Get the free California Form 3540

Get, Create, Make and Sign california form 3540

Editing california form 3540 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california form 3540

How to fill out california form 3540

Who needs california form 3540?

A Comprehensive Guide to California Form 3540

Understanding California Form 3540

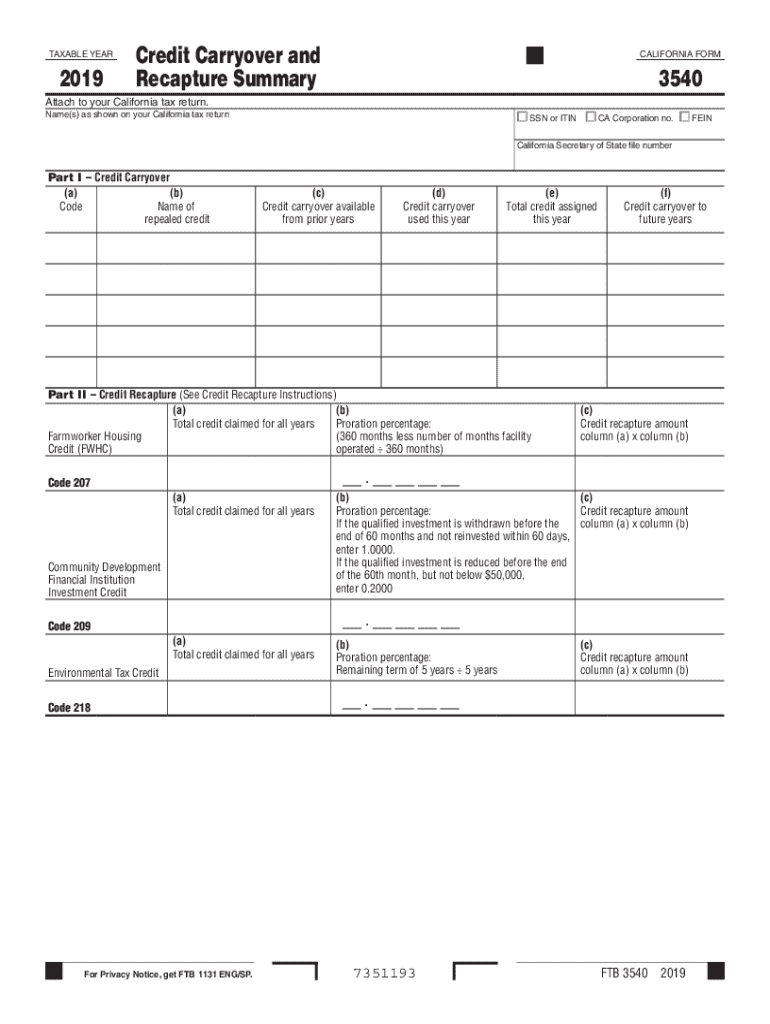

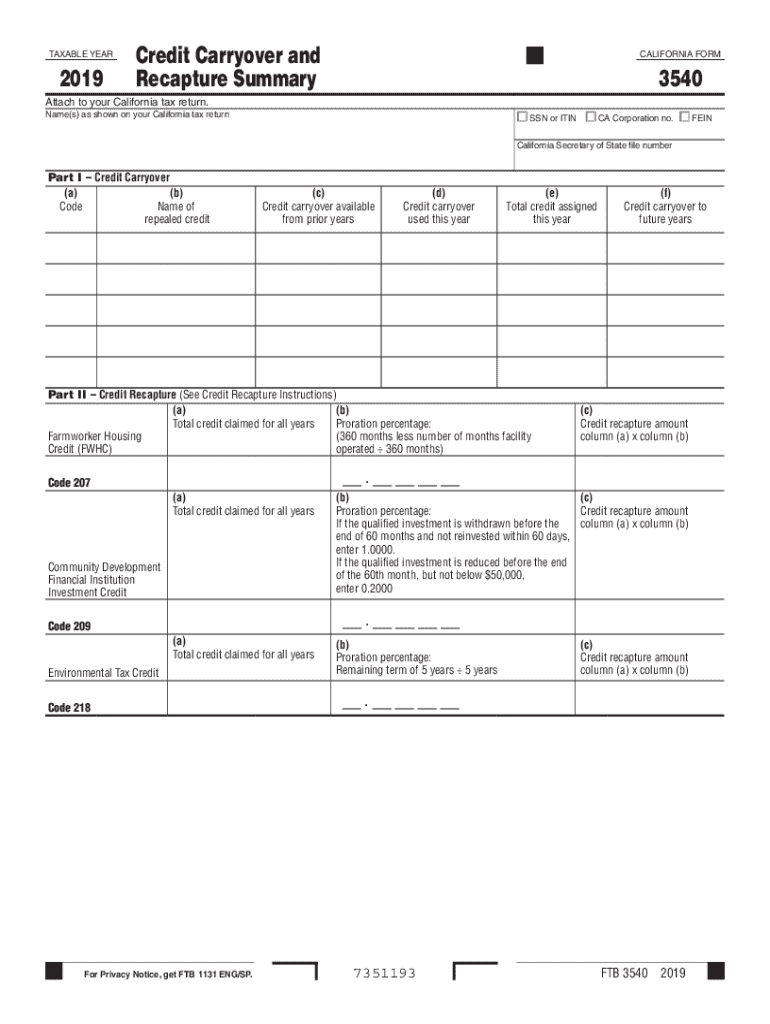

California Form 3540 is a crucial document for taxpayers engaging in certain types of income activity within the state. Specifically, it serves as a means to report various forms of income and claim applicable deductions and credits. Understanding the purpose and requirement of this form is vital for ensuring compliance with state tax regulations.

