Get the free Certificate of Insurance / Sijil Insurans

Get, Create, Make and Sign certificate of insurance sijil

Editing certificate of insurance sijil online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of insurance sijil

How to fill out certificate of insurance sijil

Who needs certificate of insurance sijil?

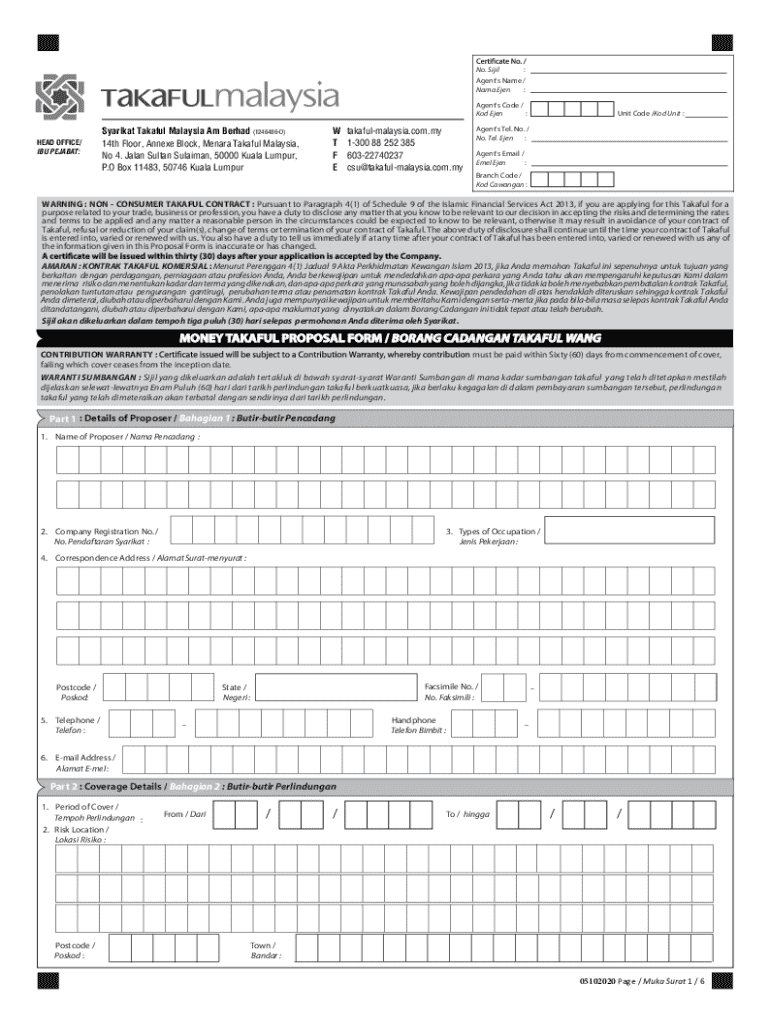

Understanding and Managing the Certificate of Insurance Sijil Form

Understanding the certificate of insurance sijil form

The Certificate of Insurance Sijil is a vital document that acts as proof of insurance coverage for businesses and individuals. This form is not merely a piece of paper; it encapsulates essential information about the insurance policy, including coverage types and limits, allowing stakeholders to verify that adequate protection exists.

The significance of this certificate in risk management cannot be overstated. It protects against liability by providing evidence that the insured has coverage to handle potential claims or damages. Whether for a contractor working on a large project or a business needing to fulfill regulatory requirements, this document assures clients and partners that the necessary safeguards are in place.

Key terms in an insurance sijil form include various coverage types such as general liability, workers’ compensation, and property coverage. Each type has specific limitations and exclusions that must be understood and communicated to all parties involved.

Purpose and uses of the certificate of insurance sijil

The Certificate of Insurance Sijil serves vital roles in many scenarios. One common necessity arises from contractual obligations, where clients require proof of insurance before entering a contract. This document is also crucial for asset protection, providing financial security in events that could lead to significant loss or liability.

Moreover, various laws and regulations demand that businesses demonstrate liability insurance to operate legally within certain sectors. Without this certificate, businesses may find it challenging to secure contracts or licenses.

Who needs a Certificate of Insurance? Various individuals and entities require this document ranging from large corporations to small businesses and independent contractors. Event organizers, for instance, are often required to present a certificate to ensure adequate coverage for any incidents during their events.

