Get the free Certificate of Trust and Account Conversion Form

Get, Create, Make and Sign certificate of trust and

Editing certificate of trust and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of trust and

How to fill out certificate of trust and

Who needs certificate of trust and?

Certificate of Trust and Form: A Comprehensive How-to Guide

Understanding certificates of trust

A certificate of trust serves as a powerful legal document that verifies the existence of a trust and helps simplify transactions involving trust property without divulging the full details of the trust itself.

Essentially, a certificate of trust provides essential information regarding the trust, such as the names of the trustor and trustee, as well as the powers granted to the trustee. With this document, individuals can assure financial institutions and other relevant parties that the trust is valid and operational, while protecting the privacy of the trust’s terms.

How a certificate of trust operates

In the realm of estate planning, a certificate of trust plays a pivotal role by acting as an abridged version of the trust document. Financial institutions, real estate agents, and other third parties often require assurance that a trust is legitimate before they engage in any transactions involving trust property.

Unlike traditional trust documents, which can be lengthy and filled with private provisions, a certificate of trust minimizes exposure of sensitive information. It effectively streamlines the process by allowing parties to verify the authority of the trustee and the existence of the trust without having to provide all the details contained within the trust document.

Benefits of utilizing a certificate of trust

One primary benefit of a certificate of trust is privacy. By using a certificate rather than a full trust document, individual detail is protected, which can prevent potential disputes and unwanted scrutiny of personal affairs.

Moreover, certificates of trust enhance clarity for financial institutions and other entities involved in transactions related to the trust. They clearly outline the trustee's authority and affirm the trust’s validity, making it easier to process requests without needing access to the complete trust portfolio. This aspect significantly simplifies transactions, allowing for efficient asset management.

When to use a certificate of trust

A certificate of trust should be utilized in various situations, particularly in instances where trust property is being handled or transactions need to occur. Real estate transactions stand out as a common scenario, where buyers or sellers may need to verify the ownership and authority connected with the trust.

Additionally, it's pertinent for situations where the trustee must manage financial assets. For example, if a trustee wishes to open a bank account for a trust or needs to liquidate assets, presenting a certificate of trust can effectively clarify their role and responsibilities.

