Company Loan to Employee Agreement Template free printable template

Show details

This Agreement outlines the terms and conditions under which a Company agrees to provide a loan to an Employee, including details on loan amount, interest rate, repayment terms, defaults, and confidentiality.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Company Loan to Employee Agreement Template

A Company Loan to Employee Agreement Template is a legal document outlining the terms of a loan extended by an employer to an employee.

pdfFiller scores top ratings on review platforms

Found my way here to create a W2...seems like the easiest choice!

Very easy to use. Quickly filled out 32 forms.

Made sending out 1099's really simple and easy.

Have been pleased with ability to complete forms and submit them.

so far so good, I thought the price was discounted, but I guess 120/year is the discount?

S far pretty good. Have not done a whole lot with it , but what I did use was very good

Who needs Company Loan to Employee Agreement Template?

Explore how professionals across industries use pdfFiller.

Company Loan to Employee Agreement Guide

How do company loans to employees work?

A Company Loan to Employee Agreement is a contractual arrangement where an employer offers financial assistance to an employee. This template serves as a guideline to help ensure clarity in the loan terms and conditions. Loans can support employees in various scenarios, fostering a supportive workplace environment while also serving specific business interests.

-

This agreement outlines the terms under which a company provides a loan to an employee, detailing the loan amount, interest rate, and repayment terms.

-

It can enhance employee retention, improve morale, and assist in financial challenges employees may face.

-

These loans can support education costs, emergency expenses, or other personal financial needs.

What are the key components of the agreement?

Understanding the key components of a Company Loan to Employee Agreement is essential for both parties to navigate their responsibilities and rights. This ensures the loan process runs smoothly and mitigates potential disputes.

-

Clear definitions help prevent misunderstandings regarding the financial obligations.

-

Both parties should be aware of their duties, including timely payments and communication.

-

Defining these terms helps enforce accountability and lays out consequences of failing to meet obligations.

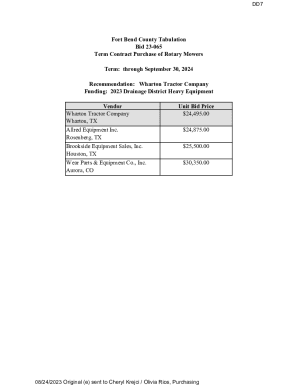

What loan details should be specified?

Transparency in loan details is crucial for trust and accountability. Specifying the loan amount and its intended use ensures employees are aware of the expectations surrounding the funds.

-

Both parties should agree on a feasible amount, taking into account the employee’s financial needs.

-

Clear parameters help both the employer and employee understand how the money should be used.

-

Employers must be aware that default risks exist and should assess employee creditworthiness.

How is the interest rate set?

Determining the interest rate for employee loans involves multiple factors. It must align with legal standards and company policies while being competitive enough to attract employees.

-

These may include current market rates, the employee’s financial situation, and company policies.

-

Employers must ensure they adhere to federal and state regulations regarding lending.

-

Creating an attractive loan program can enhance employee satisfaction and help retain top talent.

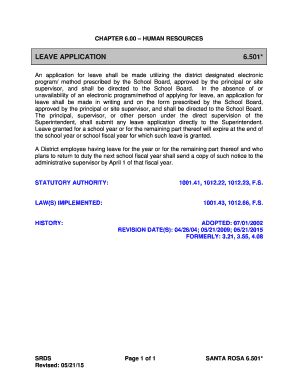

What should the repayment terms include?

Drafting clear repayment terms allows for flexibility while also protecting the company’s interests. An effective schedule will promote timely payments and minimize defaults.

-

Flexibility can allow employees to manage their payments within their budgets, promoting timely accountability.

-

Duration clarity ensures both parties understand the timeline for loan completion.

-

Clearly stating consequences helps safeguard the company's financial interests while motivating employee compliance.

How to utilize pdfFiller for agreement management?

pdfFiller simplifies creating and managing the Employee Loan Agreement. Its features allow for effective collaboration and ease of use on a cloud-based platform.

-

Start by selecting a template, then customize the fields, ensuring all relevant details are included.

-

E-signatures streamline the process and offer a legally binding option without needing physical paperwork.

-

Multiple users can access and edit files, allowing for comprehensive review and approval.

What are the pros and cons of employee loans?

While employee loans can strengthen relationships, it's important to weigh their advantages against potential downsides. A thorough evaluation can help safeguard both the company and the employee.

-

Loans can serve as an essential tool for employee support and can enhance company loyalty.

-

Default risks and employee dissatisfaction can arise if terms are not carefully managed.

-

It’s crucial to assess the employee’s repayment capability to avoid complications.

How to finalize the agreement?

Finalizing the agreement is a critical step to ensure all parties understand and agree to the terms. Clarity and documentation are keys to a successful loan arrangement.

-

Effective communication prevents misunderstandings and fosters trust.

-

Documentation may include proof of income, eligibility criteria, and repayment plans.

-

Consulting with legal experts ensures compliance with local laws and regulations.

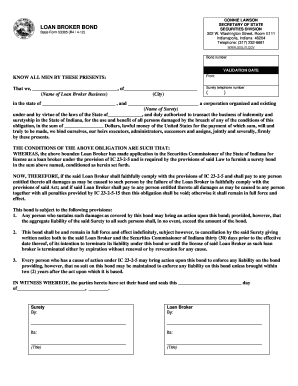

How to fill out the Company Loan to Employee Agreement Template

-

1.Open the Company Loan to Employee Agreement Template on pdfFiller.

-

2.Begin by entering the date of the agreement in the designated section.

-

3.Fill in the name of the employee receiving the loan, including their job title and department.

-

4.Specify the loan amount being provided to the employee.

-

5.Outline the purpose of the loan and any necessary conditions for its use.

-

6.Set the repayment terms, including the duration, interest rate (if applicable), and payment schedule.

-

7.Include details regarding penalties for late payments or defaults.

-

8.Add sections for signatures, specifying the employer's and employee's names and titles.

-

9.Finally, review the completed document for accuracy before saving or printing.

How do you write a loan agreement between companies?

A well-structured loan agreement should follow established practice and include these key sections in order: parties' details (names and addresses), loan amount and purpose, interest rates and calculation method, repayment schedule, security provisions (if applicable), and default conditions.

How do I record a loan to an employee?

Entry to Record a Loan to Employee The entry will debit Loan to Employee for $5,000 and will credit Cash for $5,000. Under the accrual method of accounting, at each balance sheet date the company should record any accrued interest by debiting Interest Receivable and crediting Interest Income.

How to fill a loan agreement form?

Here are the essential items your loan agreement form sample must cover: Parties Involved. Clearly identify the lender and borrower with their full legal names. Loan Amount & Interest. Repayment Schedule. Late Payment Fees. Collateral (For Secured Loans) Default Consequences. Governing Law. Signatures.

How do I make an agreement to borrow money?

How to write a loan agreement contract. Agree to terms. First, negotiate terms with the other party. Create a draft for everyone to review. Make adjustments if needed. Add signatures (and notarization). Distribute copies of the executed agreement.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.