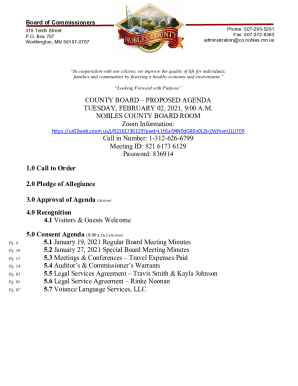

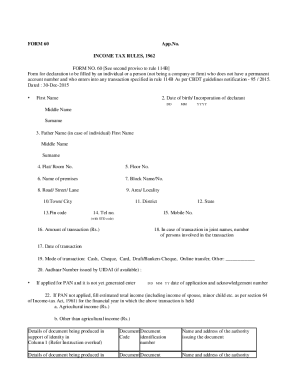

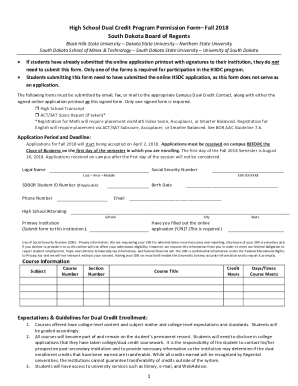

Collateral Collateral Agreement Template free printable template

Show details

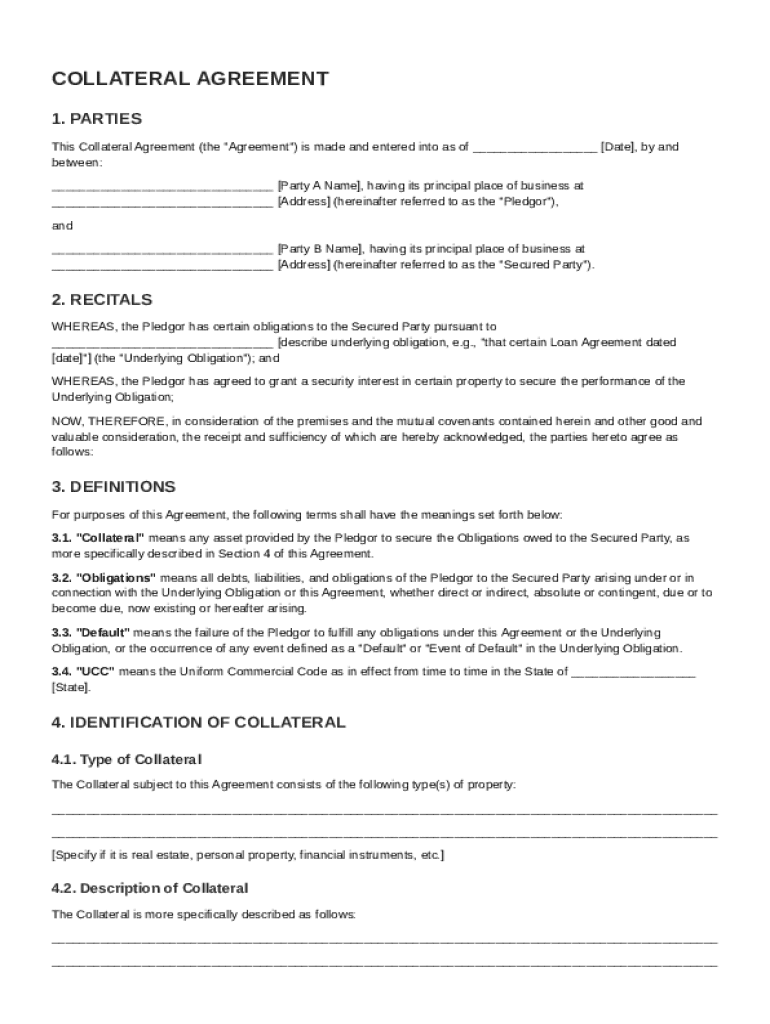

This document is a legal agreement between a Pledgor and a Secured Party regarding the security interest in certain property to secure obligations arising from an underlying obligation.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

