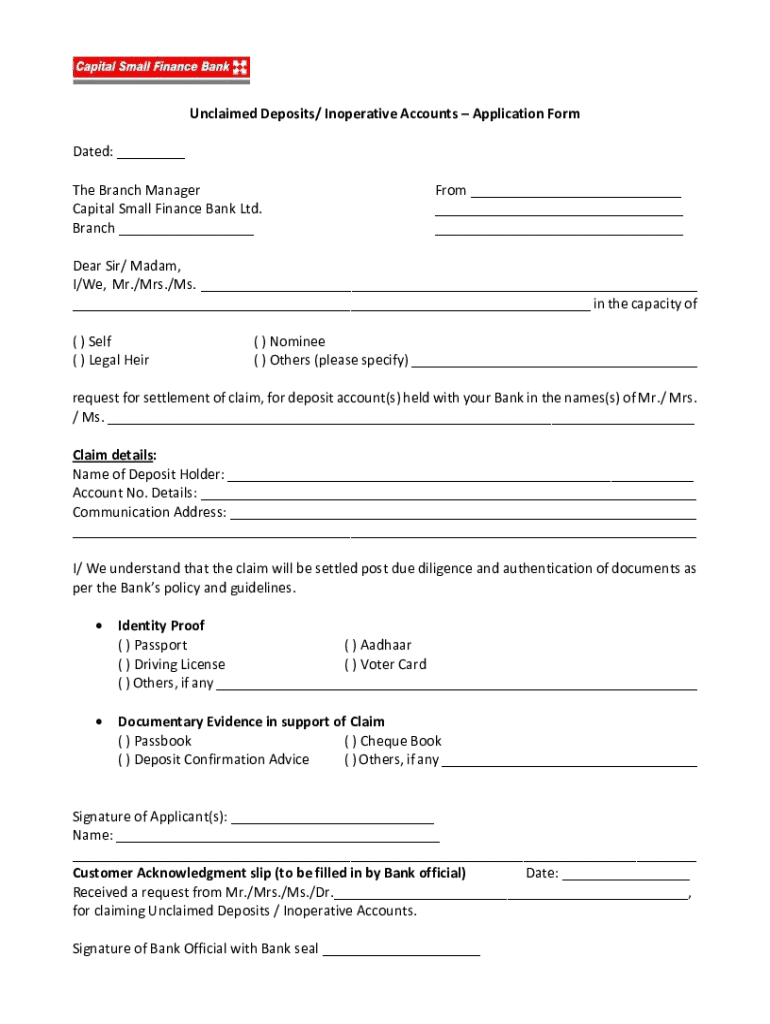

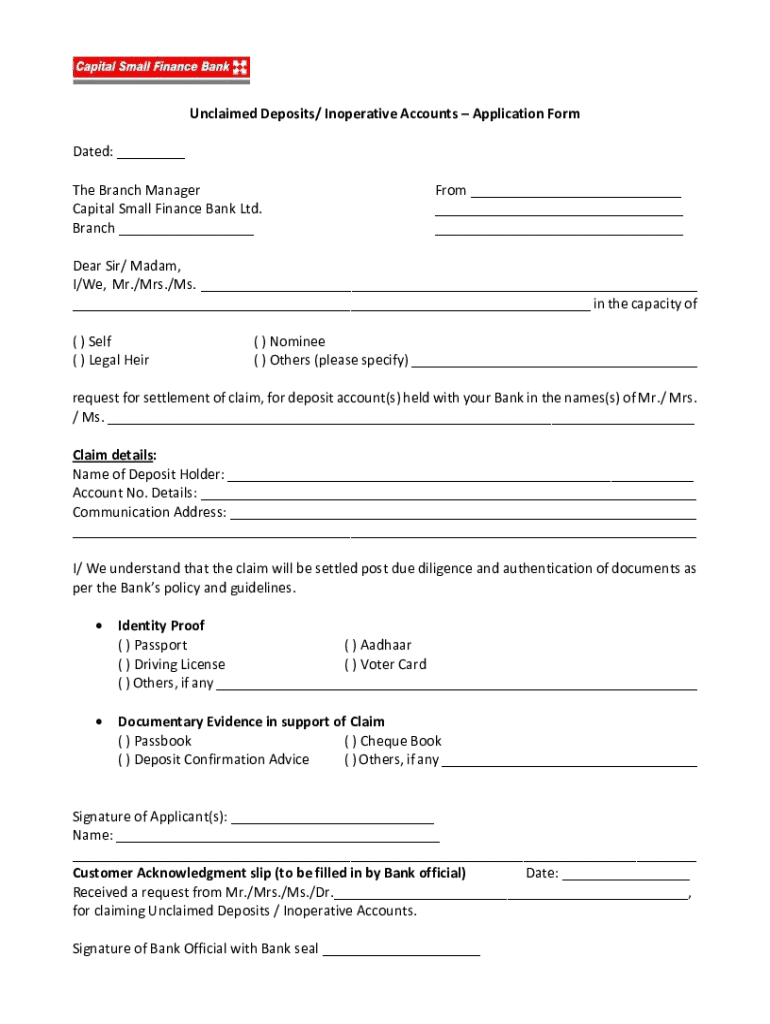

Get the free Unclaimed Deposits/ Inoperative Accounts – Application Form

Get, Create, Make and Sign unclaimed deposits inoperative accounts

How to edit unclaimed deposits inoperative accounts online

Uncompromising security for your PDF editing and eSignature needs

How to fill out unclaimed deposits inoperative accounts

How to fill out unclaimed deposits inoperative accounts

Who needs unclaimed deposits inoperative accounts?

Unclaimed deposits inoperative accounts form: a how-to guide

Understanding unclaimed deposits and inoperative accounts

Unclaimed deposits are funds held by financial institutions or banks that have gone unclaimed by the account holders for a significant period, often due to inactivity, death, or the account holder's relocation. These funds remain in limbo until the rightful owner claims them. On the other hand, inoperative accounts are those account profiles that haven't had any deposit or withdrawal activity for a predetermined amount of time, generally ranging from one to five years depending on state regulations. It's crucial to address unclaimed deposits as they can represent a significant loss of personal assets and affect financial planning.

Addressing unclaimed deposits also serves a broader social good. By reclaiming these funds, individuals can bolster their financial stability and contribute to economic growth. Moreover, understanding these concepts is vital for proactive financial management and safeguarding personal assets.

Key regulations governing unclaimed deposits

Several financial laws dictate how unclaimed deposits are handled, often varying from state to state. At the federal level, the Uniform Unclaimed Property Act provides a framework for states to follow, ensuring that unclaimed property processes are standardized, although each state modifies these regulations to fit its context. In addition, laws require that financial institutions establish a timetable for when an account is deemed unclaimed, which is generally between three to five years of inactivity. This ensures that individuals are given ample time to reactivate their accounts before funds are turned over to state treasuries.

