Get the free Kad Kredit-i Bank Islam

Get, Create, Make and Sign kad kredit-i bank islam

Editing kad kredit-i bank islam online

Uncompromising security for your PDF editing and eSignature needs

How to fill out kad kredit-i bank islam

How to fill out kad kredit-i bank islam

Who needs kad kredit-i bank islam?

Kad Kredit- Bank Islam Form: A Comprehensive How-To Guide

Understanding Kad Kredit- Bank Islam

Kad Kredit-i by Bank Islam is a credit card designed to meet the financial needs of users while adhering to Islamic principles. This card supports Shariah-compliant transactions, allowing cardholders to enjoy financial services without violating Islamic laws.

One of the card's distinguishing features is its profit-sharing structure instead of charging interest, which is a crucial element for applicants interested in ethical financial solutions. In addition, it offers a range of benefits including a substantial credit limit, flexibility in repayments, and features tailored for varied spending habits.

Kad Kredit-i caters to various spending scenarios, allowing users to make everyday purchases, conduct online shopping, and plan travel expenses effortlessly while enjoying exclusive perks.

Benefits of using Kad Kredit- Bank Islam

The Kad Kredit-i Bank Islam offers several advantages that align with the needs of modern consumers. A primary benefit of utilizing this credit card is financial flexibility, allowing users to manage their cash flow efficiently. With a revolving credit feature, users can pay a minimum amount and carry forward the balance, which provides considerable ease in times of financial strain.

Additionally, cardholders are treated to exclusive promotions and offers, contributing to savings across various merchants and services. These promotions often include cashback rewards, discounts on travel bookings, and special pricing on selected goods and services, significantly enhancing the overall user experience.