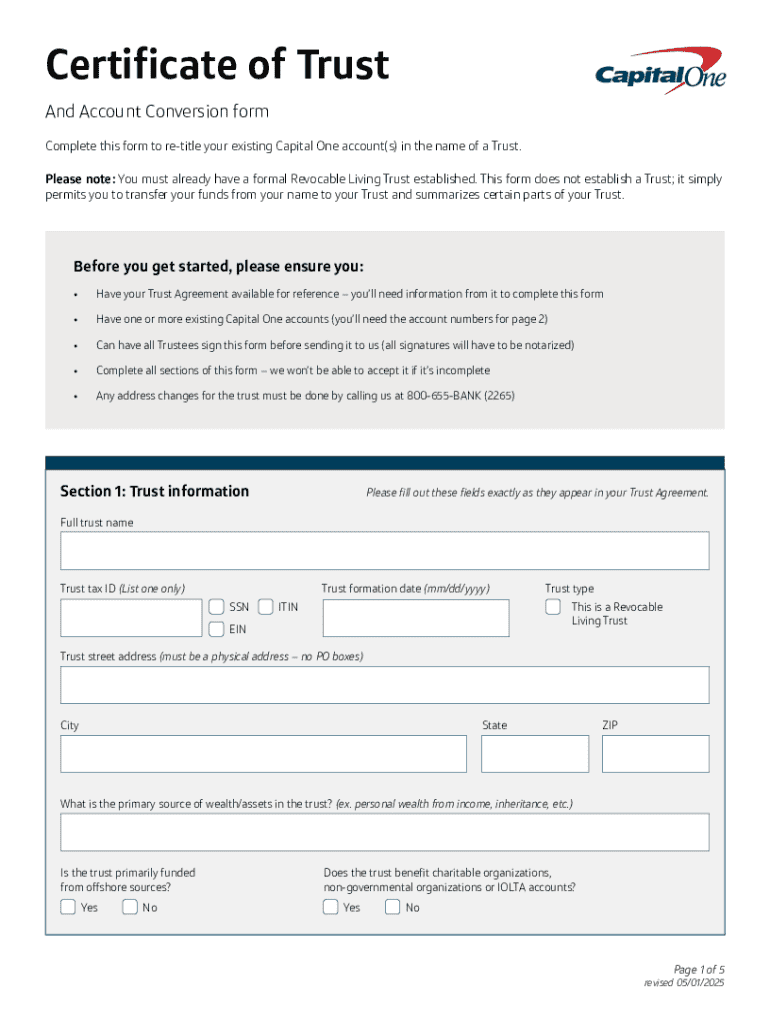

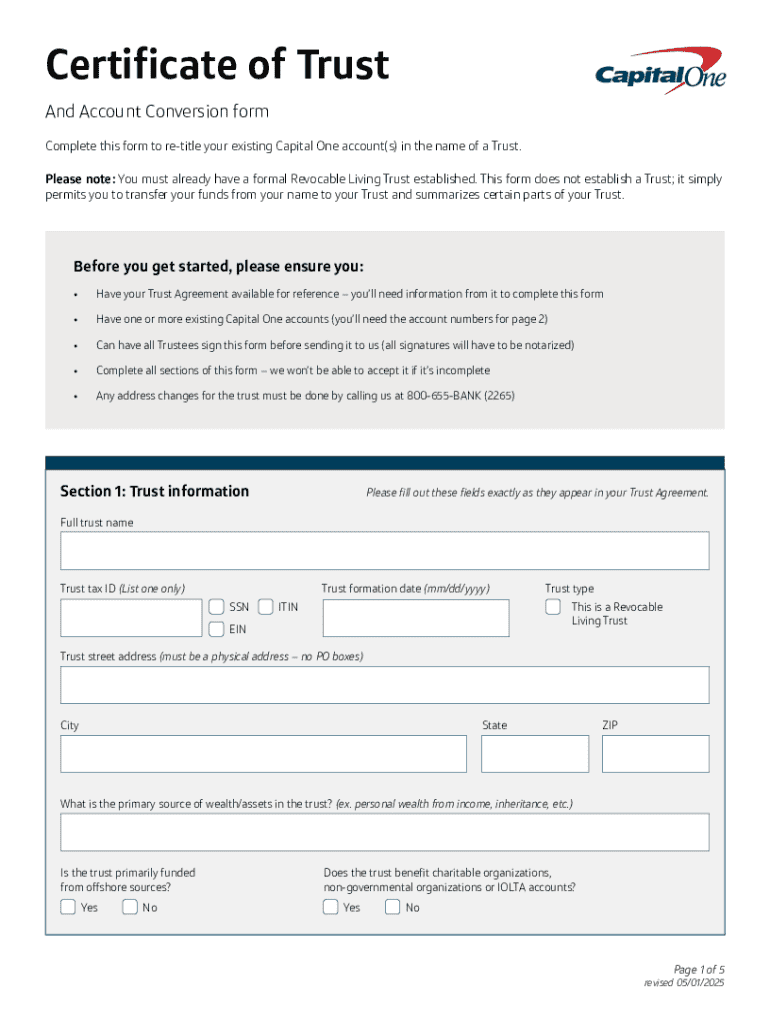

Step-by-step guide to creating a certificate of trust

Creating a certificate of trust begins with gathering the required information related to the trust. This includes the name of the trust, the trustor, the trustee, and any pertinent details about the trust's powers and purposes. Having these elements prepared will facilitate an efficient drafting process.

Drafting the document is the next step, where it’s crucial to consider legal requirements. Ensure that you follow the laws in your jurisdiction regarding trust documentation. Once you’ve drafted the certificate, finalize the document by possibly notarizing it, depending on state laws. Lastly, distribute the certificate to relevant financial institutions and beneficiaries to formalize the trust's operational capabilities.