Who needs to use Form 3540? Primarily, it’s designed for individuals, corporations, and entities who receive income from sources that are reportable by the California tax authorities. Inaccurately completing this form can lead to significant penalties or delays in processing, making meticulous attention to detail essential.

Key features of California Form 3540

California Form 3540 comprises multiple sections that guide taxpayers through the process of reporting income and claiming deductions. The form includes standardized sections such as Taxpayer Information, Income Details, Deductions, and the Declaration and Signature area. Understanding these sections is critical for accurate completion.

Within the form, specific terminologies are defined, ensuring that users can effectively navigate through the various requirements. A clear delineation of income types, allowable deductions, and potential credits highlights what users need to know when filling out the form.

Step-by-step instructions for filling out California Form 3540

Filling out California Form 3540 can seem daunting. However, with a structured approach, the process can be broken down into manageable steps.

Step 1: Gather necessary information

Before starting, gather required documents and data, such as income statements, W-2 forms, and any documentation related to deductions you plan to claim. Efficiency can be enhanced by organizing these documents beforehand.

Step 2: Complete Section A: Taxpayer Information

The first section focuses on taxpayer specifics including name, address, and Social Security Number or Tax ID. This information must be accurate as it identifies you with the taxing authorities.

Common pitfalls in this section include typos or omissions, which can delay the processing of your form.

Step 3: Fill out Section B: Income Details

In this section, report various income types like wages, interest, and other taxable income. Accurate reporting is critical, as discrepancies can raise red flags.

Step 4: Section : Deductions and Credits

This section is where you identify applicable deductions. Possible deductions may include mortgage interest, property taxes, and contributions to retirement accounts. Providing example scenarios for common deductions can clarify their application.

Step 5: Final Sections: Declaration and Signature

It's crucial to sign the form; this declaration affirms the truthfulness of your information. Ensure every section is meticulously filled to avoid complications during processing.

Editing California Form 3540 with pdfFiller

pdfFiller provides robust tools for easily editing Form 3540. Users can access the form online, allowing for seamless editing directly in their browser. The editing tools enable users to make necessary adjustments to their form without hassle.

To edit, simply upload your completed form to pdfFiller, use the editing interface to make any adjustments needed, and save or export your completed form with ease.

eSigning your California Form 3540

Adding an electronic signature using pdfFiller is straightforward. Users can access the eSignature feature, allowing for a legally binding signature without physical paperwork.

California recognizes eSignatures as valid, simplifying the submission process. Users should be aware of common issues, such as internet connectivity or browser compatibility, that could affect eSignature usage.

Collaborating with team members on California Form 3540

pdfFiller facilitates collaboration by allowing multiple users to share the form for real-time editing. Team members can provide feedback directly, enhancing the input and accuracy of the data.

With version control and document history capabilities, users can track changes made, ensuring that the most accurate and up-to-date information is retained throughout the editing process.

Safeguarding and managing your California Form 3540

Storing sensitive documents like California Form 3540 securely is paramount. pdfFiller offers various storage options, ensuring that your information remains confidential and accessible only to authorized individuals.

Additionally, pdfFiller provides capabilities for secure document management, allowing you to access your files from anywhere, regardless of your location.

Common questions about California Form 3540

Many taxpayers encounter common concerns with Form 3540, such as understanding the reporting requirements or how to amend errors after submission. Addressing these frequently asked questions can help mitigate anxiety associated with the filing process.

Avoiding mistakes while submitting Form 3540 is crucial. Common mistakes include failing to sign, incorrect information, or missing sections. Understanding follow-up processes post-submission can facilitate better compliance and transparency.

Staying updated: California Form 3540 changes and announcements

It is vital to stay informed about any changes or updates related to California Form 3540. Tax regulations can change, impacting reporting requirements, deadlines, or available deductions.

Utilizing resources from pdfFiller can ensure you have the latest information at your fingertips, and monitoring key deadlines regarding Form 3540 will help you remain compliant and avoid potential penalties.

Additional tips for a smooth filing experience

To experience a seamless filing process, consider implementing best practices such as creating a timeline for completing forms, dedicating specific days for organizing tax documents, and utilizing online tools.

Managing your time effectively can prevent the last-minute rush. Should you encounter difficulties, take advantage of pdfFiller’s customer support to address your needs promptly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in california form 3540?

Can I create an electronic signature for signing my california form 3540 in Gmail?

Can I edit california form 3540 on an Android device?

What is california form 3540?

Who is required to file california form 3540?

How to fill out california form 3540?

What is the purpose of california form 3540?

What information must be reported on california form 3540?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.