuracy in all names and dates; then, move on to the employment section detailing your job title and income. The health information section requires transparency about medical conditions, while the coverage selection section allows you to specify your desired benefits.

Reviewing the form is essential to avoid errors. Common mistakes include incomplete sections or inaccuracies in details provided. It’s advisable to create a checklist and verify each part before submission to ensure all information aligns correctly.

Editing and modifying your Sanlam risk benefits form

If you need to make adjustments to your Sanlam risk benefits form post-completion, using pdfFiller's editing tools can facilitate a seamless modification process. This platform allows users to easily access their forms and implement changes as needed. Furthermore, pdfFiller's collaborative features enable sharing documents with stakeholders or advisors for feedback.

Maintaining version control is crucial. Users can track changes made to the document which helps in managing updates and ensuring that the latest version is always at hand.

Signing the Sanlam risk benefits form

Upon completing the form, signing it is the next step. pdfFiller offers a secure digital signing option that is compliant with legal standards, making the process convenient and valid. Digital signatures not only expedite the process but also enhance security by minimizing the risk of tampering.

For those who prefer alternative signing methods, printed forms can be signed manually. However, digital signing allows for quicker processing times and easier document management.

Submitting the Sanlam risk benefits form

Once signed, the next step is submitting the Sanlam risk benefits form. Several submission channels are available, including online platforms, email, and traditional mail. Online submission is often the fastest and most efficient method, whereas email allows for direct communication with Sanlam representatives.

After submission, expect a confirmation process where Sanlam will verify receipt of your form. Timeliness for response can vary typically between several days to a couple of weeks, depending on the complexity of the application.

Managing your Sanlam risk benefits document

Once your Sanlam risk benefits form has been submitted and confirmed, it’s essential to manage the resulting document effectively. Using cloud storage solutions provided by pdfFiller, users can easily store, access, and organize their documents from anywhere, ensuring that important information is always within reach.

Organizing your documents effectively involves categorizing files based on benefits or submission status and frequently referencing them during policy reviews or updates. Additionally, sharing options with stakeholders can facilitate discussion on any required changes or renewals to your risk benefits.

Common FAQs about the Sanlam risk benefits form

Many individuals have questions when managing their Sanlam risk benefits form. If you encounter issues during the completion or submission process, first ensure that all required fields are correctly filled out and check for any unclear instructions on the form. If problems continue, reaching out to Sanlam's customer support is advisable.

Updating your risk benefits information involves submitting a new or amended form. Sanlam typically allows existing clients to update information via the same submission channels as the original form. It’s important to keep all your details current to avoid potential issues during claims.

Additional considerations for risk benefits

Understanding your coverage is paramount when engaging with Sanlam risk benefits. Periodically reviewing the terms of your insurance policy ensures that you are appropriately covered for your current life circumstances. Familiarizing yourself with all terms and conditions can prevent misunderstanding regarding your entitlements.

Asking essential questions about your benefits, such as specifics on exclusions, claim processes, and the timeline for receiving benefits, can provide clarity. These inquiries are vital especially during life events such as marriages, births, or career changes when coverage needs may adjust.

Leveraging pdfFiller for your document needs

pdfFiller stands out as a cloud-based solution that significantly enhances the document management process for users dealing with forms like the Sanlam risk benefits form. Non-technical users can easily adjust and manage their forms, facilitating a smoother experience from completion to submission.

Interactive tools offered by pdfFiller make document management easy. Features such as drag-and-drop editing, collaboration options, and comprehensive tracking capabilities streamline the entire risk benefits process. Users can feel empowered and organized when using such tools.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit sanlam risk benefits online?

How can I edit sanlam risk benefits on a smartphone?

Can I edit sanlam risk benefits on an Android device?

What is sanlam risk benefits?

Who is required to file sanlam risk benefits?

How to fill out sanlam risk benefits?

What is the purpose of sanlam risk benefits?

What information must be reported on sanlam risk benefits?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.