Get the free Form 10-q

Get, Create, Make and Sign form 10-q

Editing form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Understanding Form 10-Q: A Comprehensive Guide

Comprehensive overview of Form 10-Q

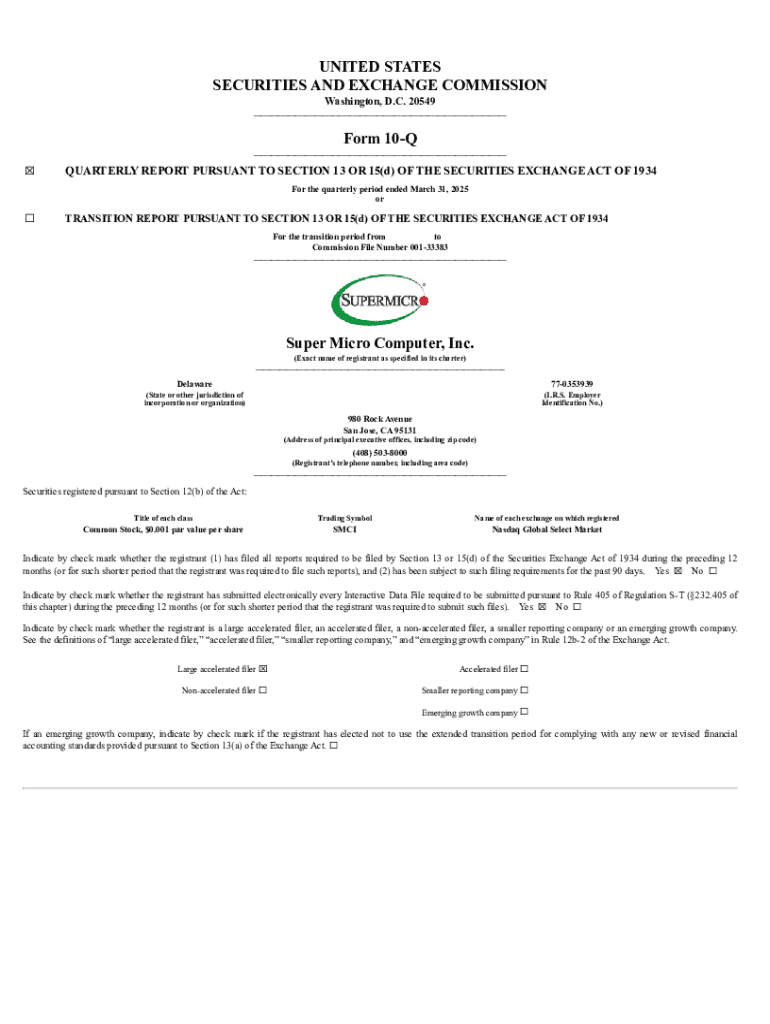

The SEC Form 10-Q is a crucial document that public companies use to report their financial performance on a quarterly basis, featuring unaudited financial statements. It is designed to provide transparency about a company's financial health and operational performance between annual reports, making it a vital tool for stakeholders. Investors can assess a company’s ongoing viability, evaluate management’s effectiveness, and make informed decisions based on the latest financial insight.

For public companies, filing Form 10-Q is not just a regulatory requirement; it's an opportunity to communicate with investors and analysts. Regular disclosures allow shareholders to gauge performance and react promptly to any significant changes in business conditions. Thus, the importance of Form 10-Q lies in its role in maintaining market integrity and promoting informed investment.

Key elements of Form 10-Q

Understanding the components of Form 10-Q is essential for companies preparing the document as well as for investors analyzing it. The form is divided into two main sections: Part I focuses on financial information, while Part II contains other significant information relevant to investors.

Part : Financial information

This section includes critical financial statements that provide insights into the company’s performance:

Additionally, there’s a crucial section known as Management’s Discussion and Analysis (MD&A), where management provides detailed commentary about the financial performance, operational trends, and future outlook, allowing stakeholders to understand the context behind the numbers.

Part : Other information

This section includes various disclosures that are also vital for investors, such as:

Detailed breakdown of contents

A typical Form 10-Q is a comprehensive report that goes beyond mere numbers. It includes a business description that outlines what the company does, its market position, and strategic direction. Investors are also provided with quantitative and qualitative disclosures about market risk, helping them understand how external factors could impact financial performance.

