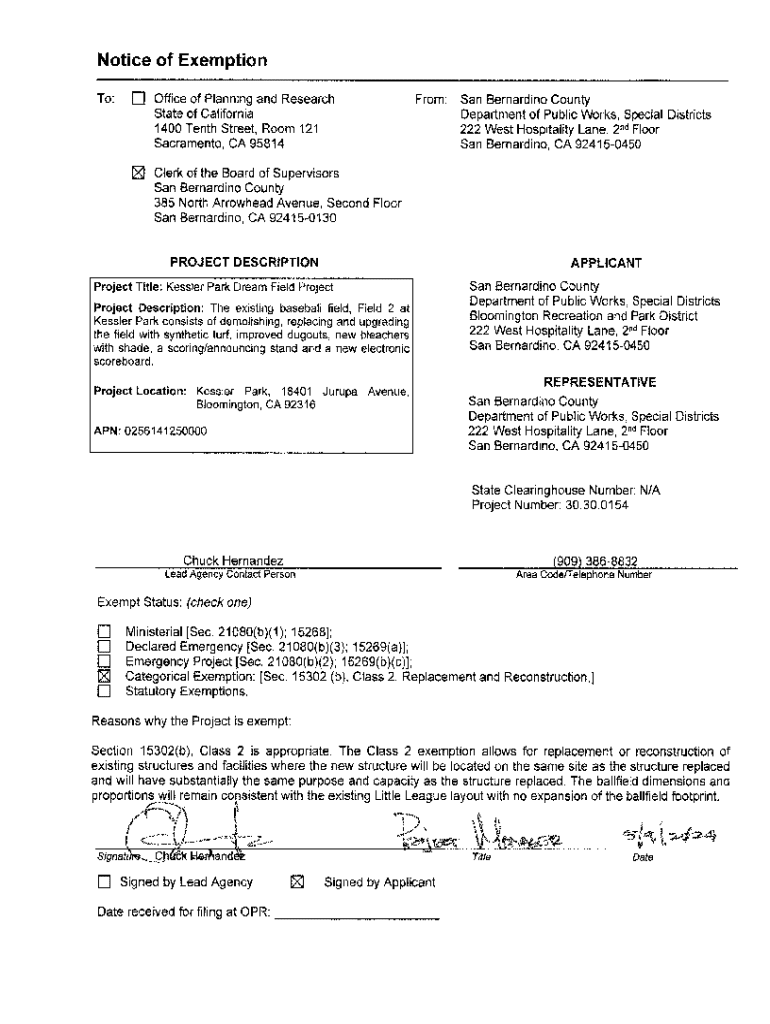

Get the free Notice of Exemption

Get, Create, Make and Sign notice of exemption

Editing notice of exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of exemption

How to fill out notice of exemption

Who needs notice of exemption?

