Get the free Management Liability Proposal Form

Get, Create, Make and Sign management liability proposal form

How to edit management liability proposal form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out management liability proposal form

How to fill out management liability proposal form

Who needs management liability proposal form?

Management Liability Proposal Form How-to Guide

Understanding management liability insurance

Management liability insurance serves as a crucial safeguard for businesses and non-profits. It protects individuals in managerial positions, such as directors and officers, against legal claims arising from their decisions. With the increasing scrutiny and complexity of corporate governance, having a policy in place can mean the difference between stability and financial ruin.

Key components of a management liability policy include directors and officers liability, employment practices liability, and coverage for crime and fiduciary liabilities. Each component addresses different vulnerabilities that management may face, reinforcing the importance of comprehensive coverage in today's litigious environment.

For businesses and non-profits alike, investing in management liability insurance is not just about risk mitigation—it's also about preserving reputation and ensuring longevity in an increasingly regulated landscape.

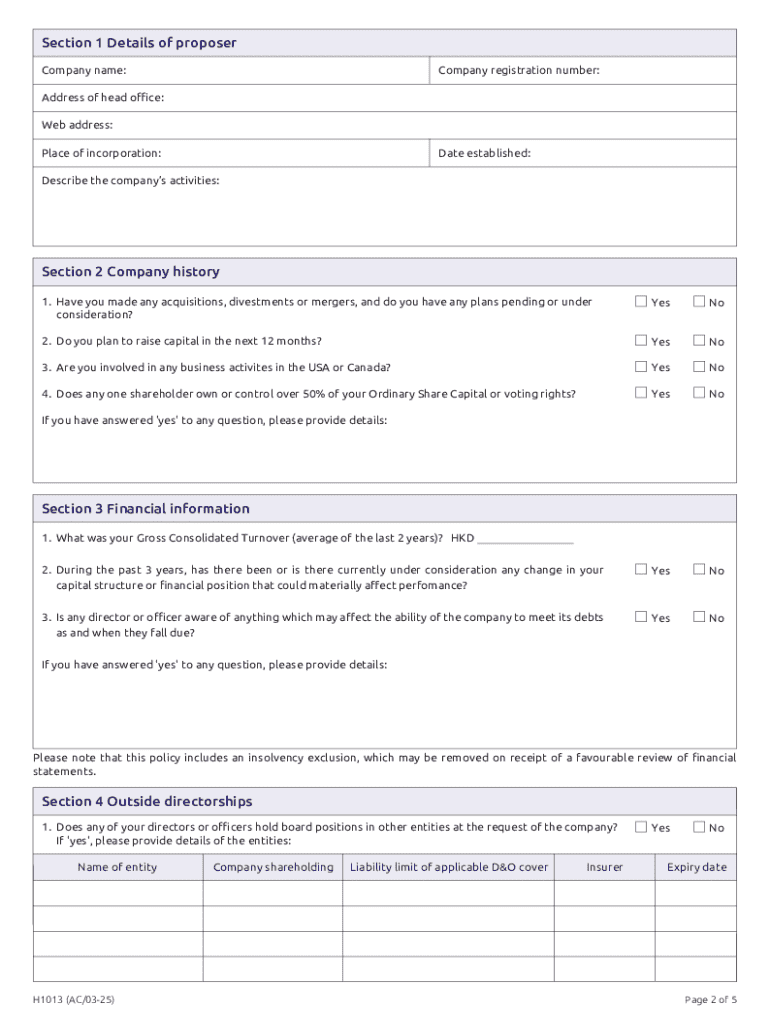

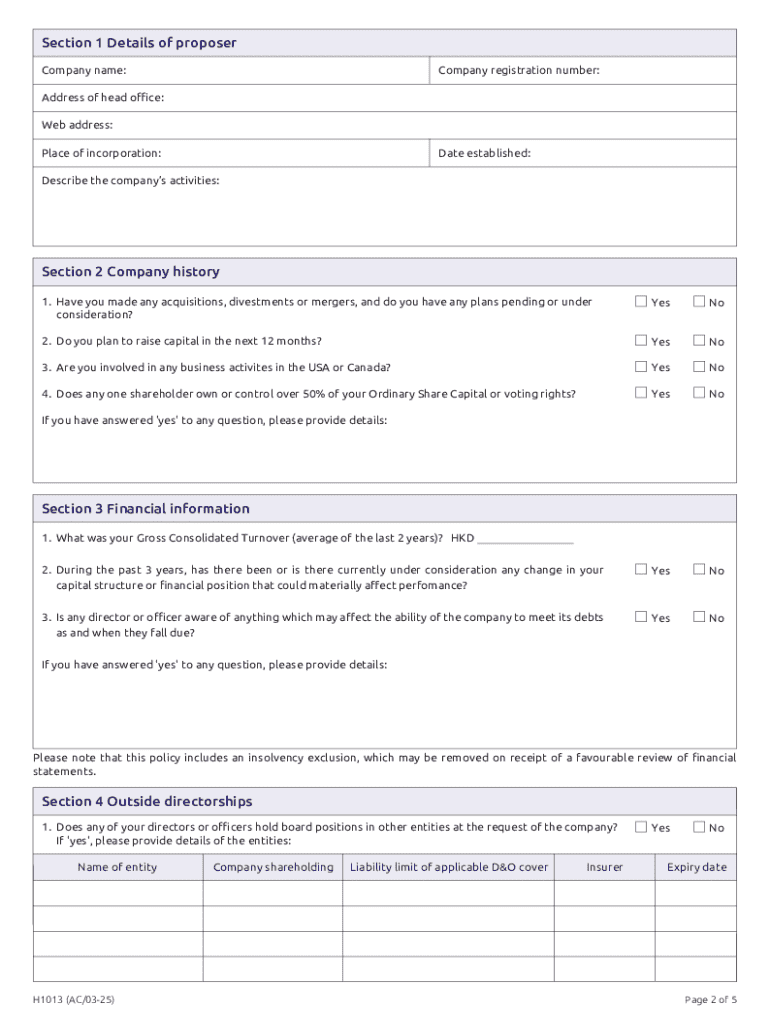

Overview of the management liability proposal form

The management liability proposal form is a document designed to collect essential information from businesses seeking coverage. This form assists insurers in assessing risk and determining appropriate premiums. By accurately completing it, organizations can ensure they receive the best possible coverage tailored to their needs.

Typically, any organization seeking management liability insurance—whether a large corporation or a small non-profit—must complete this form. Filling it out thoroughly can lead to advantageous terms and improved coverage options.

