Get the free Ikhlas Fidelity Guarantee Takaful

Get, Create, Make and Sign ikhlas fidelity guarantee takaful

Editing ikhlas fidelity guarantee takaful online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ikhlas fidelity guarantee takaful

How to fill out ikhlas fidelity guarantee takaful

Who needs ikhlas fidelity guarantee takaful?

Understanding the Ikhlas Fidelity Guarantee Takaful Form

Understanding Ikhlas Fidelity Guarantee Takaful

Fidelity Guarantee Takaful is a specialized insurance product designed to protect businesses against losses incurred due to employee dishonesty, including theft, fraud, and other dishonest actions. This type of takaful is essential for safeguarding an organization’s financial well-being, ensuring that financial losses caused by employees do not unduly impact the business. With the rise of numerous cases involving fraud and theft in workplaces across various industries, Fidelity Guarantee Takaful plays a pivotal role in risk management.

By providing coverage specifically targeting employee dishonesty, businesses can operate with the assurance that they have a safety net in place. This sense of security not only protects financial assets but also fosters trust among stakeholders, enhancing the overall reputation of the organization.

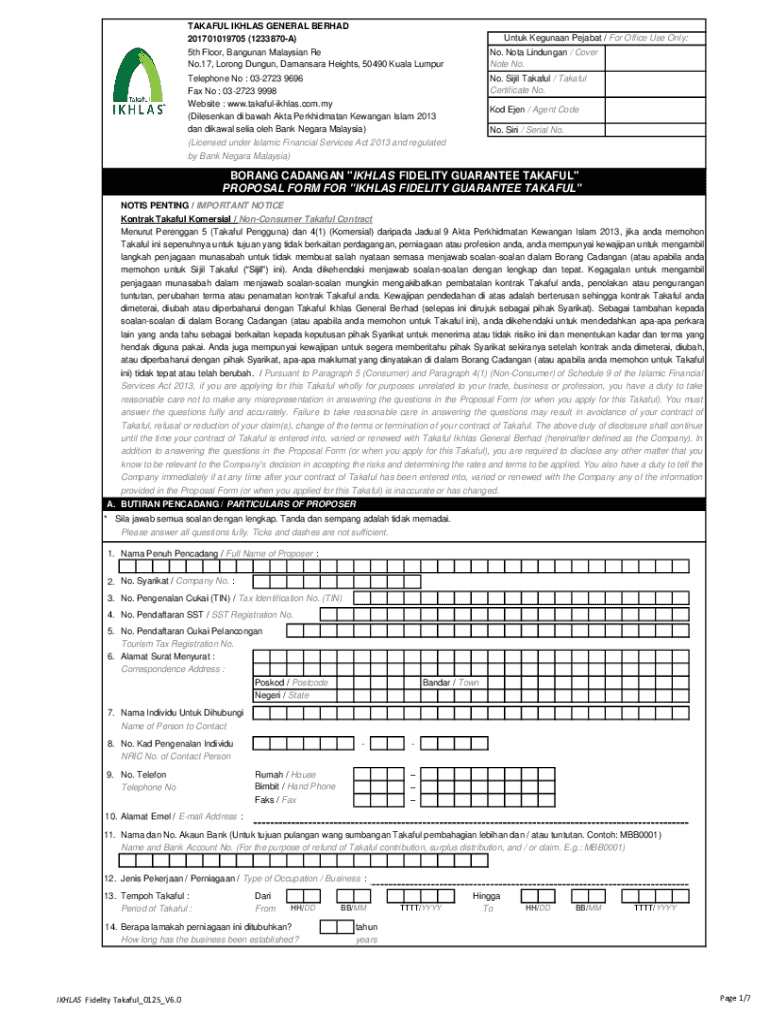

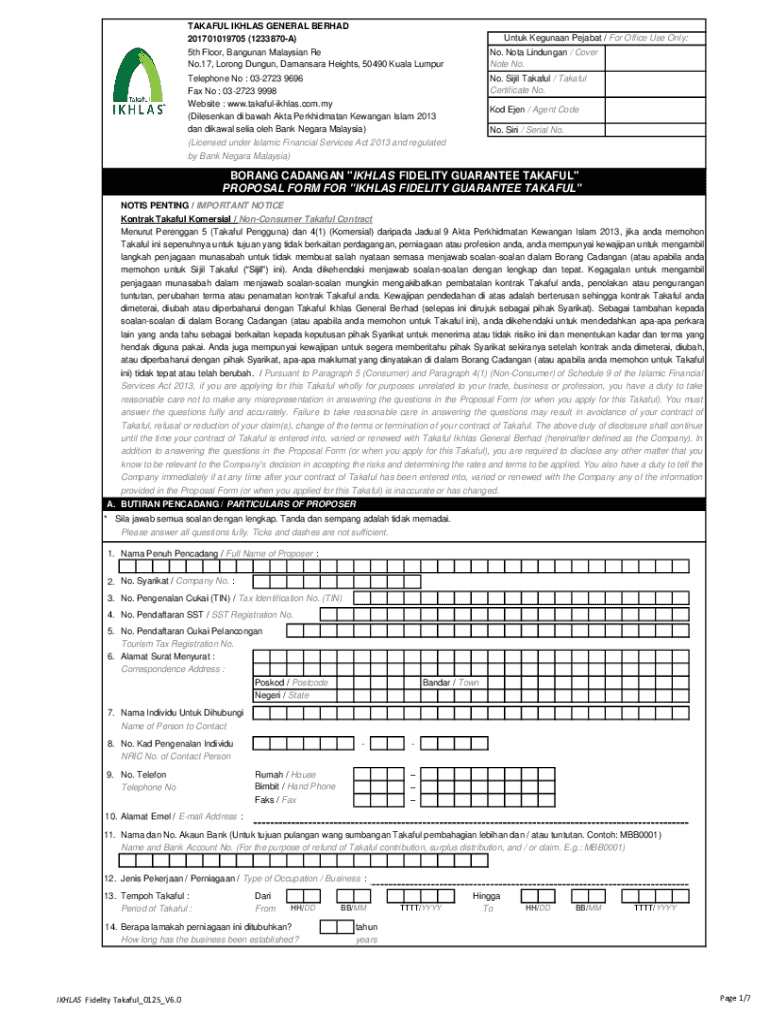

Overview of the Ikhlas Fidelity Guarantee Takaful Form

The Ikhlas Fidelity Guarantee Takaful form serves as a crucial interface between the policyholder and the takaful provider, facilitating the application process. This form captures key details necessary for assessing risks and defining the terms of coverage. It also ensures that the potential policyholder understands their responsibilities and the specifics of the coverage being offered.

This form is not just a application; it represents an agreement between the insurer and the insured regarding what risks are covered. It outlines the obligations of both parties and serves as foundational information for future claims. Understanding the purpose behind each section of this document is pivotal for businesses looking to optimize their risk management strategies.

