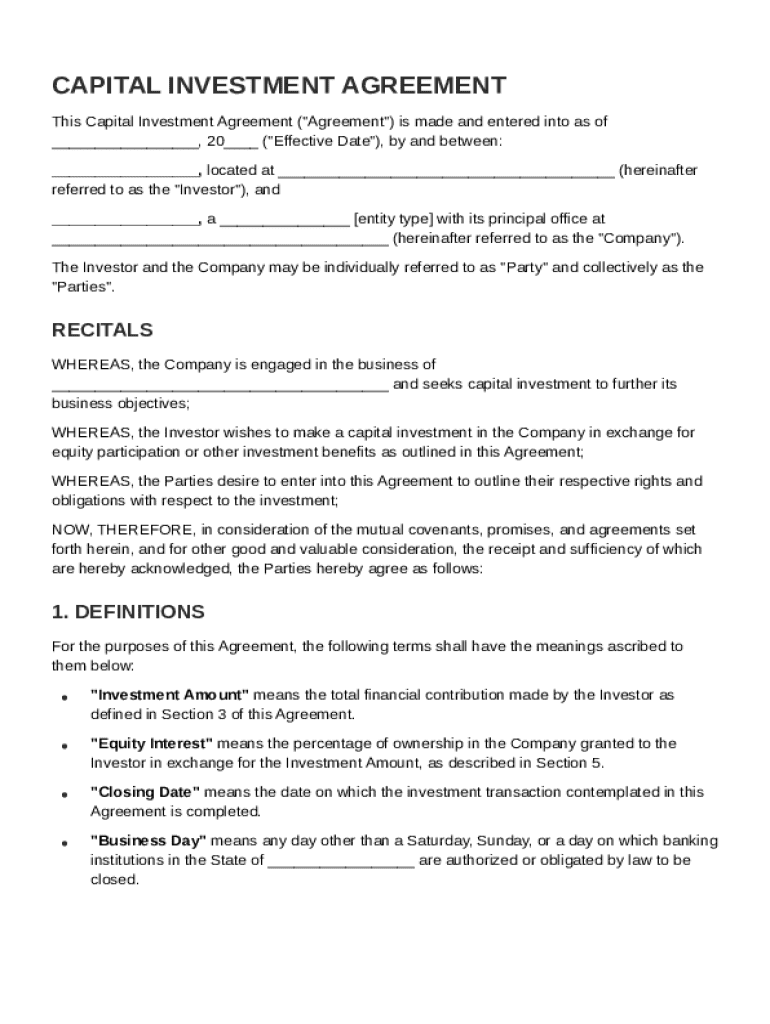

Capital Investment Agreement Template free printable template

Show details

This document outlines the terms and conditions of a capital investment agreement between an investor and a company, detailing rights, obligations, and investment amounts.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

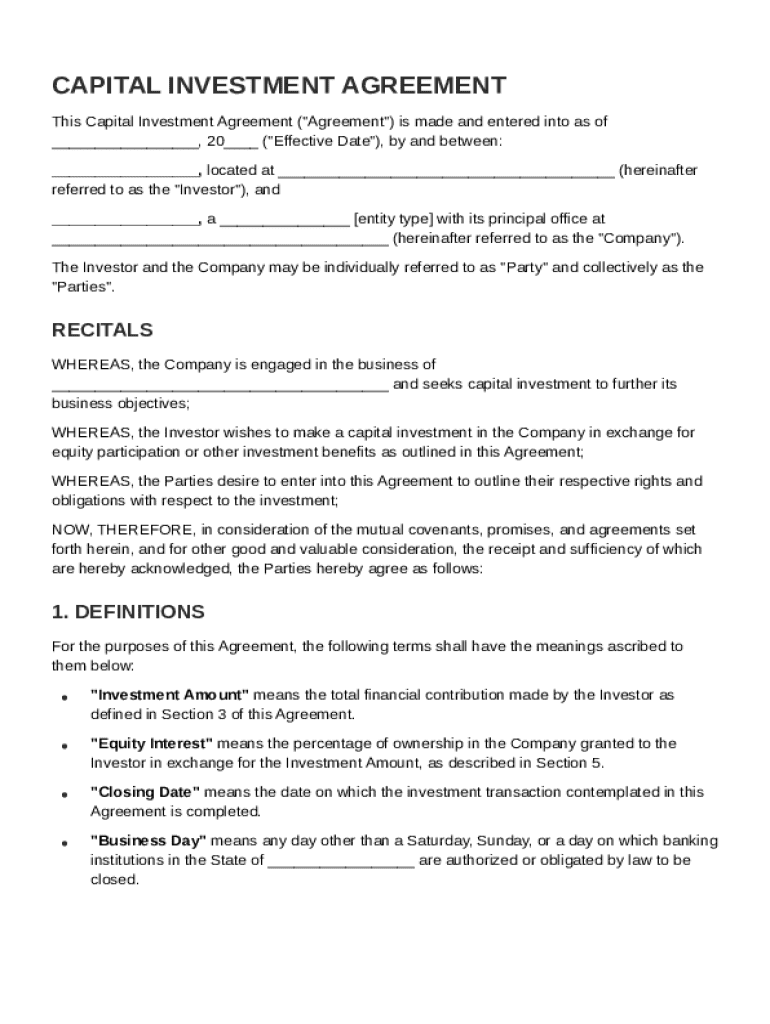

What is Capital Investment Agreement Template

A Capital Investment Agreement Template is a formal document that outlines the terms and conditions under which a capital investment is made between parties.

