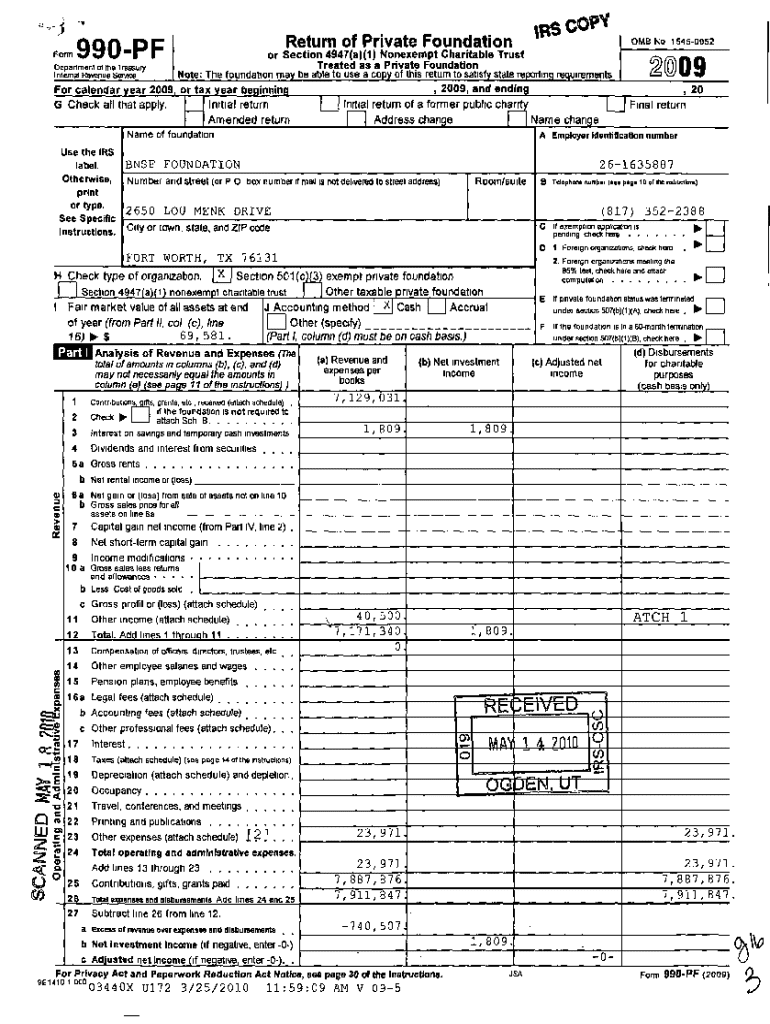

Get the free Form 990-pf

Get, Create, Make and Sign form 990-pf

Editing form 990-pf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-pf

How to fill out form 990-pf

Who needs form 990-pf?

