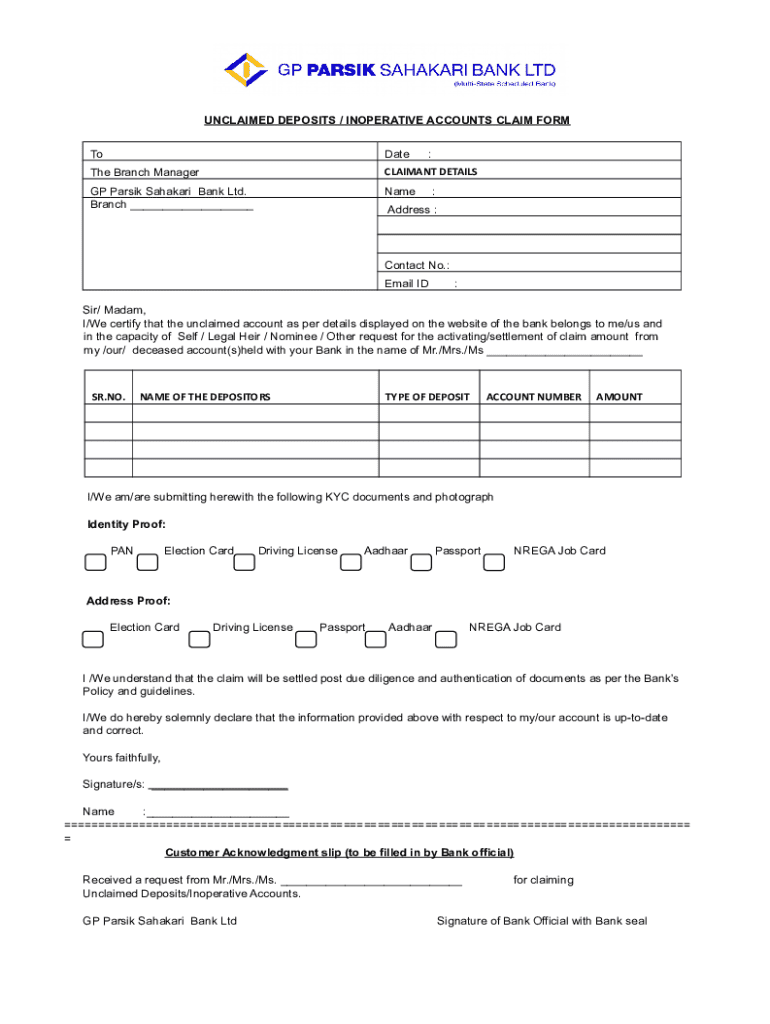

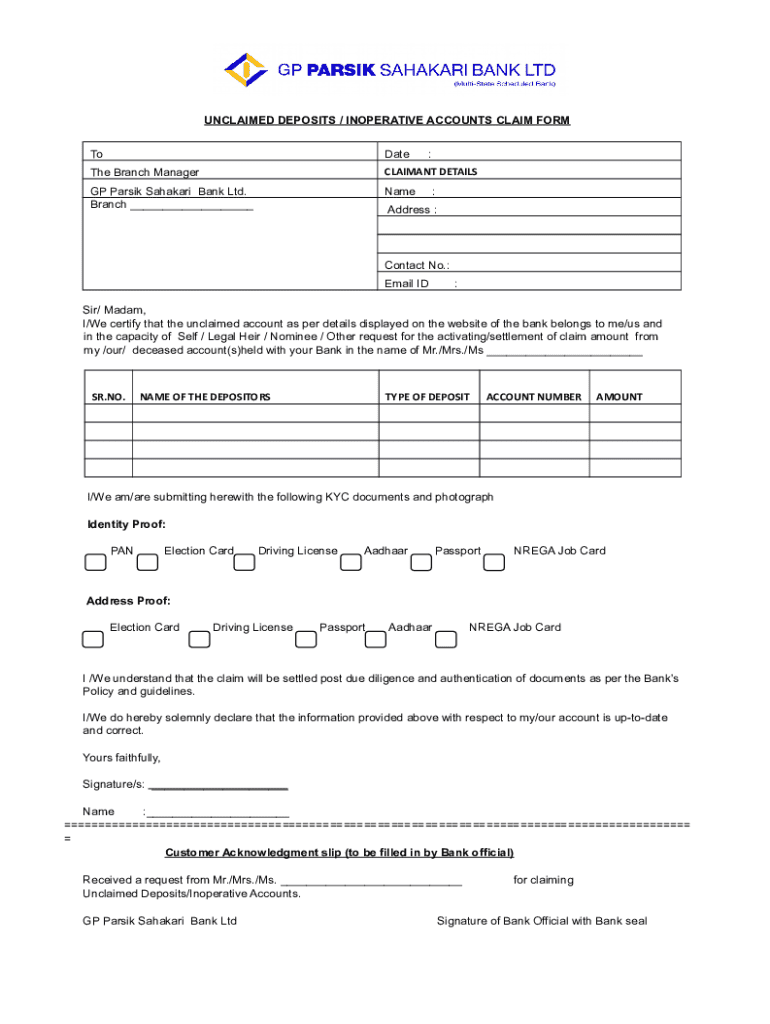

Get the free Unclaimed Deposits / Inoperative Accounts Claim Form

Get, Create, Make and Sign unclaimed deposits inoperative accounts

How to edit unclaimed deposits inoperative accounts online

Uncompromising security for your PDF editing and eSignature needs

How to fill out unclaimed deposits inoperative accounts

How to fill out unclaimed deposits inoperative accounts

Who needs unclaimed deposits inoperative accounts?

