Get the free Unipol Assicurazioni Consolidated Financial Statements ... - hr un

Get, Create, Make and Sign unipol assicurazioni consolidated financial

How to edit unipol assicurazioni consolidated financial online

Uncompromising security for your PDF editing and eSignature needs

How to fill out unipol assicurazioni consolidated financial

How to fill out unipol assicurazioni consolidated financial

Who needs unipol assicurazioni consolidated financial?

Unipol Assicurazioni Consolidated Financial Form: A Comprehensive Guide

Understanding Unipol Assicurazioni: An overview

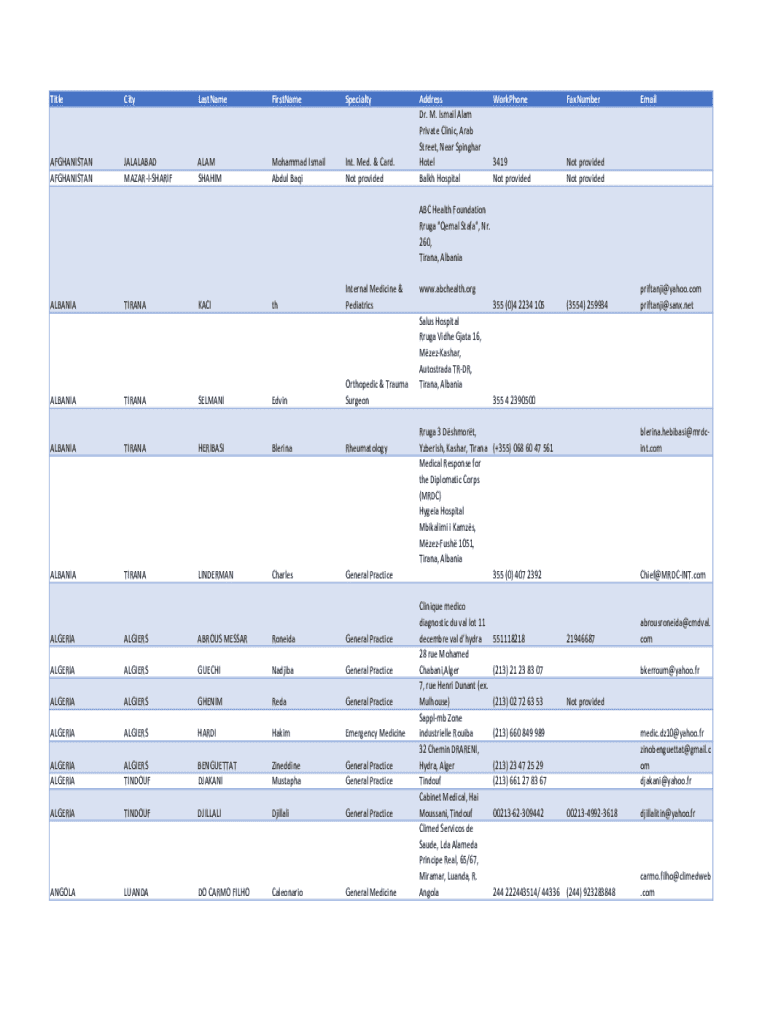

Unipol Assicurazioni has established itself as a significant player in the Italian insurance market since its founding in 1962. The company has undergone numerous transformations and strategic mergers, including the merger with Fonsai in 2012, which expanded its portfolio and market share. Today, it offers a wide array of insurance solutions, encompassing life, health, motor, and property insurance, catering to both individuals and businesses.

The Unipol Assicurazioni consolidated financial form is vital not just for internal analysis but also for maintaining compliance with regulatory frameworks. By consolidating financial data, it provides a clear picture of the company's overall health and operational efficiency, essential for stakeholders including investors, regulators, and customers.

