Employee Loan Agreement Template free printable template

Show details

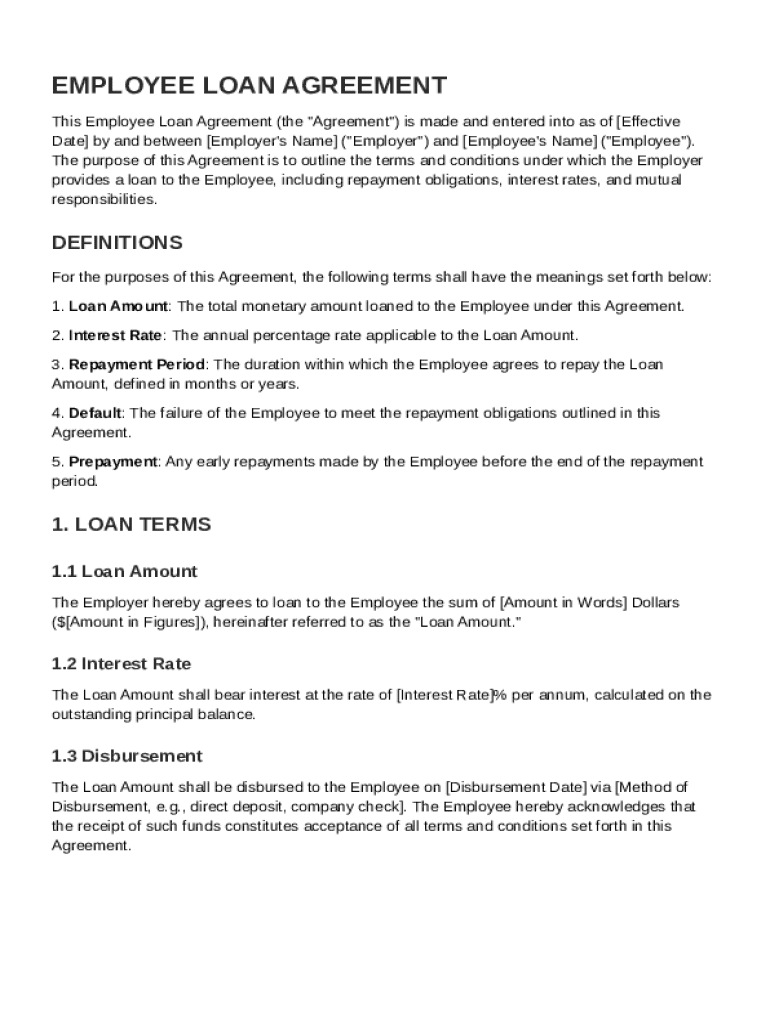

This document outlines the terms and conditions under which an employer provides a loan to an employee, including repayment obligations, interest rates, and mutual responsibilities.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Employee Loan Agreement Template

An Employee Loan Agreement Template is a formal document outlining the terms and conditions under which an employer offers a loan to an employee.

pdfFiller scores top ratings on review platforms

Great time saving service. Easy, efficient.

It works and is the best value I could find.

It's solved a HUGE need for our business.

Although I wish there were more forms from the American Welding Society, I have found this very useful for many of my needs.

Easy to use with lots of features to edit and create documents to get business done!

Wonderful convenient makes work projects easier.

Who needs Employee Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Employee Loan Agreement Template Form

In this guide, we'll outline the essentials of creating an Employee Loan Agreement Template form. This document serves as a formal contract between an employer and an employee regarding the conditions of a loan extended to the employee. Understanding the various components of the agreement is critical for both parties.

What is an Employee Loan Agreement?

An Employee Loan Agreement is a written contract between an employer and an employee detailing the terms under which a loan is offered. Such an agreement typically outlines the responsibilities of both parties, including repayment schedules and interest rates.

-

It establishes a clear understanding of the loan conditions, protecting both the employer and employee in case of disputes.

