Credit Terms Agreement Template free printable template

Show details

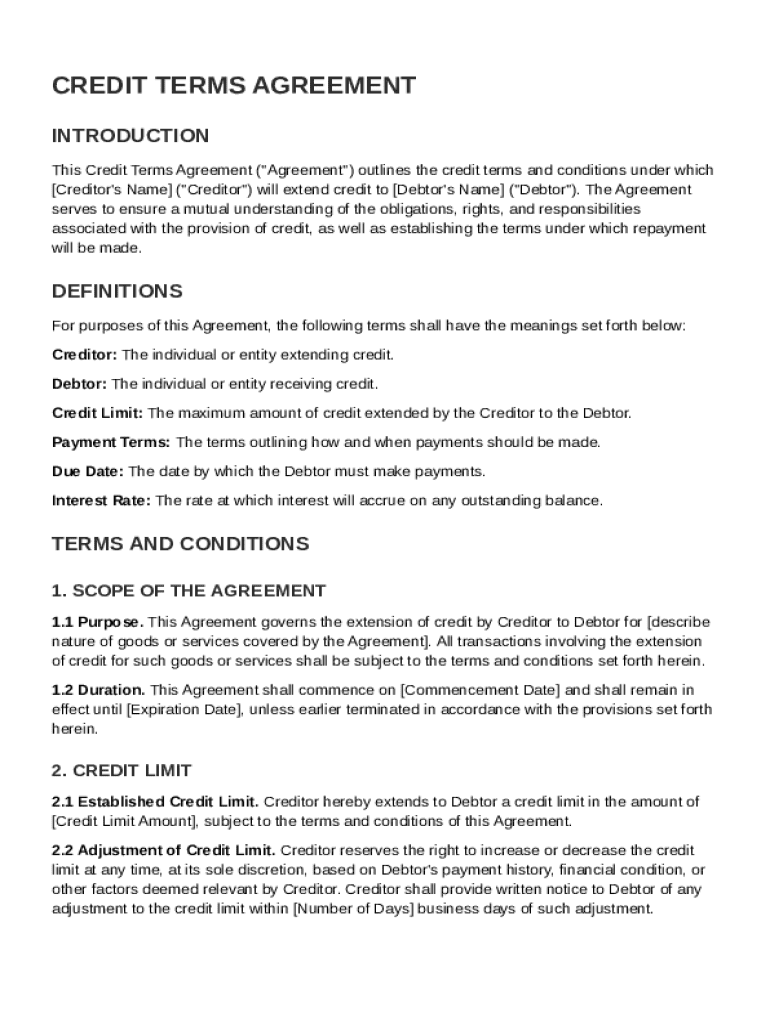

This document outlines the credit terms and conditions under which a creditor extends credit to a debtor, detailing obligations, rights, repayment terms, and default conditions.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Credit Terms Agreement Template

A Credit Terms Agreement Template outlines the payment terms and conditions agreed upon between a lender and borrower.

pdfFiller scores top ratings on review platforms

This has saved my work life by increasing efficiency with PDFs!

didn't know I had to buy the product, maybe ealier disclosure that is visible. Otherwise, great product and filled a need I had in a hurry.

Very easy to use. Completely satisfied.

chat support: wonderful spoke to 2 different people and both terrific. Love this service. I need to get forms from years back and thanks to this service they are all available in minutes.

Always comes in handy for me. Can fill out forms on line and have them processed right away.

Adding an Undo feature would be a great enhancement.

Who needs Credit Terms Agreement Template?

Explore how professionals across industries use pdfFiller.

How to effectively create a Credit Terms Agreement Template form for your needs

What is a Credit Terms Agreement and why is it important?

A Credit Terms Agreement is a document outlining the terms and conditions under which a creditor extends credit to a debtor. This agreement is significant in financial transactions as it specifies payment terms, due dates, and the responsibilities of both parties, effectively protecting their respective interests. Mutual understanding in credit obligations ensures both creditors and debtors are aware of the potential risks and rewards involved.

