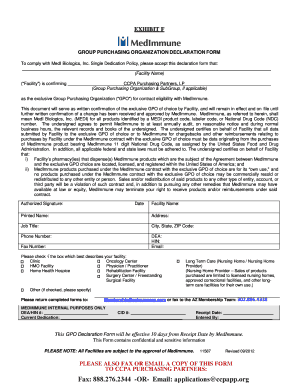

Customer Credit Application Agreement Template free printable template

Show details

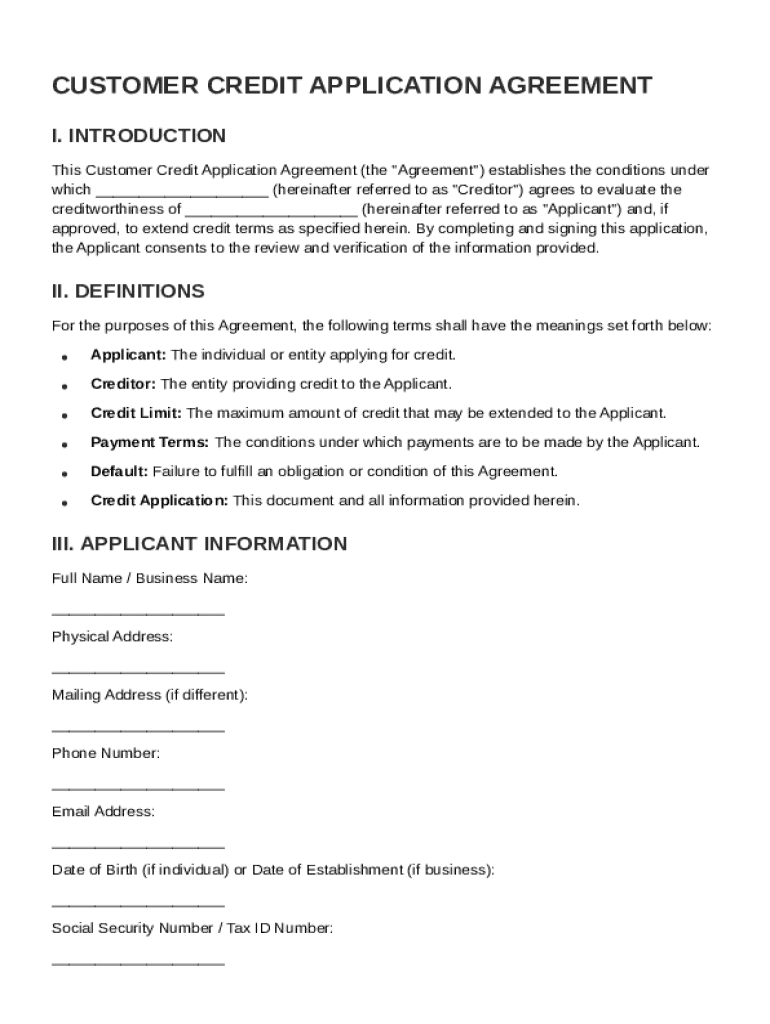

This document establishes the conditions under which a creditor evaluates the creditworthiness of an applicant and, if approved, extends credit terms.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Customer Credit Application Agreement Template

A Customer Credit Application Agreement Template is a formal document used by businesses to evaluate a customer's creditworthiness before extending credit terms.

pdfFiller scores top ratings on review platforms

Needed something fast

Needed something fast! First day using it, seems to be the way of the world now working remotely. Easy to learn, pretty good!

Great for professional docs!

Very clear and easy to use

Tree saver

My son has to do virtual school with everything going on at the moment. This is great for filling out worksheets instead of printing and killing trees

Great

Great, easy to use and nice having a free trail to get to know the product.

Happy with PDF Filler

I'm happy with PDF Filler. Easy to use and very convenientWould recommended to anyoneThanks

very complete but not trial without…

very complete but not trial without subscription

Who needs Customer Credit Application Agreement Template?

Explore how professionals across industries use pdfFiller.

Customer Credit Application Agreement Guide

Filling out a Customer Credit Application Agreement Template form can be straightforward if you understand the necessary details. This guide provides key insights into the agreement process, terminology, and best practices.

What is a customer credit application agreement?

A Customer Credit Application Agreement is a document that outlines the terms and conditions under which a creditor extends credit to an applicant. It serves as a protection for both parties, ensuring clarity in the obligations of the applicant and the creditor.

-

Definition of the agreement is vital to understand its purpose.

-

Importance for both the applicant and the creditor helps realize responsibilities.

-

The process flow includes application, assessment, approval, and credit limit assignment.

What are the key terms in the agreement?

-

The individual or business seeking credit.

-

The financial institution or lender providing credit.

-

The maximum amount the creditor is willing to extend to the applicant.

-

Details outlining how and when the applicant must repay the credit.

How do fill out the applicant information?

-

Enter the legal name of the applicant to ensure correct identification.

-

Provide the current residential or business address for verification purposes.

-

Include a valid phone number and email address for communication.

-

For individuals, provide your date of birth; for businesses, the date of establishment is crucial.

-

Provide securely, as these numbers are sensitive and necessary for the credit process.

What details are included in the credit request?

Understanding the types of credit available—revolving or installment—is essential for determining your needs.

-

Allows continuous borrowing up to a set limit, repaid as debts are incurred or settled.

-

Involves preset payments over a defined period for a fixed amount.

-

Specify how much credit you wish to access based on your financial assessment.

-

Clearly state how you intend to repay the borrowed credit to avoid misunderstandings.

How is financial information submitted?

-

Provide annual and monthly gross income to give a complete picture of your earning potential.

-

Include sources like bonuses or freelance income to strengthen your application.

-

Detailing what you own and owe is critical for creditors to assess your creditworthiness.

What do need for credit history requirements?

-

Provide reliable references that can confirm your credit history and behavior.

-

Understand the implications of granting permission to run your credit check.

-

Honesty about past bankruptcies can impact your application's approval chances.

How does pdfFiller enhance the application process?

pdfFiller streamlines the editing of PDF forms, allowing users to input information efficiently. Its eSigning feature facilitates seamless approvals, making the application process simpler.

-

Users can easily modify text and details without needing complex software.

-

This allows applicants to sign documents digitally, saving time and resources.

-

Teams can manage applications and collaborate on edits in real-time.

What common mistakes should avoid?

-

Always double-check that all required information is filled in before submission.

-

Ensure that the referees you choose can provide valid feedback about your creditworthiness.

-

Familiarize yourself with the terms to avoid default and ensure a smooth repayment plan.

What can expect post-submission?

-

Typically, creditors will inform you of their decision within a few business days.

-

Know what to do next whether your credit request is approved or denied.

-

Learn how to respectfully check the status of your application with creditors.

How to fill out the Customer Credit Application Agreement Template

-

1.Start by downloading the Customer Credit Application Agreement Template from pdfFiller.

-

2.Open the template using pdfFiller’s editor.

-

3.Begin filling in the customer’s information in the designated fields, including their full name, address, and contact information.

-

4.Input relevant business information, like the type of business and years in operation.

-

5.Next, detail the customer's financial information, such as income, expenses, and bank references, ensuring accuracy.

-

6.Review any additional questions or requirements specified in the template to gather complete information.

-

7.If included, ensure the customer signs and dates the application at the bottom of the form.

-

8.Lastly, save your completed application and submit it according to your organization's procedures, either electronically or in print.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.