Overview of the application process

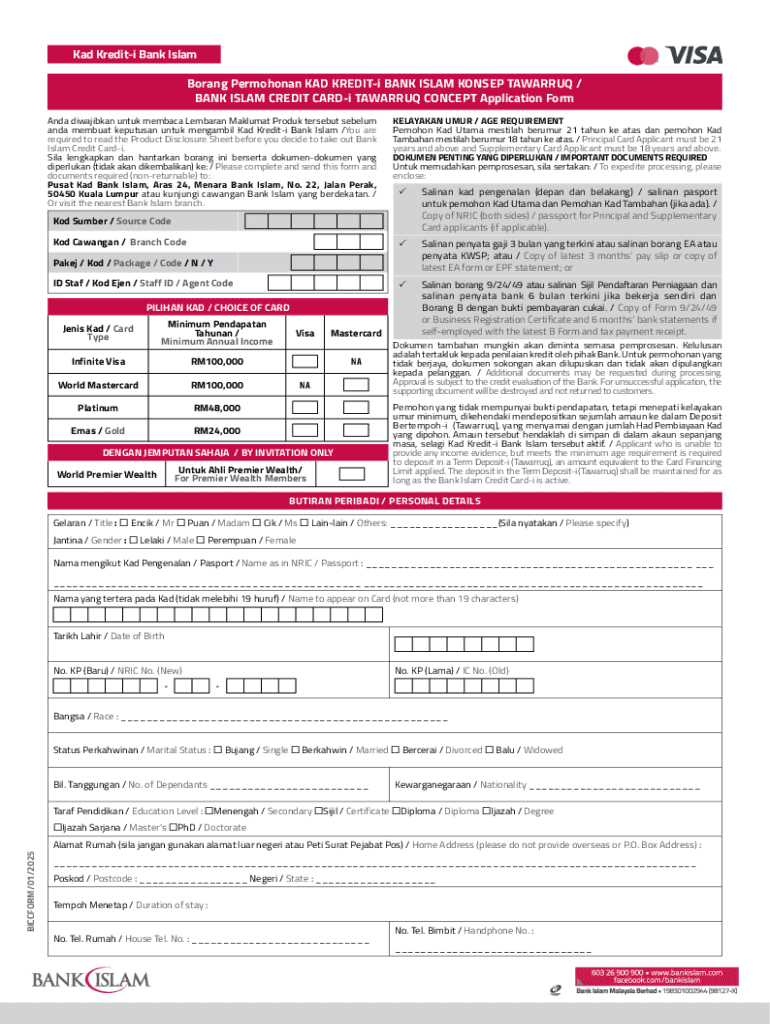

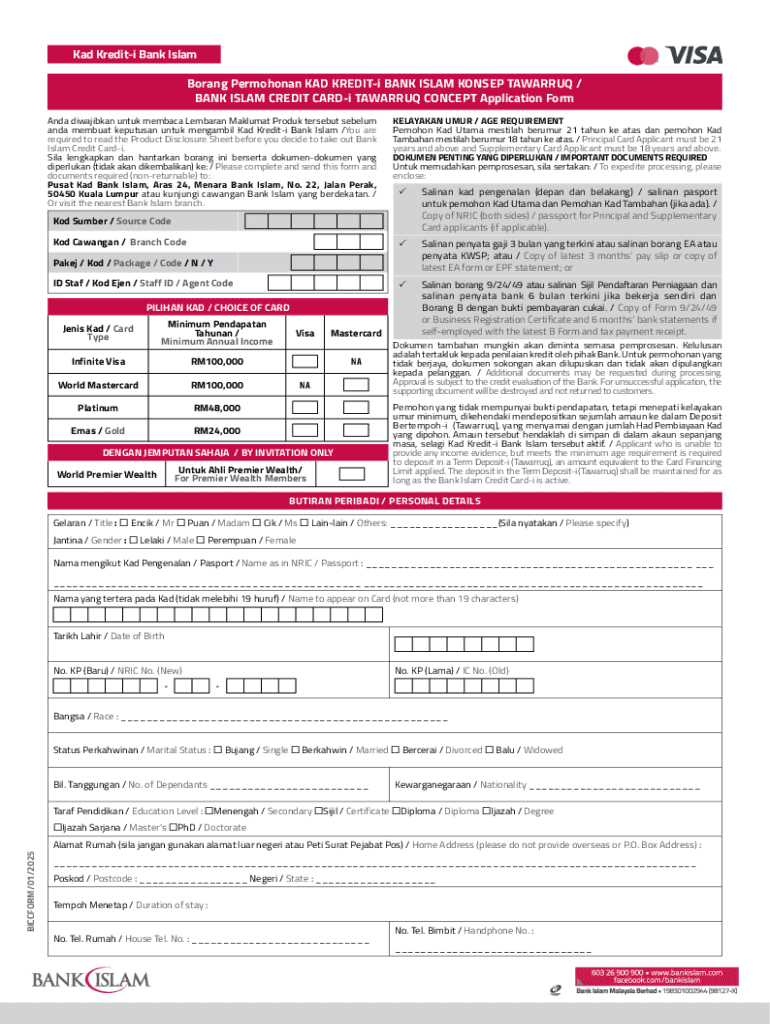

Applying for the Kad Kredit-i involves a straightforward process, beginning with understanding the eligibility criteria. Applicants must meet specific requirements, such as being at least 21 years of age and having a minimum monthly income that can range based on the card type. Additionally, necessary documentation such as identification, proof of income, and financial statements must be prepared.

Gathering these documents is crucial for a smooth application process. Potential applicants should prepare a copy of their National Identity Card (MyKad), recent pay slips or bank statements, and any other relevant financial information to ensure all criteria are met before submission.

Filling out the Kad Kredit- application form

Accessing the Kad Kredit-i application form is easy via Bank Islam's official website. Users can find the form under the credit card section, where detailed instructions guide them through the application.

The form typically features several sections requiring personal and financial information. The Personal Information section requires applicants to provide their full name, address, contact details, and identity card number. Applicants must pay close attention to accurately filling in this data to avoid delays.

Editing, signing, and submitting the application form

After filling out the application form, applicants can utilize pdfFiller to edit the document if necessary. This powerful tool allows for easy modifications to ensure all information is accurate and up-to-date before submission.

Once the form is complete and verified, applicants can electronically sign the document. pdfFiller provides user-friendly tools for eSigning, allowing for a smooth transition from editing to submission. After signing, the last step is to submit the completed form online through the Bank Islam portal.

After submission: What to expect

Once the application form is submitted, applicants can expect a confirmation notification from Bank Islam. This confirmation is essential as it verifies that the application has been received and is under review.

The application undergoes a review process where Bank Islam assesses the provided details and determines the applicant's eligibility for the card. Common outcomes include approval, request for additional documentation, or rejection. Once the review period concludes, the bank will communicate the outcome to the applicant, guiding the next steps based on the decision.

Managing your Kad Kredit- post approval

Upon approval, activating your Kad Kredit-i is a straightforward process that typically involves following steps sent via email or SMS. Users can activate their cards easily through the Bank Islam portal or mobile app, ensuring they are set to enjoy their new financial tool.

Additionally, utilizing pdfFiller for ongoing document management becomes invaluable. Users can manage their monthly statements, payment slips, and other related documents seamlessly, enabling organized record-keeping and easy accessibility.

Troubleshooting common issues

In the event your application is rejected, it’s critical to review the reasons outlined by Bank Islam. They often provide insights that can help you rectify any issues, allowing you to reapply in the future.

Additionally, if there are issues with card activation, users should contact customer service for assistance. Keeping personal information up to date is crucial; therefore, Bank Islam provides users with straightforward methods to update their details online to avoid any service interruptions.

Frequently asked questions (FAQs)

Common questions about the Kad Kredit-i revolve around fees, rewards, and card limits. Users often inquire about the types of fees, such as annual fees or late payment penalties, and the specific percentages associated with them.

Clarifications on rewards systems and the terms and conditions surrounding them are also frequent, as potential users want to maximize the benefits from their Kad Kredit-i usage. It’s advisable for applicants to thoroughly review the FAQs provided by Bank Islam to gain a deeper understanding before applying.

Conclusion: Maximizing your Kad Kredit- experience

To maximize the Kad Kredit-i experience, users should adopt best practices in managing their card wisely. This includes paying balances on time to avoid unnecessary fees, leveraging rewards with each purchase, and keeping track of expenditures to maintain a healthy credit score.

Furthermore, utilizing tools like pdfFiller for document management ensures users can access their important financial documents with ease, supporting a streamlined process in managing their credit effectively. Ultimately, being proactive and informed equips users to enjoy all the benefits that the Kad Kredit-i offers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out kad kredit-i bank islam using my mobile device?

How do I edit kad kredit-i bank islam on an iOS device?

How do I fill out kad kredit-i bank islam on an Android device?

What is kad kredit-i bank islam?

Who is required to file kad kredit-i bank islam?

How to fill out kad kredit-i bank islam?

What is the purpose of kad kredit-i bank islam?

What information must be reported on kad kredit-i bank islam?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.