-

While the employer provides the funds, the employee receives financial support and is responsible for repayment.

-

A well-structured agreement minimizes misunderstandings and provides legal protection for both parties.

What are the essential definitions?

Understanding the key terms associated with an Employee Loan Agreement is crucial. Each definition impacts how the loan operates and the responsibilities of both parties involved.

-

This refers to the total sum of money that the employer lends to the employee, which is critical to define upfront.

-

The percentage charged on the loan amount that affects the total repayment costs; it should be decided mutually.

-

The time frame within which the employee must repay the loan; clarity here prevents future disagreements.

-

Default occurs when the employee fails to repay according to the agreed terms, leading to potential legal action.

-

Conditions that allow the employee to pay off the loan early, which can vary by agreement.

How should the loan terms be structured?

Structuring loan terms is a crucial step in the agreement process. It involves defining key components that outline the loan’s financials and distributions.

-

Calculating the loan amount requires understanding both the employee's needs and the employer's capacity to lend.

-

Factors to consider include market rates, the financial health of the business, and legal lending limits.

-

Options include direct deposit, check, or any method convenient for both parties; clarity in this part is essential.

-

Both parties should sign the agreement to acknowledge they accept the outlined terms.

What are the key components of crafting repayment terms?

Having clear repayment terms is paramount for a functioning loan agreement. This lays the groundwork for how and when repayments will occur.

-

Options vary between monthly, bi-weekly, or weekly payments; choose what fits both parties' financial situations.

-

This refers to how much the employee will pay on each due date, which should be manageable.

-

Clearly defined dates for payments help prevent missed deadlines, ensuring both parties know their obligations.

-

Include default clauses detailing the implications of late payments, such as increased interest or penalties.

How to fill out the Employee Loan Agreement template

Filling out an Employee Loan Agreement Template form requires careful attention to detail to ensure all necessary information is captured accurately.

-

Collect details from both the employer and employee to complete the agreement accurately.

-

Clearly document the agreed amounts and the interest rate to avoid misunderstandings later.

-

Indicate how the funds will be distributed to the employee.

-

Define clearly how and when repayments will be made.

-

Finalizing the agreement with signatures makes it legally binding.

What are the pros and cons of lending to employees?

Lending to employees can have significant benefits for businesses but also comes with certain risks. Evaluating these can help in determining if it aligns with your business goals.

-

Financial support for employees can lead to increased loyalty and ease financial burdens for them.

-

Potential financial risks for the employer and legal compliance issues must be considered.

-

Assess your company’s financial capacity and employee needs to determine suitability.

How can interactive tools help manage employee loans?

Utilizing tools like pdfFiller can streamline the process of managing Employee Loan Agreements. These platforms offer interactive features that enhance both document creation and collaborative efforts.

-

Easy edits and electronic signatures enhance both speed and security.

-

Allow for real-time changes and input from both parties, facilitating better communication.

-

This ensures that agreements are securely stored and accessible from anywhere.

What are tips for ensuring a successful employee loan experience?

Effective communication and proactive management are vital for a successful employee loan process. Integrating solid practices can prevent issues and enhance relationships.

-

Maintain open lines between employer and employee to address concerns promptly.

-

Implement tools and strategies to keep track of payments and adhere to the schedule.

-

Update agreements as necessary based on changes in the employee’s financial situation.

How to fill out the Employee Loan Agreement Template

-

1.Download the Employee Loan Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller's editor.

-

3.Begin by entering the date at the top of the agreement.

-

4.Input the employee's name and job title in the designated fields.

-

5.Fill in the loan amount being offered to the employee.

-

6.Specify the interest rate and repayment schedule clearly to avoid confusion.

-

7.Include any conditions related to the loan, such as consequences of default.

-

8.Review all entered information for accuracy and completeness.

-

9.Add any additional clauses that may be relevant to your company's policies.

-

10.Save the document and send it to the employee for their review and signature.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.