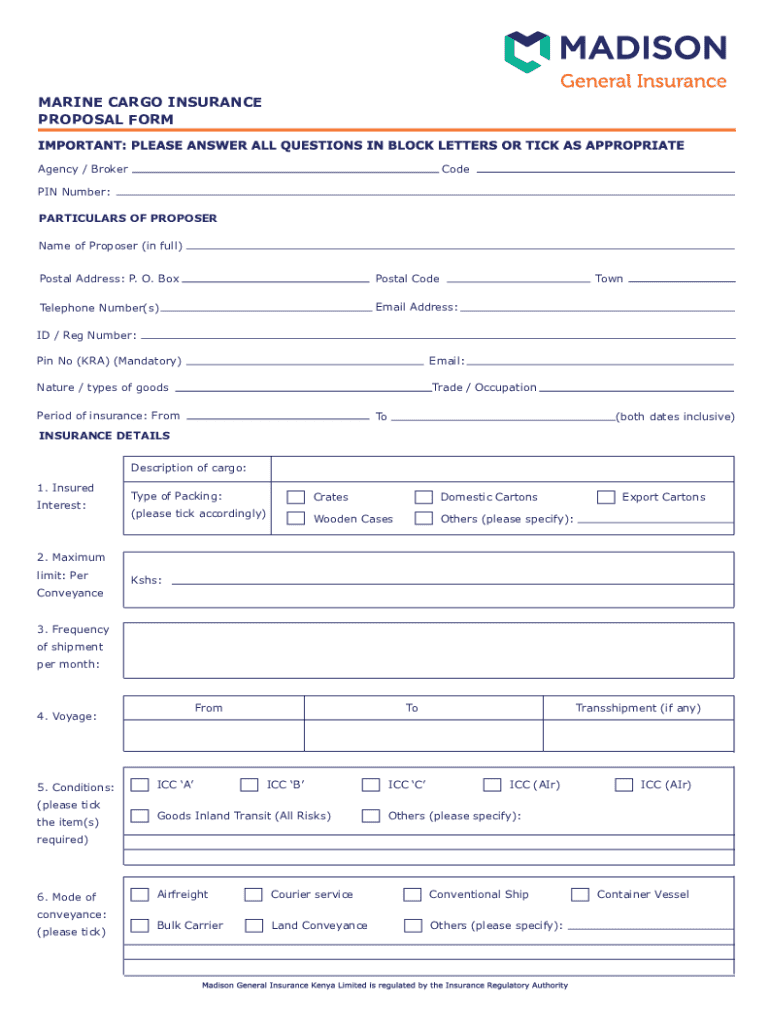

Get the free Marine Cargo Insurance Proposal Form

Get, Create, Make and Sign marine cargo insurance proposal

How to edit marine cargo insurance proposal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out marine cargo insurance proposal

How to fill out marine cargo insurance proposal

Who needs marine cargo insurance proposal?

Everything You Need to Know About the Marine Cargo Insurance Proposal Form

Understanding marine cargo insurance

Marine cargo insurance is a crucial aspect of maritime trade, protecting entities against losses or damages to goods while in transit. Its significance cannot be overstated, as it mitigates financial risks associated with shipping, providing peace of mind to businesses and individuals alike.

Marine cargo insurance policies typically fall into different categories, including total loss and partial loss, which pertain to whether the cargo is completely destroyed or partially damaged. Additionally, there are two main coverage types: all risks, which cover virtually all potential damages, and named perils, which specify particular risks that are covered.

