Get the free Retail Installment

Get, Create, Make and Sign retail installment

How to edit retail installment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out retail installment

How to fill out retail installment

Who needs retail installment?

Comprehensive Guide to the Retail Installment Form

Understanding the retail installment form

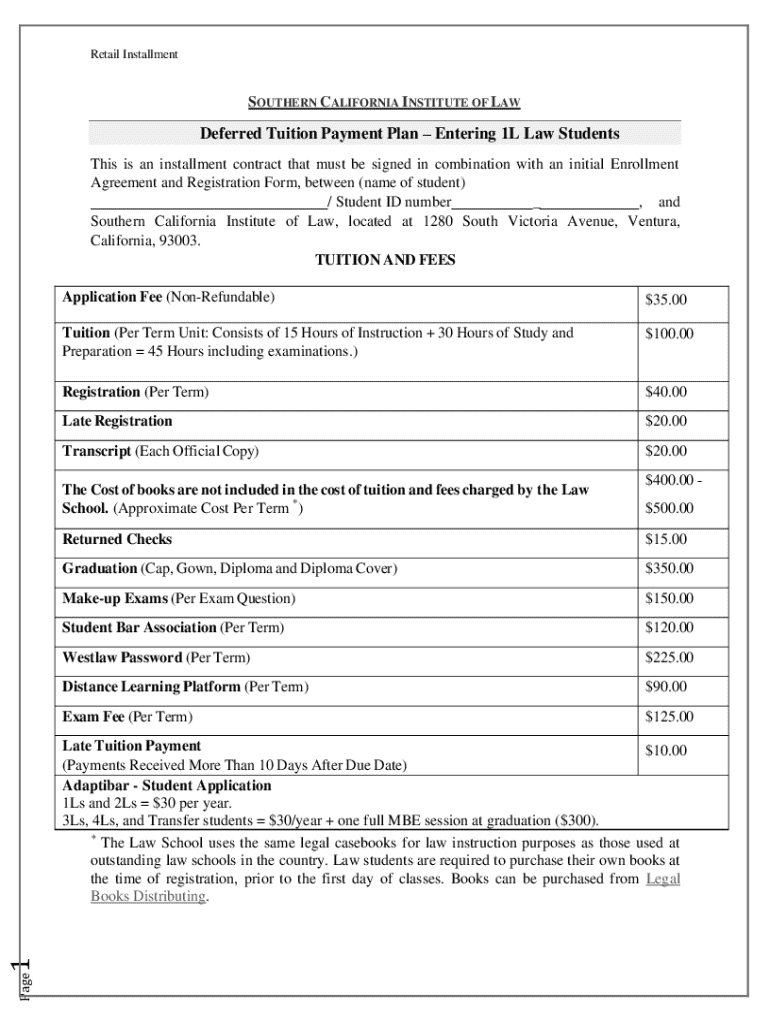

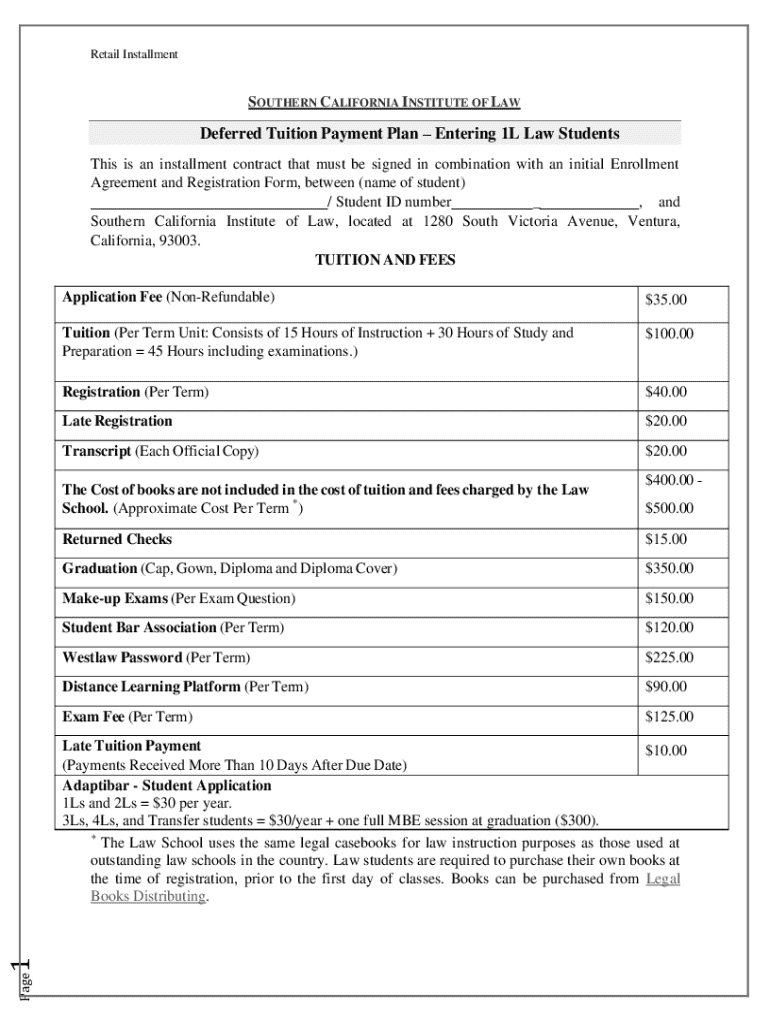

A retail installment form is a crucial document used in consumer financing, allowing buyers to purchase goods or services on credit while breaking down the total cost into manageable installments.