Step-by-step guide to filling out the Ikhlas Fidelity Guarantee Takaful form

Completing the Ikhlas Fidelity Guarantee Takaful form can appear daunting, but with the right preparation, it can be a straightforward process. Begin by gathering all necessary documents, including financial records, employee details, and company information. These documents will assist you in filling out the form accurately. Tips for streamlining the preparation process include creating a checklist of required information and ensuring that all documentation is up-to-date and relevant.

When you’re ready to fill out the form, pay close attention to each section. Personal information should be filled in carefully, as incorrect details can delay the processing of your takaful application. Special focus should also be given to providing accurate company details and selecting the coverage that best fits your organization's needs.

Detailed instructions for each section of the form

Personal information

When filling out the personal information section, provide your full name, residential address, and contact details. Ensure that the information is correct and reflects your current status. This is critical, as any discrepancies can lead to issues in claim processing down the line.

Company details

In the company details section, accurately represent your business information including the registered name, address, and nature of business. If your business has a CEO or primary contact, clearly indicate their role and contact information. This ensures that all communications will reach the appropriate individual.

Coverage details

Choosing the right coverage options is vital. Assess your business needs and select the coverage limits that appropriately reflect the risks your organization faces. Be clear on what is included and possibly excluded in your policy coverage to align it with your operational requirements.

