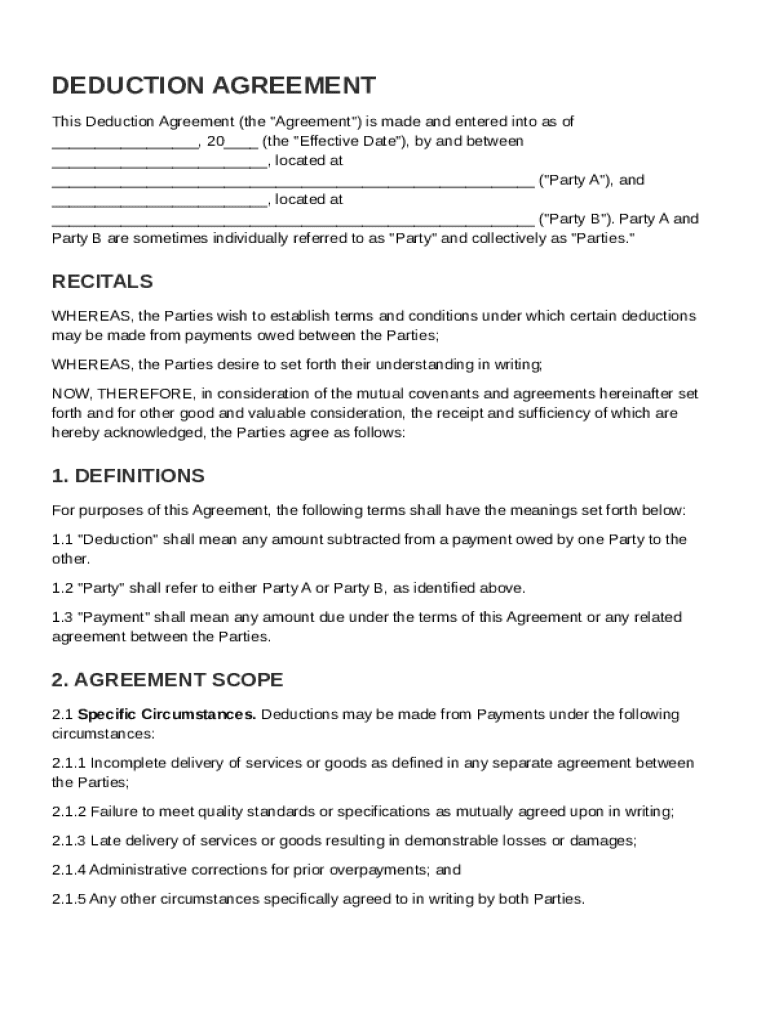

Deduction Agreement Template free printable template

Show details

This document outlines the terms and conditions for deductions to be made from payments between two parties, including definitions, scope, process, payment terms, and dispute resolution.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Deduction Agreement Template

A Deduction Agreement Template is a legal document that outlines the terms under which certain deductions, usually from payroll, are agreed upon by both the employer and the employee.

pdfFiller scores top ratings on review platforms

Pretty useful but a little bit expensive

So far the app has worked very well. It is very user-friendly and intuitive. Customer feedback has been quick and very helpful

Just beginning to use it. Would like a tutorial of some sort.

Super easy getting contracts over to people with a verified E-signature.

Very simple and easy to use. Only problem I've had is with one document that did not download properly/

Seems easy to do and will help me a lot with my new business

Who needs Deduction Agreement Template?

Explore how professionals across industries use pdfFiller.

Deduction Agreement: Comprehensive Guide for Individuals and Teams

Filling out a Deduction Agreement Template form requires understanding the specific context and obligations of the parties involved. Ensure that you accurately provide required details about deductions based on predefined conditions, follow procedures thoroughly, and understand the legal implications.

What is a deduction agreement?

A Deduction Agreement is a formal document outlining the circumstances under which one party can reduce payments to another. This agreement is crucial as it protects both parties by clarifying when deductions are permissible, preventing disputes over payments.

-

It refers to a mutually recognized document between parties detailing when and how payment deductions can occur.

-

Having a written Deduction Agreement formalizes expectations and provides a legal framework, which is critical in any business transaction.