A Comprehensive Guide to the Notice of Exemption Form

Understanding the Notice of Exemption Form

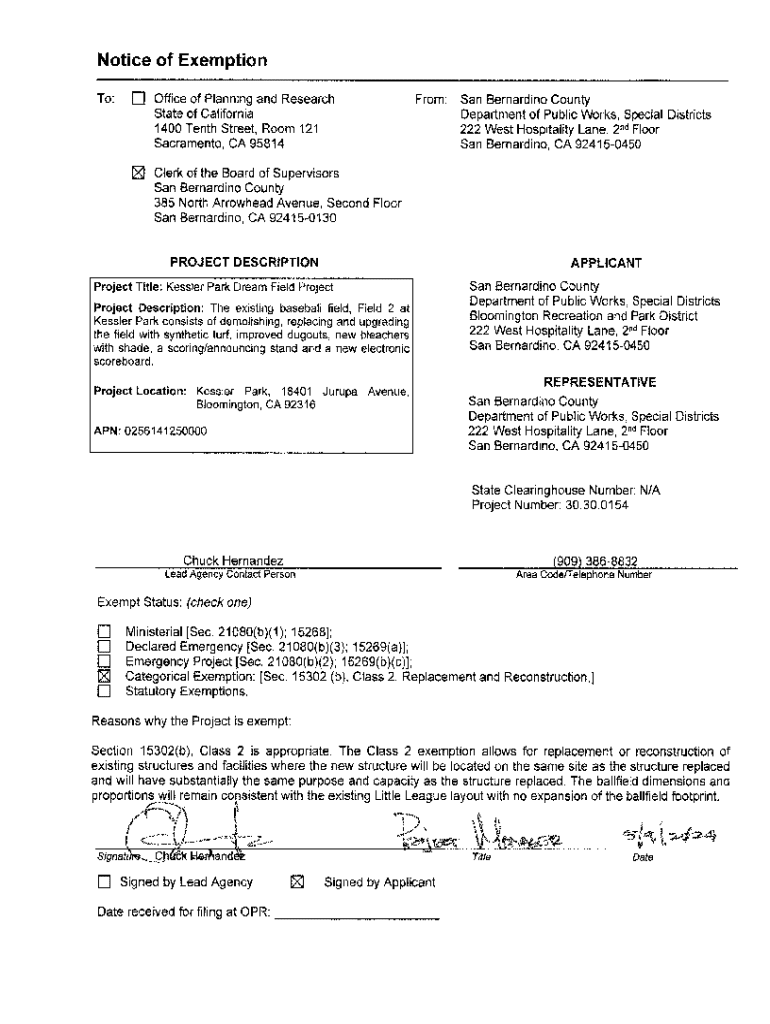

The Notice of Exemption Form serves as a formal document that notifies relevant authorities about certain exemptions from regulations or requirements. Its primary purpose is to streamline processes such as property transactions, tax exemptions, and environmental assessments. By filing this form, individuals and organizations can claim exemptions based on clearly defined criteria, thus avoiding unnecessary bureaucratic hurdles.

Using the Notice of Exemption Form carries significant benefits, including speeding up approval processes, reducing compliance costs, and ensuring that parties meet legal requirements. It can be a crucial tool for navigating complex regulatory environments, especially when time-sensitive projects or financial considerations are at stake.

Who should use the Notice of Exemption Form?

The Notice of Exemption Form is relevant to a variety of stakeholders. Individual homeowners, for instance, may need this form if they are seeking to finalize property transactions exempt from certain local zoning laws. Similarly, small business owners looking for tax breaks—such as those relating to new hiring or green initiatives—can leverage this form to simplify their exemption applications.

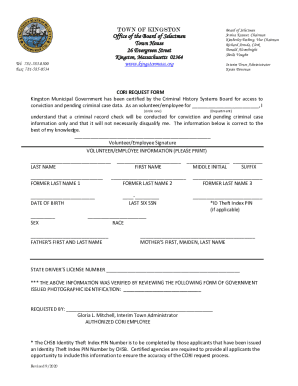

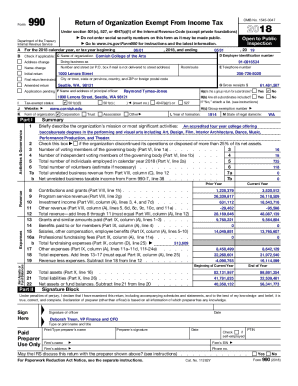

Nonprofit organizations can benefit significantly by utilizing the Notice of Exemption Form to secure tax-exempt status or to obtain exemptions on various projects benefiting their communities. Additionally, team administrators in larger organizations often utilize this form to manage multiple exemption claims efficiently, ensuring that all regulatory requirements are accounted for throughout different departments.

Key components of the Notice of Exemption Form

When preparing to fill out the Notice of Exemption Form, certain key components must be included to ensure proper submission. Required information generally begins with personal information or organizational details, which establishes the identity of the applicant. This section typically requires full names, contact information, and entity types if applicable.

Project details come next, outlining the nature of the project for which the exemption is being requested. This part includes a description of the project, its location, and timelines. Equally important is stating the exemption reasons, clearly articulating why the exemption applies and under what conditions.

Supporting documentation also plays a critical role in the approval process. Be prepared to include proof of exemption eligibility and potentially, tax records from past years to demonstrate compliance with requirements.

Step-by-step guide to completing the Notice of Exemption Form

Completing the Notice of Exemption Form can seem daunting, but breaking it down into manageable steps can simplify the process. Begin by gathering the necessary information mentioned above to create a solid foundation for your form.

Step 2 involves filling out the form accurately. Each section should be completed in detail. For example, when describing the project, be precise in its scope and timeline, as this can significantly impact the outcome. Review and double-check your entries in Step 3 to avoid common clerical errors that could delay processing.

