Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990: A Comprehensive Guide

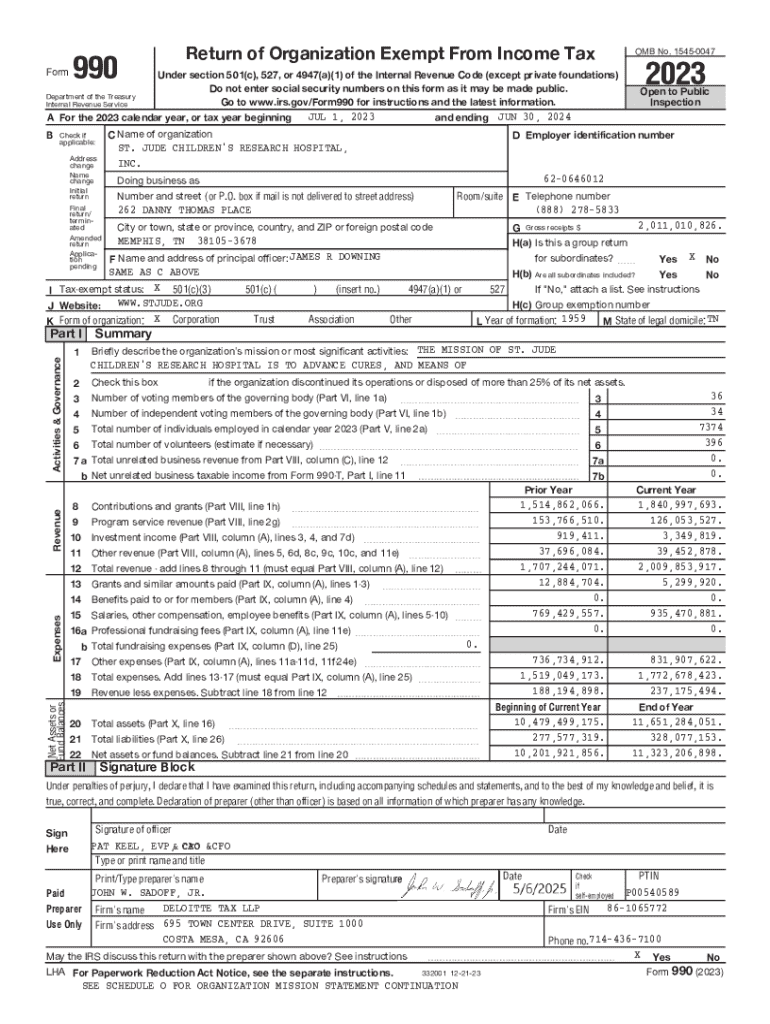

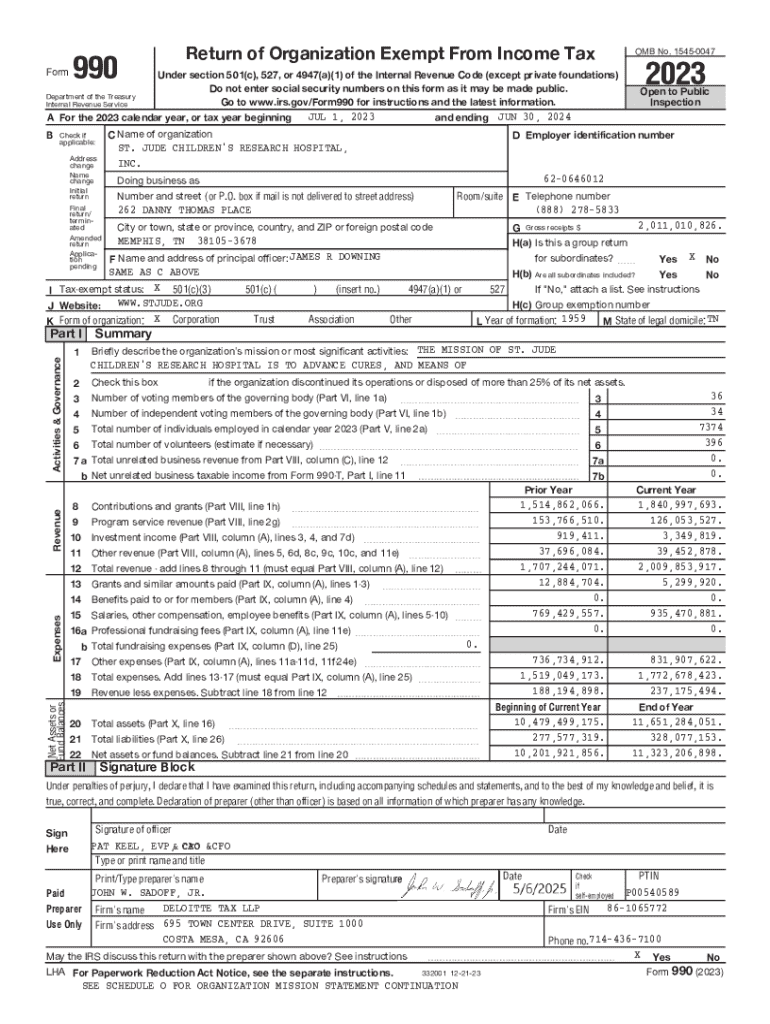

Understanding Form 990

Form 990 is a vital document that provides the Internal Revenue Service (IRS) and the public with information about nonprofit organizations. This comprehensive report covers financial activities, operational details, and governance information, helping to ensure transparency and accountability within the nonprofit sector. By documenting how organizations use the contributions they receive, Form 990 serves not only a regulatory purpose but also provides insights into the nonprofit’s impact.

