Car Finance Agreement Template free printable template

Show details

This Car Finance Agreement outlines the terms and conditions for financing the purchase of a vehicle, including the obligations of the Borrower and the rights of the Lender.

We are not affiliated with any brand or entity on this form

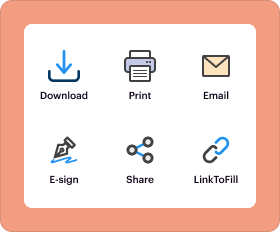

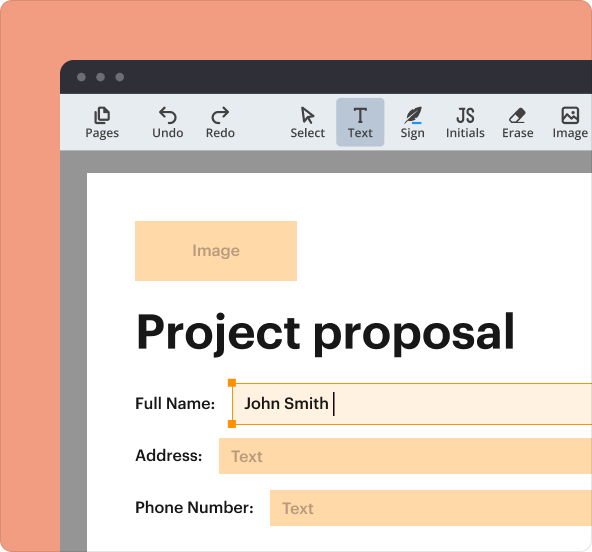

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Car Finance Agreement Template

A Car Finance Agreement Template is a legal document outlining the terms and conditions under which a buyer finances the purchase of a vehicle.

pdfFiller scores top ratings on review platforms

Excellent site! Saved me hours in scanning and printing PDF's.

Looks very professional, easy to use and reasonably priced.

So far has made life easy, being able to work on pdf forms and send them!

First time with their form and so far so good--seems easy to work on so far. so far I would recommend highly!

I am a 71 year old social worker and managing technology is not always easy. However, your site has been easy for me, and fulfilling

It takes a few minutes to sort things out, but overall it's very helpful

Who needs Car Finance Agreement Template?

Explore how professionals across industries use pdfFiller.

Car Finance Agreement Template on pdfFiller

How can understand a car finance agreement?

A car finance agreement is a legal document outlining the terms of a loan used to purchase a vehicle. Understanding this agreement is vital as it contains the rules that govern your borrowing and repayment responsibilities. Besides defining the obligations of both parties, it also contains potential legal implications should either party fail to adhere to the terms.

-

This document serves as a contract between the lender and the borrower, detailing how much money is being borrowed, the terms of repayment, and what happens in the case of default.

-

Signing the agreement makes you fully responsible for the payment terms stated within it, and non-compliance can lead to penalties, including repossession of the vehicle.

What parties are involved in the agreement?

A typical car finance agreement involves two main parties: the lender and the borrower. Each party's details must be accurately provided in the document to ensure clarity and legality.

-

The lender's name, type (bank, credit union, etc.), address, and contact information must be included for legal and operational correspondence.

-

Borrower's information, including name, full address, and contact number, establishes their identity and serves as a basis for credit evaluation.

What are the key components of the agreement?

Understanding the key components of a car finance agreement is essential for making informed financing decisions. Each component carries significant implications for your financial obligations.

-

The total amount financed for the vehicle, which impacts repayment schedules and interest calculations.

-

Indicates the cost of borrowing over a year, enhancing your ability to compare different financing options effectively.

-

This specifies the overall duration of the loan, which could affect monthly payments and total interest paid.

-

The vehicle itself often serves as collateral, meaning if payments are missed, it may be repossessed.

-

Defines the situations that might be considered breaches of agreement, outlining the consequences if such instances occur.

What vehicle information do need?

Providing accurate vehicle information is critical in any car finance agreement. Misrepresentation can lead to complications or even voiding the agreement.

-

Essential information such as make, model, year, vehicle identification number (VIN), color, and odometer reading must be included to verify the vehicle's suitability for financing.

-

Any inaccuracies in vehicle details can lead to delays in processing the agreement or potential legal actions, emphasizing the importance of double-checking before submission.

How do fill out the car finance agreement?

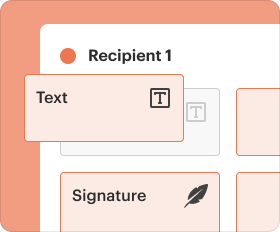

Filling out a car finance agreement may seem daunting, but a step-by-step approach can simplify the process significantly. Utilizing tools helps ensure accuracy while also saving time.

-

Begin by gathering all necessary information and documents about the vehicle and your personal details to streamline the process.

-

Avoid common pitfalls by double-checking all entries and ensuring every required field is completed.

-

Utilizing pdfFiller's editing features not only allows you to fill out the form digitally but also lets you sign and save the document securely.

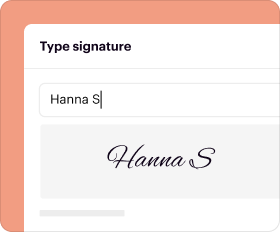

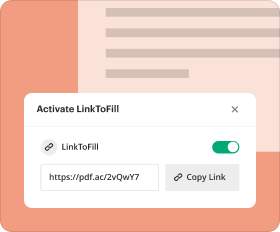

How do manage my car finance agreement?

Managing your car finance agreement effectively can save time and reduce stress, especially as payments come due or changes are required.

-

pdfFiller provides a secure cloud storage solution, making it easy to access your document whenever necessary.

-

Share your agreement with lenders or co-signers through collaborative tools that facilitate seamless communication and updates.

-

The eSigning feature in pdfFiller allows you and other parties to sign the document electronically, thus expediting the process while maintaining legal validity.

What common pitfalls should avoid?

Avoiding common pitfalls is essential for ensuring that your car finance experience is smooth and hassle-free. Awareness of frequent mistakes can help you steer clear of costly errors.

-

Many individuals overlook certain details when filling out the agreement, which can lead to misinterpretations or complications.

-

Due diligence in studying the contract terms can prevent the surprise of hidden fees, ensuring that the total cost of financing is understood upfront.

What legal compliance considerations should know?

Legal compliance is crucial to avoid complications arising from regulatory infringements. States may have specific laws affecting car finance agreements that must be followed.

-

Understanding the rules applicable to your location ensures that your agreement adheres to specific requirements put forth by financial regulators.

-

By verifying your agreement against local policies, you can mitigate risks associated with non-compliance, which may include penalties or legal disputes.

How to fill out the Car Finance Agreement Template

-

1.Download the Car Finance Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller to start filling it out.

-

3.Enter the buyer's full name and contact information in the designated fields.

-

4.Fill in the seller's details, including name and dealership or private seller information.

-

5.Specify the vehicle details, such as make, model, VIN, and year of manufacture.

-

6.Indicate the total purchase price of the vehicle and the down payment amount.

-

7.Provide the loan amount needed and the repayment terms, including the interest rate and duration.

-

8.Include any additional fees or charges related to the financing, if applicable.

-

9.Review the terms and conditions section to ensure they are accurate and clear.

-

10.Sign and date the agreement in the designated signature area, ensuring all parties sign as required.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.