Form 990-PF: A Comprehensive Guide

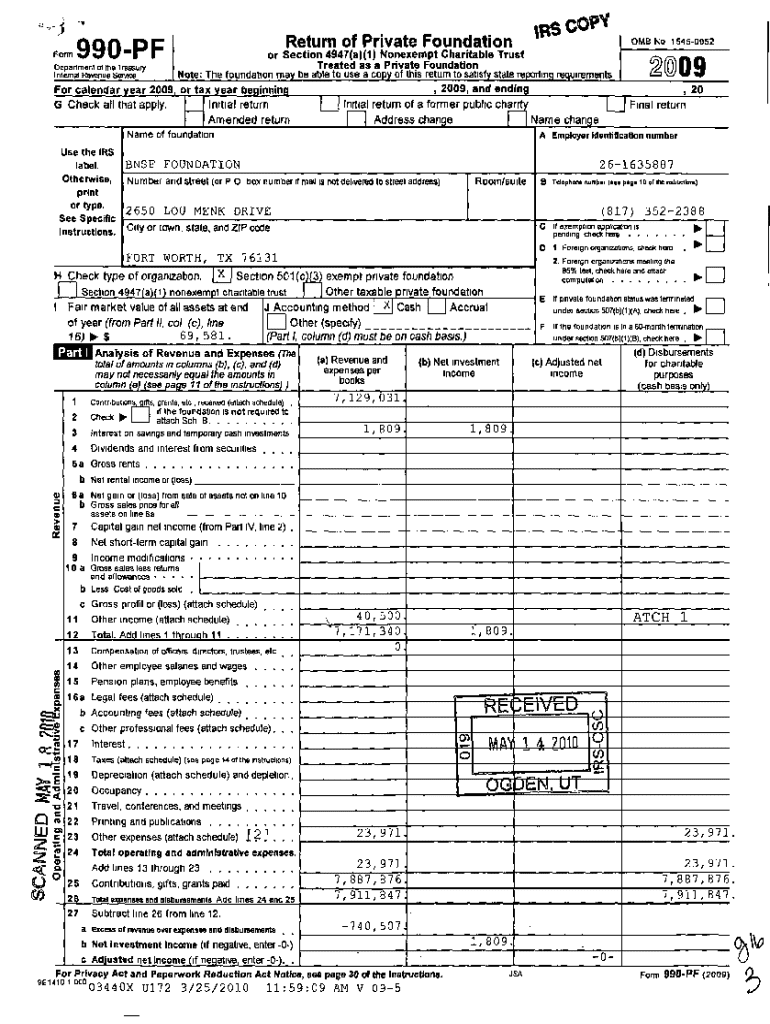

Understanding Form 990-PF

Form 990-PF is the annual tax return for private foundations recognized under section 509(a) of the Internal Revenue Code. Designed specifically for private foundations, this form serves to provide essential financial information to the Internal Revenue Service (IRS) and the general public about the foundation's operations, funding, and charitable activities.

The importance of Form 990-PF cannot be overstated. It ensures transparency in the financial activities of private foundations, informing stakeholders about how their funds are allocated and the impact of their charitable contributions. By presenting a clear picture of a foundation's fiscal health and mission, Form 990-PF fosters trust and accountability.

Who needs to file Form 990-PF?

Private foundations, by definition, are entities set up for charitable purposes, primarily funded by a single source, whether an individual, family, or corporation. If your organization operates as a private foundation, it is mandated to file Form 990-PF annually. However, various criteria can determine whether your foundation qualifies as a private foundation and, therefore, is subject to this filing requirement.

There are exceptions to this rule. For instance, private foundations that are classified as supporting organizations may not need to file, but understanding the specific IRS criteria is critical for compliance. Filing is essential not only for adhering to IRS guidelines but also for maintaining your foundation’s tax-exempt status.

Key dates and deadlines

The timely filing of Form 990-PF is crucial. Typically, the form is due on the 15th day of the 5th month after the close of the foundation’s fiscal year. For example, if your fiscal year ends on December 31, your Form 990-PF would be due by May 15 of the following year. However, it is essential to stay informed about any potential delays or extensions.

Understanding the crucial deadlines associated with Form 990-PF can help minimize the risk of penalties. This includes knowing when to file for extension if needed, which allows an additional six months for filing, pushing the due date to November 15 in the example above.

Breakdown of Form 990-PF

Understanding the structure of Form 990-PF is essential for accurate completion. The form itself consists of several key sections detailing various aspects of the foundation’s operation, including tax identification, financial data, and disbursement of funds.

Each section requires specific information:

Additional filing requirements

In addition to Form 990-PF, private foundations must often include supplementary schedules and supporting documentation. The extent of these requirements can vary based on the foundation’s activities and financial activities throughout the year.

States may have additional filing regulations as well. For example, some states require that foundations also file a copy of their Form 990-PF along with their state income tax returns, while others may enforce different compliance practices. Proper record-keeping is crucial; foundations should not only maintain all records related to their finances but also be prepared to provide documentation upon request from regulatory bodies.

What are the penalties for late filing?

Failing to file Form 990-PF on time can lead to stiff penalties imposed by the IRS. Each month that the return is late can incur a penalty calculated as a percentage of the foundation’s assets or a flat amount per month, whichever is higher. These penalties can quickly add up, affecting the foundation's financial resources.

Moreover, failure to file for three consecutive years results in automatic revocation of the foundation's tax-exempt status, emphasizing the need for consistent compliance. Therefore, proactive planning and adherence to filing timelines are vital strategies for foundations seeking to avoid these repercussions.