Utilizing a management liability proposal form is a strategic step towards securing essential protection for an organization's leadership.

Step-by-step guide to filling out the management liability proposal form

Approaching the management liability proposal form can be overwhelming, but with the right preparation and organization, the process can be straightforward. Start by gathering necessary documents and relevant information.

The proposal form is typically divided into several sections, each requiring specific details from your organization. Below is a breakdown of these sections:

Section breakdown of the proposal form

Completing each section accurately ensures that your organization is evaluated properly, allowing you to secure the right level of coverage.

Editing and customizing the proposal form

Once the form is completed, it's crucial to review and edit it for accuracy. Utilizing tools such as pdfFiller can greatly enhance this process, offering versatile editing features that allow for easy modifications within the document.

Collaboration is another essential aspect. With pdfFiller's cloud-based platform, multiple team members can contribute, making it simple to gather insights and finalize the document efficiently.

Interactive features of pdfFiller for management liability proposal form

One of the standout features of pdfFiller is its cloud-based accessibility, which allows users to access their management liability proposal form from anywhere. This flexibility means you can work on the document while on the go, ensuring you never fall behind on essential tasks.

Real-time collaboration tools facilitate teamwork, enabling various stakeholders to provide input simultaneously. Additionally, pdfFiller integrates seamlessly with other platforms and tools, ranging from cloud storage services to email providers, enhancing the document management experience.

