Get the free Third Party Payment Declaration Form

Get, Create, Make and Sign third party payment declaration

How to edit third party payment declaration online

Uncompromising security for your PDF editing and eSignature needs

How to fill out third party payment declaration

How to fill out third party payment declaration

Who needs third party payment declaration?

Third Party Payment Declaration Form - How-to Guide

Understanding the third party payment declaration form

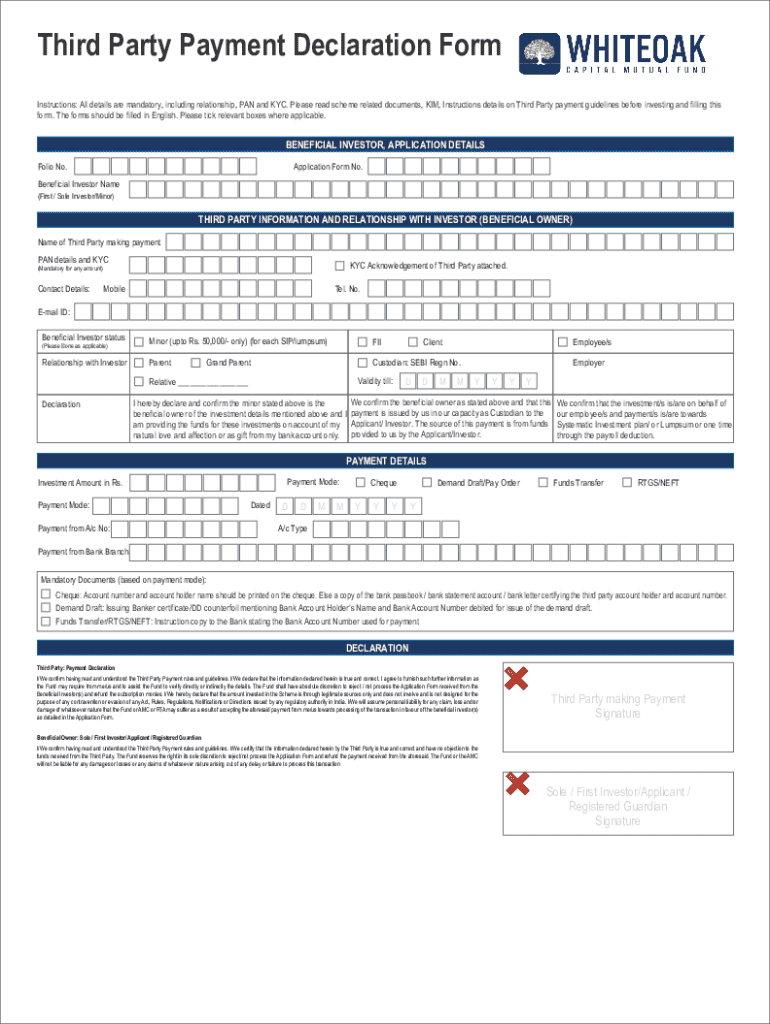

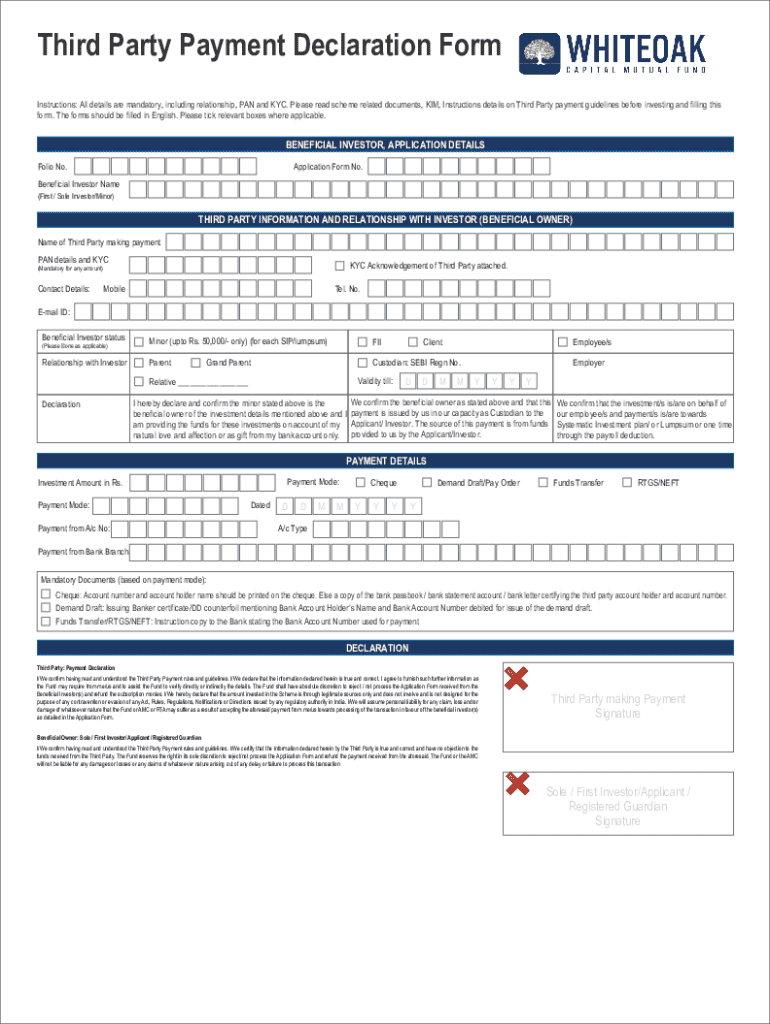

The third party payment declaration form is a crucial document that helps establish the legitimacy of payments made by one party on behalf of another. Its primary purpose is to provide a transparent record of financial transactions, particularly in cases where the payer is not the ultimate beneficiary of the payment. This form is required in various circumstances, particularly in business transactions, tax filings, and governmental interactions where clarity and accountability regarding funds are necessary.

Key benefits of utilizing a third party payment declaration form include compliance with financial regulations, safeguarding against potential fraud, and simplifying the audit process. By documenting who paid what and for whom, the integrity of financial operations is upheld, ensuring that all parties are protected from unwanted liabilities.

Who needs to use the third party payment declaration form?

Various individuals and organizations may require a third party payment declaration form. Individuals, for instance, may need it when receiving funds from someone else or when paying bills on behalf of another person. Additionally, businesses and organizations often use this form to clarify payment responsibilities during transactions that involve multiple parties, such as vendor payments funded by different departments or third-party reimbursements.

