UK Scottish Widows 12260 2019 free printable template

Show details

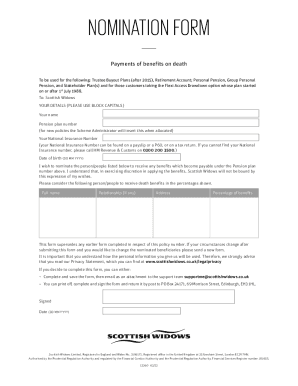

NOMINATION FORM To be used for the following: Trustee Buyout Plans (after 2015), Retirement Account; Personal Pension, Group Personal Pension, and Stakeholder Plan(s). To: Scottish Widows PLEASE USE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK Scottish Widows 12260

Edit your UK Scottish Widows 12260 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK Scottish Widows 12260 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK Scottish Widows 12260 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit UK Scottish Widows 12260. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK Scottish Widows 12260 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK Scottish Widows 12260

How to fill out UK Scottish Widows 12260

01

Start by downloading the UK Scottish Widows 12260 form from the official website or obtain a physical copy.

02

Carefully read the instructions provided alongside the form to understand the requirements.

03

Fill in your personal information such as name, address, and date of birth in the designated sections.

04

Provide details of your employment and income, if applicable, in the corresponding fields.

05

Indicate any investment information if required, including existing policies or funds.

06

Review the form for any missing information or errors before proceeding to the next step.

07

Sign and date the form where indicated to verify that all information is accurate.

08

Submit the completed form either online or via mail, as per the submission guidelines.

Who needs UK Scottish Widows 12260?

01

Individuals who have policies or funds with Scottish Widows and need to update their information.

02

Those seeking to make claims or manage their investments through Scottish Widows.

03

People looking for guidance in filling out financial or retirement-related paperwork.

Fill

form

: Try Risk Free

People Also Ask about

Can I claim my dead ex husband's pension UK?

Pension benefits technically fall outside a person's estate, so are not covered by a will. Savers who want to name a beneficiary of their pension pot must therefore complete an 'expression of wish' or 'nomination of beneficiaries' form when enrolling on a workplace pension or private pension scheme.

How do I claim my ex husband's pension after divorce?

In order to gain access to a percentage of your pension, your spouse would have to specifically ask for their share at the time of the divorce – not at the time of your retirement. This is done via a court order called a qualified domestic relations order (QDRO).

How do I add a beneficiary to my Scottish Widows pension?

We'll send you an expression of wish form so you can nominate a beneficiary, and if you want to make changes we can send you a new one. It is important to note that in exercising discretion in applying the benefits, Scottish Widows will not be bound by this expression of wish. Remember to update your will too.

What happens to pension after death?

When a participant in a retirement plan dies, benefits the participant would have been entitled to are usually paid to the participant's designated beneficiary in a form provided by the terms of the plan (lump-sum distribution or an annuity).

Can I still get my ex husband's pension?

Generally, your former spouse's community property interest may be up to 50 percent of your pension benefit. We won't release pension benefits to you or your former spouse until the community property claim is resolved. For retirees: One-half of your monthly allowance is held until the claim is resolved.

What happens to my ex husband's pension if he dies UK?

Pension benefits technically fall outside a person's estate, so are not covered by a will. Savers who want to name a beneficiary of their pension pot must therefore complete an 'expression of wish' or 'nomination of beneficiaries' form when enrolling on a workplace pension or private pension scheme.

What happens to my ex husband's pension when he dies?

It depends on the dissolution decree. As with other divided property, the ex-spouse's share of the pension remains his/her property. Without an agreement to return your ex-spouse's share to you, the law provides for the ex-spouse's share to be passed on to the beneficiary of the ex-spouse, or his/her estate.

Where do I send my Scottish widow nomination form?

If your circumstances change after submitting this form and you would like to change the nominated beneficiaries please send a new form. Signed Date (DD MM YYYY) If you decide to complete this form, please return it to Scottish Widows, 15 Dalkeith Road, Edinburgh, EH16 5BU.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify UK Scottish Widows 12260 without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including UK Scottish Widows 12260, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send UK Scottish Widows 12260 for eSignature?

When you're ready to share your UK Scottish Widows 12260, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit UK Scottish Widows 12260 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign UK Scottish Widows 12260. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is UK Scottish Widows 12260?

UK Scottish Widows 12260 is a specific form used for reporting and managing certain types of pension schemes and investments associated with Scottish Widows.

Who is required to file UK Scottish Widows 12260?

Individuals or entities that have pension schemes or investments managed by Scottish Widows that require regulatory reporting are typically obligated to file the UK Scottish Widows 12260.

How to fill out UK Scottish Widows 12260?

To fill out UK Scottish Widows 12260, gather the required information regarding your pension or investment, complete the designated sections of the form, ensuring accuracy, and submit it to the appropriate Scottish Widows department.

What is the purpose of UK Scottish Widows 12260?

The purpose of UK Scottish Widows 12260 is to report financial information related to pension accounts or investments to ensure compliance with regulatory guidelines and provide transparency.

What information must be reported on UK Scottish Widows 12260?

The UK Scottish Widows 12260 form must typically include personal details of the account holder, details of the pension scheme or investment, contributions made, and other relevant financial information.

Fill out your UK Scottish Widows 12260 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK Scottish Widows 12260 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.