Moreover, all states mandate periodic reviews and reporting requirements from financial institutions to ensure transparency and accountability. This allows transparency into how many deposits are unclaimed and under which circumstances. Individuals should familiarize themselves with these regulations to ensure they stake a claim on their rightful funds.

What is the unclaimed deposits inoperative accounts form?

The unclaimed deposits inoperative accounts form is a specific document that must be submitted by individuals wishing to claim funds from banks or financial institutions that have been classified as unclaimed or inoperative. The purpose of this form is twofold: first, it formally requests the release of funds back to the account holder, and second, it provides the financial institution with verification of the claimant's identity and right to the funds.

This form becomes crucial in various scenarios, such as when an individual discovers they have an account with a bank that has become inoperative or if they've inherited funds from a relatives' account. Having the proper form completed accurately ensures a smoother claims process.

How to obtain the unclaimed deposits inoperative accounts form

Obtaining the unclaimed deposits inoperative accounts form can be accomplished in several ways. The most convenient method is to access the form online through a financial institution's website, where these forms are typically downloadable. Many states also provide standardized forms on their treasurer's website, ensuring easy accessibility.

For those who prefer traditional means, the form can often be requested at branch locations of your financial institution. Additionally, pdfFiller provides a straightforward platform where users can download the form as a PDF, making it easy to fill out and submit. Here’s a step-by-step guide to downloading it:

Detailed walkthrough: completing the form

Completing the unclaimed deposits inoperative accounts form correctly is essential for a successful claim. The required fields generally include personal information such as your name, contact details, and Social Security number. You'll also need to provide your account number, along with details about the financial institution where the inoperative account is held.