Key components of the consolidated financial form

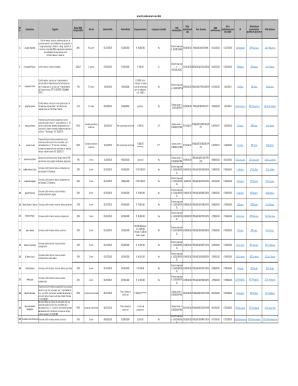

The consolidated financial form consists of several essential components that provide valuable insights into the financial standing of Unipol Assicurazioni. Generally, it includes sections like the balance sheet, income statement, cash flow statement, and shareholders' equity updates.

In addition, the form captures various financial performance metrics like revenue, profit margins, and return on equity, which help assess the organization's profitability, and sustainability. Furthermore, details pertaining to risk assessments, such as underwriting risks associated with different insurance products, are integral aspects of the form.

Navigating the consolidated financial form

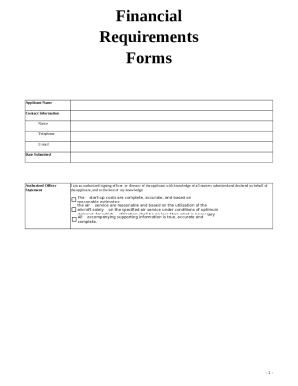

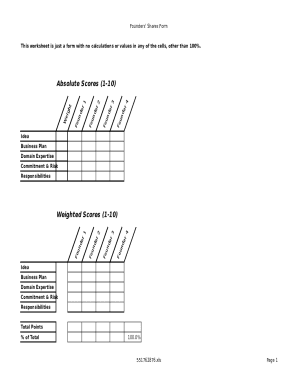

Filling out the Unipol Assicurazioni consolidated financial form is a structured process that requires careful attention to detail. A step-by-step guide can streamline the process, making it manageable and efficient.

Using pdfFiller for the consolidated financial form

pdfFiller offers a user-friendly platform to manage the Unipol Assicurazioni consolidated financial form, enhancing both the completion and collaboration processes.

To edit and customize the form, first upload it to pdfFiller. The platform's tools allow users to add, modify, or remove content, ensuring clarity and accuracy. Moreover, features like text formatting and annotation tools help to emphasize essential data or explanations.

Managing your documents effectively

Effective document management is crucial when handling financial forms. Organizing documents in a systematic manner enables easier retrieval and minimizes the risk of errors or omissions.

By maintaining organized records and tracking changes, companies can improve financial accuracy and compliance, ultimately leading to a smoother audit process.

Frequently asked questions (FAQs)

Understanding the common queries regarding the Unipol Assicurazioni consolidated financial form can provide clarity. For instance, many individuals wonder what steps to take if they discover missing information during submission.

Technical issues may arise while using pdfFiller. Utilizing the platform’s support resources can help troubleshoot common problems effectively.

Future considerations for Unipol Assicurazioni

As financial reporting continuously evolves, Unipol Assicurazioni must stay ahead of emerging trends. Digital transformation has already changed how financial forms are created and submitted, offering real-time insights and analytics.

Monitoring changes in legislation and industry standards will help Unipol Assicurazioni adapt and thrive amid regulatory shifts.

Best practices for financial accuracy and compliance

Adhering to financial reporting standards is crucial for companies within the insurance sector. Key regulations, such as IFRS or local national standards, must be followed to ensure legally compliant and transparent financial reporting.

Implementing such best practices can significantly enhance the accuracy of financial statements and foster trust among stakeholders.

User testimonials and case studies

Listening to real users can provide valuable insights into the practical implications of the Unipol Assicurazioni consolidated financial form. Many report enhanced efficiency in their processes after transitioning to pdfFiller for document handling.

These testimonials highlight the importance of using tailored solutions like pdfFiller to simplify complex document management tasks efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in unipol assicurazioni consolidated financial?

How can I fill out unipol assicurazioni consolidated financial on an iOS device?

Can I edit unipol assicurazioni consolidated financial on an Android device?

What is unipol assicurazioni consolidated financial?

Who is required to file unipol assicurazioni consolidated financial?

How to fill out unipol assicurazioni consolidated financial?

What is the purpose of unipol assicurazioni consolidated financial?

What information must be reported on unipol assicurazioni consolidated financial?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.