Nonprofit organizations, particularly those classified under Section 501(c)(3), must file Form 990 annually to maintain their tax-exempt status. This requirement ensures that nonprofits operate in the public interest and adhere to the laws governing charitable organizations. Typically, organizations need to submit their Form 990 by the 15th day of the 5th month after the end of their accounting year.

Types of Form 990

There are different variants of Form 990 tailored to the size and revenue of nonprofit organizations. The main types include:

Choosing the right form depends on your organization’s size and revenue. It is crucial to assess your financial data against the IRS guidelines to determine which version applies to your nonprofit.

Getting started with Form 990

Getting started with completing Form 990 involves a few key steps. First, you’ll need to locate the form relevant to your organization’s size on the IRS website or through platforms like pdfFiller, which provides an intuitive interface for editing and filing. Each variant of Form 990 comprises various sections that require detailed financial and operational information.

Understanding the format and sections of Form 990 is critical. Familiarizing yourself with the required fields will streamline the completion process. pdfFiller also offers tools that make filling out, editing, and signing Form 990 straightforward. They have built-in templates that guide users through the completion steps, ensuring nothing essential is overlooked.

Detailed breakdown of Form 990 sections

Form 990 is divided into various parts, each serving a distinct purpose in providing a comprehensive overview of a nonprofit organization’s operations. Here's a brief look at key sections:

Filing requirements and deadlines

The IRS mandates that nonprofit organizations file Form 990 annually. The deadlines vary based on the organization’s fiscal year end date. Nonprofits typically must file by the 15th day of the 5th month following the close of their fiscal year. It’s crucial to also consider state-specific filing requirements, as some states may require separate submissions or additional information.

Setting reminders for key deadlines can prevent overlooking important submission dates. Nonprofits may request an extension if more time is needed, but they should file Form 8868 to avoid penalties.

Potential penalties for non-compliance

Failing to file Form 990 or submitting inaccurate information can lead to significant penalties. The IRS imposes a penalty of $20 per day for late filings, capping at a maximum of $10,000. For organizations with gross receipts exceeding $1 million, the penalty increases to $100 per day. Inaccurate reporting can also jeopardize the nonprofit’s tax-exempt status.

To avoid penalties, nonprofits should establish a rigorous review process for Form 990, ensuring all details are accurate and complete. Regular training for staff responsible for tax reporting can also mitigate risk.

Public inspection and transparency

Form 990 is not just an obligatory report; it plays a crucial role in promoting transparency. Nonprofits are required to make their Form 990 available for public inspection, fostering trust with stakeholders and potential donors. This transparency can lead to enhanced credibility and community support.

Furthermore, making Form 990 accessible allows stakeholders, including funders and regulatory bodies, to evaluate an organization’s financial health and program effectiveness. Nonprofits can leverage this transparency to demonstrate accountability and gain support for their missions.

Using Form 990 for evaluation and research

Stakeholders utilize Form 990 extensively for evaluating the viability and impact of nonprofit organizations. Grantmakers often require this documentation as a part of their funding decision processes. Analyzing Form 990 allows funders to assess operational efficiency, fundraising effectiveness, and programming success.

Moreover, researchers and policymakers can benefit from the data within Form 990 to understand broader trends in the nonprofit sector. By analyzing aggregated data, they can inform practices, policy decisions, and further research initiatives aimed at improving nonprofit operations.

Interactive tools and features on pdfFiller

Utilizing pdfFiller for Form 990 offers numerous advantages, scaling from document creation to collaborative tools. Users can easily edit the form online, insert digital signatures, and share it with team members for collective input. This platform simplifies the often complex process of filling out Form 990.

Step-by-step guides on pdfFiller even provide assistance in navigating each section of the form, ensuring users do not miss critical details. Collaboration features enhance teamwork, allowing multiple stakeholders to review and contribute to completing Form 990, significantly reducing submission errors.

Additional considerations and best practices

While filling out Form 990, it's essential to remain vigilant about common mistakes that can lead to non-compliance. Frequent errors include miscalculating figures, missing sections, and neglecting to include required disclosure information. Nonprofits should consider implementing a checks-and-balances system where several team members review the completed form.

Best practices also recommend maintaining organized financial records throughout the year, facilitating the seamless preparation of Form 990. By consistently updating records and documenting processes, organizations can enhance their readiness for annual reporting and improve compliance.

Resources for further learning

Leverage resources available on pdfFiller to enhance your understanding of Form 990. Users can access templates, edits, and guidelines specifically tailored for nonprofit organizations, streamlining the preparation process. Additionally, the IRS provides comprehensive guides and FAQs to assist organizations in navigating type-specific requirements.

Several online webinars and tutorials focused on using Form 990 effectively aim to equip nonprofits with the knowledge needed to comply with federal regulations and improve their reporting practices.

Historical context and recent changes

Form 990 has evolved significantly since its inception, reflecting changes in the regulatory environment surrounding nonprofit organizations. Originally designed to increase transparency, the form has undergone numerous updates to enhance reporting requirements and simplify the process for various sized organizations.

Recent changes, such as the introduction of streamlined forms for smaller nonprofits, aim to reduce the reporting burden while still providing necessary disclosures. Understanding these changes is essential for organizations to maintain compliance and adapt to the evolving landscape of nonprofit requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form 990?

How do I fill out the form 990 form on my smartphone?

How do I edit form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.