Get the free Ifta-200s

Get, Create, Make and Sign ifta-200s

How to edit ifta-200s online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ifta-200s

How to fill out ifta-200s

Who needs ifta-200s?

Your Comprehensive Guide to the IFTA-200S Form

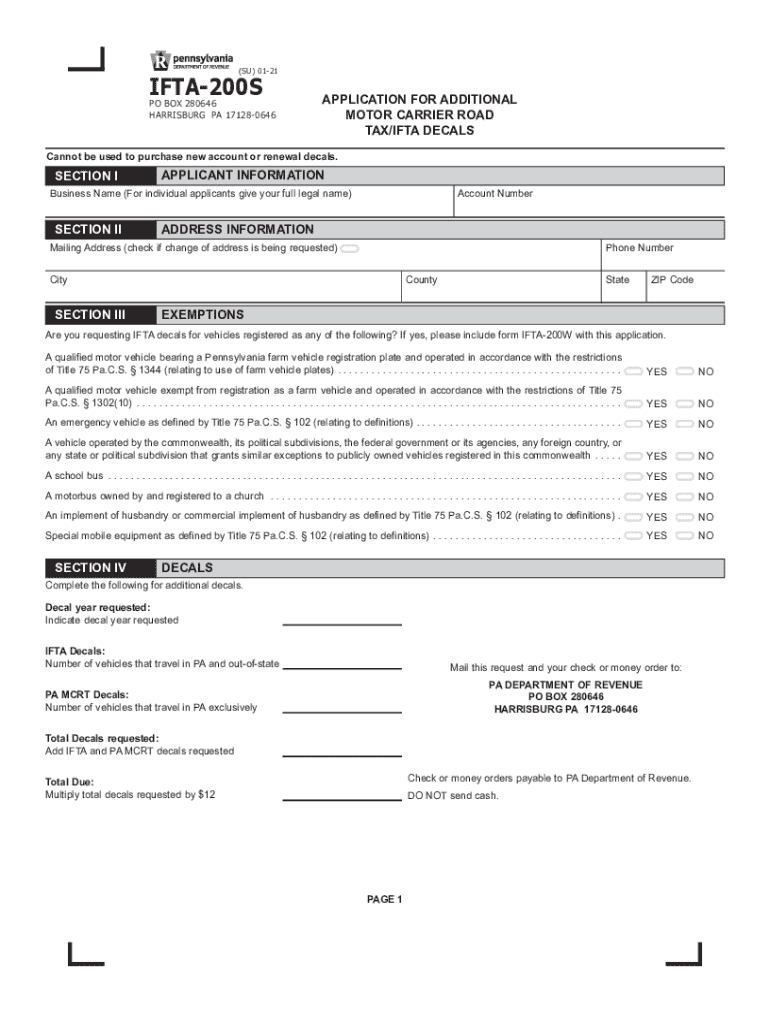

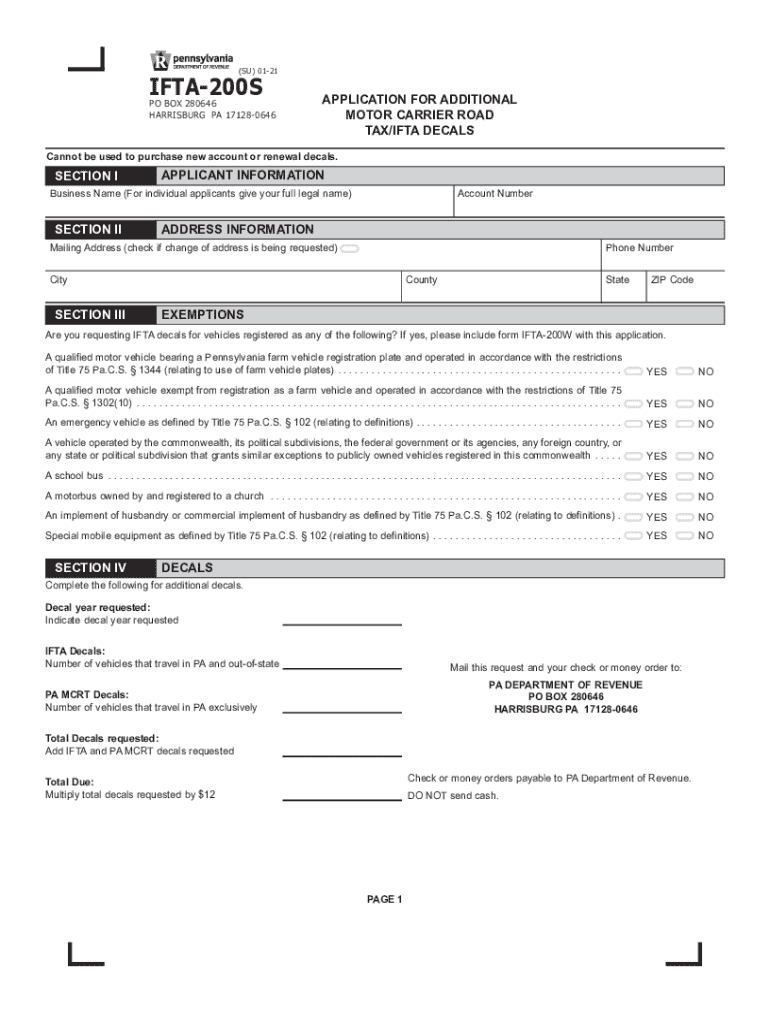

Overview of the IFTA-200S form

The IFTA-200S form is a crucial document for motor carriers who operate between jurisdictions. This form enables these carriers to report their fuel usage and calculate the taxes owed, fostering compliance with both federal and state regulations. It is essential for ensuring that taxes are collected and distributed fairly among the jurisdictions visited by the vehicles, playing a vital role in the interstate transportation system.