-

Deductions refer to amounts subtracted from payments, while payments are the compensation provided for goods and services rendered.

Who are the parties involved in a deduction agreement?

In a Deduction Agreement, two primary parties are involved: Party A and Party B, each with distinct roles and responsibilities. Understanding these roles can streamline processes and clarify accountability.

-

Typically, Party A is the payer, while Party B is the payee. Their obligations are outlined in the agreement.

-

Businesses often enter Deduction Agreements with suppliers or contractors who provide goods or services.

-

It's essential to correctly identify all parties to avoid legal ambiguities, and ensure that each party's rights and obligations are clearly stated.

What circumstances allow for deductions?

Deductions from payments may arise due to several reasons, rooted in failure to meet expectations in the provided goods or services. Each situation must be documented to maintain the validity of the deduction.

-

If services or goods are not delivered as agreed upon, deductions may be considered justified.

-

Failure to deliver according to specified quality metrics can be grounds for deductions.

-

Delays that result in financial implications need to be properly recorded as reasons for deductions.

-

Errors that lead to overpayments can also warrant necessary deductions.

-

Additional circumstances may apply depending on the nature of the goods or services provided.

How is the deductions process carried out?

Understanding the deductions process is crucial for effective management of payments. This ensures both parties are aware of the necessary actions to take when a deduction is proposed.

-

Follow a structured approach to identify and notify relevant parties about proposed deductions.

-

It’s necessary to include specific information about the nature of the deduction in notifications.

-

Providing evidence helps justify the deducted amounts and protects against disputes.

-

Adhere to established timelines for notifying the other party to avoid complications in the process.

How do you fill out the deduction agreement template?

Utilizing interactive tools like those on pdfFiller simplifies the process of completing a Deduction Agreement Template form. This makes it easier to ensure compliance and correctness.

-

Interactive tools facilitate easy edits needed for completion of the template.

-

Carefully enter all required information in the designated fields of the Deduction Agreement.

-

Regularly review and manage documents to maintain clarity and compliance.

-

Utilize the eSigning feature for legally binding signatures, ensuring the agreement is valid.

How to manage deduction agreements on pdfFiller?

Managing your Deduction Agreements with a cloud-based solution like pdfFiller streamlines collaboration and document tracking. This ensures that all parties can access and modify documents as needed.

-

Utilize cloud services for efficient document management and retrieval.

-

Team members can collaborate in real-time, enhancing the review process.

-

Track changes to maintain comprehensive documentation and clarity on agreements.

-

Maintain legal compliance through secure document management practices within the platform.

What are the compliance and legal considerations?

Compliance with regional regulations is essential in the context of Deduction Agreements. Understanding potential legal hurdles can help in creating a robust agreement.

-

Each region may have specific laws governing deductions; familiarize yourself with these requirements.

-

Identify typical mistakes made in agreements to avoid potential legal issues.

-

Ask legal counsel for guidance to ensure each agreement meets the pertinent legal standards.

How to fill out the Deduction Agreement Template

-

1.Open the Deduction Agreement Template in pdfFiller.

-

2.Begin by entering the date at the top of the document.

-

3.Fill in the full name of the employee for whom the deductions will apply.

-

4.Include the employee's job title and department for clarity.

-

5.Specify the types of deductions that will be made, such as health insurance, retirement contributions, or loan repayments.

-

6.Clearly state the amount or percentage for each deduction to avoid ambiguities.

-

7.Include the terms under which deductions can be modified or revoked.

-

8.Provide space for both the employee's signature and the employer's representative’s signature.

-

9.Ensure that both parties sign and date the document to validate the agreement.

-

10.Review all entries for accuracy and completeness before finalizing the document.

What is a 2159?

IRS Form 2159, Payroll Deduction Agreement, is a tax document to set up an installment agreement, a form of tax debt relief that allows taxpayers to make monthly payments on their federal tax debt by having funds withheld from their paychecks and sent directly to the IRS.

What is the maximum an employer can deduct from salary?

If there is a shortfall in the till or stock shortage, your employer is not allowed to take more than 10 per cent of your gross wages for a pay period. If the 10 per cent isn't enough then your employer can continue to take money from your wages on subsequent paydays.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.