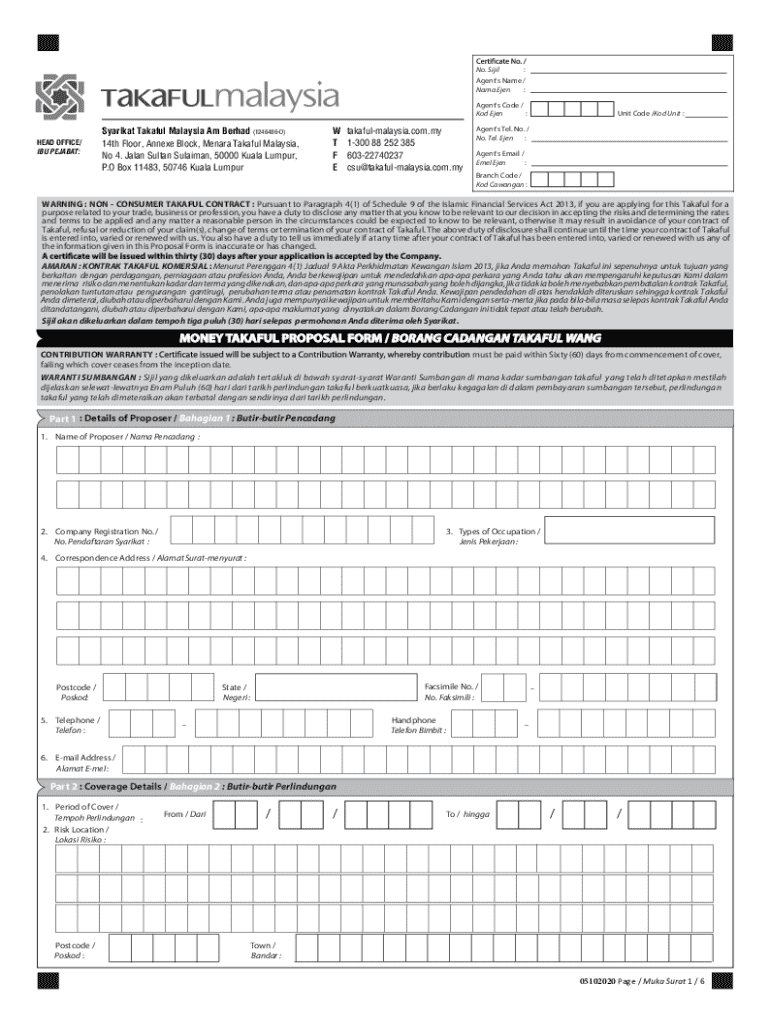

Essential components of the certificate of insurance sijil form

A comprehensive Certificate of Insurance Sijil form will include several critical components that provide a snapshot of the insurance status. The insured name and address are foundational, establishing who is covered under the policy. The insurance provider's information comes next, detailing which company underwrites the coverage.

Policy numbers and coverage details are also essential; they specify what is covered and any limits on the coverage. Understanding terms like coverage limits, effective dates, and any exclusions is crucial to ensure that all relevant information is clear and accurate.

Before submitting the certificate, verifying the accuracy of information and ensuring that the coverage is adequate for needs is essential, helping avoid future disputes.

Step-by-step guide to filling out the certificate of insurance sijil form

Filling out the Certificate of Insurance Sijil form can seem daunting, but with proper preparation, it becomes straightforward. The first step involves gathering all required information, including personal details, business information, and specifics about the coverage needed. Understanding these needs will facilitate correct form completion.

Once you have collected the necessary information, begin filling out the personal and business information, making sure all fields are accurate. Specifically, pay attention to specifying the types of coverage included in your policy and any additional insured parties if required.

After filling out the form, it’s crucial to conduct a thorough review to ensure no mistakes are present. Common errors include incorrect names, wrong policy numbers, or missing coverage details, all of which could lead to complications in the future.

Editing and customizing your certificate of insurance sijil

Once you have completed the Certificate of Insurance Sijil, you may need to edit or customize it. Tools like pdfFiller offer user-friendly editing options, allowing straightforward modifications, whether for updating coverage or correcting details. You can easily utilize features to highlight specific sections or annotate additional information.

Adding signatures and dates can also be accomplished seamlessly using pdfFiller. eSigning options accommodate multiple users signing off on a single document, crucial for collaborative environments where stakeholder approval is needed.

The versatility of these tools empowers users to keep their documents updated and tailored to their specific needs, ensuring that the certificate remains relevant and compliant.

Managing the certificate of insurance sijil document

Storage and management of the Certificate of Insurance Sijil are essential for both personal and professional use. Utilizing a cloud-based solution keeps your documents accessible from anywhere, allowing for quick retrieval in case of audits or contractual obligations.

Benefits of having a cloud storage system include the ability to track document history and manage different versions effectively. This is especially important for businesses that need to maintain accurate records of their insurance communications.

Utilizing such dynamic document management features ensures that all parties always have access to the most up-to-date versions of the certificate, reducing confusion and enhancing compliance.

Frequently asked questions (faqs)

The world of insurance and certificates can often lead to queries. A common question is, 'What if my insurance provider doesn’t issue a Certificate?' In such cases, reaching out directly to the provider to request it is essential, as many companies understand the industry's need for such documentation.

Another frequent concern is regarding the validity of the Certificate of Insurance. Typically, these certificates are valid for the period specified in the insurance policy; however, it is critical to keep track and update them as needed to avoid lapses in coverage.

Final tips for using the certificate of insurance sijil effectively

To maximize the effectiveness of your Certificate of Insurance Sijil, staying informed about any changes in coverage is crucial. Regular updates to the certificate reflect changes in policy or coverage levels and contribute to risk management.

Periodic reviews and updates of your certificate are essential to maintaining compliance and operational integrity. Working with tools available on pdfFiller enhances the ability to manage documents efficiently, incorporating updates in real-time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my certificate of insurance sijil directly from Gmail?

Where do I find certificate of insurance sijil?

How do I edit certificate of insurance sijil on an iOS device?

What is certificate of insurance sijil?

Who is required to file certificate of insurance sijil?

How to fill out certificate of insurance sijil?

What is the purpose of certificate of insurance sijil?

What information must be reported on certificate of insurance sijil?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.