India HDFC Bank Form 60 2015-2025 free printable template

Show details

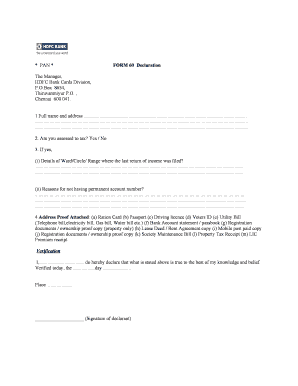

FORM 60 App.No. INCOME TAX RULES 1962 FORM NO. 60 See second proviso to rule 114B Form for declaration to be filled by an individual or a person not being a company or firm who does not have a permanent account number and who enters into any transaction specified in rule 114B As per CBDT guidelines notification - 95 / 2015. Dated 30-Dec-2015 First Name 2. Date of birth/ Incorporation of declarant DD MM YYYY Middle Name Surname 3. Father Name in case of individual First Name 4. Flat/ Room No*...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income tax 60 form

Edit your in form 60 pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income form 60 download form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing income tax form 60 pdf online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit in form 60 download. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 60 filled sample

How to fill out India HDFC Bank Form 60

01

Obtain the Form 60 from HDFC Bank's website or branch.

02

Provide your full name as it appears in your records.

03

Enter your father's name in the designated field.

04

Fill in your residential address accurately.

05

Add your date of birth in the specified format.

06

Specify the nature of your business or profession if applicable.

07

Mention your PAN details if you have one; otherwise, leave it blank.

08

Sign the form at the bottom, ensuring the signature matches other identification documents.

09

Submit the completed form along with any necessary identification documents at the bank branch.

Who needs India HDFC Bank Form 60?

01

Individuals who do not have a PAN and need to carry out financial transactions in India.

02

New bank account holders who are required to submit Form 60 instead of providing a PAN.

03

People seeking loans or other banking services where PAN details are typically required.

Fill

india form 60 download

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit income tax rules 60 form online?

With pdfFiller, the editing process is straightforward. Open your income tax rules form 60 pdf in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I sign the declaration 60 pdf electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your declaration 60 download in minutes.

Can I edit in income tax form 60 pdf on an iOS device?

You certainly can. You can quickly edit, distribute, and sign income form 60 pdf on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is India HDFC Bank Form 60?

India HDFC Bank Form 60 is a declaration form used by individuals who do not have a Permanent Account Number (PAN) to open an account or conduct financial transactions. It serves as an alternative for those exempt from PAN requirement.

Who is required to file India HDFC Bank Form 60?

Individuals who do not possess a PAN and wish to open an account or make financial transactions that require PAN are required to file India HDFC Bank Form 60.

How to fill out India HDFC Bank Form 60?

To fill out India HDFC Bank Form 60, individuals need to provide their personal details, including name, address, and contact information, along with a declaration stating that they do not have a PAN.

What is the purpose of India HDFC Bank Form 60?

The purpose of India HDFC Bank Form 60 is to facilitate banking services for individuals without a PAN while ensuring compliance with tax regulations and reporting requirements.

What information must be reported on India HDFC Bank Form 60?

Information that must be reported on India HDFC Bank Form 60 includes the individual's name, address, date of birth, contact number, and a declaration regarding the absence of a PAN.

Fill out your tax form 60 download online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

In Tax Form 60 is not the form you're looking for?Search for another form here.

Keywords relevant to income tax rules form 60

Related to sbi form 60 pdf download

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.