Managing your certificate of trust

Managing your certificate of trust requires periodic reviews to ensure all information remains current. Whenever there’s a significant change in the trust, such as adjusting beneficiaries or altering trustee roles, it's imperative to update the certificate to reflect these modifications. Regular updates help avoid confusion and disputes in the future.

In terms of record-keeping, maintain copies of the certificate along with related trust documents in an organized manner. Identifying who needs access to your certificate is also crucial. Generally, trustees, beneficiaries, and relevant financial institutions should be privy to this documentation to ensure smooth management and transitions of trust assets.

FAQs about certificates of trust

Many individuals have questions regarding the necessity and implications of certificates of trust. One frequently asked question is whether all trusts require a certificate. While not mandatory for every trust, having a certificate serves to simplify interactions with third parties and streamline transactions.

Another common query is whether a certificate of trust is legally binding. It is, in fact, legally recognized as a binding document in most jurisdictions, helping to secure the trust's authority. Privacy remains a prevalent concern, leading many to seek clarification on how a certificate impacts personal confidentiality. Lastly, individuals often wonder if a certificate of trust can be revoked; alterations or revocations typically depend on the terms set within the trust itself.

Specialized forms related to certificates of trust

In conjunction with certificates of trust, other important legal documents play significant roles in trust management. An affidavit of trust, for example, serves as another form of verification but differs in that it provides a sworn statement attesting to the validity of the trust and its provisions.

Moreover, related trust documents like health care proxies and living wills are also essential components of comprehensive estate planning. Each document serves a unique purpose but collectively contributes to a complete and efficient management strategy for trusts and estate plans.

Interactive tools for document management

Managing your documents, including certificates of trust, can be significantly enhanced through interactive tools. Platforms like pdfFiller offer comprehensive features that allow users to edit PDFs, eSign documents, collaborate with others, and manage documentation from any location seamlessly.

Utilizing pdfFiller, you can easily fill out and manage your certificate of trust, ensuring that your documentation remains organized and accessible. The electronic signing options streamline the process, eliminating the need for physical paperwork and enhancing efficiency in trust management.

Understanding various types of trusts and their certificates

There are several types of trusts, each with distinct characteristics that may dictate the specifics of their corresponding certificates. Living trusts, for instance, are often set up during an individual's lifetime, allowing for ease of asset management and distribution upon death, and their certificates will reflect these unique elements.

Charitable trusts, in contrast, have a focus on philanthropy, often providing tax benefits to the grantor while stipulating how funds must be managed and distributed for charitable purposes. Each type's certificate is tailored to reflect its specific terms and conditions, highlighting the flexibility and customization involved in trust management.

Planning ahead: Future considerations for trust management

As estate laws continue to evolve, it's important to stay informed about potential changes in trust legislation. Keeping abreast of these updates allows trustees and beneficiaries to adapt their strategies and maintain compliance, ultimately safeguarding the trust's integrity over time.

Digital trust management is also on the rise, with increasing avenues for managing trusts and associated documents online. Embracing these advancements not only improves efficiency but also enhances accessibility, empowering trustees to keep accurate records and facilitate smoother interactions with beneficiaries and institutions.

Exploring related topics in trust management

Trust management often intersects with various other legal documents, such as wills, powers of attorney, and guardianship matters. Each of these legal instruments serves distinct purposes yet work together to create a comprehensive estate plan.

For those looking to expand their knowledge in these areas, resources such as legal workshops, online courses, and professional advisors can provide valuable insights and education on trust and estate planning fundamentals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send certificate of trust and to be eSigned by others?

Can I create an eSignature for the certificate of trust and in Gmail?

Can I edit certificate of trust and on an iOS device?

What is certificate of trust?

Who is required to file a certificate of trust?

How to fill out a certificate of trust?

What is the purpose of a certificate of trust?

What information must be reported on a certificate of trust?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.