Understanding who needs to file this form is equally important. Motor carriers traveling between two or more jurisdictions are required to file the IFTA-200S. In this context, a 'licensee' refers to the carrier who holds an International Fuel Tax Agreement license, which is necessary for operating across state lines.

Key components of the IFTA-200S form

The IFTA-200S form contains several key components that must be completed accurately to avoid complications. The form starts with the carrier information section, where the motor carrier's name, address, and IFTA license number are required. This ensures identification and helps local tax agencies match the data submitted.

The quarterly reporting section is where carriers note down the reporting periods, which typically align with calendar quarters. Following this is the fuel usage section, where different fuel types must be documented. This includes diesel, gasoline, and any other applicable fuels. Detailed instructions guide how to record the total miles traveled and total fuel gallons purchased across jurisdictions.

Lastly, the tax calculation component provides a simple guide for determining the taxes owed based on the reported fuel usage and mileage. A clear understanding of these components is essential for accurate filing.

Step-by-step guide to completing the IFTA-200S form

Completing the IFTA-200S form involves several steps that can mitigate errors. First, gather the necessary documentation, such as fuel receipts and mileage logs, to ensure you have all information on hand. This preparation is key to a hassle-free filing process.

As you fill out the IFTA-200S form, be meticulous in recording information in each section. Common pitfalls include transposing numbers or neglecting to include totals for fuel usage or miles traveled. After filling out the form, double-check your entries. Verification not only minimizes the risk of rejections during the submission process but also helps you ensure compliance with your reporting obligations.

Filing the IFTA-200S form

When it comes to submitting the IFTA-200S form, there are two primary options: online submission and paper filing. Many motor carriers opt for online filing as it tends to be quicker and allows for immediate confirmation of submission. Resources like pdfFiller provide convenient tools for electronic filing of the IFTA-200S form, simplifying the entire process.

Keep in mind the quarterly deadlines for filing. Late submissions can result in significant penalties, including fines and interest on any taxes owed. Being aware of these critical dates is essential to maintain good standing with taxing authorities.

Managing your IFTA reporting with pdfFiller

Using pdfFiller for managing your IFTA-200S form provides multiple advantages. Its cloud-based platform allows you to access your documents from anywhere, which is especially beneficial for remote or mobile teams. Additionally, pdfFiller secures electronic signing and storage of documents, reducing physical paperwork and enhancing security.

pdfFiller offers interactive tools that facilitate easier management of the IFTA-200S form. Features that allow users to edit, sign, and collaborate on documents digitally contribute to a more streamlined workflow and improve team efficiency in reporting.

Frequently asked questions about the IFTA-200S form

One common misconception is that all vehicles require an IFTA license. In reality, only motor carriers whose vehicles travel into multiple jurisdictions must file. Additionally, if your submission is rejected, finding out the reason is crucial. Often, errors in calculations or missing information can lead to denials. For troubleshooting, directly contacting the state revenue office can provide clarity on the next steps.

Lastly, additional resources, including state-specific tax services, can provide support and guidance on the IFTA-200S form and filing process.

IFTA compliance best practices

Keeping accurate records is fundamental for IFTA compliance. This encompasses diligent tracking of mileage and fuel purchases. Implementing systematic methods to record this data can dramatically reduce errors during file preparation. Carriers may find digital logging tools especially useful in maintaining up-to-date records.

Regular audits are also recommended to prepare for potential IFTA audits. Developing a routine review process of your documentation and filing practices will not only ensure compliance but also alleviate stress during audit periods. Staying informed about IFTA regulations can prevent unnecessary surprises during filing periods.

Related forms and information

Alongside the IFTA-200S form, there are various other relevant forms, such as IFTA-200 and state-specific requirements that may apply to your business. Understanding the differences between these forms can help you navigate the compliance landscape more effectively. Additionally, using software solutions like TruckLogics can help manage and streamline your reporting processes.

These tools can simplify the complexities of maintaining compliance across different jurisdictions, allowing for better focus on your core business operations.

Connect with pdfFiller support

pdfFiller offers ongoing support through a variety of customer service channels. By requesting a live demo, users can learn more about document management solutions suited for their needs. Moreover, pdfFiller provides numerous help articles that facilitate a better understanding of their platform and associated forms like the IFTA-200S.

This ongoing support ensures that users are never alone in their document management journey, paving the way for successful IFTA reporting and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out ifta-200s using my mobile device?

How do I complete ifta-200s on an iOS device?

How do I complete ifta-200s on an Android device?

What is ifta-200s?

Who is required to file ifta-200s?

How to fill out ifta-200s?

What is the purpose of ifta-200s?

What information must be reported on ifta-200s?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.