Get the free Application for Annuity Policy

Get, Create, Make and Sign application for annuity policy

How to edit application for annuity policy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for annuity policy

How to fill out application for annuity policy

Who needs application for annuity policy?

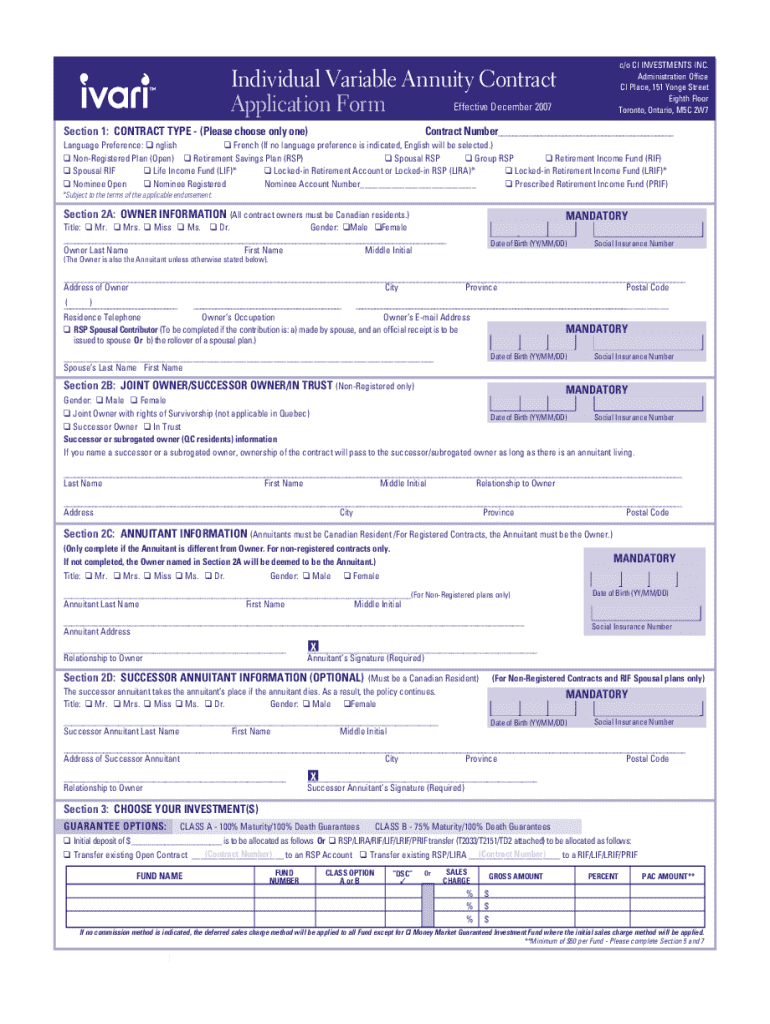

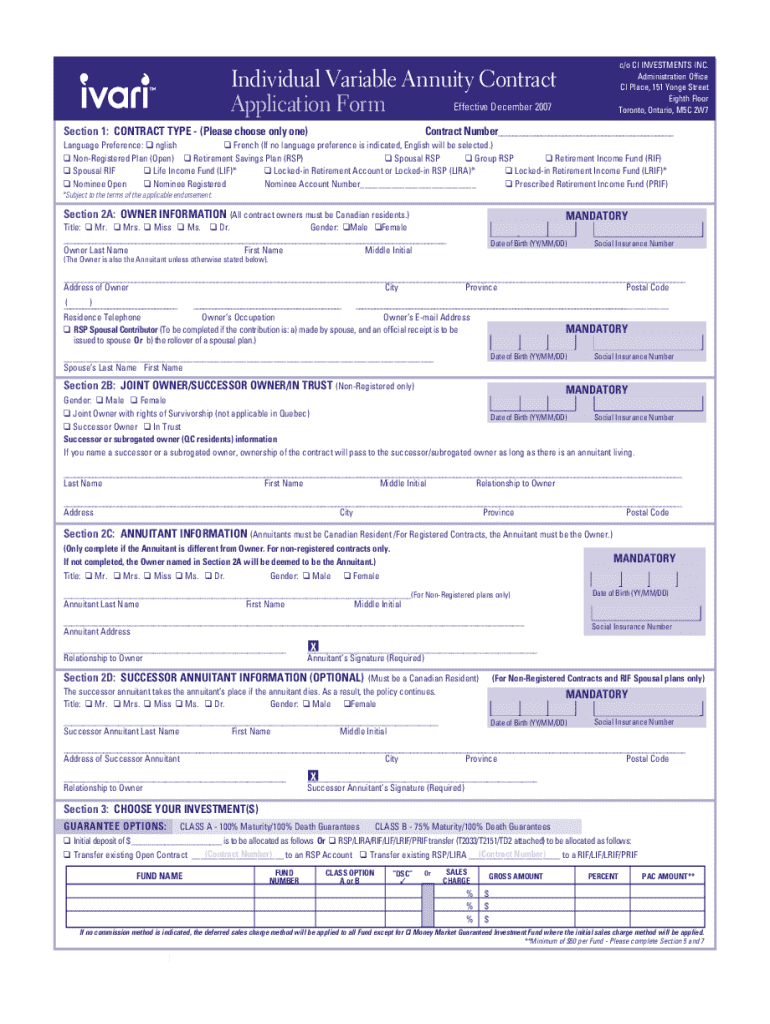

Application for Annuity Policy Form: A Comprehensive Guide

Understanding annuity policies

Annuity policies serve as a financial product designed to provide individuals with a steady income stream, especially during retirement. At their core, annuities are contracts between an individual and an insurance company. The individual pays a lump sum or a series of payments to the insurer in exchange for financial security in the future. They come in several types: fixed, variable, and indexed annuities.