Extensions for Form 990-PF

If more time is needed to prepare Form 990-PF, foundations can request an extension. The IRS allows for an automatic six-month extension by filing Form 8868 before the original due date of Form 990-PF. This extension can provide invaluable time for thorough preparation, especially for foundations with complex financials.

It is critical to note that an extension only applies to the filing deadline, not to tax payment dates. Any taxes owed must still be paid by the original due date to avoid interest and potential penalties. Thus, planning is essential when seeking an extension.

Step-by-step guide to filing Form 990-PF

To file Form 990-PF accurately, follow this step-by-step guide that ensures every aspect of your foundational data is addressed. Start by gathering all necessary documentation, including financial statements, accounting records, and any supporting materials related to grants and contributions.

Next, carefully fill out each section of the form. Go section by section to ensure that no crucial information is overlooked. As you complete the form, consider the following:

Tips for a smooth filing experience

Embarking on the process of filing Form 990-PF doesn't have to be intimidating. Here are practical tips to enhance your filing experience. Establish a checklist early on to organize required documents and data to avoid the last-minute scramble. Ensuring thorough documentation is paramount because lacking crucial information can delay filing.

Additionally, utilize online tools such as pdfFiller for a streamlined experience. These tools offer interactive capabilities, enabling users to fill out documents efficiently and correctly, minimizing the risks associated with traditional paper filing methods. Regularly consulting with tax professionals knowledgeable about Form 990-PF can provide valuable insights and help avoid common pitfalls.

Insights from the 2024 updates and changes

Tax laws fluctuate, and it is imperative for private foundations to stay updated on changes that affect Form 990-PF filings. Recent amendments in tax laws may include revised guidelines on disclosures, operational expenses, and more. The IRS frequently publishes updates that influence structural changes within Form 990-PF, which necessitates slipping into the latest revisions for compliance.

Foundations are encouraged to participate in webinars and training sessions to familiarize themselves with these new requirements. Implementing feedback from these sessions can significantly enhance the accuracy and compliance of filings moving into the 2024 season.

Case studies: Successful Form 990-PF filers

Exploring real-world case studies of private foundations that have successfully navigated the Form 990-PF process offers valuable lessons. For instance, the 'Sample Family Foundation' utilized a clear timetable and assigned responsibilities to board members, ensuring accountability and follow-through.

By documenting their processes and lessons learned, many foundations have streamlined their filing significantly. Foundations that embrace transparency with stakeholders about their accounting practices are also more likely to sustain donor trust and encourage future contributions.

Interactive tools and resources

pdfFiller provides a range of interactive tools and templates to facilitate the preparation and filing of Form 990-PF. Users can access editable formats that allow for easy data input, eliminating the hassles associated with traditional paper forms. The platform also offers e-signature capabilities, ensuring that documents are signed and sent seamlessly during the filing process.

Additionally, users can benefit from a library of resources tailored specifically for private foundations. These resources include templates, guidelines, and tutorial videos aimed at easing the form completion process and ensuring compliance.

Support and guidance

Navigating the complexities of Form 990-PF is inherently challenging, but support is readily available. pdfFiller offers extensive resources, including FAQs and help sections that can assist users in understanding the nuances of filing accurately. Direct contact support is also available for those who need personalized assistance. Engaging in community forums can present additional networking opportunities for private foundations seeking advice and best practices from peers.

For any inquiries, reaching out to support representatives who specialize in nonprofit tax compliance can provide clarity and guidance tailored to your foundation's needs, enhancing overall filing competency.

Staying compliant beyond filing

Compliance doesn't end with the successful submission of Form 990-PF. Private foundations must adopt best practices and proactive strategies for ongoing tax compliance. This may include regular audits of financial processes, annual assessments of governance practices, and continual engagement with stakeholders to maintain transparency.

Establishing a culture of accountability within the foundation is critical. By regularly updating stakeholders on financial health and operational priorities, foundations lay the groundwork for sustained philanthropic engagement and ensure compliance with IRS regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 990-pf online?

How do I make edits in form 990-pf without leaving Chrome?

How do I edit form 990-pf straight from my smartphone?

What is form 990-pf?

Who is required to file form 990-pf?

How to fill out form 990-pf?

What is the purpose of form 990-pf?

What information must be reported on form 990-pf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.