Get the free Lst-3 Personal Return (self-employed)

Get, Create, Make and Sign lst-3 personal return self-employed

Editing lst-3 personal return self-employed online

Uncompromising security for your PDF editing and eSignature needs

How to fill out lst-3 personal return self-employed

How to fill out lst-3 personal return self-employed

Who needs lst-3 personal return self-employed?

A Comprehensive Guide to the lst-3 Personal Return Self-Employed Form

Understanding the lst-3 personal return self-employed form

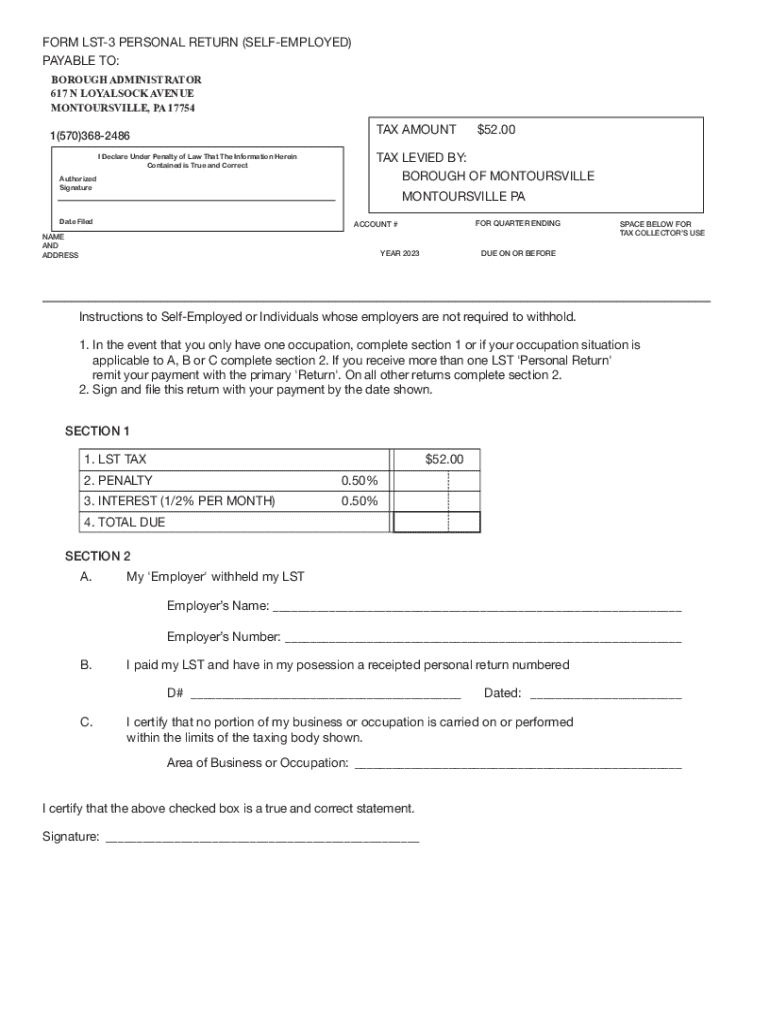

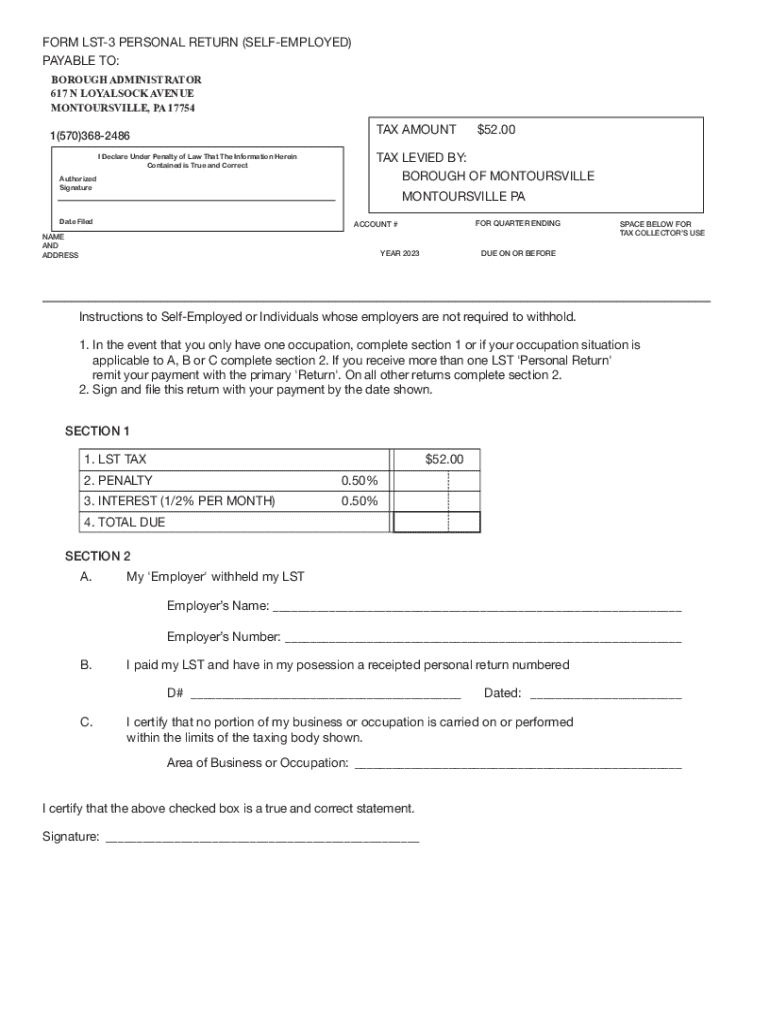

The lst-3 personal return self-employed form is a crucial document for individuals operating their own businesses or freelancing. This form allows self-employed individuals to report their income and claim tax deductions specific to their business operations. Unlike forms typically used by salaried employees, the lst-3 is tailored to capture the nuances of self-employment income, which can vary significantly based on the nature of the work, expenses incurred, and tax obligations.

