Get the free Application for Internal Credit Transfer and Application for External Credit Transfe...

Get, Create, Make and Sign application for internal credit

How to edit application for internal credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for internal credit

How to fill out application for internal credit

Who needs application for internal credit?

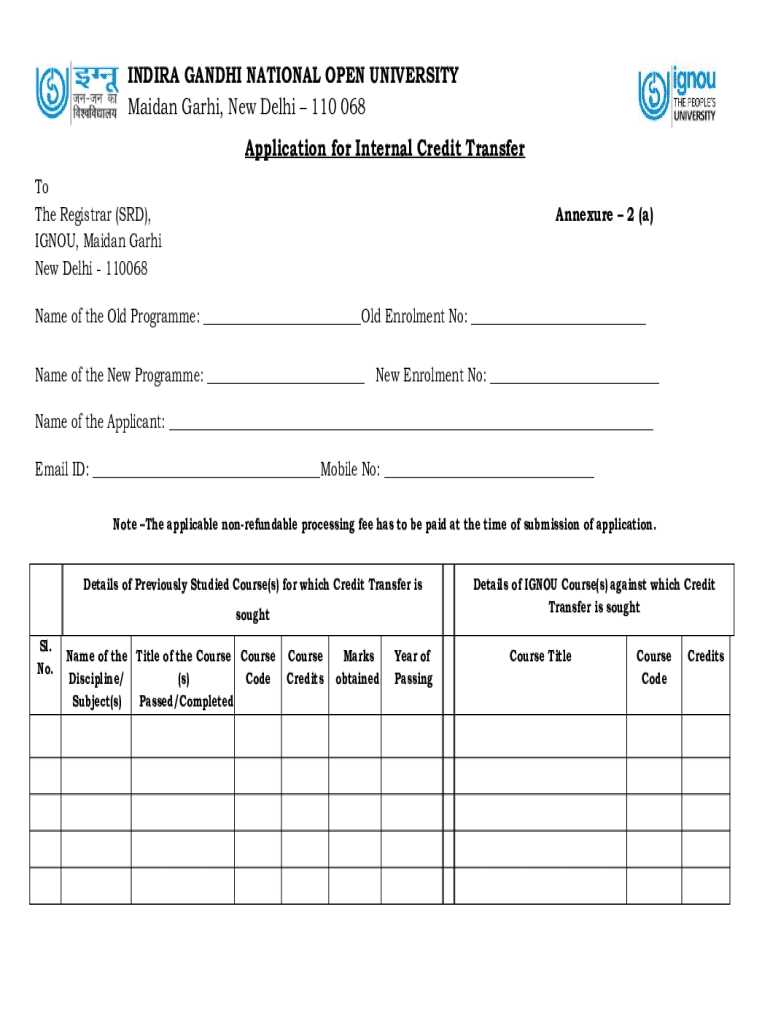

Comprehensive Guide to the Application for Internal Credit Form

Understanding the internal credit form

An internal credit form is a significant document used within organizations to request monetary support or credit for various purposes. This form serves as an official method to record and approve requests for internal credits, which are essentially funds allocated for specific needs related to projects or operational costs. It provides a structured way to manage financial resources efficiently.

The importance of internal credit forms cannot be overstated, especially in maintaining transparency and accountability in financial transactions. Proper documentation ensures that funds are tracked accurately, preventing misuse and fostering trust among team members and departments making requests for funds.

Typical scenarios for the use of an internal credit form include funding for cross-credit courses, improvements in departmental resources, or covering costs associated with training and other educational programmes. For instance, a team might submit a request to cover the costs associated with a diploma programme to help enhance skill sets relevant to their roles.

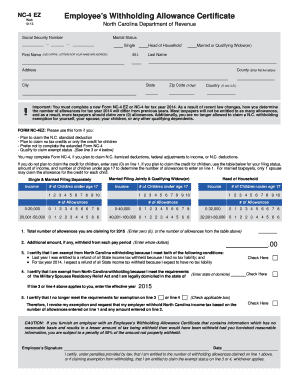

Key components of an internal credit form

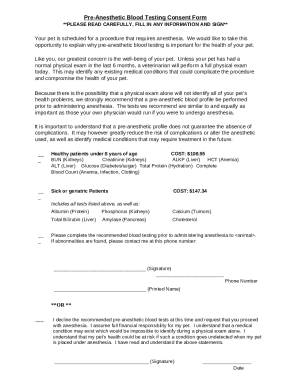

When filling out the application for internal credit form, several key components need to be included to ensure that the request is processed smoothly. Primarily, the essential information required includes applicant details, the credit amount requested, and a clear purpose for the credit. This information helps approvers determine the validity and necessity of the request.