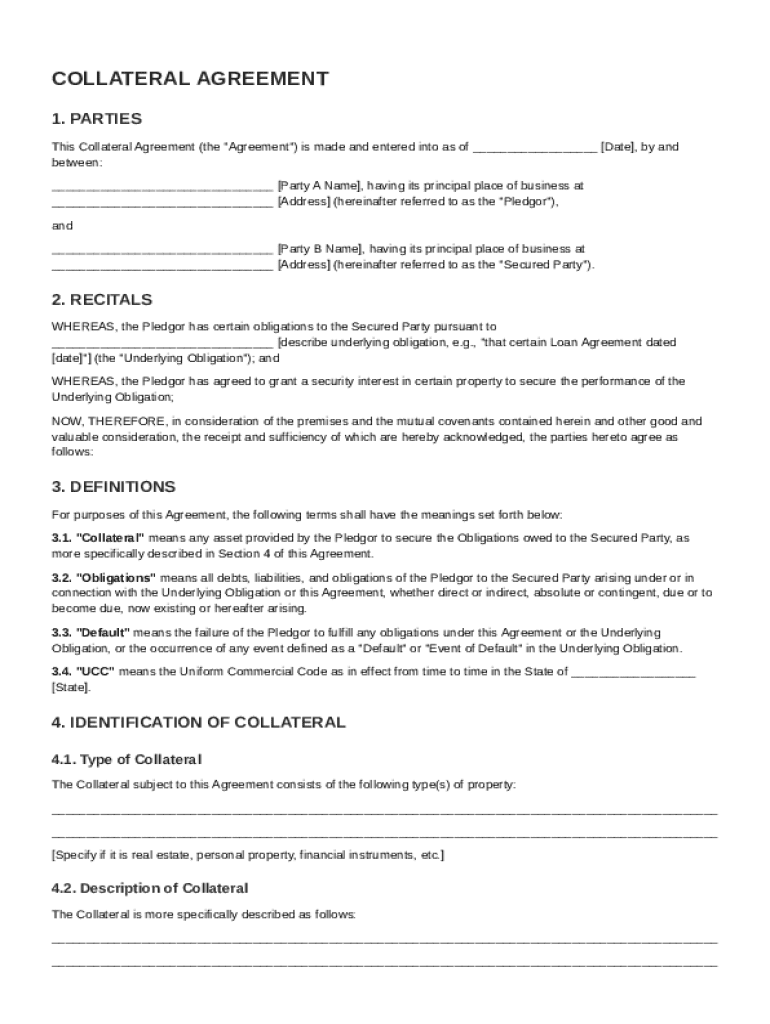

What is Collateral Collateral Agreement Template

A Collateral Collateral Agreement Template is a legal document that outlines the terms and conditions of collateral used to secure a loan or an obligation.

pdfFiller scores top ratings on review platforms

Just started so not a lot of feedback yet. It would be nice to be able to review who I sent documents for e-signatures too, so that if I can determine whether or not I made a mistake and have to redo the whole document, or if I have to tell the client to look in their spam folder, or what. Thanks!

I appreciate not having to use the old fashioned type writer!

Ovrall,vryufullbutabitcotlyandtillhaafwbug

It has been tremendously helpful to me in having to complete forms that require numerous drafts.

PDF Filler allows me to submit professionally prepared forms.

I needed this for an emergency document and paid for it thinking I probably will not use this much....but was I wrong. I use it all the time and LOVE IT!!!

Who needs Collateral Collateral Agreement Template?

Explore how professionals across industries use pdfFiller.

Collateral Agreement Guide on pdfFiller

Filling out a collateral agreement template is crucial for securing loans and other financial transactions. This guide aims to provide clear instructions and insight into the key components of these agreements, ensuring that individuals and teams can effectively use the pdfFiller platform to create, edit, and manage their documents.

What are collateral agreements?

A collateral agreement is a legal document that secures a loan or obligation by pledging specific assets as collateral. This agreement is vital in ensuring debts are covered while enhancing the trust between the pledgor and the secured party.

