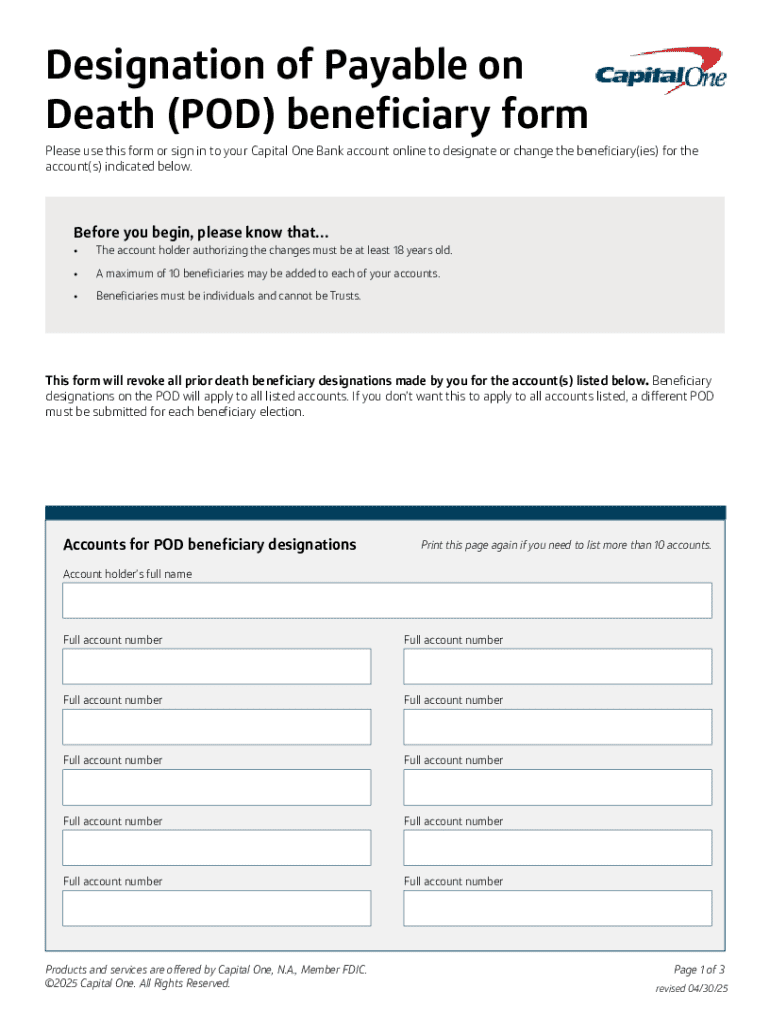

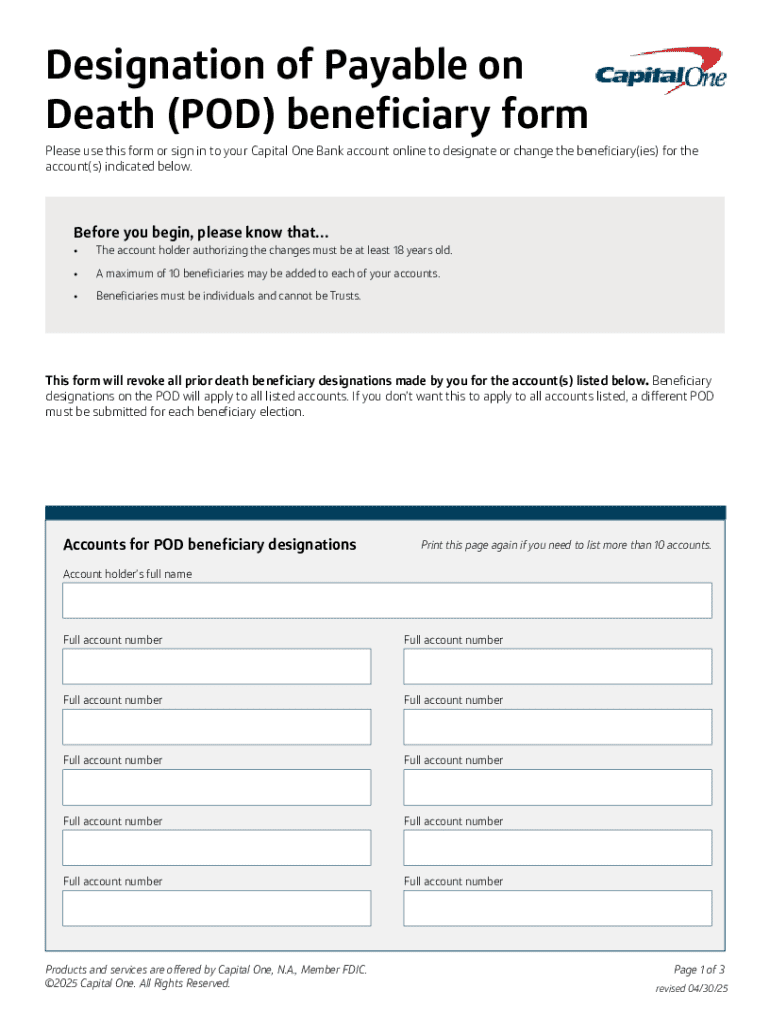

Get the free Designation of Payable on Death (pod) Beneficiary Form

Get, Create, Make and Sign designation of payable on

How to edit designation of payable on online

Uncompromising security for your PDF editing and eSignature needs

How to fill out designation of payable on

How to fill out designation of payable on

Who needs designation of payable on?