Additionally, supporting documentation is often necessary to substantiate the request. This could include project proposals, previous budgets, or contracts related to the expenditure being requested. Understanding the necessary approval workflow is also vital, as it dictates who needs to sign off on the application before it can be processed.

Step-by-step guide to filling out the internal credit form

Filling out the application for internal credit form requires attention to detail and following specific steps to ensure that the request is accurate and comprehensive. Here’s a step-by-step guide to navigate through the process successfully.

Editing and collaborating on your internal credit form

pdfFiller offers several tools for editing documents, which streamline the process of completing an application for internal credit form. Users can utilize annotation and commenting features to provide additional details or seek clarification within the document.

Moreover, incorporating signatures and initials can elevate the form's legitimacy and traceability. Once a draft is ready, sharing options allow team members to collaborate efficiently, providing a platform for collective contributions and feedback, ensuring the request is robust and well-supported.

Managing feedback and revisions is made easy on pdfFiller, as users can track changes and updates in real-time. This feedback mechanism enhances the collaborative effort in submitting a thorough and effective internal credit application.

Tracking your application status

After the application for internal credit form has been submitted, tracking its status becomes essential. pdfFiller provides users with the ability to monitor their submission progress clearly. Regular updates can keep you informed of where the process stands and if any further action is required.

Establishing communication with approvers can also be beneficial. Utilizing the notification features within pdfFiller ensures you receive updates promptly concerning your application's status. This proactive approach can facilitate quicker resolutions, especially if additional documentation or clarification is requested.

Common issues and troubleshooting tips

While submitting an application for internal credit form can be straightforward, issues may arise. One common concern is receiving a rejection notice. Understanding the reasons behind rejection can help you amend your request effectively. Always ensure your submission conforms to credit regulations and provides sufficient justification.

Navigating these common hurdles will facilitate smoother submission processes and enhance the overall experience in managing credit requests.

Related forms and templates

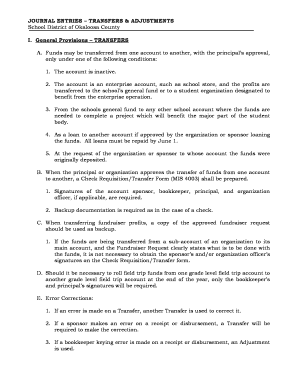

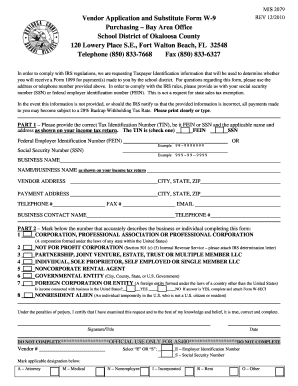

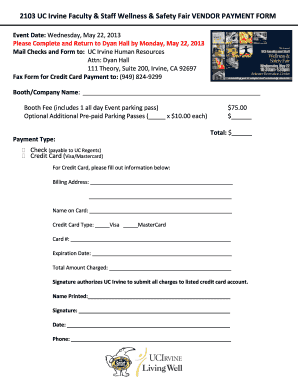

Many organizations leverage various forms in tandem with the application for internal credit form. Understanding the interconnectedness of these documents can streamline financial processes. Other related forms available on pdfFiller include expense reports, purchase requisitions, and project funding requests.

These templates enhance the organization’s efficiency and effectiveness, ensuring that all financial matters are handled with precision and clarity. Quick links to similar templates can further assist in expediting the form-filling process.

User testimonials and case studies

User experiences with pdfFiller highlight the platform's effectiveness in streamlining document management. For instance, one user remarked on how the collaborative features allowed their team to finalize funding requests more quickly and with fewer errors.

