Get the free Fatca and Crs Self-certification (for Individual)

Get, Create, Make and Sign fatca and crs self-certification

How to edit fatca and crs self-certification online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fatca and crs self-certification

How to fill out fatca and crs self-certification

Who needs fatca and crs self-certification?

Understanding FATCA and CRS Self-Certification Forms

Understanding FATCA and CRS

FATCA and CRS are essential frameworks aimed at combating tax evasion and enhancing transparency in global financial systems. The Foreign Account Tax Compliance Act (FATCA) set forth by the U.S. government in 2010 requires financial institutions outside the U.S. to report on the foreign assets of American account holders. This legislation stems from the need to prevent tax evasion by U.S. taxpayers using offshore accounts.

The Common Reporting Standard (CRS), developed by the Organization for Economic Co-operation and Development (OECD) and implemented in 2014, aims to standardize the reporting requirements for financial institutions worldwide. Like FATCA, it ensures that countries cooperate in sharing financial information about residents’ offshore accounts to strengthen compliance with tax obligations.

An important aspect of both FATCA and CRS is the interconnectedness between the two systems. While FATCA specifically targets U.S. citizens and residents, CRS creates a broader framework for international tax compliance, helping various countries ensure taxpayers meet their domestic obligations.

The necessity of self-certification forms

A self-certification form serves as a declaration from individuals or entities regarding their tax residency status and compliance with FATCA and CRS regulations. This form is necessary to establish the account holder's status in relation to tax obligations, thereby ensuring financial institutions collect the correct information for reporting. It simplifies the process of identifying who needs to be reported to tax authorities.

Both FATCA and CRS require account holders to provide self-certification to confirm their tax residency. This aids institutions in being compliant and reduces the risk of penalties. A self-certification form typically captures personal details, tax residency information, and certifies that the data provided is accurate.