Signature and authorization

Finally, ensure that the form is signed and dated correctly. This is a crucial step indicating that you agree to the terms and conditions laid out in the document. Electronic signature options are available through platforms like pdfFiller, allowing for a seamless signing experience.

Interactive tools for editing and customizing your form

pdfFiller has emerged as a powerful tool for users looking to edit and customize their Ikhlas Fidelity Guarantee Takaful form. By leveraging its features, users can easily upload their forms and use the robust editing capabilities available. You can modify text, insert comments, and highlight sections requiring attention, making the process intuitive and user-friendly.

Additionally, pdfFiller allows for secure saving of completed forms in the cloud. This ensures that your documents are accessible from anywhere at any time, providing convenience especially for teams working remotely or on the go.

Collaborating on your takaful form

Collaboration is key in filling out the Ikhlas Fidelity Guarantee Takaful form, especially in larger organizations where multiple stakeholders may need to be involved. pdfFiller provides an array of tools that support document sharing for review and approval. Users can easily send the form to team members, allowing them to participate in the editing or feedback process.

Incorporating feedback and managing revisions has never been easier. With tracking capabilities, pdfFiller enables users to see changes made by colleagues, enhancing transparency and streamlining the finalization process. Following best practices for collaborative editing can significantly improve efficiency and accuracy.

Signing your Ikhlas Fidelity Guarantee Takaful form

The signing process of your Ikhlas Fidelity Guarantee Takaful form can be completed electronically, offering numerous advantages. E-signatures provide a fast and secure means of endorsing documents while minimizing the need for physical paperwork. With pdfFiller, electronic signing is simplified through a user-friendly interface that walks you through the signing steps.

Beyond convenience, ensuring compliance with local regulations regarding electronic signatures is essential. In Malaysia, e-signatures are legally recognized, which adds a layer of legitimacy to your signed documents, confirming the commitment made by stakeholders involved.

Frequently asked questions about the Ikhlas Fidelity Guarantee Takaful

Several common inquiries arise when discussing the Ikhlas Fidelity Guarantee Takaful and specifically its form. Many policyholders want clarity regarding the scope of coverage, especially concerning what types of losses are included and excluded. It’s crucial to read the policy document thoroughly since there might be critical exclusions that affect the overall coverage you receive.

Troubleshooting submission issues can also be a concern. If you face problems while filling out the form or if submission fails, checking for required fields that may have been overlooked often resolves these issues. pdfFiller offers support resources to assist users with common problems encountered during the process.

Explore additional coverage options

Having Fidelity Guarantee Takaful is often an essential part of a comprehensive business insurance strategy, but it's wise to consider other related takaful products for a more rounded protection plan. This may include personal accident takaful, which protects employees while they’re at work and property takaful that protects physical assets. Exploring multiple takaful options can help tailor a plan that comprehensively covers the varying risks faced by your organization.

As your business evolves, you may also find that your coverage needs may change. Indicators such as increasing employee numbers, expanding operations, or entering new markets are clear signals that it may be time to upgrade your takaful coverage. Regular assessments of your current policies against your business goals will ensure you remain adequately protected.

Contacting insurance agents for personalized assistance

Choosing the right insurance agent can significantly affect your understanding and acquisition of the Ikhlas Fidelity Guarantee Takaful. Select a professional who has experience with takaful products and who can address your specific business needs effectively. Take time to assess their expertise, industry knowledge, and customer reviews before making your choice.

When engaging with your insurance agent, prepare a list of questions that clarify your understanding of policy options, including coverage limits, pricing, and claims processes. Engaging in thorough discussions will help establish a strong partnership that enhances your insurance acquisition experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ikhlas fidelity guarantee takaful to be eSigned by others?

How do I make changes in ikhlas fidelity guarantee takaful?

How do I make edits in ikhlas fidelity guarantee takaful without leaving Chrome?

What is ikhlas fidelity guarantee takaful?

Who is required to file ikhlas fidelity guarantee takaful?

How to fill out ikhlas fidelity guarantee takaful?

What is the purpose of ikhlas fidelity guarantee takaful?

What information must be reported on ikhlas fidelity guarantee takaful?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.