Specific scenarios include tax purposes, where taxpayers must declare third-party payments to avoid discrepancies with income reporting. Similarly, during financial transactions where funds are routed through intermediaries, having a formal declaration can help track and validate these payments. In each case, knowing when to utilize the form can save individuals and organizations from misunderstandings and potential legal issues.

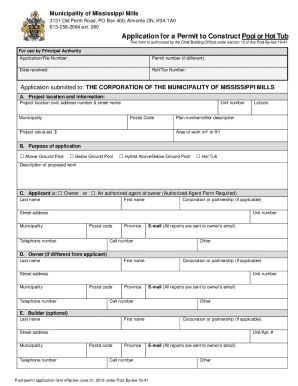

Key components of the form

Each section of the third party payment declaration form serves an essential function in ensuring compliance and simplifying information retrieval. Key components include personal information, which captures details about both the payer and payee, allowing for transparency. The payment details section outlines the specific transaction, including the amount and purpose, which are crucial for compliance during audits.

The declaration statement is another critical element, where the signer affirms the legitimacy of the transaction. Each component must be completed accurately; missing or erroneous information can lead to processing delays, audits, or legal complications, so understanding these sections is vital for anyone dealing with financial documentation.

Preparing to fill out the form

Before completing the third party payment declaration form, gathering necessary documentation is essential. Identification documents are typically required to establish the identity of all parties involved, which may include Social Security numbers or tax identification numbers. Additionally, any documents that detail the payment source, such as bank statements or invoices, should be assembled to support the transaction's legitimacy.