Understanding the difference between personal returns for employees versus self-employed individuals is essential. Employees generally receive a W-2 form, which condenses their income data and tax withholdings. In contrast, self-employed individuals must gather income from various sources, make estimated tax payments, and are responsible for their own deductions. This distinction emphasizes the importance of thorough preparation when completing the lst-3 form.

Preparing for your lst-3 personal return

Preparation is key when it comes to filing your lst-3 personal return. It begins with gathering all necessary financial records, including invoices, receipts, and bank statements, which provide proof of income and expenses. Moreover, having your identification and tax information on hand simplifies the filing process. Ensuring accuracy with your personal details helps prevent any delays or issues with the submission.

Familiarizing yourself with important terminology is also crucial. Terms such as gross income, net income, self-employment tax, and deductions will frequently appear in the lst-3 form. Understanding these terms helps ensure accurate reporting. Additionally, determining eligibility factors for filing the lst-3 form is a must. If you earn income through freelance work, operate a business, or receive payment without tax withholdings, you will likely need to file this form.

Step-by-step guide to filling out the lst-3 form

The lst-3 form consists of multiple sections, each designed to capture specific pieces of information. Navigating through the document involves understanding each part clearly. Section 1 revolves around providing your personal information; it is essential to ensure this is filled out correctly to avoid processing delays.

In Section 2, income reporting is critical. The lst-3 lets you specify income from self-employment during the tax year, requiring detailed records that substantiate your earnings. For Section 3, knowing which deductions apply to your situation can reduce your taxable income significantly. Common deductions include operating expenses and business-related supplies. Remember, failing to claim eligible deductions could mean paying more tax than necessary.

Finally, Section 4 addresses your additional tax obligations. This includes an understanding of self-employment tax—a tax designed to cover Social Security and Medicare contributions for self-employed individuals. Calculating estimated payments throughout the year can help manage tax liabilities, preventing any surprises come tax season.

Common pitfalls to avoid

While filling out the lst-3 form, several common pitfalls can lead to issues. One of the main mistakes is either underreporting or overreporting income, which can raise red flags for tax authorities. It's vital to cross-check the income reported against actual bank deposits and invoices to avoid discrepancies.

Accuracy with deductions is equally important. Misclaiming expenses can result in audits or financial penalties. Therefore, maintaining thorough documentation and receipts for all claimed deductions is essential. A good practice is to always err on the side of caution and exclude any borderline expenses that might lead to disputes.

Utilizing tools for filing

With digital tools making paperwork more manageable, pdfFiller offers interactive solutions for completing the lst-3 personal return self-employed form. Users can fill out, edit, and eSign the form within a user-friendly platform that streamlines the filing process.

Cloud-based document management means self-employed individuals can access their files from anywhere, making it easy to manage multiple forms and documents. Utilizing features like automatic saving, tracking changes, and team collaboration can significantly simplify the preparation process, allowing for efficient communication and document sharing.

After filing - what comes next?

Filing your lst-3 personal return is only the first step in the process. After submission, it’s important to understand when to expect feedback from tax authorities. Typically, processing times can vary based on the methods used for filing—electronic submissions may receive quicker responses than paper submissions. Be diligent about tracking your filing status if electronically submitted.

Frequently asked questions (FAQs)

Navigating tax forms can raise numerous questions. Here are some common concerns related to the lst-3 personal return self-employed form. One significant query is, 'What if I miss the filing deadline?' In most cases, late filings can incur penalties, so it’s advisable to file as soon as possible, even if it’s late. Another frequent question is about amending the lst-3 form if errors are discovered post-submission. Amendments are permissible, but it's crucial to follow the correct procedures to avoid complications.

Lastly, many individuals worry about their financial situation changing after filing. If you experience a significant change in income, it may impact your tax obligations. Therefore, staying informed throughout the tax year can help manage any new developments effectively.

Additional support and resources

Seeking assistance during the filing process can make a significant difference. pdfFiller offers extensive resources for users needing help with the lst-3 form. From easy-to-follow guidelines to access to community forums, these resources promote collaborative learning and support. Engaging with experts in consultations or forums can provide valuable insights to demystify complex tax scenarios.

Staying informed

Tax laws are frequently updated, and self-employed individuals must stay informed about changes affecting their returns. Subscribe to relevant newsletters or follow pdfFiller for timely updates on tax forms, regulations, and tools to facilitate the filing process. Staying ahead of these changes ensures better preparedness for the tax season.

Sharing your experience

Encouraging users to share insights or questions about the lst-3 form process not only fosters community engagement but also helps others navigate their challenges more effectively. Engaging with the pdfFiller community can unveil new perspectives and support from those who have walked the same path, enriching the learning experience for all involved.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit lst-3 personal return self-employed in Chrome?

Can I create an eSignature for the lst-3 personal return self-employed in Gmail?

Can I edit lst-3 personal return self-employed on an iOS device?

What is lst-3 personal return self-employed?

Who is required to file lst-3 personal return self-employed?

How to fill out lst-3 personal return self-employed?

What is the purpose of lst-3 personal return self-employed?

What information must be reported on lst-3 personal return self-employed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.