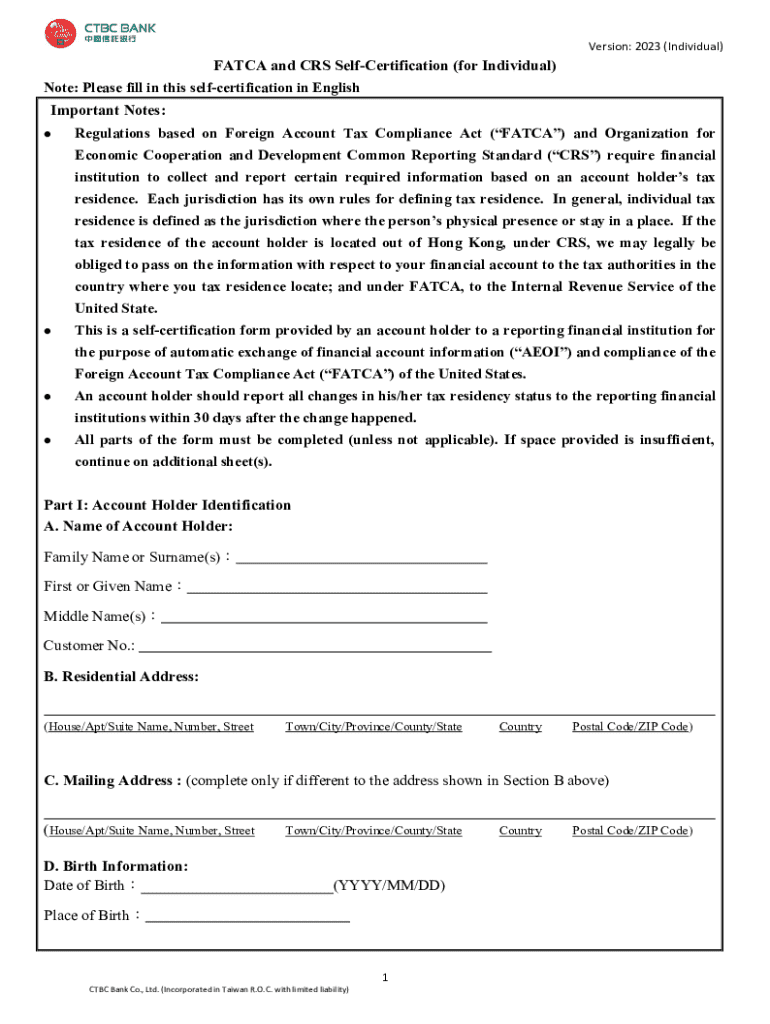

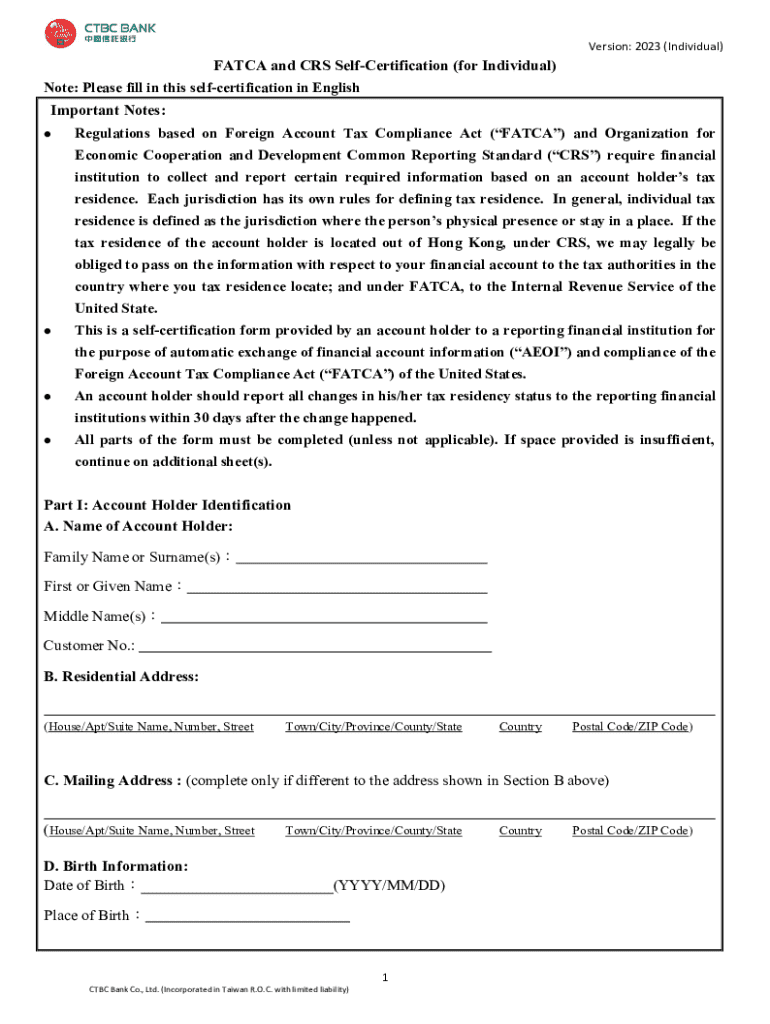

Components of the FATCA and CRS self-certification form

The components of the FATCA and CRS self-certification form are crucial in providing a clear picture of the individual's or entity's tax residency status. The form typically begins with personal and identification details, where the account holder must provide their full name, address, date of birth, and sometimes Social Security Number (SSN) or Tax Identification Number (TIN).

Tax residency is another significant section. Tax residency determines an individual's or entity's tax obligations and is recorded based on where they are considered a resident for tax purposes. Completing this section correctly is vital to prevent potential tax issues.

Step-by-step guide to completing the self-certification form

Completing the FATCA and CRS self-certification form requires attention to detail, and it's beneficial to follow a structured approach. Begin by gathering all necessary information before you start filling out the form. This includes personal documents like your passport, tax identification numbers, and proof of residency, ensuring you have everything on hand for accurate completion.

When filling out the form, ensure you understand each section clearly. Pay close attention to personal details; even minor errors can lead to delays in processing. Review the completed form meticulously before submission to catch and rectify common mistakes such as typos or incorrect residency declarations.

Tips for managing your self-certification forms

Effective management of self-certification forms is crucial for compliance with FATCA and CRS. Start by securely storing your documents to protect sensitive information. Digital solutions such as the pdfFiller platform offer secure storage options, allowing you to maintain and manage your documents easily and efficiently.

Additionally, it's wise to re-evaluate your self-certification regularly, particularly if any changes occur in your financial situation or residency status. Awareness of FATCA and CRS regulations is vital, as laws and compliance requirements can undergo changes, necessitating updates to your forms.

Common questions and troubleshooting

Navigating the self-certification process can raise questions, particularly for those new to FATCA and CRS regulations. If issues arise during certification, contact your financial institution for guidance. They can provide necessary information on rectifying mistakes and ensure that your submissions align with their compliance requirements.

Moreover, after submission, if you discover errors, prompt rectification is essential. Most institutions have processes in place to allow corrections; ensure you understand their protocols to amend your submitted forms successfully.

Resources like pdfFiller can ease the form management process, providing tools for editing, signing, and storing important documents securely.

Advantages of using pdfFiller for self-certification forms

pdfFiller offers a suite of features aimed at simplifying the process of completing and managing self-certification forms. One notable advantage is seamless editing capabilities. Users can fill out, edit, and customize their PDF forms online with ease, ensuring a user-friendly experience during the form completion process.

Additionally, the eSignature capabilities enhance compliance and provide flexibility in managing document signing. With pdfFiller, you can securely collaborate and share forms with tax professionals or team members, making it an excellent tool for individuals and organizations alike.

Key takeaways

Understanding the FATCA and CRS self-certification forms is critical for individuals and entities to ensure compliance with international tax regulations. The provided guidelines and structured steps outlined above aim to empower users to navigate the requirements without stress. Utilizing technological solutions like pdfFiller enhances efficiency, allowing for easy document management and collaboration.

Remaining informed about changes in FATCA and CRS regulations is indispensable. This knowledge not only facilitates timely updates to self-certification forms but also aligns users with their future tax obligations. In the realm of international finance and taxation, proactive compliance can save time and mitigate potential penalties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit fatca and crs self-certification straight from my smartphone?

How do I edit fatca and crs self-certification on an iOS device?

Can I edit fatca and crs self-certification on an Android device?

What is fatca and crs self-certification?

Who is required to file fatca and crs self-certification?

How to fill out fatca and crs self-certification?

What is the purpose of fatca and crs self-certification?

What information must be reported on fatca and crs self-certification?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.