Security features in pdfFiller are also designed with user safety in mind, employing encryption and secure sign-in processes to protect sensitive information throughout the proposal process.

Common pitfalls when completing the management liability proposal form

Many applicants encounter challenges when completing the management liability proposal form. Common risks include overlooked sections and insufficient information, which can lead to misrepresentations or omissions that affect coverage.

Misrepresentations on the form can have severe consequences, including denial of claims or cancellation of the policy. To prevent this, it's essential to double-check the information provided and ensure it is accurate and comprehensive.

By being aware of these common pitfalls, organizations can enhance their chances of a successful proposal and obtain necessary coverage.

After submission: what to expect

Upon submitting the management liability proposal form, the next step involves the review process by insurers. Underwriters will evaluate the details provided to assess risk and determine premium costs.

It's not uncommon for underwriters to follow up with additional questions or request clarifications. Responding promptly and thoroughly can expedite the evaluation process.

Knowing what to expect after submission streamlines the process and prepares you for any forthcoming discussions or negotiations.

Frequently asked questions about management liability insurance

As businesses navigate the management liability insurance landscape, several common questions arise. Understanding these can assist in making informed decisions when applying for coverage. One notable concern is what happens if information changes post-submission; it’s vital to update your insurer as changes can affect the policy's validity.

Another frequent inquiry pertains to handling denied claims or rejections. Engage with your insurer to understand the reasons behind any denied claims and what steps can be taken next. In terms of renewal processes, knowing the requirements and being proactive can ensure seamless continuity of coverage.

Being informed about these frequent inquiries equips organizations with the necessary knowledge for effective management of their insurance needs.

Key features and benefits of management liability policies

Management liability policies offer a comprehensive coverage overview that includes protection against a spectrum of risks. These policies are designed to be cost-effective, ensuring that organizations receive value for money while safeguarding their leadership teams.

Deciding on a management liability provider boils down to evaluating the features that suit your organizational needs. Companies looking for seamless document handling will find pdfFiller to be an exceptional option, providing the necessary tools for effective proposal management, along with added benefits like easy editing and secure electronic signatures.

Choosing the right provider is essential, and pdfFiller's features make it a standout choice for creating and managing management liability proposals.

Navigating additional options for management liability coverage

When it comes to management liability coverage, the landscape is constantly evolving. Organizations are increasingly looking for tailored policies that fit their specific needs. This means that different types of organizations, whether for-profit or non-profit, can find coverage that aligns with their operational realities.

Emerging trends in management liability insurance suggest a growing emphasis on protection for a broader array of leadership roles. Companies may also benefit from co-benefits that extend protection to related leadership staff, enhancing both morale and security within executive tiers.

Navigating the available options is crucial for ensuring adequate protection against management-related risks, especially in an ever-changing business climate.

Support and guidance through the proposal process

Entering the proposal process can be daunting; however, pdfFiller offers customer support services and a variety of resources to assist users throughout. From tutorials that guide you on how to navigate the proposal form to live assistance available at your fingertips, help is readily accessible.

Utilizing these support channels can streamline your experience, ensuring that you maximize the potential of your management liability proposal form effectively.

Ensuring you have access to effective support can make all the difference in navigating your management liability proposal.

Conclusion and next steps

Completing the management liability proposal form is a crucial step towards securing protection for your organization's top decision-makers. Before hitting submit, ensure you’ve reviewed all details and are confident that the provided information is accurate.

Post-submission, tracking your proposal's progress is important; stay informed and engage with underwriters as needed. Emphasizing proactive risk management strategies and being open to coverage adjustments can protect your organization in a changing landscape.

By staying informed and diligent, your organization can navigate the complexities of management liability insurance effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify management liability proposal form without leaving Google Drive?

How can I send management liability proposal form to be eSigned by others?

How do I fill out management liability proposal form on an Android device?

What is management liability proposal form?

Who is required to file management liability proposal form?

How to fill out management liability proposal form?

What is the purpose of management liability proposal form?

What information must be reported on management liability proposal form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.