Success stories from teams demonstrate how improving document management processes resulted in smoother operations. Effective communication and document tracking have allowed teams to minimize delays in funding approvals, thus facilitating prompt project initiation.

Contact and support information

For any doubts or questions regarding the internal credit form process, pdfFiller offers various options for support. Users can access the pdfFiller Help Center, which provides extensive resources, including FAQs that address common concerns.

Additionally, live support options are available to help users navigate specific issues encountered when filling out or submitting their internal credit forms. Reaching out for assistance ensures that no queries go unanswered.

Interactive tools and additional features

pdfFiller isn’t just about document submission; it also provides a range of additional features to enhance document management. Users can explore interactive tools for creating and editing documents, eSigning, and ensuring compliance with internal credit regulations.

Future updates promise to expand these features, offering even greater functionality, which will further improve users’ experiences and streamline document handling across various departments.

Gathering user feedback

Encouraging user engagement is vital for continuous improvement within pdfFiller’s system. Users are prompted to provide ratings and reviews regarding their experiences with the internal credit form process, which in turn helps sharpen the tool for future iterations.

Establishing a feedback mechanism that captures insights from users enables a thriving ecosystem for collaboration and improvement, ensuring that the application for internal credit form remains effective and useful.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my application for internal credit directly from Gmail?

Can I create an electronic signature for signing my application for internal credit in Gmail?

How do I fill out application for internal credit on an Android device?

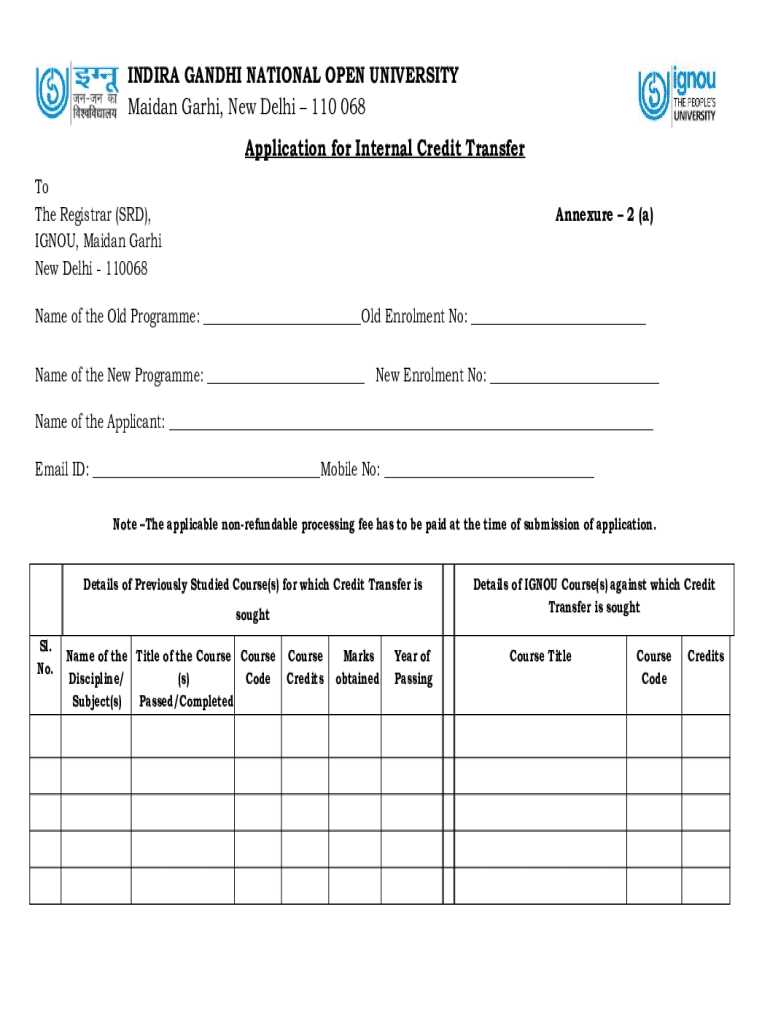

What is application for internal credit?

Who is required to file application for internal credit?

How to fill out application for internal credit?

What is the purpose of application for internal credit?

What information must be reported on application for internal credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.