Once you’re satisfied with the completed form, the fourth step is to attach any required documentation that supports your exemption claim, such as previous tax records or proof of eligibility. Finally, in Step 5, choose how to submit your form; many authorities accept online submissions for convenience, while others may require in-person submission.

Tips for successfully managing your Notice of Exemption Form

To successfully navigate the process of managing your Notice of Exemption Form, implementing best practices for documentation is essential. Clearly organized files and records will help streamline your application process. Consider maintaining copies of the form and documentation, even after submission, to have a clear record for future reference.

Avoid common mistakes such as incomplete information, missing attachments, or misunderstanding exemption criteria as these can lead to delays or denials. Frequently asked questions regarding form management often arise about submission timelines and follow-ups. Staying proactive about these inquiries can help ensure smooth processing.

Editing and customizing your Notice of Exemption Form with pdfFiller

Using pdfFiller, you can easily edit and customize your Notice of Exemption Form. The platform provides various tools for document editing, allowing for modifications as needed, such as correcting information or adding new sections. Understanding how to use these tools effectively can enhance the way you manage all of your documents.

If changes are necessary after submission, pdfFiller offers options to amend your documents efficiently. Furthermore, eSigning features and the ability to collaborate with team members streamline the process even more, ensuring everyone involved is on the same page.

What to expect after submitting your Notice of Exemption Form

After submitting your Notice of Exemption Form, it’s crucial to understand what happens next. Typically, the form enters a review process where pertinent authorities will assess the information provided. Depending on the volume of applications and the specifics of your submission, this process can take varying amounts of time.

Expect confirmation notifications, which can come in the form of emails or public postings from the governing department. However, should your application face potential rejection or require additional information, knowing how to handle such situations is paramount. Being prepared for rejections or follow-up requests can ease stress and expedite eventual approval.

Common questions about the Notice of Exemption Form

As you navigate the process of using the Notice of Exemption Form, several common questions may arise. Eligibility criteria are often the first point of concern; understanding who qualifies for various exemptions can make or break an application. It’s important to research the specific requirements for your situation.

Renewal processes are another area of frequent inquiry, particularly regarding how often exemptions need to be re-applied or verified. Furthermore, variances in procedures that differ by state or region can influence how you approach your exemptions, making knowledge of local laws essential.

Engaging with your community and understanding local regulations

Engaging with local agencies can significantly enhance your understanding of regulations surrounding the Notice of Exemption Form. Attending community meetings or workshops offered by local governments can provide insights not readily available through online resources. Networking with other individuals and organizations in your area who have successfully navigated these forms can be invaluable.

Staying updated on changes to regulations is equally crucial. Regularly reviewing local government websites, subscribing to newsletters, or joining relevant online forums can keep you informed about new exemptions, forms, or legal changes that may impact your application process. Community learning and sharing experiences can lead to discoveries beneficial to all parties involved.

Case studies: Successful use of the Notice of Exemption Form

Real-life examples of successful use of the Notice of Exemption Form can serve as motivating illustrations for stakeholders. For instance, a small business in North Carolina was able to utilize the form to qualify for a property tax exemption by demonstrating community impact through job creation. This case not only highlights the form's utility but also its role in encouraging local economic growth.

Lessons learned from common experiences in navigating the exemption process often revolve around meticulous preparation and maintaining clear communication with authorities. Achieving success with the Notice of Exemption Form often reflects the importance of understanding and meeting all local requirements.

Final thoughts on utilizing the Notice of Exemption Form effectively

Effectively utilizing the Notice of Exemption Form presents a significant opportunity for various stakeholders to navigate complex regulatory landscapes. By staying informed about eligibility criteria and leveraging available resources such as pdfFiller, users can maximize the efficiency of their document management processes.

Encouraging proactive engagement with regulatory processes can foster a smoother experience and lead to successful outcomes. Submitting a well-prepared Notice of Exemption Form can pave the way for projects to proceed without unnecessary delays, ultimately benefiting individuals and organizations alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get notice of exemption?

How do I make changes in notice of exemption?

Can I create an electronic signature for signing my notice of exemption in Gmail?

What is notice of exemption?

Who is required to file notice of exemption?

How to fill out notice of exemption?

What is the purpose of notice of exemption?

What information must be reported on notice of exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.