Get the free 2024 Tax Preparation Checklist

Get, Create, Make and Sign 2024 tax preparation checklist

How to edit 2024 tax preparation checklist online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 tax preparation checklist

How to fill out 2024 tax preparation checklist

Who needs 2024 tax preparation checklist?

2024 Tax Preparation Checklist Form: Your Essential Guide

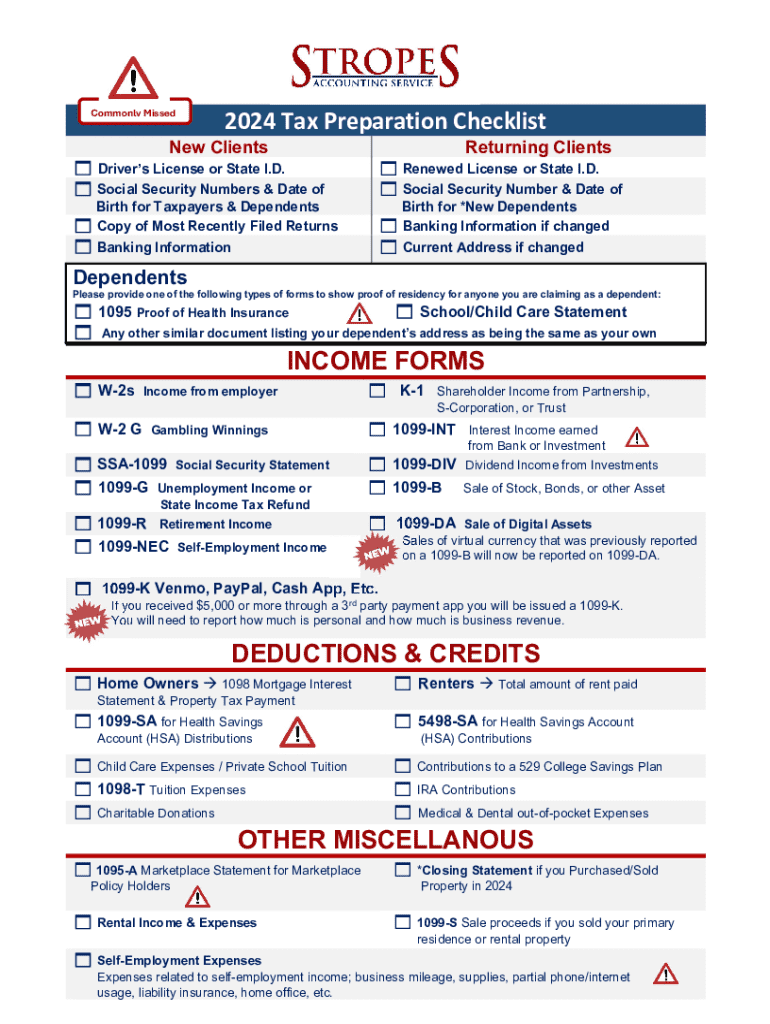

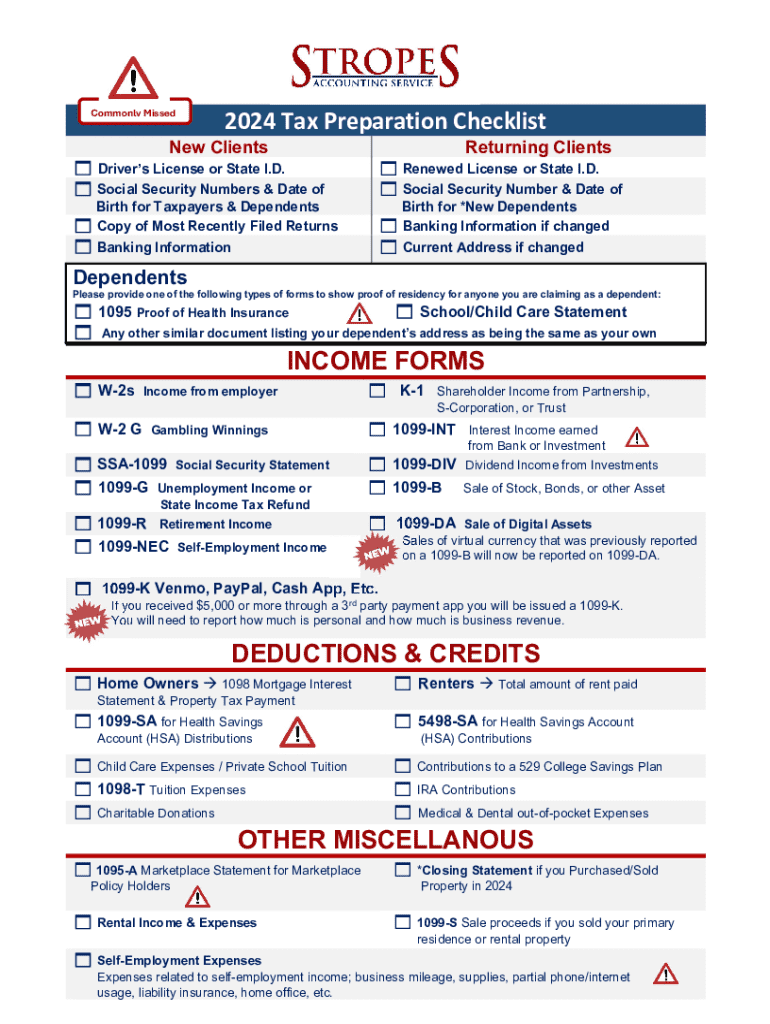

Overview of the 2024 tax preparation checklist

As tax season approaches, having a comprehensive 2024 tax preparation checklist form becomes essential for ensuring a smooth filing process. This checklist not only simplifies the task but also minimizes stress by helping you stay organized. Whether this is your first filing or you're a seasoned taxpayer, utilizing a checklist can guide you through the necessary steps, ensuring you don't overlook critical elements. pdfFiller plays a pivotal role in this, offering a cloud-based solution that allows users to create, edit, and manage their tax documents effortlessly.