The form typically asks for a description of the unclaimed funds, including the amount and type of account. Common mistakes when filling it out include providing inaccurate information, failing to include necessary signatures, or submitting incomplete forms. To avoid these pitfalls, carefully review the instructions accompanying the form, double-check your details, and ensure all sections are filled out completely.

Here are a few tips for accurate completion of the form: double-check personal information, keep copies for your records, and consider submitting electronically if that option exists to streamline the process.

Submitting the unclaimed deposits inoperative accounts form

Once you have completed the unclaimed deposits inoperative accounts form, the next step is submission. There are multiple avenues for this: submitting online via platforms like pdfFiller offers a fast and efficient option for those comfortable with digital processes. Typically, such platforms provide quick confirmation of receipt and processing times.

If you prefer traditional methods, a mail-in submission is usually acceptable. Be sure to send your completed form to the appropriate address for your financial institution, and consider using certified mail for tracking purposes. Always confirm you receive acknowledgment of your submission to avoid any misunderstandings later.

Tracking your unclaimed deposit claim

After submitting your claim, tracking its status is vital for knowing when to expect funds. Many financial institutions offer online portals where you can log in to check the status of your submission. Alternatively, you can call customer service for updates.

Expect to wait some time after submission, as processing can vary based on the institution's internal practices. Generally, timelines can range from a few weeks to several months. If waiting proves too lengthy, don’t hesitate to reach out to the institution for further clarification on your claim’s status.

Additional resources for managing inoperative accounts

Staying informed about unclaimed deposits and inoperative accounts is essential for effective financial management. Frequently asked questions about unclaimed deposits can address common concerns, while further reading materials can provide greater insights into financial rights. Websites, like pdfFiller, also offer tools for document management, streamlining the claims process.

Utilizing online resources can make claiming funds more accessible. Search engines allow for quick finding of state-specific regulations and guidelines. Moreover, leveraging online tools via pdfFiller aids in creating, editing, and managing the necessary documentation efficiently.

Case studies: success stories of claiming unclaimed deposits

Numerous individuals have successfully navigated the complexities of claiming unclaimed deposits. For instance, one woman discovered an inoperative account from her late father and successfully claimed over $10,000 using the appropriate form and following state regulations.

Another example includes a young man who learned about an old savings account from his college years. By using the unclaimed deposits inoperative accounts form, he was able to claim $2,200 he had forgotten about, supporting his move into a new apartment. These stories not only highlight the success of individuals reclaiming their funds but also emphasize the importance of being proactive about financial accounts.

Keeping your accounts active to prevent inoperability

Preventing your accounts from becoming inoperative requires a proactive approach. Regular account activity is key, so consider small deposits or withdrawals at least once a year. This guarantees that your account remains active and in good standing. Additionally, setting up automatic transfers or scheduled payments can keep your financial activities ongoing.

Regular reviews of your financial accounts ensure you are aware of their status and activities. Employ platforms like pdfFiller to easily manage related documentation, set reminders, and keep track of your accounts' activity levels. This will not only help maintain account functionality but also empower you as a financially aware individual.

Conclusion: empowering yourself with financial knowledge

Managing financial accounts demands an informed and proactive approach. Understanding the unclaimed deposits inoperative accounts form can be the first step in reclaiming lost assets and enhancing personal financial wealth. With resources like pdfFiller at your disposal, document management and the claims process are simplified, enabling anyone to effectively navigate through these often-complex issues.

By educating yourself about your financial rights and the tools available for managing your accounts, you can prevent your assets from falling into the unclaimed category again. Take ownership of your financial future and ensure that you are making informed decisions in managing your assets wisely.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my unclaimed deposits inoperative accounts in Gmail?

Can I create an electronic signature for signing my unclaimed deposits inoperative accounts in Gmail?

How can I fill out unclaimed deposits inoperative accounts on an iOS device?

What is unclaimed deposits inoperative accounts?

Who is required to file unclaimed deposits inoperative accounts?

How to fill out unclaimed deposits inoperative accounts?

What is the purpose of unclaimed deposits inoperative accounts?

What information must be reported on unclaimed deposits inoperative accounts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.