Get the free Business Banking Group Application Form

Get, Create, Make and Sign business banking group application

How to edit business banking group application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business banking group application

How to fill out business banking group application

Who needs business banking group application?

Business Banking Group Application Form - How-to Guide

Understanding the business banking group application form

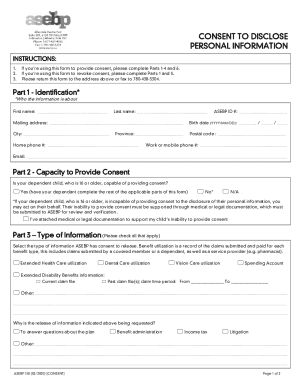

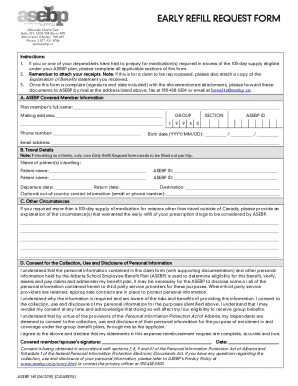

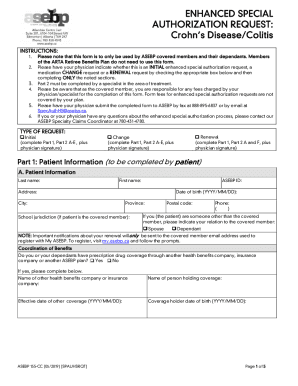

The Business Banking Group serves as a vital service sector in financial institutions, specifically designed to support businesses with their banking needs. The group provides a range of services tailored to meet the diverse financial requirements of small enterprises to larger corporations. Understanding the business banking group application form is crucial for any business seeking financial support, as it acts as the gateway to accessing banking services.

The primary purpose of the application form is to collect relevant data about your business and its owners, allowing the bank to assess eligibility for various financial products. Its importance cannot be overstated; failing to fill out this form correctly could delay your application or even lead to rejection. Furthermore, the application form includes key features such as predefined sections for business information, financial data, and personal details of stakeholders, streamlining the process for both the applicant and the bank.

Navigating the application form

To access the business banking group application form, visit pdfFiller and navigate to the financial documents section. Look for a dedicated page for business banking forms, where you can find the application form available for download in PDF format. When preparing to fill out the form, it’s beneficial to gather all necessary documents and information in advance, such as your business registration details, tax ID numbers, and financial statements.

Filling out the application form

The application form requires specific information to evaluate your business accurately. Essential business information includes the business name, its registered address, and the type of business entity. This information provides the bank with a foundational understanding of your operations and structure. Furthermore, financial data such as annual revenue, tax identification number, and existing debts are crucial for determining your creditworthiness.

In addition to business and financial information, personal details of key stakeholders, such as owners and guarantors, are typically required. Each section of the form needs to be completed with precision to avoid common mistakes that could derail your application.

Common pitfalls include incomplete sections or inconsistent information across documents. Be diligent when completing the form, and ensure that all entries match your business registrations and financial reports.

Editing and customizing your application

Once you have filled out the business banking group application form, pdfFiller provides comprehensive editing tools that allow for convenient modifications. You can easily adjust PDF fields, add necessary sections, or remove superfluous information based on your unique requirements. This flexibility ensures that your application accurately reflects your business needs.

Additionally, pdfFiller fosters collaboration by offering interactive features that enable team members to review and comment on the document before finalization. Centralizing the editing process helps streamline communication within your team, ensuring everyone is aligned on the information that will be submitted.

Signing the application form

After completing the business banking group application form, the next step is to sign it. pdfFiller provides several options for eSigning—whether it’s drawing your signature, typing it in, or uploading a handwritten version. This versatility simplifies the signing process, making it secure and straightforward.

Adding signatures and dates in a secure manner is imperative, as the bank requires proper verification of all signatories. Ensure that individuals responsible for signing the document understand the implications of their signatures, and double-check that all signatures are affixed correctly before proceeding to the submission stage.

Submitting your application

With your application signed, you’re ready to submit it. pdfFiller offers multiple submission methods, including online submissions directly through the platform. Alternatively, you can choose to email the application or send it through conventional mail if required. The selection of the method may depend on the urgency of the application and the specific requirements of your banking institution.

To track your application post-submission, keep a record of submission confirmation and any reference numbers provided by the bank. Monitoring response times can help you manage expectations regarding approval or any follow-up communication. It’s essential to stay engaged with the bank after submission to address queries or provide additional information if needed.

Managing your application and documentation

Organizing and managing your completed forms afterward is equally important. Utilizing pdfFiller, you can store your completed business banking group application form securely. The platform offers features for easy organization of multiple applications, allowing you to sort documents by business name, submission date, or type.

Furthermore, adjust security settings depending on who needs access to sensitive documents. This thoughtful management of application documentation not only improves efficiency but safeguards essential information against unauthorized access.

Troubleshooting common issues

Even with careful preparation, issues can arise during the application process. If discrepancies or errors are identified, it is vital to contact your bank promptly for resolution. Ensure that you have all relevant documents on hand to facilitate a quick conversation with customer service.

Utilizing pdfFiller’s support resources, such as FAQs and live chat, can also provide assistance in resolving common questions related to fillable forms. Familiarizing yourself with these resources enhances efficiency and minimizes miscommunications.

Further considerations

Submitting your business banking group application form can have significant implications. Once submitted, be prepared for potential follow-up discussions or meetings with bank representatives to discuss your business needs further. Have all necessary documentation on hand to facilitate these conversations successfully.

Maintaining organized documentation for future banking needs can streamline the process. Whether it is future loan applications, account changes, or renewals, being prepared with prior documentation improves your standing as a reliable borrower.

Engaging with pdfFiller for enhanced experience

Beyond simply filling out forms, pdfFiller provides additional features that enhance your overall document management experience. You can utilize various document collaboration tools that allow multiple users to work on forms simultaneously, greatly improving efficiency.

Moreover, pdfFiller's integration capabilities with other applications and cloud services provide unparalleled accessibility. Other security features ensure that sensitive data remains protected throughout the documentation process, allowing businesses to focus on growth without compromising their information.

Optimizing your business banking experience

Maintaining a strong banking relationship is essential for long-term business success. To achieve this, ensure regular communication with your bank regarding your accounts and any new needs your business may evolve into over time.

Employ banking services effectively to support growth. Whether utilizing credit lines, loans, or treasury services, engage fully to understand how these can be used strategically. Regularly reviewing your financial position and identifying opportunities to optimize your banking setup can yield significant benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find business banking group application?

Can I create an electronic signature for the business banking group application in Chrome?

How do I fill out business banking group application using my mobile device?

What is business banking group application?

Who is required to file business banking group application?

How to fill out business banking group application?

What is the purpose of business banking group application?

What information must be reported on business banking group application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.