Accuracy and completeness are paramount when filling out the form. Common tips include double-checking all entries for typographical errors and ensuring no fields are left blank unless specifically allowed. Having a checklist can help in streamlining this process, preventing mistakes that may lead to processing delays.

Step-by-step instructions for completing the form

Accessing the third party payment declaration form is straightforward with platforms like pdfFiller, where users can locate the form easily. The platform also offers interactive tools that enhance the user experience, such as guided filling instructions and prompts to ensure all fields are completed correctly.

Editing and collaborating on the form

Once the third party payment declaration form is filled out, using pdfFiller's editing features can enhance collaboration among team members. The platform allows users to add comments and notes directly on the form, making it easier to communicate any necessary changes or clarifications. This feature is particularly useful in a team environment where multiple individuals may need to contribute to the form.

Sharing the form with team members or third parties is seamless on pdfFiller; users can send links or invite collaborators to review and edit. This ensures that everyone involved is on the same page, reducing the likelihood of errors and ensuring that all necessary information is addressed before submission.

Signing the form electronically

The adoption of electronic signatures has simplified the signing process for documents like the third party payment declaration form. E-signatures are recognized legally, significantly accelerating the process of formalizing agreements without the need for physical paperwork. Using pdfFiller, users can easily create electronic signatures that comply with e-signature laws.

Managing submitted forms

After submission, managing the third party payment declaration form is essential for ongoing compliance and verification. Users are encouraged to store and organize completed forms securely, which can be done effectively through the cloud services offered by pdfFiller. This not only protects sensitive information but makes it easily accessible whenever needed.

Accessing previously submitted forms is straightforward with pdfFiller’s intuitive interface. It includes features for tracking the status of submissions, assisting users in keeping tabs on pending forms or responses required. This organized approach can help alleviate worries about lost documentation and improve overall efficiency in managing financial records.

Common mistakes to avoid

Mistakes can lead to significant delays in payment processing when using the third party payment declaration form. Frequently overlooked sections typically include the declaration statement and payment details, which are crucial for verifying transaction legitimacy. Additionally, incorrect identification details can cause confusion and may lead to non-compliance with financial regulations.

Troubleshooting and FAQs

When utilizing the third party payment declaration form, users often encounter common questions regarding the process. For instance, clarification on how to declare payments accurately can be a concern. Providing clear, detailed guidance on filling out each section helps empower users and bolster their confidence in managing the form.

To troubleshoot typical problems, users can refer to the help section on pdfFiller, which offers solutions for common issues, such as accessing the form or understanding compliance requirements. Additionally, reaching out to customer support can provide personalized assistance for unique circumstances, enhancing the user experience when dealing with complex forms.

Benefits of using pdfFiller for your documentation needs

pdfFiller stands out for its comprehensive document management capabilities that cater to the diverse needs of individuals and teams. It enables users to seamlessly edit PDFs, e-sign, collaborate, and manage documents, all from one cloud-based platform. This integrated approach means that users can handle their documentation needs without having to switch between multiple programs.

Furthermore, accessing pdfFiller from anywhere increases usability, allowing for on-the-go document management. Whether you're in the office or working remotely, you can conveniently manage all your forms, including the third party payment declaration form, enhancing productivity and ensuring you never miss an essential step in your financial processes.

Legal considerations and compliance

Navigating legal considerations for the third party payment declaration form is essential for ensuring compliance with relevant regulations. Various laws govern third-party payments, highlighting the need for transparent declarations to prevent fraud and mishandling. Therefore, maintaining meticulous records of all transactions and declarations is paramount, as this can help substantiate financial dealings during audits.

pdfFiller assists users in maintaining compliance by offering tools that securely save your documents while providing access to auditing features. This proactive approach not only reinforces accountability but also strengthens trust between all parties involved in financial transactions, ultimately contributing to a smoother operational workflow.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in third party payment declaration?

How can I edit third party payment declaration on a smartphone?

How do I edit third party payment declaration on an Android device?

What is third party payment declaration?

Who is required to file third party payment declaration?

How to fill out third party payment declaration?

What is the purpose of third party payment declaration?

What information must be reported on third party payment declaration?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.