-

It’s a binding contract that establishes the terms under which collateral is pledged.

-

Understand critical terms like Pledgor (the borrower) and Secured Party (the lender) to navigate these agreements.

-

Collateral agreements build confidence among parties involved in financial dealings.

What are the key components of a collateral agreement?

Understanding the essential components of a collateral agreement is fundamental to its effectiveness. Each section plays a critical role in clarifying the responsibilities and expectations of all parties involved.

-

Identify the Pledgor and Secured Party to ensure accountability.

-

Detail the reasons for creating the agreement to reinforce understanding.

-

Clearly specify the types of assets being pledged to avoid future disputes.

-

Outline essential terms used within the agreement for clarity.

How do you fill out the collateral agreement template?

Using pdfFiller, you can fill out a collateral agreement template with ease. Here’s a step-by-step guide to ensure you complete the form accurately.

-

Log into pdfFiller and locate the collateral agreement template.

-

Enter information like names, collateral details, and obligations in the specified text fields.

-

Utilize eSign and editing features to finalize the document.

-

Ensure all entries meet applicable local regulations.

What legal considerations should be made in collateral agreements?

Legal considerations are critical to ensure your collateral agreement is enforceable and protects your interests. Understanding local regulations and applicable laws can prevent costly litigation.

-

The Uniform Commercial Code (UCC) governs secured transactions in the U.S. Understanding its provisions is essential.

-

Know which state's laws apply to your agreement to ensure legal validity.

-

Common clauses that confirm the legitimacy of claims made about collateral.

-

The importance of including terms that remain effective even after default is critical.

How can you manage collateral agreements effectively?

Effective management of collateral agreements ensures compliance and protects your interests. PDF solutions like pdfFiller can help keep everything organized.

-

Regularly check that all parties are adhering to the agreement terms.

-

Understanding remedies available under default conditions can save you from potential losses.

-

Keeping lines open with the secured party fosters trust and transparency.

-

Utilize pdfFiller’s document management tools to keep all records accessible and organized.

What common mistakes should be avoided in collateral agreements?

Awareness of common pitfalls can prevent issues during the execution of a collateral agreement. Avoiding these mistakes will lead to more effective documents.

-

Failing to clearly define collateral assets is a frequent oversight.

-

Misinformation about the pledgor or secured party can nullify the agreement.

-

Leave out crucial terms, like survivability, can lead to enforcement issues.

-

Using old or irrelevant forms can lead to misapplications of the law.

How to fill out the Collateral Collateral Agreement Template

-

1.Obtain the Collateral Collateral Agreement Template from pdfFiller.

-

2.Open the template in your pdfFiller account.

-

3.Fill in the borrower's details including name, address, and contact information in the designated fields.

-

4.Insert the lender's information in the appropriate sections.

-

5.Identify the specific collateral items being pledged, including descriptions and values.

-

6.Detail the terms of the agreement, including loan amount, interest rate, and repayment schedule.

-

7.Specify any conditions under which the collateral may be forfeited.

-

8.Review all entered information for accuracy and completeness.

-

9.Save your changes and download or print the completed agreement.

What is an example of a collateral agreement?

Collateral contracts are secondary agreements that are related to the first agreement. For example, when a contract is used for the exchange of goods, the collateral contract can be used to make sure those goods are of the quality promised before the contract was entered.

How do I write a loan agreement with collateral?

A contract for a collateral loan should clearly state what asset(s) are being used to secure the loan and include a clause on what could happen to the asset if the borrower defaults. It should also clearly outline the circumstances under which the collateral could be forfeited to the lender.

How to establish a collateral contract?

Two requirements must be fulfilled to establish the existence of a valid and binding collateral contract: The representor must have intended the promise to be legally binding. The representee must have entered into the main contract on the basis of the statement and in reliance upon it.

What is a collateral pledge agreement?

A Security Agreement, also known as a Collateral Agreement or Pledge Agreement, gives to a lender or other party a security interest in property that a debtor or obligor owns.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.