What key terminology should you know?

-

The individual or entity that extends credit; they have the legal right to receive payment based on the agreement.

-

The party who receives credit and is obligated to repay the borrowed amount under agreed terms.

-

This is the maximum amount of credit that the creditor allows the debtor to borrow.

-

These describe how and when the debtor is expected to make payments, including any installment schedules.

-

The specific date by which payment must be made to avoid penalties or default.

-

The rate at which interest will be charged if the debt is not paid back in full by the due date.

What is the scope and application of the Credit Terms Agreement?

The scope of a Credit Terms Agreement typically encompasses various types of transactions such as loans, credit lines, or purchase agreements. The agreement should explicitly state its duration, highlighting when it initiates and concludes. It is also crucial to identify situations that may warrant modifications to the agreement, ensuring flexibility for any unforeseen circumstances.

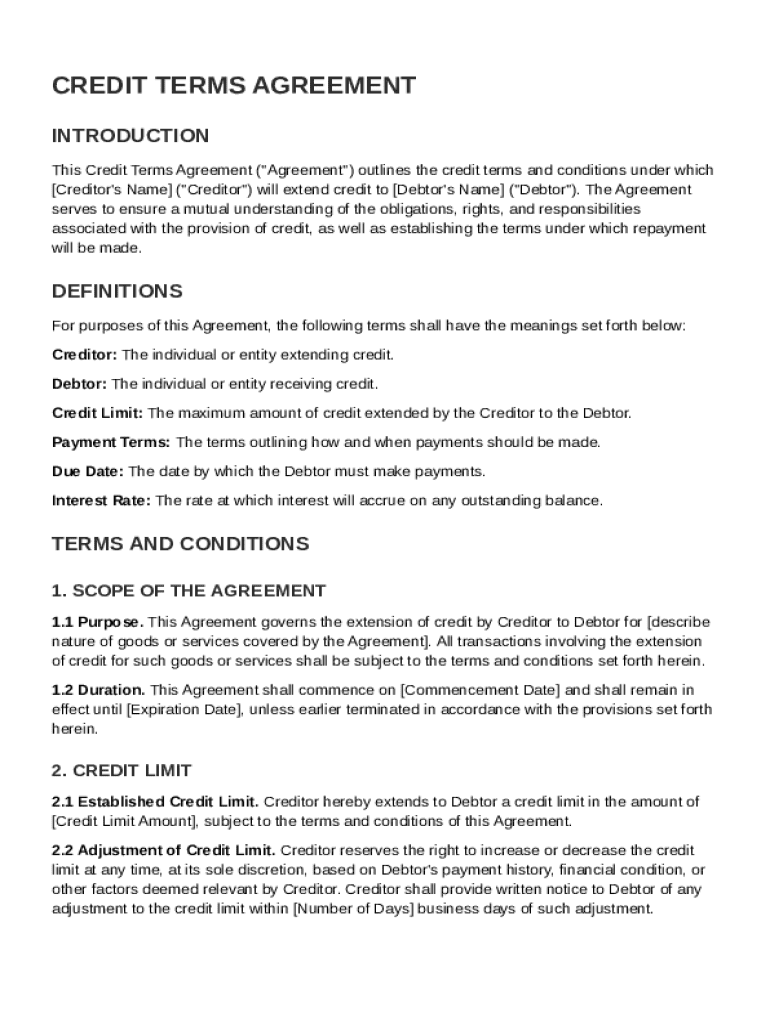

How to understand credit limit specifications?

-

The initial credit limit is usually set based on the debtor’s creditworthiness as assessed by the creditor.

-

Credit limits may change based on payment patterns, relationship duration, or a change in the debtor's financial situation.

-

It is important to establish a process for notifying the debtor about any changes in the credit limit to maintain transparency.

How to navigate the payment terms?