Key changes and updates for 2024 tax year

The 2024 tax year brings several important changes that taxpayers should be aware of. New tax laws have been introduced, impacting various aspects of deductions and credits. For instance, improvements in tax brackets could affect how much you owe or how much of a refund you might receive. It's crucial to stay updated with these changes to effectively plan your taxes and maximize potential benefits.

Essential documents to gather

Preparing for taxes involves gathering a variety of documents to ensure accurate reporting. The first step is to collect personal information such as Social Security numbers and, for small businesses, the Tax ID or EIN. Next, you'll need income records like W-2 forms from employers and 1099 forms for any freelance or side jobs. Don’t forget statements detailing interest and dividends, which also contribute to your overall taxable income.

In addition to income records, it's vital to gather documentation related to deductions and credits. Items like mortgage interest statements, medical expenses, and receipts for charitable contributions are essential for maximizing your deductions. Lastly, reference your previous year’s tax return as it can aid in adjusting any carryovers and ensuring consistency in reporting.

Filling out the 2024 tax preparation checklist form

Now that you have gathered all necessary documents, it's time to fill out the 2024 tax preparation checklist form. Start by capturing personal information accurately. Ensure every detail is correct, as discrepancies can delay your filing and possible refunds. Next, report your income meticulously. This section requires careful attention as it lays the foundation for your overall tax liabilities.

Following the income section, detail out your deductions. You’ll need to decide whether to itemize your deductions or take the standard deduction. Each option has its benefits, and understanding which is more advantageous for your situation is crucial. The final step involves calculating your tax liability and estimating potential refunds or amounts owed. This will help you prepare for any cash flow requirements.

Tips for accurate and efficient completion

To enhance the accuracy of your tax preparation, utilizing pdfFiller's editing features can be invaluable. The platform allows users to fill out forms effortlessly, edit text, and eSign documents, making the entire process quicker and more efficient. With pdfFiller's collaborative tools, team members can work together seamlessly on shared documents, ensuring that every detail is correct before submission.

Moreover, it’s essential to double-check entries for accuracy. Small mistakes in numbers or misreported income can lead to headaches later on. Investing time in reviewing your entries will save you from potential audits and ensure compliance with tax regulations.

Common mistakes to avoid during tax preparation

When preparing your taxes, certain common mistakes can complicate the process and lead to issues down the line. One of the most prevalent mistakes is overlooking essential documents. This can include forgetting to include all income sources or failing to provide relevant deductions that could lower your tax bill.

Another mistake is incorrectly reporting income types, which can result in discrepancies with the IRS. Additionally, miscalculating deductions can be detrimental; many taxpayers miss out on savings simply because they don’t take the time to analyze their financial records and account for all eligible deductions.

Interactive tools provided by pdfFiller

pdfFiller offers an array of interactive tools designed to streamline the tax preparation process. The platform's formatting and editing features enable users to manipulate PDFs easily to match their needs. This flexibility is particularly useful for tax forms that often require specific formatting.

Furthermore, pdfFiller's real-time collaboration tools allow teams to work together without geographical constraints. This means that you can gather insights and contributions from across your organization, leading to a more thorough and accurate tax preparation experience.

Help and support resources

Navigating tax preparation can be daunting, which is why pdfFiller provides robust help and support resources. Access to customer support is readily available for any queries related to forms or technical difficulties. Additionally, community forums offer an opportunity to engage with fellow users, sharing experiences and solutions to common problems.

Further, the platform features a comprehensive FAQ section that addresses frequent document-related issues, helping to alleviate concerns and make the process smoother.

Tax resources and educational materials

To aid in your tax preparation journey, pdfFiller provides access to a variety of tax resources and educational materials. This includes links to IRS guidelines, which ensure you are up-to-date with the latest regulations and updates. Additionally, the platform features suggested readings on tax strategies that can empower users to make informed financial decisions.

For those seeking a more in-depth understanding, workshops and webinars are available, providing expert insights into effectively managing taxes and maximizing returns.

Stay connected with pdfFiller

To ensure you're always informed and equipped during tax season, pdfFiller offers various subscription options for ongoing support. Signing up for newsletters provides regular updates on tax and document management topics, keeping you ahead of the curve.

Additionally, following pdfFiller on social media channels will keep you engaged with a stream of tips and insights, fostering a community of informed taxpayers.

Related forms and templates

As you prepare for tax season, having access to the correct forms and templates is crucial. pdfFiller provides easily accessible links to Form 1040 and other relevant tax forms. In addition, the platform offers custom templates designed for various tax scenarios, making it easier to address unique situations.

Resource availability extends to state-specific tax preparation forms, ensuring that individuals across different regions have access to the necessary documents tailored to their regulations. This comprehensive resource base simplifies the tax preparation process significantly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2024 tax preparation checklist online?

How do I edit 2024 tax preparation checklist straight from my smartphone?

Can I edit 2024 tax preparation checklist on an Android device?

What is tax preparation checklist?

Who is required to file tax preparation checklist?

How to fill out tax preparation checklist?

What is the purpose of tax preparation checklist?

What information must be reported on tax preparation checklist?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.