Get the free Commercial Flat Rate Rebate Application

Get, Create, Make and Sign commercial flat rate rebate

How to edit commercial flat rate rebate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out commercial flat rate rebate

How to fill out commercial flat rate rebate

Who needs commercial flat rate rebate?

Commercial Flat Rate Rebate Form - How-to Guide

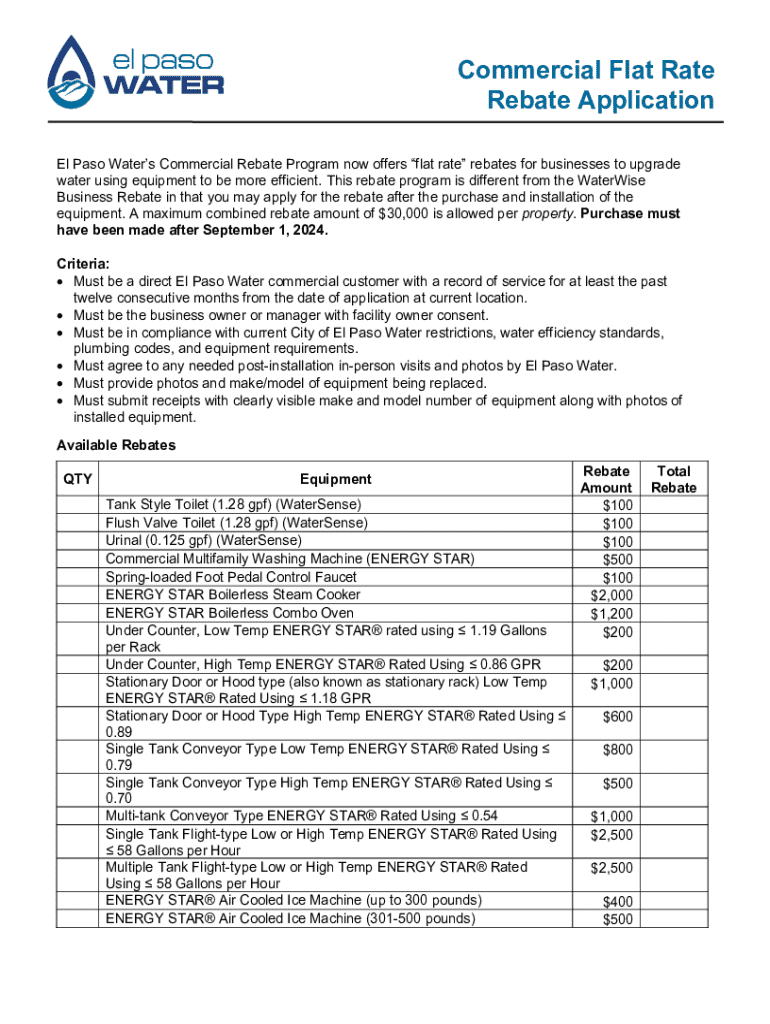

Understanding the commercial flat rate rebate

A commercial flat rate rebate is a financial relief tool designed for businesses to receive a discount on taxes or utilities based on a flat rate rather than variable rates depending on usage. This rebate system simplifies budgeting for small businesses by providing predictable expenses. It represents an essential incentive aimed at stimulating business growth and encouraging investment in local economies.

For businesses, the importance of this rebate extends beyond immediate financial savings. It can enhance cash flow, enabling funds to be allocated toward other operational needs or expansion projects. Understanding the eligibility criteria is essential to take full advantage of this program, ensuring that businesses are effectively positioned to capitalize on available benefits.

Determining your eligibility for the rebate

Before applying for the commercial flat rate rebate, it's crucial to assess whether your business meets the eligibility criteria. This rebate is primarily available to both owners of commercial properties and tenants with leasehold agreements that demonstrate a valid operational need and fall within financial thresholds set by local governing bodies.

Various factors determine eligibility, such as the type of property utilized and the specifics of its operation. Businesses may also need to demonstrate a minimum financial performance threshold to qualify. Local government websites often provide comprehensive resources that can clarify these criteria.

Preparing your documentation

Gathering the required documentation is a vital step in the application process for the commercial flat rate rebate. Essential documents typically include proof of ownership or lease, tax-related documents, and business registration details. Ensuring you have all necessary documents in order will enhance the chances of a successful application.

Once you’ve identified the needed documents, compile and organize your information efficiently. This might involve arranging financial statements and ensuring all records are current and accurate. Utilizing tools like pdfFiller can be beneficial for managing your documentation securely and conveniently.

Step-by-step application process

Beginning the application process for the commercial flat rate rebate involves locating the correct form. This form can typically be accessed via local government websites or specific municipal offices. Ensure to download and print required forms for your records and initiation.

While completing the application form, it's essential to provide accurate and comprehensive information. Watch out for common mistakes like providing inconsistent details or failing to include all required supporting documents, which can delay processing times.

After submission: what to expect?

Once you’ve submitted your application, it’s important to understand the processing timeline. Typically, applications may take several weeks to process, but this duration can vary depending on the volume of applications received and the completeness of your submission. Factors such as missing documentation can slow down the process significantly.

It’s prudent to follow up on your application after a reasonable time. Checking your application status can be done through local government contact methods, and knowing how notifications are sent out ensures that you're prepared for updates. If the application is denied, guidelines on subsequent steps may also be included in the notification.

Tips for maximizing your rebate

Keeping accurate records and maintaining documentation integrity is crucial for maximizing your rebate benefit. Ensure that all invoices, tax returns, and application-related documentation are retained safely. A robust record-keeping system not only streamlines future applications but also provides essential reference in case of audits.

Reapplying for future rebates is not uncommon, especially if your business circumstances change. Staying informed about modifications in eligibility or available rebates can help in leveraging these opportunities effectively. Consulting with financial advisors can also yield insights into tax benefits and strategic approaches to your financial planning.

Utilizing pdfFiller for ongoing document management

In the digital age, using a cloud-based platform like pdfFiller for document management provides essential benefits for businesses. This service not only enhances accessibility but also enables seamless collaboration among team members handling applications and records. With the ability to access your documents from any device, you can remain efficient and organized.

With pdfFiller, managing all documentation related to your commercial flat rate rebate becomes simple. You can store files securely, ensure easy access to forms, and collaborate with colleagues directly within the platform, eliminating the hassle of managing physical files.

Frequently asked questions

When approaching the commercial flat rate rebate process, several questions commonly arise among applicants. Understanding these queries can provide clarity and assist in successful applications. Some frequently asked questions may include inquiries about the specific qualification requirements or how long the application process typically takes.

It’s beneficial to familiarize yourself with troubleshooting guidelines for application issues. Having a list of various contact sources for government support can also streamline resolving concerns or complications that may arise along the way.

Related forms and resources

In addition to the commercial flat rate rebate form, various other forms may cater to different business rebate opportunities. Familiarizing yourself with these related forms can ensure you explore all avenues for potential financial benefit. Furthermore, local government resources often provide comprehensive guides and tools that may assist in managing various business finances.

Connecting with local resources can amplify your knowledge about available incentives. Links to useful tools or additional resources can aid in tracking changes in eligibility and accessing forms efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my commercial flat rate rebate in Gmail?

How can I send commercial flat rate rebate to be eSigned by others?

How do I complete commercial flat rate rebate on an Android device?

What is commercial flat rate rebate?

Who is required to file commercial flat rate rebate?

How to fill out commercial flat rate rebate?

What is the purpose of commercial flat rate rebate?

What information must be reported on commercial flat rate rebate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.