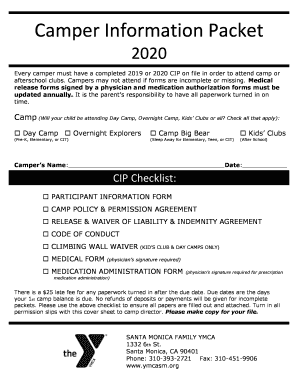

Get the free 10 Cash Flow Ratio

Get, Create, Make and Sign 10 cash flow ratio

How to edit 10 cash flow ratio online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 10 cash flow ratio

How to fill out 10 cash flow ratio

Who needs 10 cash flow ratio?

10 Cash Flow Ratio Form: Essential Metrics for Financial Analysis

Understanding cash flow ratios

Cash flow ratios are vital tools in evaluating a company’s financial health, providing insights into liquidity and operational efficiency. Unlike static financial ratios, cash flow ratios focus on the cash generated and used in a given period, illustrating how well a company can meet its obligations. This dynamic analysis is crucial for stakeholders who need to assess the resilience of a business amid fluctuating market conditions.

Investors, creditors, and management rely heavily on cash flow ratios for strategic decision-making. Financial analysis isn’t just about understanding profits; it also involves comprehending how cash is managed, thus highlighting true financial performance. For businesses seeking growth and stability, mastering cash flow ratios is imperative.

Key cash flow ratios explored

Within the realm of cash management, a handful of key ratios stand out. These ratios provide a comprehensive snapshot of a company’s ability to generate cash, manage its liabilities, and invest in future growth. Understanding each ratio's characteristics is essential for clear financial comprehension.

Cash flow margin ratio

The cash flow margin ratio provides insight into how efficiently a company converts its sales into actual cash. It is calculated as cash flow from operations divided by total revenue, resulting in a percentage. A higher cash flow margin indicates better cash generation relative to sales, which enhances financial stability.

Business leaders use this ratio to track cash effectiveness versus sales. Companies can identify operational improvements or marketing strategies that may enhance this ratio. For example, a retail company might find that certain sales promotions yield high revenue but low cash flow, prompting strategic adjustments.

Cash flow to net income ratio

This ratio assesses the relationship between cash generated by business operations and net income. It is calculated by dividing cash flow from operating activities by net income. A ratio greater than one indicates that the company generates more cash than it reports in net income, a positive sign for investors.

Interpreting this ratio is essential for stakeholders. A decline may suggest operational inefficiencies or accounting anomalies. For instance, if a technology firm shows a significant deviation, it could point to revenue recognition issues regarding software sales, urging for further investigation.

Cash flow coverage ratio

This ratio allows investors to see how easily a company can cover its debt obligations with cash generated from operations. The formula involves dividing cash flow from operations by total debt service. A ratio above 1 is generally favorable, indicating strong cash sufficiency.

For example, if a manufacturing company carries substantial debt, the cash flow coverage ratio can signal financial health and risk. Analysts might compare this ratio to industry standards, unveiling insights into operational cash commitments and long-term viability.

Price to cash flow ratio

The price to cash flow ratio measures the market's valuation of a company against its operational cash flow. It’s computed by dividing the market capitalization by cash flow from operations. Investors often prefer this metric over price-to-earnings (P/E) due to its focus on cash generation rather than accounting earnings.

It’s particularly useful in capital-intensive industries where high depreciation can distort net income. For instance, comparing this ratio between rival firms can reveal which business is more efficiently generating cash for shareholders.

Current liability coverage ratio

This ratio assesses how well a company can cover its short-term liabilities with its cash flow. It's calculated by dividing cash flow from operations by current liabilities. A higher ratio signifies improved liquidity, favorable for creditors and investors alike.

Understanding this ratio enables businesses to strategize better around operational cash management. For example, a retail business entering a holiday season could closely monitor this ratio to ensure enough liquidity to cover temporary inventory increases.

Advanced cash flow metrics

Beyond the essential cash flow ratios lies a spectrum of advanced metrics that lend greater clarity to financial audits and stability evaluations. These metrics allow deeper dives into revenue generation and expenditure management, essential for corporate strategy.

Understanding these advanced ratios is crucial for businesses looking to enhance their financial intelligence and respond to market dynamics effectively.

Calculating cash flow ratios: A step-by-step guide

Calculating cash flow ratios involves a systematic approach to extracting accurate figures from financial statements. Here's a step-by-step guide to streamline the process:

Common pitfalls during calculations include failure to account for off-balance sheet financing or ignoring seasonal variations in cash flows. Diligence in addressing these factors improves accuracy and relevance.

Practical applications of cash flow ratios

The applications of cash flow ratios extend across numerous aspects of financial planning and corporate strategy. Integrating these ratios into financial modeling and performance evaluation ensures that organizations stay ahead of potential cash flow issues.

Here are practical applications highlighting the value of cash flow ratios:

Best practices for monitoring cash flow ratios

Monitoring cash flow ratios requires a structured approach that fosters consistent tracking and improvement. Establishing relevant KPIs based on business goals is vital, ensuring that the focus remains on growing financial health.

To maintain an edge, companies should:

FAQs on cash flow ratios

Financial analysis often raises many questions regarding the cash flow ratios. Here are some frequently asked questions with insights into their importance:

Interactive tools and resources

Utilizing the right interactive tools can greatly enhance the cash flow analysis process. When it comes to managing cash flow ratios effectively, consider employing calculators and templates that simplify the process.

Notable resources include:

Case studies and real-world examples

Case studies provide invaluable insights into how leading companies utilize cash flow ratios in their strategic frameworks. Whether through enhancing operational efficiency or optimizing capital expenditures, lessons from industry giants can guide best practices.

Examples of companies successfully using cash flow ratios include:

Wrapping up cash flow ratio knowledge

Mastering cash flow ratios is crucial for any organization seeking to maintain financial health and sustainability. By integrating these ratios into regular financial analysis, businesses can make informed decisions regarding growth, investment, and debt management.

Using integrated solutions like pdfFiller can further streamline the process, ensuring that all documentation is efficiently managed, signed, and shared enhancing overall productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the 10 cash flow ratio in Gmail?

How can I fill out 10 cash flow ratio on an iOS device?

How do I complete 10 cash flow ratio on an Android device?

What is 10 cash flow ratio?

Who is required to file 10 cash flow ratio?

How to fill out 10 cash flow ratio?

What is the purpose of 10 cash flow ratio?

What information must be reported on 10 cash flow ratio?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.