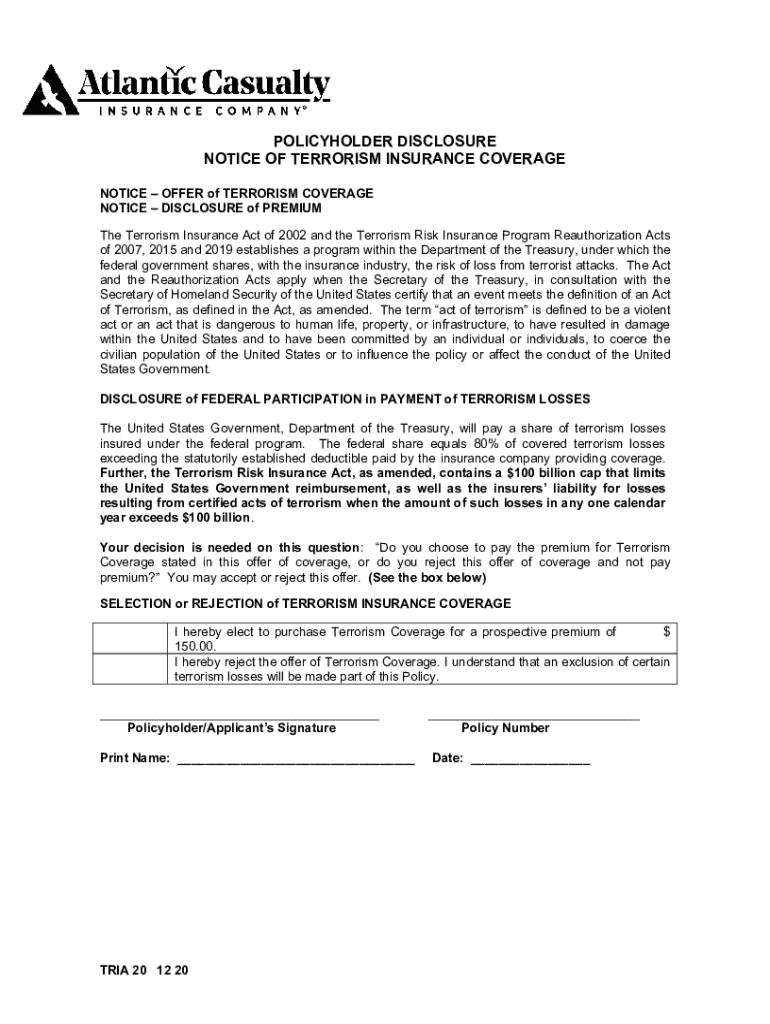

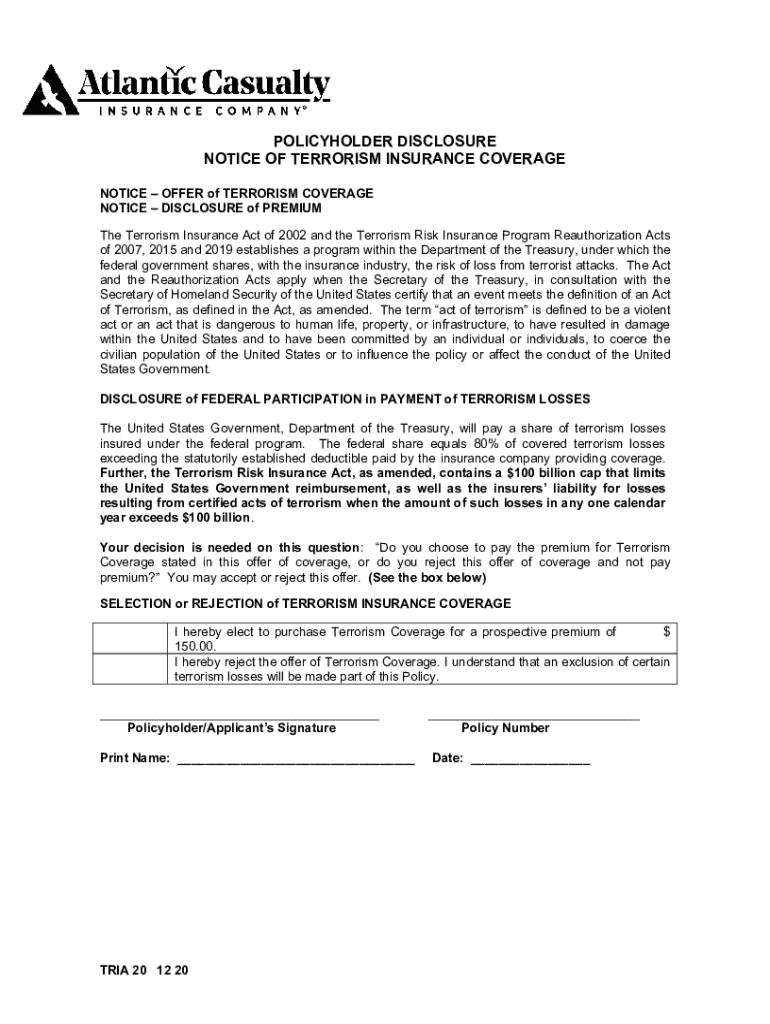

Get the free Policyholder Disclosure

Get, Create, Make and Sign policyholder disclosure

How to edit policyholder disclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out policyholder disclosure

How to fill out policyholder disclosure

Who needs policyholder disclosure?