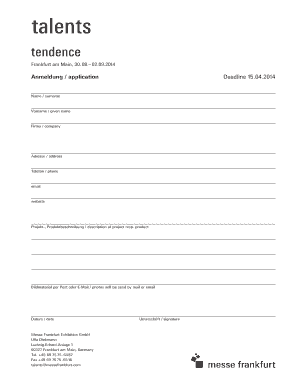

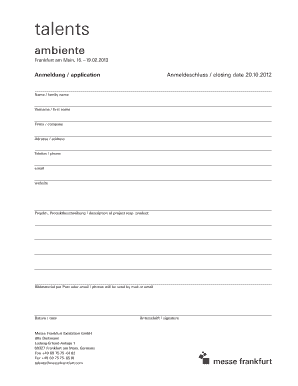

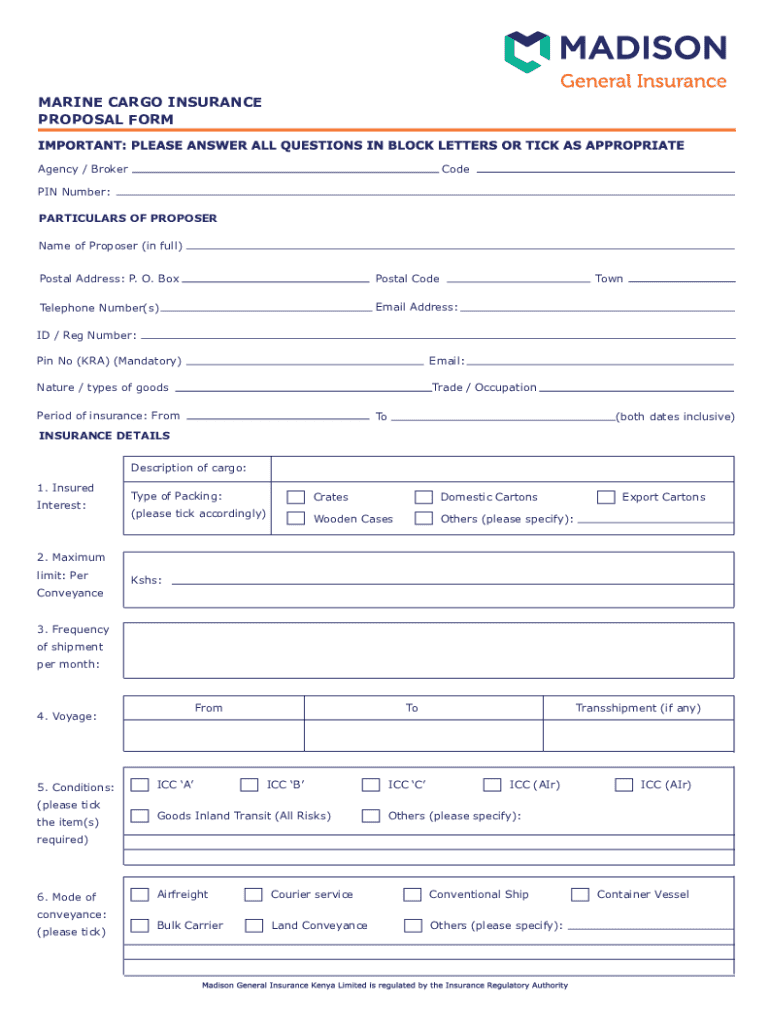

Key components of the marine cargo insurance proposal form

The marine cargo insurance proposal form is structured to gather essential information relevant to your shipment. This information is vital for the underwriting process, ensuring that the risks associated with your cargo are adequately assessed. The form is typically divided into several sections, each focusing on specific details.

Step-by-step guide to filling out the marine cargo insurance proposal form

Filling out the marine cargo insurance proposal form can be straightforward if you follow a structured approach. Begin by gathering all necessary documents to support your application.

Next, ensure your personal information is accurate. Include your contact details and the legal business name. When describing the goods, classify them correctly and consider valuation aspects to avoid underinsurance. Lastly, detail your shipping method by specifying the mode of transport, such as sea or air, and estimating the transit duration.

Common mistakes to avoid when completing the form

Common errors can lead to complications down the line, such as delays in processing claims. One prevalent mistake is providing inaccurate information. A thorough double-check of shipment details can prevent misunderstandings.

Reviewing and submitting your marine cargo insurance proposal

Once the form is completed, a thorough review is essential before submission. This ensures that all information is correct and complete, which can greatly affect the proposal's acceptance.

Regarding submission, you have options. Some insurance companies allow online submission, streamlining the process, while others may require physical submission. Be aware of any specific requirements they may have, such as supporting documentation or formatting preferences.

Post-submission: What to expect

After submitting your marine cargo insurance proposal, you can expect a processing timeline. The underwriting criteria will include evaluating your information to determine the risk and premium rates. Expect to receive notification of approval or rejection based on their assessment.

Managing your marine cargo insurance policy

Once your marine cargo insurance policy is active, it's essential to understand how to manage it effectively. Should your cargo needs change, you can modify your coverage by adding additional goods or routes.

The claims process typically requires supporting documents like the bill of lading, invoices, and photographs of the damaged goods. Adherence to timelines for filing claims is critical to ensure timely compensation.

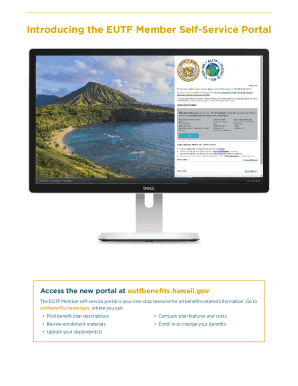

Utilizing pdfFiller for your marine cargo insurance proposal

pdfFiller offers a seamless solution for managing your marine cargo insurance proposal. With its editing, signing, and collaboration features, users can efficiently complete the necessary forms without the hassle of physical paperwork.

Frequently asked questions about marine cargo insurance proposals

Understanding marine cargo insurance proposals can often lead to questions. Notably, a binding marine cargo insurance contract is established once the insurer accepts your proposal and provides a policy document. Premiums are determined based on various factors, including the value of goods and the risks involved.

The future of marine cargo insurance

The marine cargo insurance landscape is evolving, particularly with the advent of digital solutions. Trends such as automation and the simplification of document processes are shaping the industry, allowing for faster and more efficient operations.

Moreover, platforms like pdfFiller are at the forefront of this digital transformation, enhancing document management through cloud-based solutions. Such innovations will continue to facilitate easier processes for users and redefine how marine cargo insurance is administered.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my marine cargo insurance proposal in Gmail?

How can I get marine cargo insurance proposal?

Can I edit marine cargo insurance proposal on an iOS device?

What is marine cargo insurance proposal?

Who is required to file marine cargo insurance proposal?

How to fill out marine cargo insurance proposal?

What is the purpose of marine cargo insurance proposal?

What information must be reported on marine cargo insurance proposal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.