Unclaimed Deposits Inoperative Accounts Form: A Comprehensive Guide

Understanding unclaimed deposits

Unclaimed deposits refer to funds held in an account that have not seen any activity for a predetermined period. These deposits can accumulate in various types of accounts, including savings accounts, checking accounts, and even certificates of deposit. An account may be classified as unclaimed if the owner fails to make a withdrawal, deposit, or contact the financial institution over several years, leading to a loss of claim.

Most financial institutions and regulatory bodies define the period for inaction differently, but it often ranges from three to five years. Each locality may have specific rules regarding the types of accounts that can become unclaimed deposits, which emphasizes the need for account holders to keep their information updated.

The importance of claiming unclaimed deposits

Claiming unclaimed deposits is crucial not just for financial recovery but also for emotional peace of mind. When funds go unclaimed, they often remain inaccessible for years, which can contribute to financial instability. This situation is particularly challenging for those who may be unaware of lost funds, exacerbating financial burdens when least expected.

In addition to the financial implications, the emotional weight of lost or unclaimed funds can be significant. Many individuals feel a sense of loss or anxiety about their financial situation. On the flip side, by updating or claiming inoperative accounts, individuals have the opportunity to not only recover their funds but also improve their financial health by mitigating any penalties or fees associated with dormant accounts.

Overview of the inoperative accounts form

The Inoperative Accounts Form is a critical document for anyone looking to claim unclaimed deposits. This form serves to authenticate your claim and facilitates the return of your funds. It captures essential information about the account and the owner, ensuring the financial institution can accurately process the claim.

Typical requirements for filling out this form include personal identifying details, account numbers, and previous activity logs. Be prepared to provide information that substantiates your claim, as financial institutions will need to confirm ownership before releasing any funds.

How to fill out the inoperative accounts form

Filling out the Inoperative Accounts Form may seem daunting, but it is a straightforward process when broken down into steps. Here’s how to successfully complete the form:

Each of these steps is crucial as they shepherd you through the intricacies of the Inoperative Accounts Form whilst ensuring nothing is overlooked.

Editing and managing your form using pdfFiller

pdfFiller revolutionizes the way you manage forms by offering a suite of tools for editing and eSigning. Once you’ve accessed the Inoperative Accounts Form, you can take full advantage of pdfFiller's easy-to-use editing features. Editing the form before submission helps avoid errors that could slow down your claims process.

Using pdfFiller, you can also leverage the eSigning feature, which simplifies signing processes without the need for printing. This means you can expedite your submission electronically, adhering to modern expectations of speed and convenience in document management.

Follow-up actions after form submission

Once you've submitted your Inoperative Accounts Form, you should know what to expect in the coming days. Financial institutions typically send a confirmation of receipt for your form within a few business days, ensuring you are kept in the loop regarding your claim.

Processing times can vary, but it's wise to anticipate a timeframe of several weeks. If additional documentation is required, the institution will reach out to you directly.

FAQs about unclaimed deposits and inoperative accounts

As with any financial process, queries often arise regarding unclaimed deposits. Here are some common questions that you may find helpful to understand better:

Navigating challenges with unclaimed deposits

Despite a clear process, challenges can arise when dealing with unclaimed deposits. One common issue is having an application denied, which can occur due to incorrect information or lack of supporting documents.

In such cases, you can appeal the decision by submitting required documents again or providing additional information. It's essential to keep a record of your communications with the financial institution and be persistent in following up.

Conclusion on taking action for your financial well-being

Addressing unclaimed deposits is more than just a financial necessity; it’s an essential step toward maintaining your financial health. By using the Inoperative Accounts Form effectively and utilizing the tools available through pdfFiller, you can reclaim lost funds and restore your financial stability.

Taking control of your dormant accounts ensures you are making informed choices about your finances and empowers you to secure your financial future. Start by gathering your documents and visit pdfFiller to handle your forms with ease!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find unclaimed deposits inoperative accounts?

Can I create an electronic signature for the unclaimed deposits inoperative accounts in Chrome?

How can I fill out unclaimed deposits inoperative accounts on an iOS device?

What is unclaimed deposits inoperative accounts?

Who is required to file unclaimed deposits inoperative accounts?

How to fill out unclaimed deposits inoperative accounts?

What is the purpose of unclaimed deposits inoperative accounts?

What information must be reported on unclaimed deposits inoperative accounts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.