Understanding the Designation of Payable on Form

Understanding the designation of payable on form

Designation of payable refers to the specification of individuals or entities that are authorized to receive payments from a particular source, such as insurance benefits, estate assets, or corporate dividends. This designation ensures that the rightful payees receive their entitled amounts, minimizing disputes and ensuring smooth transactions. It plays a critical role across a wide range of contexts, from financial documents to legal forms, ensuring clarity and legal compliance.

The necessity of a properly filled designation of payable form cannot be understated; it is vital in protecting the interests of both the payer and the payee. This is especially true in complex scenarios like estate planning or trust management, where miscommunication can lead to significant financial complications.

Types of designation of payables

Understanding the different types of designations is crucial for effectively managing payables. The three primary categories include individual, joint, and corporate designations, each serving distinct purposes and audiences.

Individual designation involves naming a single person as the recipient of funds or benefits. This is common in settings like life insurance policies where a single beneficiary receives all proceeds upon the account holder's death. The simplicity of this designation ensures straightforward processing and fewer complications.

Joint designation, on the other hand, allows multiple parties to share payables. This is particularly beneficial for couples or business partners, ensuring that both parties can collaborate in managing funds or benefits jointly. This type can also assist in estate planning, enabling a seamless transfer of assets.

Corporate designation pertains to businesses or organizations and often requires a more formal process. It may involve designating a corporate officer or a specific department to handle payables, ensuring proper oversight and compliance with regulations essential for corporate governance.

When to use designation of payable

The decision to utilize a designation of payable form should take place when there's a need to clearly outline entitlements and streamline payment processes. Specific situations include estate planning, where clarity around beneficiary designations can prevent disputes among heirs.

Insurance policies frequently require designating a payable to ensure the correct party receives the benefit upon a policyholder's passing. This clear articulation of intent safeguards families from legal and financial turmoil in times of grief.

Further, in trusts and wills, the designation of payable can delineate how assets are to be distributed, ensuring that the intentions of the grantor or testator are honored posthumously. By functioning as a legally recognized document, it underscores the importance of clear communication in potential conflict areas.

Filling out a designation of payable form

Filling out a designation of payable form accurately is essential to ensure all payables are acknowledged and processed without issues. Here’s a step-by-step guide to assist you in this process.

Frequently asked questions (FAQs)

Navigating the designation of payable form process stimulates various questions. Here are answers to common inquiries:

Tools and resources

To assist you in managing your payable designations, consider utilizing tools that streamline the form-filling process. Online platforms such as pdfFiller can provide invaluable resources.

Benefits of using pdfFiller for designation of payable forms

PdfFiller offers a range of features that make managing designation of payable forms a smooth and efficient process. The platform is designed to empower users to create, edit, and manage documents from a single, cloud-based interface.

Troubleshooting common issues

While filling out designation of payable forms, users may encounter issues such as submission errors or document discrepancies. Understanding how to troubleshoot these problems is essential for maintaining workflow efficiency.

Keeping your designation of payable forms secure

Document security is a key consideration when dealing with designation of payable forms. Ensuring that sensitive information remains protected is crucial to avoid unauthorized access and potential fraud.

Implementing best practices for maintaining both privacy and integrity includes using secure passwords for document access and regularly updating security settings within your working platform.

Managing your designated payables

Once you have established your designations, managing them effectively is critical. This includes routinely reviewing and updating your designations to reflect any changes in your personal or financial circumstances.

Regular audits of your payable designations ensure that your beneficiaries are up to date and that your documents reflect your current wishes, reducing the likelihood of complications down the road.

Regional variations in designation practices

The designation of payable processes can vary by state or region, largely due to differing regulations and legal frameworks governing financial and estate planning matters.

Being aware of local regulations is essential for ensuring compliance and protecting your rights as a payee. Utilize resources like legal advisors or official state websites to stay informed about your regional practices.

Additional considerations for organizations

Businesses must navigate a more complex landscape when designating payables. Organizations should implement clear guidelines for designating payables to mitigate risks and ensure compliance with regulatory requirements.

Best practices include defining who has the authority to designate payables, maintaining clear documentation of decisions, and regularly training staff on the designation processes to minimize misunderstandings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my designation of payable on in Gmail?

How can I get designation of payable on?

How do I edit designation of payable on in Chrome?

What is designation of payable on?

Who is required to file designation of payable on?

How to fill out designation of payable on?

What is the purpose of designation of payable on?

What information must be reported on designation of payable on?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.