pdfFiller scores top ratings on review platforms

Very Practical, basic functions are intuitive

it works just fine

signature appear too light which does not appear rear.

Good workflow, easy to use, will recommend!

Makes my job so much easier

good,easy form

Who needs Capital Investment Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to capital investment agreements

A capital investment agreement template form establishes the terms of investment between a company and an investor. This guide walks you through the essentials of creating this important document, ensuring a smooth process that adheres to best practices.

What is a capital investment agreement?

A capital investment agreement is a legally binding contract between an investor and a company outlining the investment terms, roles, and responsibilities of each party. It plays a crucial role in facilitating smooth connections between stakeholders and ensuring that both parties’ interests are addressed.

-

This is a contract that details the obligations and rights that arise from an investment, crucial for both parties involved.

-

It protects the investor's contributions and ensures the company is transparent in its operations and financial reporting.

-

Typically includes an Investor who provides capital and a Company that receives funds to pursue growth or operational objectives.

How to navigate the essentials of the agreement?

Understanding the fundamental aspects of a capital investment agreement can enhance your negotiation power and ensure all necessary elements are considered.

-

This date marks the beginning of the agreement and establishes when commitments and obligations start to take effect.

-

Clearly identifying the investor and company avoids confusion and ensures each party understands their roles.

-

It is vital to describe the business's nature and operations, which helps to present a transparent outline of how investments will be utilized.

What are the key components of a capital investment agreement?

Each capital investment agreement contains specific sections that clear define the investment and operational expectations.

-

This should detail the monetary contribution from the investor, providing clarity on the commitment.

-

Ownership percentage exchanged is vital, outlining how much of the company will be shared post-investment.

-

Including this date is essential as it marks the formal agreement's completion and the actual start of investment terms.

-

This term should be defined for clarity on how days of operation affect the agreement's execution.

What operational clauses are in the agreement?

Operational clauses define how the agreement will function post-signing and set the framework for business interactions.

-

This outlines who will manage operations and how control will be shared post-investment, crucial for decision-making.

-

Details regarding the extent of the investor’s influence in company decisions help clarify the power dynamics.

-

It establishes how profits or losses will be shared among parties, affecting financial expectations.

-

These clauses protect sensitive information shared between parties during and after the investment.

How to understand financial terms in the agreement?

The financial terms in a capital investment agreement outline crucial monetary aspects necessary for both parties' understanding.

-

This section breaks down how the investment will be utilized, specifying any conditions attached.

-

Clear steps outlined for unwinding the agreement in the future if necessary provide safety.

-

Understanding conditions that can lead to agreement termination safeguards both parties' interests.

How to fill out the capital investment agreement?

Properly completing the capital investment agreement template form ensures a valid contract that reflects agreed terms.

-

Follow a structured approach to fill out the agreement focusing on accuracy and compliance.

-

Utilize pdfFiller's tools for ease in document handling, ensuring all steps are executed accurately.

-

Double-check each entry and refer to company operational details to fill out the form correctly.

What are best practices for post-agreement management?

Effective management of the capital investment agreement post-signature is vital for maintaining healthy investor-company relationships.

-

Utilize organized structures for managing the signed agreement to ensure easy access and referencing.

-

Foster open communication to address challenges and ensure periodic evaluations of the agreement.

-

Make use of pdfFiller's functionalities for continuous document management and modifications.

How to fill out the Capital Investment Agreement Template

-

1.First, download the Capital Investment Agreement Template from a reliable source or pdfFiller.

-

2.Open the document in pdfFiller to begin editing.

-

3.Start by filling out the date of agreement at the top of the template.

-

4.Identify the parties involved, including their full legal names and addresses, and enter this information.

-

5.Specify the amount of capital being invested and the terms of the capital contribution in the designated sections.

-

6.Include any conditions or contingencies that may apply to the investment.

-

7.Outline the ownership percentages and rights of the involved parties regarding the investment.

-

8.Provide sections for signatures and date for both parties once the terms are agreed upon.

-

9.Review the completed template thoroughly to ensure accuracy and completeness.

-

10.Finally, save the document and share it with the involved parties for signing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.