The contents of the Form 10-Q can be summarized in an itemized list, including:

This depth of information within a Form 10-Q allows investors to gain a clearer picture of the company’s operational dynamics and future potential.

Filings and deadlines

Filing Form 10-Q is a structured process regulated by the SEC, with specific timelines set for when companies must submit their reports. Generally, public companies must file their Form 10-Q within 40 to 45 days after the end of the quarter they are reporting on. For accelerated filers, this timeline is typically 40 days, while all others are allowed 45 days.

The frequency of these filings is quarterly, meaning companies must maintain a consistent schedule of reporting their financial performance every three months. This regular cadence helps keep investors informed about the performance and any new issues that arise.

Failure to file on time can result in significant consequences. The SEC may impose penalties, increase scrutiny over the company, and there could be a loss of investor trust, which could adversely affect stock performance.

Common pitfalls in filing Form 10-Q

One of the most critical pitfalls companies face is the failure to meet filing deadlines. This misstep can have severe repercussions, such as damaging the company's reputation and investor confidence. Investors rely on timely disclosures, and late filings can lead to speculation and uncertainty, potentially driving down stock prices.

Additionally, inaccuracies in the financial statements or failure to provide necessary disclosures can result in SEC penalties. Companies that do not comply with the filing regulations may face enforcement actions, which could lead to legal problems and affect the company's standing in the market.

Strategies for locating Form 10-Qs

Locating Form 10-Q documents can be straightforward, especially with the availability of digital tools. The SEC EDGAR database is a primary resource for accessing all public filings, including Form 10-Q. Users can search for specific companies and easily navigate through the timeline of submissions. This database allows stakeholders to gather pertinent information directly from the source.

Another effective strategy is to visit company investor relations pages, where often, the latest filings are readily available for download. Companies typically provide easy access to their Form 10-Qs along with past filings for context. Additionally, using online document management tools like pdfFiller can enhance the searching process, making it easier to track changes and access archives of previous filings.

Tools and resources for managing Form 10-Qs

Utilizing interactive features within pdfFiller can drastically simplify the management of Form 10-Q documents. This platform allows users to edit, sign, and collaborate on filings in real-time. Advanced features such as document version control ensure that all changes are tracked and previous versions can be retrieved easily, providing peace of mind for teams responsible for these crucial filings.

In addition to editing capabilities, pdfFiller offers robust sharing options for collaborative efforts among teams. Multiple users can work on a document simultaneously, making it easier to prepare filings efficiently. With cloud-based access, teams can manage Form 10-Qs from any location, facilitating seamless collaboration whether in an office or working remotely.

Enhancing your understanding of Form 10-Q

For individuals and teams eager to enhance their understanding of Form 10-Q, various additional learning materials are available. Online tutorials can provide step-by-step guidance on editing and submitting forms correctly. Furthermore, webinars focused on SEC filings can offer insights from industry experts, illuminating complexities that may not be immediately apparent to new filers.

FAQs addressing common issues with Form 10-Q are also accessible, covering topics from technical aspects of the forms to strategic advice on how to present financial data effectively. These resources contribute to building a comprehensive understanding of the significance and requirements of Form 10-Q, engaging teams looking to improve their compliance practices.

Key highlights from recent Form 10-Q filings

Recent Form 10-Q filings have revealed noteworthy trends and industry-specific variations. For instance, in sectors like technology and healthcare, companies have shown increased transparency regarding supply chain challenges and market risks resulting from global events. Trends highlight a rise in disclosures around sustainability practices, reflecting an ongoing shift in shareholder expectations.

Innovations and changes in reporting practices are also notable. Companies are increasingly adopting more visual reporting techniques, making it easier for readers to digest complex financial data quickly. This shift indicates a continuous evolution in how companies communicate their financial health and strategic outlook as they recognize the need for clarity and accessibility in financial reporting.

Conclusion

Form 10-Q plays a pivotal role in the financial reporting landscape, serving as a bridge between annual disclosures and real-time performance updates. As a vital tool for both companies and investors, it provides the necessary visibility into a company's operations and financial health. Leveraging effective document management solutions such as pdfFiller allows teams to navigate the complexities of Form 10-Q filings smoothly and efficiently.

By committing to a streamlined approach for handling these essential disclosures, companies can enhance transparency, maintain investor trust, and comply with SEC regulations—ultimately contributing to their long-term success in the marketplace.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 10-q from Google Drive?

Can I edit form 10-q on an Android device?

How do I complete form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.