Fixed annuities offer guaranteed returns, making them a low-risk investment, ideal for conservative investors. Variable annuities, on the other hand, allow policyholders to invest in various funds, which can yield higher returns but also come with increased risk. Indexed annuities are linked to a stock market index, providing moderate growth potential while protecting the principal.

The importance of annuity policies in financial planning cannot be overstated. They play a crucial role in retirement strategy by ensuring individuals have a consistent income once they stop working. This is particularly important given that Social Security may not cover all essential expenses during retirement, making annuities an attractive solution for those looking for financial stability.

Overview of the annuity policy application process

The application for annuity policy form is a critical step in securing your financial future. A well-completed application ensures that your chosen annuity product can be issued smoothly and is appropriate for your needs. Accuracy in this process is paramount; even minor errors can delay approval or lead to issues with your future benefits.

Key components of the application form include personal information, such as your name, address, and social security number, which are necessary for identity verification. Additionally, your financial background, including sources of income and current assets, helps the insurer assess your suitability for the requested annuity. Lastly, you must detail the specific annuity product you wish to purchase, including the type (fixed, variable, or indexed), the amount, and the duration of the annuity.

Step-by-step guide to filling out the annuity policy application form

Filling out the annuity policy application form may seem daunting, but following a structured approach can facilitate the process. To begin, gather the required documentation. You will need proof of identity, such as a driver’s license or passport, and income verification, which might include recent tax returns or pay stubs. These documents will help corroborate the information in your application.

The second step is completing the application form itself. This involves accurately providing your personal information as instructed. Pay close attention to sections where you disclose your financial background; providing comprehensive and truthful details can aid in a faster processing time. Selecting the appropriate type of annuity policy is also crucial, as each type serves different investment needs and risk tolerances.

Finally, before submitting your application, review all information for accuracy. Double-checking helps avoid common errors such as inaccurate data entry or sections left blank. Ensuring that all information is consistent with your documentation will make the review process smoother and increase the likelihood of swift approval.

Utilizing interactive tools on pdfFiller

Accessing the annuity policy application form has never been easier with pdfFiller. To get started, navigate to pdfFiller’s website, where you can either search for the form directly or browse through categories related to financial documents. Once you locate the annuity policy application form, you can open it to begin your edits.

Editing your form with pdfFiller’s features is straightforward. The platform allows you to add text, insert your signature, and even include additional notes as needed. You can save your form securely in the cloud, ensuring that your information remains accessible from anywhere at any time. This cloud-based solution is particularly beneficial for individuals balancing busy schedules.

Furthermore, the eSigning feature streamlines the application process. Electronic signatures are legally recognized, providing an efficient way to sign your documents without the hassle of printing anything. To add a signature electronically, simply follow the prompts on pdfFiller to create your signature and insert it directly into the application.

Collaborating on the application form

Working with financial advisors or family members during the application process can enhance the accuracy and completeness of your application. pdfFiller facilitates collaboration by allowing users to share the application form with others for feedback or assistance. This collaborative approach can prove invaluable, particularly for individuals unfamiliar with financial products.

Additionally, pdfFiller’s collaboration features enable users to track changes and comments made to the application. This means that you can easily see who has added feedback and make adjustments accordingly, ensuring that your application form is as thorough and accurate as possible.

Submitting your annuity policy application

Once you have completed the application for annuity policy form, understanding submission methods is essential. You can submit your application online, which is often faster and more efficient, or via physical mail, though the latter may lead to delays. If you choose to submit online through pdfFiller, ensure that you follow up on the submission process to confirm it was received successfully.

After submission, your application will undergo a review process where the insurance provider evaluates the details you've submitted. This process may take several days or weeks, depending on the complexity of your application. Therefore, it’s advisable to maintain communication with your provider, which can facilitate any queries they may have and help avoid unnecessary delays.

Frequently asked questions (FAQs)

As you proceed with your annuity application, you may have some common queries regarding the process. For instance, you might wonder how long it typically takes to fill out the application. On average, completing the application form may take anywhere from 30 minutes to an hour, depending on the complexity of your financial situation.

Another common concern is the potential for errors on your application. If you make a mistake after submission, contact your insurance provider immediately to discuss possible steps forward. Lastly, know that you can modify your application in certain circumstances, particularly if you catch an error before your application is processed.

Tips for a successful annuity application

To maximize your chances of a successful annuity application, adhere to best practices throughout the process. One critical aspect is the importance of honesty and transparency in providing your financial details. False information can lead to denial of your application or future claims. Keeping copies of all submitted documentation for your records is equally vital, as it serves as proof of what you provided.

Before sending your application, conduct final checks on critical details such as dates, signatures, and numerical values. These last-minute checks can prevent processing delays and further ensure that your application adheres to the insurer’s requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the application for annuity policy electronically in Chrome?

How do I edit application for annuity policy on an iOS device?

How do I fill out application for annuity policy on an Android device?

What is application for annuity policy?

Who is required to file application for annuity policy?

How to fill out application for annuity policy?

What is the purpose of application for annuity policy?

What information must be reported on application for annuity policy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.