Payment terms should be clearly defined, as they lay the foundation for the repayment process. This includes explanations of standard and alternative payment schedules to accommodate debtor preferences. It's essential to outline the implications of late payments, including possible fees and interest penalties, alongside the available methods of payment that can ease the repayment process.

What happens in cases of default and modification?

-

Defaulting occurs when the debtor fails to meet their repayment obligations as outlined in the agreement.

-

Consequences may include penalties, increased interest rates, or legal actions taken by the creditor.

-

If circumstances change, either party may seek to modify the agreement, often requiring a formal process to ensure both parties agree.

What governing laws apply to your Credit Terms Agreement?

Understanding jurisdiction is vital, as different regions may have varying laws governing these types of agreements. Both parties must be aware of the applicable laws to avoid future disputes. Additionally, incorporating dispute resolution mechanisms, such as mediation or arbitration, can be beneficial for effective conflict resolution.

What about ownership and rights in the agreement?

-

The terms and conditions outlined in the agreement are legally owned by the drafting party until modifications are made.

-

Understanding ownership is crucial, particularly if rights are to be transferred or sold; these actions should be clearly defined in the agreement.

-

Both the creditor and debtor maintain specific rights, including the right to seek payment and the right to seek dispute resolution.

How can pdfFiller facilitate your Credit Terms Agreement process?

pdfFiller offers comprehensive tools for creating and managing a Credit Terms Agreement. Users can easily create and customize their agreement using an intuitive interface. Step-by-step instructions guide users in filling out necessary fields, and eSigning capabilities enable a seamless signing process, making agreements valid and enforceable. Collaborative tools further enhance team efforts in managing and editing these important documents.

What are the critical elements to remember?

In summary, a well-structured Credit Terms Agreement contains several critical elements, including clear definitions of roles and responsibilities, detailed payment terms, and provisions for potential modifications. Ensuring compliance with legal standards and fostering mutual understanding are essential for smooth operations. Utilizing tools like pdfFiller can greatly enhance the efficiency of creating and managing these agreements.

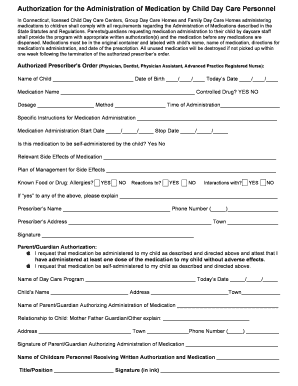

How to fill out the Credit Terms Agreement Template

-

1.Download the Credit Terms Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Begin by entering the names and contact information of both parties in the designated fields.

-

4.Specify the loan amount and interest rate clearly to avoid misunderstandings.

-

5.Fill in the payment schedule, including due dates and the total repayment period.

-

6.Add any specific terms related to late payments or default to ensure compliance.

-

7.Review all entries for accuracy, ensuring all necessary details are included.

-

8.Once all information is complete, save your work to prevent data loss.

-

9.Print the agreement for signatures once confirmed by both parties.

-

10.Upload the signed document back into pdfFiller for digital storage and record-keeping.

How to write a credit agreement?

The Lender agrees to loan (total amount of the credit) to the Borrower. The Borrower agrees to repay the total amount in full before , along with any interest incurred on the unpaid monies at the rate of _% per year, beginning on (date).

What are the terms of a credit agreement?

Lenders must provide a full disclosure of all of the loan's terms in the credit agreement. That can include the annual interest rate (APR), how the interest is applied to outstanding balances, any fees associated with the account, the duration of the loan, the payment terms, and any consequences for late payments.

What are the 7 day credit terms?

For example, a contract with net 7 payment terms means your customer owes payment to your company within 7 days of when you sent the invoice. A contract with net 45 terms means your customer doesn't owe payment for a whole month.

What are 14 day credit terms?

Net 14 payment terms refer to a specific type of trade credit where the full amount of an invoice is required to be paid within 14 days of the invoice date. This is a short-term financing option commonly utilized in supplier-customer relationships. In this system, the supplier offers goods or services to the customer.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.