The primary function of this form is to outline the specifics of the purchase agreement, including payment terms and conditions. When a consumer opts to finance a purchase through a retailer, this form guides them through their financial commitment.

The retail installment agreement: An overview

Understanding the key elements of retail installment agreements starts with familiarizing oneself with terms like principal, interest rates, and payment schedules. The principal refers to the total amount financed, while the interest rate is the cost of borrowing expressed as a percentage. Payment schedules can vary significantly based on the agreement, which may include monthly or bi-weekly payments.

Additionally, it's essential to note that language and structure may differ depending on jurisdiction. Some states may have specific regulations governing how these agreements must be articulated, which can affect everything from payment terms to borrower rights.

How to effectively fill out a retail installment form

Filling out a retail installment form requires attention to detail. Start with a pre-application checklist to ensure you have all required documents at hand, such as identification and proof of income. This preparatory step sets the tone for a smoother application process.

The form walkthrough typically includes providing your personal information, detailing the loan specifics, and understanding payment terms and conditions. Pay close attention to each section to ensure accuracy and completeness, as errors can lead to delays or possible denials.

Common mistakes to avoid

Two common pitfalls when filling out a retail installment form are incomplete information and misunderstandings of terms and conditions. Leaving out required data can delay the process, while failing to understand the implications of certain clauses may lead to unforeseen consequences.

To mitigate such issues, it’s vital to double-check the information for accuracy and clarify any legal jargon you encounter. Resources like pdfFiller can assist in navigating these complexities through their robust support and easy-to-use tools.

Editing and customizing your retail installment form

Once you're ready to edit the retail installment form, utilizing pdfFiller’s online tools enables real-time changes, allowing users to modify the document to suit their needs effectively. This provide flexibility and adaptability in creating a tailored agreement.

When customizing, don't forget to add your signatures and initials appropriately, as these mark the agreement as legally binding. The process for eSigning through pdfFiller is straightforward, making it easy to finalize your form.

Managing your retail installment agreement

Effectively managing your retail installment agreement entails keeping track of payment schedules and due dates. Various tools are available that can help monitor these payments, such as calendar reminders or financial apps that sync with payment dates.

In the event of a missed payment, it’s critical to act promptly. Contacting your lender to discuss potential negotiations or adjustments may help preserve your agreement's terms and prevent any further complications.

Frequently asked questions (FAQs)

Many borrowers often wonder about the implications of a retail installment agreement. Common questions include: What happens if I want to cancel a retail installment agreement? Can I refinance my current retail installment loan? What rights do I have as a borrower?

Addressing these questions requires a clear understanding of both personal rights and the terms laid out in your specific agreement. Engaging with knowledgeable sources or accessing legal resources can provide further clarity.

Legal aspects of retail installment forms

Understanding your rights under consumer credit laws is vital when dealing with a retail installment form. Borrowers enjoy certain protections that can safeguard them against unfair lending practices or ambiguous terms.

Defaulting on payments can have serious legal consequences, including repossession of goods or damage to credit scores. Knowing the potential repercussions informs better decision-making and encourages proactive management of your agreements.

Related forms and resources

In addition to retail installment forms, several related financial forms may be relevant, such as personal loan applications and credit card agreements. Familiarizing yourself with these documents expands your financial literacy and aids in successfully navigating consumer credit.

For those looking for additional templates and documents, pdfFiller offers a vast library that can be browsed to find and download related forms that suit various financial situations.

Contact and support options

Having access to reliable support options is essential when managing your retail installment form. pdfFiller provides various channels, including chat, email, and phone support, ensuring that you can get assistance as you navigate your documentation needs.

Moreover, understanding the policies and terms of use on the platform allows users to manage their documents more effectively, ensuring compliance with guidelines and protecting your financial interests.

Explore related questions

User-generated inquiries often shed light on common concerns surrounding retail installment agreements. Questions may arise about the refinancing process, default implications, or even specifics about cancellation terms.

Feel free to suggest further questions for exploration, as engaging with a community of knowledgeable individuals can provide insights that empower your financial decision-making.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my retail installment directly from Gmail?

How do I make changes in retail installment?

Can I create an electronic signature for the retail installment in Chrome?

What is retail installment?

Who is required to file retail installment?

How to fill out retail installment?

What is the purpose of retail installment?

What information must be reported on retail installment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.