Policyholder Disclosure Form: A Comprehensive How-To Guide

Understanding the Policyholder Disclosure Form

A policyholder disclosure form is a critical document in the insurance and financial sectors. It serves as a formal declaration by the policyholder regarding their insurance coverage, often providing essential information necessary for risk assessment and underwriting. By utilizing this form, insurance companies ensure that both parties have a clear understanding of the coverage details, which can significantly impact claims procedures and premium calculations.

Various individuals and organizations are required to complete a policyholder disclosure form. Homeowners, business owners, auto owners, and even renters may need to provide this information to their respective insurance providers. It ensures that all relevant details about the insured property or individual are accurately presented to the insurer to prevent unnecessary disputes or misunderstandings later.

The regulatory environment surrounding policyholder disclosures is robust. Many jurisdictions require insurers to follow strict guidelines when requesting disclosures. Regulations like the National Association of Insurance Commissioners (NAIC) model laws help protect consumers while ensuring that companies maintain transparency in their operations.

Key components of the policyholder disclosure form

A typical policyholder disclosure form includes several essential sections designed to capture critical information. Understanding these sections helps users complete the form accurately and efficiently:

Familiarity with common terms related to the policyholder disclosure form can greatly enhance the completion process. Terms such as 'premium,' 'deductible,' and 'exclusions' may appear frequently and can impact the understanding of the policyholder's responsibilities.

Step-by-step instructions for completing the policyholder disclosure form

To complete the policyholder disclosure form successfully, one must follow a systematic approach. Start by gathering necessary information, which typically includes:

The first step in filling out the form involves entering personal information. Double-check for accuracy, ensuring all names are spelled correctly and addresses reflect current residency. Next, provide policy details, including the effective date and types of coverage. Be precise when detailing the items covered and their respective values.

In the disclosure statements section, read each statement carefully and acknowledge your understanding of your obligations and the implications of the information provided. Finally, sign the form. With pdfFiller, you can easily add your eSignature, simplifying this process.

Editing and managing your policyholder disclosure form with pdfFiller

pdfFiller offers a suite of interactive tools aimed at streamlining the editing, signing, and management of your policyholder disclosure form. These tools are particularly beneficial for individuals and teams looking to handle documents from anywhere, ensuring that users always have access to the latest information.

Making edits is straightforward on pdfFiller's platform. Once you upload your document, use the intuitive interface to correct, add, or modify text effortlessly. You can also leverage pdfFiller's eSignature features to ensure your signature is legally binding and compliant, giving you peace of mind that your document is complete.

After completing your form, storing it for future reference is crucial. Saving your policyholder disclosure form within pdfFiller allows for easy retrieval and management as needed, eliminating the hassle of cumbersome file systems.

Collaborating with team members on the policyholder disclosure form

If you're part of a team, sharing the policyholder disclosure form for collaborative efforts can enhance accuracy and efficiency. pdfFiller makes this process seamless by allowing users to share the form with team members. This facilitates collective input and ensures that each member can contribute to the document review.

Along with sharing features, pdfFiller provides tools for tracking changes and adding comments. This lets users identify who made specific edits, fostering transparent collaboration while minimizing the risk of errors—ensuring that everyone is on the same page.

Best practices for submitting the policyholder disclosure form

Before submitting your policyholder disclosure form, it is vital to conduct a thorough review. Ensure that all sections are completed accurately, and double-check for any typographical errors or omissions. A checklist can help verify that all required fields are filled:

Consider various submission channels available. Many insurance providers allow online submission through secure portals, but traditional methods like mailing or faxing may be acceptable as well. After submitting the form, keep a archived copy for personal records. Storing it in pdfFiller means it’s readily accessible if needed in the future.

Frequently asked questions (FAQs)

Mistakes happen. If you fill out the form incorrectly, it’s important to contact your insurer right away for guidance on how to correct the mistake. Many insurers have procedures in place for amending submitted forms and will appreciate your honesty in addressing the issue.

Understanding how the policyholder disclosure impacts insurance coverage is crucial. Non-disclosure of key information may lead to denied claims or cancellation of the policy, so complete transparency is essential. Additionally, inquire whether you can use the same disclosure form for multiple policies; sometimes, insurers allow it, but clarity is key to ensure all policies are properly documented.

Additional insights

When completing the policyholder disclosure form, steering clear of common mistakes will facilitate a smooth application process. Some pitfalls to avoid include providing outdated information, neglecting to ask clarifying questions, or overlooking sections of the form that may seem insignificant.

Lastly, understanding your rights as a policyholder is paramount. You have the right to receive information about your insurance coverage, the means to amend any inaccuracies, and the right to challenge any decisions made by your insurer based on your disclosures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send policyholder disclosure for eSignature?

How do I execute policyholder disclosure online?

How do I fill out policyholder disclosure on an Android device?

What is policyholder disclosure?

Who is required to file policyholder disclosure?

How to fill out policyholder disclosure?

What is the purpose of policyholder disclosure?

What information must be reported on policyholder disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.